Unit 2.8: Demerit goods / negative externalities

.jpg) Introduction

Introduction

This page focuses on another cause of market failure, the negative spillover costs associated with the consumption of demerit goods and some of the policies that governments can use to reduce the negative spillover costs. While IB students will generally understand the concept of external costs they will often struggle with the appropriate diagrams.

Enquiry question

Why might the provision of some goods e.g. cigarettes and alcohol be over provided by the market. What measures can a government take to reduce the negative externalities caused by the production and consumption of certain products.

Teacher notes

Teacher notes

Lesson time: 90 minutes

Lesson objectives:

Explain, using diagrams and examples, the concepts of negative externalities of production and consumption, and the welfare loss associated with the production or consumption of a good or service.

Explain that demerit goods are goods whose consumption creates external costs.

Evaluate, using diagrams, the use of policy responses, including market-based policies (taxation and tradable permits), and government

regulations, to the problem of negative externalities of production and consumption.

Teacher notes:

1. Opening question - Answer the opening question which asks students to guess the most dangerous demerit good (in terms of lives lost). (10 minutes)

1. Opening question - Answer the opening question which asks students to guess the most dangerous demerit good (in terms of lives lost). (10 minutes)

2. Processes - technical Vocabulary - your classes can learn the required vocabulary watching the next video and completing activities 3 - 7. (30 minutes)

3. Reinforcement activities - activity 8 (10 minutes).

4. Link to the IA - many students choose to complete a microeconomics commentary on demerit goods and the benefits associated with correcting the market failure. The handout details a range of options that students can discuss in their IA, with accompanying diagrams to illustrate their work. Activities 3 - 7 also includes an example of such a welfare loss related to the spillover costs associated with traffic congestion e.t.c.

5. TOK exercise - included in activity 9 - 10, how do governments decide which goods are demerit goods? Is it up to governments to decide what is good for us as a society and what is not?

6. Discussion activities - activities 11 - 12 should be completed as a discussion in groups. I will begin these activities with an initial 'free' discussion and then have the classes watch the relevant videos. I then assign the students into groups so that they can present the opposing arguments raised in the videos. (30 minutes)

7. Link to the assessment - the last activity, number 13 includes a relevant paper one style question for your students to consider or attempt as a classwork / homework exercise. (10 minutes)

Beginning activity

Which of the following demerit goods, in your opinion, should be considered harmful to society - guns, narcotics, alcohol, cars. Which of these do you think is the most dangerous for any society and which the least dangerous?Hint:

According to national statistics, the USA had the following recorded deaths in 2017:

- deaths from cigarette smoking - 480,000 deaths, including 41,000 deaths resulting from secondhand smoke exposure.

- death from car accidents - 38,300 plus 4.4 million sustained injuries which required hospital treatment

- deaths from alcohol - 88,001

- death from illegal drugs - 70,237

- death from fire arms - 39,733, including 24,000 recorded as suicide.

Some of you may be surprised to see the above statistics which raises the question as to why governments continue to be alert to the dangers caused by illegal narcotics and weapons but allow almost unrestricted use of motor cars and cigarettes?

Key terms:

Demerit good - can be defined as one that produces negative externalities when consumed. They are generally over  consumed in a free market, relative to the socially optimum level of output and provide another example of market failure.

consumed in a free market, relative to the socially optimum level of output and provide another example of market failure.

Negative externalities – spillover costs to a third party caused by the production, or consumption of a good (or service). They occur when MSC is greater than MSB in the market for a good or service.

Marginal private benefit - the additional benefit obtained by the consumer or producer from the consumption or production of one additional unit of a product.

Marginal social benefit - equal to the private marginal benefit a good provides plus any external benefits it creates. MSB measures the total marginal benefit of the good to society as a whole.

Marginal private cost - the additional cost incurred by the user or producer of one additional unit of a good or service.

Marginal social cost - the total cost to society as a whole when one more unit of a good or service is consumed or produced.

Socially optimum level of output - where the MSB for a good or service is equal to MSC.

Tradable pollution permits - sometimes called a cap and trade scheme. This policy provides an economic solution to the problem of negative spillover costs, caused by excessive pollution. Under the scheme each company is given a legal right to pollute a certain amount per fixed time span. Firms that pollute less can then sell their leftover pollution permits to firms that pollute more.

Indirect (pigouvian) taxes - a tax on any market activity that compensates for the negative externalities created by the consumption / production of a de-merit good. An example might be carbon taxes or excise duty on car fuel or tobacco products.

The activities on this page are available as a PDF file at: ![]() Demerit goods

Demerit goods

Activity 2: Different government approaches to demerit goods

Complete the following table, which includes a list of goods that produce negative externalities in your country. Divide these into those products which are considered so dangerous that there production and sale is prohibited, goods which are legal but where their consumption and sale is limited / restricted. Lastly, list the goods in your country which are legal and can be sold without limits but are taxed by the government to limit their use.

| Prohibited | Restricted | Taxed | |

| Tobacco | √ age restricted | √ | |

| Petrol | √ | ||

| Marijuana | √ though restricted in some nations | ||

| Hand guns | √ in most nations | ||

| Alcohol | √ | √ | |

| Narcotics | √ | ||

| Junk food | √ in many nations | ||

| Prescription drugs | √ |

Each country applies different rules and regulations but in most nations the sale of hard drugs, weapons, poisons e.t.c. belong in the first category, while tobacco and alcoholic products may belong in the second, available only to those old enough to consume them and with sales restricted to licenced premises. Some nations may also place soft drugs such as marijuana in this category. The third category consists of goods such as petrol and unhealthy foods

Illustrating market failure on a diagram

Watch the following video which explains how economists illustrate market failure before completing the activities which follow. The video uses cigarettes as an example of a demerit good but the theory can be applied to all demerit goods.

Activity 3: Market failure in the market for private cars

Activity 3: Market failure in the market for private cars

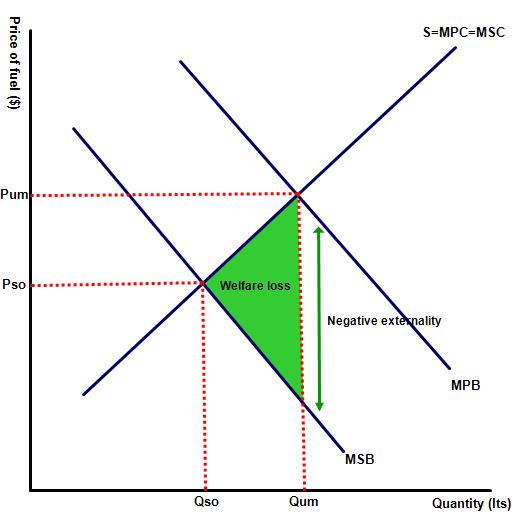

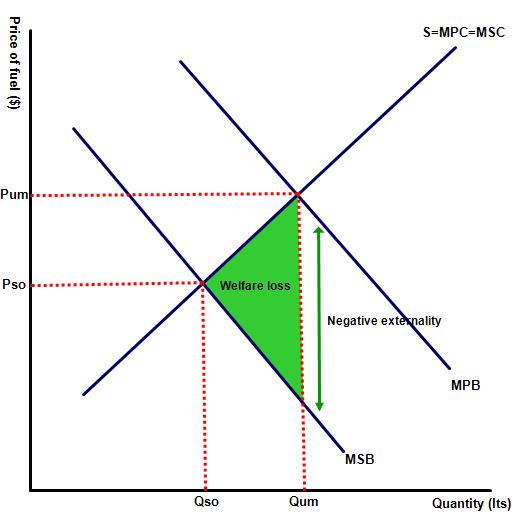

The diagram to the right illustrates the market for petrol in an unregulated market.

(a) Explain why the consumption of petrol is above the socially optimum level of Qso.

At each output level above Qso the MSC of production is greater than the MSB.

(b) Explain why in an unregulated market the market for fuel will also represent a market failure?

When a car owner drives their car he / she (and passengers) receive the exclusive benefits from their consumption through increased utility. However, the costs are paid by both the car driver and third parties which the car owner does not consider when making their consumption decision.

(c) Explain why some third parties suffer as a result of the purchase.

Third parties suffer because the already crowded city has one more car clogging up the roads plus the car will take up a valuable parking space. There is also the increased noise and air pollution that the vehicle causes.

Activity 4: Correcting market failure through taxation

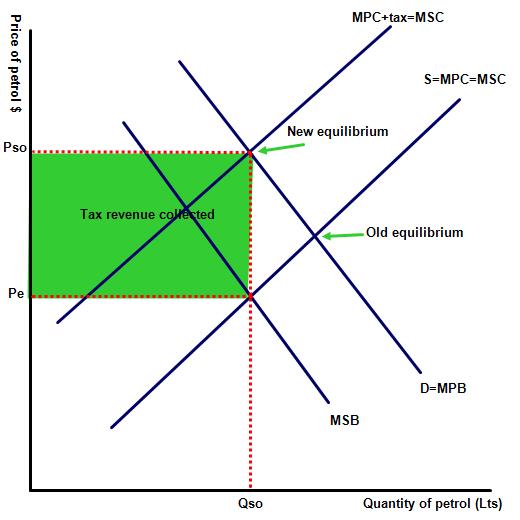

The government decides to try and correct the market failure by imposing a tax on petrol sales, equal in size to the negative externality, in the hope that car owners may use their cars less often.

(a) Draw the impact of the tax on a demand and supply diagram and illustrate the following points:

i. The new equilibrium price and output

ii. The level of tax revenue collected for the government.

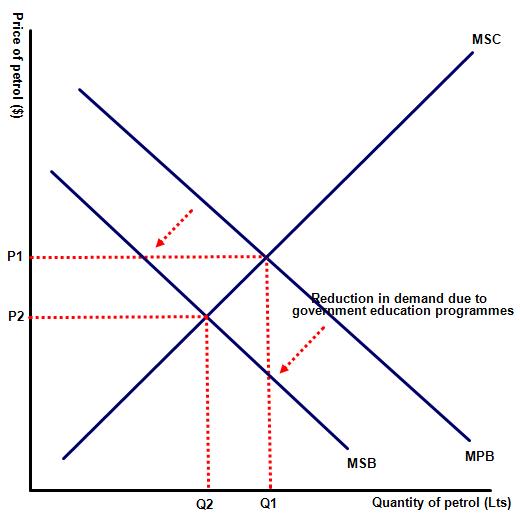

(b) The government also decides as part of its commitment reduce the number of private cars on the roads, to invest in a government education campaign. They hope that this will encourage consumers to leave their cars at home and instead use public transport. How would this be illustrated on a supply and demand diagram? Is this policy likely to be effective?

The policy might be effective but only if the advertising campaign and supported by improvements in public transport - and this would be expensive. By encouraging private car owners to leave their cars at home and instead use public transport, the government may be able to reduce the number of car journeys. This would be represented by a fall in the demand for car fuel from the original MPB line to a demand closer to the MSB curve.

The policy might be effective but only if the advertising campaign and supported by improvements in public transport - and this would be expensive. By encouraging private car owners to leave their cars at home and instead use public transport, the government may be able to reduce the number of car journeys. This would be represented by a fall in the demand for car fuel from the original MPB line to a demand closer to the MSB curve.

One thing is for certain, however, car owners are unlikely to simply give up using their cars just because the government tells them to?

Activity 5: Traffic congestion in a fast growing LEDC

One of the more obvious examples of market failure caused by traffic congestion exists in Istanbul. Rapid urbanisation has made Istanbul one of the most congested cities in Europe, with traffic costing the city more than 5 billion Turkish Liras per year ($ 2bn) in lost revenue. This is caused by a loss of labour and excess fuel consumption, according to Kasım Kutlu, the general manager of the Istanbul Municipality - Affiliated Intelligent Transportation Systems (İSBAK).

Watch the following short video and then answer the following question.

1. Why is the absence of a comprehensive metro system an example of market failure?

The absence of a more comprehensive metro system increases the number of car, taxi and bus journeys made in the city to a level beyond the equilibrium level.

2. Explain how an electronic road pricing scheme might help reduce the externality caused by excessive car consumption in the city?

An electronic pricing system, as used in London or Singapore might help reduce the volume of cars on the cities roads closer to the socially optimum level, leading to less congestion. Such a policy would increase the cost of each car journey to a price closer to the marginal social cost.

Activity 6: Limiting market failure with enforceable limits and tradable permits

Activity 6: Limiting market failure with enforceable limits and tradable permits

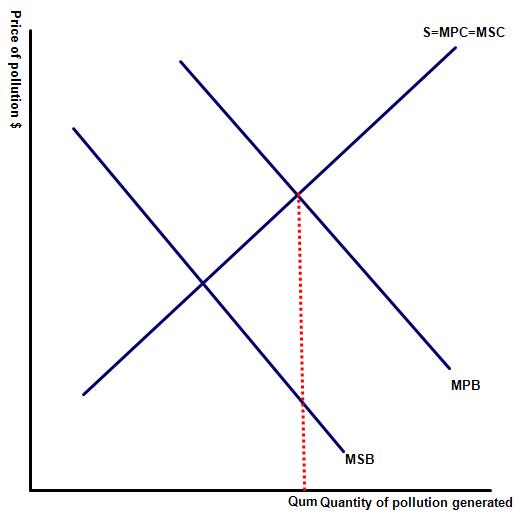

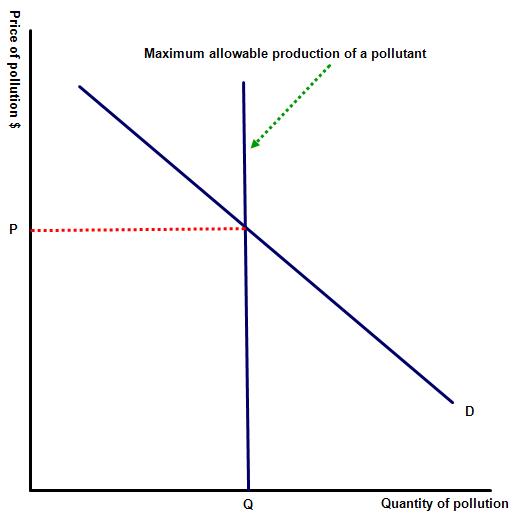

The diagram to the right illustrates the level of pollution in an unregulated market. The government decides to implement an system of agreed pollution limits and tradable permits.

(a) Complete the diagram by adding a tradable quota, at the socially optimum level of output.

(b) How will the market price of permits be derived?

The demand curve for this product will change over time but the equilibrium output will remain at the socially optimum level. The price that polluting firms will need to pay will then adjust in response to market forces. In this example the price of the pollutant is valued at P.

Activity 7: The market for renewable and clean energy

Activity 7: The market for renewable and clean energy

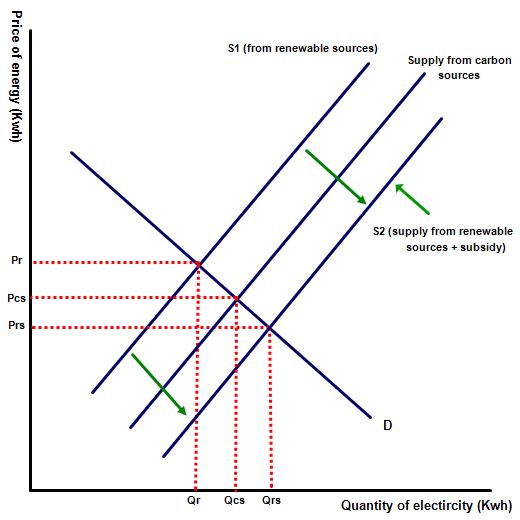

The diagram to the left illustrates the market for renewable energy, with a government subsidy.

(a) Using the diagram explain why many governments believe that the most effective way of reducing dependence on carbon based energy sources is to provide subsidies for alternative products e.g. clean energy sources.

Without the support of government subsidies electricity from clean technologies can be produced at price Pr. This is above the price of electricity generated by conventional sources, Pcs. Left up to the free market the consumer will choose to purchase the cheaper, polluting energy rather than the electricity generated from renewable sources. However, by providing a subsidy for the cleaner energy the government can make it viable for the cleaner technologies to compete, allowing them to produce energy for the same or even lower Kwh price as non renewable sources. This is illustrated by a fall in production costs, which shifts the supply of energy from renewable sources to S2.

(b) Suggest how the government might fund the subsidy on cleaner / renewable energy sources.

One obvious solution would be to place a tax on polluting carbon based energy sources as a way of generating funds for the subsidy - increasing the effectiveness of the subsidy.

Activity 8: Taxation or legislation, which is more effective?

The following short video is taken from a question and answer session given by Milton Freedman during his visit to Rochester University. Milton Freedman is one of the worlds most prominent free market economists. During his career he has consistently promoted the notion that governments should intervene only in the most extreme of circumstances.

After watching the following video discuss the merits and weaknesses of Freeman's assertion that governments should use taxation rather than legislation (prohibiting actions) to correct market failure.

The advantage of governments using taxation as a method of correcting market failure is that the policy is self policing and does not adversely effect the market. By imposing a series of taxes and subsidies, equal in value to the externality, the government can ensure that irresponsible production / consumption is no longer profitable. Similarly the production of socially responsible products becomes economically viable for the first time. The problem associated with this policy, however, is the difficulty of calculating the size of the externality and therefore the size of the tax / subsidy to be applied to each item.

Legislation as Milton Freedman correctly points out is very difficult to implement and effectively police. For example he makes the point that you cannot ban Rochester University from heating their campus just to prevent smoke in the atmosphere which is dirtying peoples shirts. Imposing legislation will often lead to other unforeseen consequences. As Milton says, 'based on previous experience government action is as likely to make the problem worse as better'.

9. TOK link: How do governments decide which goods to classify as demerit goods?

Classifying a product as a demerit goods is a normative judgement and that by consuming these goods we are making the assumption that the consumer is making an irrational decision. In reality however the consumption decision may be either the result of poor information or perhaps the consumer is aware of the costs but simply chooses to consume the good anyway - for example alcohol, narcotics and cigarettes can be highly addictive.

Activity 10: Links to TOK:

Governments use a range of methods to restrict consumption of demerit goods such as cigarettes, alcohol and narcotics. Why do governments use taxation to restrict consumption of some goods while prohibiting the sale of others?

Hint:

Much of the reason comes down to economic reasons e.g. petrol, tobacco e.t.c. are highly PED inelastic and so generate large sums of tax revenue for the government. However, societal attitudes to each demerit good also has a bearing e.g. in many parts of the world alcohol is a socially acceptable drug, while in some parts of the Middle East this is not the case.

Activity 11: What represents a safe level of alcohol consumption

Watch the following short video and then answer the questions: 'Is there a safe limit for alcohol consumption' and how should governments respond to the problems caused by the over consumption of alcoholic beverages?

Some of you maybe surprised to hear that there is actually a safe limit for alcohol consumption and this is approximately one unit a day for women and 2 for men. In fact there is general acceptance that unlike the consumption of tobacco products, a moderate level of alcohol consumption does not contribute in any significant way to market failure. Almost all of the negative externalities associated with alcohol consumption comes from excessive use. For example 30,000 people die from alcohol related causes in USA each year, compared to just 18,000 from excessive drug use. Tobacco remains the deadliest product by far in the USA with 480,000 deaths each year.

For this reason governments are generally reluctant to limit the consumption of alcohol and focus their resources more on advertising campaigns aimed at discouraging 'excess drinking', as well as taxing the product to gain tax revenue, which can then be used to provide resources towards merit goods, such as improved health care.

Activity 12: Should cannabis be legalised?

Activity 12: Should cannabis be legalised?

The consumption of cannabis / marijuana is considered a demerit good, just as the consumption of cigarettes and alcohol are considered demerit goods. The difference being that while most nations impose a blanket ban on the sale of all narcotics including cannabis; consumption of tobacco and alcohol products remain legal - though both goods are taxed to reduce consumption levels. As a point of comparison the number of deaths in the USA in 2015 from all illegal narcotics was 17,000, of which 0 where related to the consumption of cannabis. By contrast deaths from tobacco related products stood at 480,000 deaths, or 1 in every 5 deaths in the country. Of course such a comparison is unfair because rates of tobacco consumption are far greater than levels of drug consumption.

Watch the following video and complete the discussion point which follows:

Discussion point

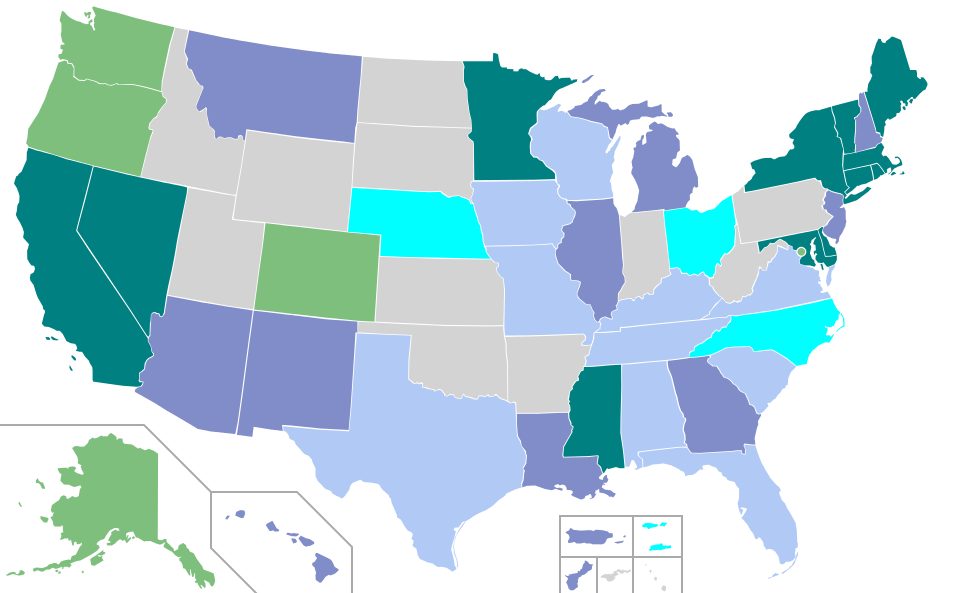

In the USA the legality of the recreational drug cannabis is determined by individual states. As the diagram to the right identifies different states have very different laws on its use.

In the USA the legality of the recreational drug cannabis is determined by individual states. As the diagram to the right identifies different states have very different laws on its use.

At one end of the spectrum, those shaded have fully legalised the recreational drug. Here the drug is still considered a demerit good and the production is subject to a tax to discourage its use. The states shaded have kept the drug illegal but have de-criminalised its use. In the other states shaded , , cannabis remains illegal and consumers face prosecution for its use.

Outline the arguments for an against a state government legalising the drug. Consider the following stakeholders in your decisions:

- the state tax collection service

- occasional users of the drug for recreational purposes

- non users of the drug

- the criminal gangs running the illegal trade

- the drug and law enforcement agencies.

Further reading on this topic can be accessed at: ![]() Marijuana

Marijuana

Activity 13: Link to the paper 1 examination

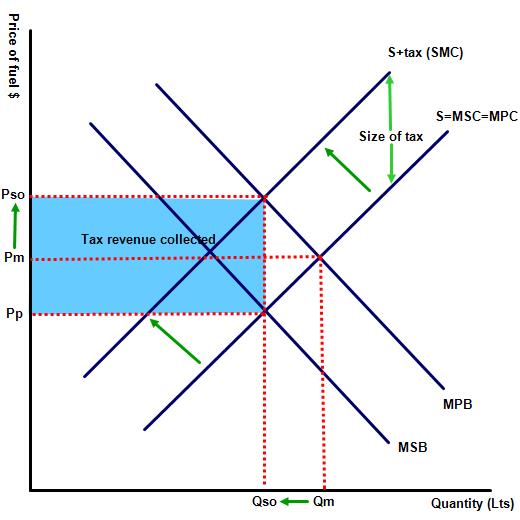

(a) Explain with a diagram how the government imposition of a specific tax could reduce pollution levels in a city. [10 marks]

Command term: Explain

Meaning explain how either a tax on fuel or some form of road pricing can reduce the number of cars in a city. In completing this question responses should include the following:

Key terms to define: demerit goods and specific sales taxes.

Examples of relevant taxes that might be used to reduce the volume of cars in a city e.g. a specific tax on petrol, a tax on new car ownership or an electronic road pricing system similar to the one used in cities around the world such as London or Singapore.

Examples of relevant taxes that might be used to reduce the volume of cars in a city e.g. a specific tax on petrol, a tax on new car ownership or an electronic road pricing system similar to the one used in cities around the world such as London or Singapore.

A diagram, such as the one to the right, illustrating that in unregulated markets the number of car journeys in the city (output Qfm) will exceed the socially optimum level, represented by Qso, because at Qfm the MSC>MSB This is because the equilibrium price (P1) is derived from the private costs and benefits only (MPC and MPB) and does not consider the wider society benefits of their decision (MSB). The social costs of excessive car journeys in the city include greater levels of pollution, lost productivity due to increased journey times and a greater number of accidents on the road. In other words the price of using a car in the city is too low from the view point of the cities residents.

A recognition that by imposing a specific sales tax equal to the size of the externality, illustrated on the diagram by MSC=MPC + tax, then the government can correct this market failure and reduce the size of the inefficiency in the market. Of course if the tax is insufficient to cover the entire externality then the welfare loss will be reduced but not eliminated.

Examples of some alternative solutions for reducing pollution such as legislation, greater subsidies on public transport, specific lanes for public transport e.t.c.

(b) Using real world examples, evaluate the effectiveness of indirect taxes in reducing the consumption levels of demerit goods such as tobacco, petrol and alcohol products? [15 marks]

Command term: Evaluate

This section (b) question requires an evaluative response, which means that candidates must evaluate not only how the government may use taxes to reduce consumption of demerit goods, but also consider should they do so? Responses should also include the following:

Key terms to define: demerit goods, indirect taxes, PED / PES elasticity. Candidates should already have defined both terms in part (a) of the question so they do not need to repeat those definitions, but should refer to those definitions in the beginning part of the response.

Examples of real world examples might include the negative externalities caused by the consumption of fuel, tobacco and alcohol products in the candidates own country and the economic and social costs of consumption.

A diagram providing an explanation of why in unregulated markets demerit goods such as tobacco, petrol and alcohol products tend to be overconsumed due to being sold below the socially optimum price. Illustrated on the diagram below by Pfm.

A diagram providing an explanation of why in unregulated markets demerit goods such as tobacco, petrol and alcohol products tend to be overconsumed due to being sold below the socially optimum price. Illustrated on the diagram below by Pfm.

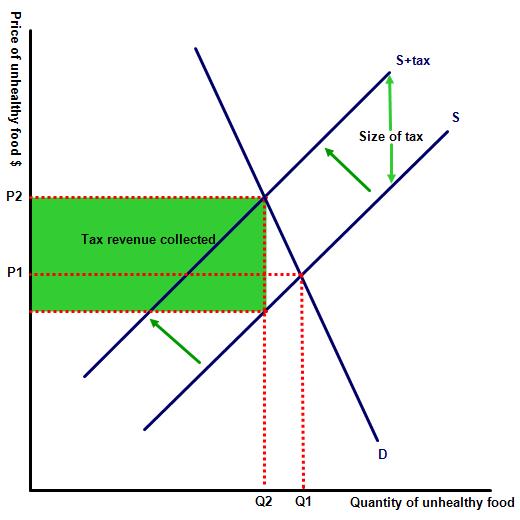

Responses should then continue by stating that the imposition of a specific sales tax, equal to the size of the externality, means that the government can correct the market failure and reduce the size of the inefficiency in the market. Following the sales tax, price will rise (illustrated on diagram 2) from P1 to P2 and quantity demanded will fall from Q1 to the socially optimum level of Q.

As part of the evaluative response required, candidates should also include the following disadvantages of imposing a specific tax on demerit goods. Examples include:

As a result of the sales tax the real income levels of consumers may fall, many of who may be from low income households.

That given the addictive nature of of alcohol and tobacco products, for example, the impact on consumption may be small. Such goods typically have low levels of PED elasticity. Therefore, a tax on those products may be largely ineffective in reducing consumption, illustrated on the diagram below by Q1 to Q2 but will raise a significant  amount of tax revenue, illustrated by the green area - leading to questions over the real motivations of governments imposing a tax.

amount of tax revenue, illustrated by the green area - leading to questions over the real motivations of governments imposing a tax.

A recognition that as a result of the tax and the addictive nature of those products, many low income households may react to the tax by cutting back on other essential items such as food rather than reduce their consumption of alcohol and tobacco products.

A recognition that a rise in the selling price due to an increase in indirect taxation is also likely to lead to a rise in smuggling and black market sales.

Responses should finish with a conclusion considering the strengths of both arguments, as well as the impact on different stakeholders as well as the short and long term consequences of a sales tax. An example might be that in the short-term a sales tax will have little impact on consumption levels but may reduce sales levels over time.

In the paper three examination candidates may be required to suggest possible government options to correct market failure and / or illustrate the impact of such policies on a diagram. They may also be required to calculate the impact of any tax and or subsidy from the data provided.

IB Docs (2) Team

IB Docs (2) Team