Efficiency in perfect competition (HL only)

Introduction

Introduction

This page focuses on the concepts of productive and allocative efficiency and looks at why firms in perfect competition will be both productive and allocatively efficient in the long run. Productive efficiency is no longer part of the new syllabus but allocative efficiency remains.

Enquiry question

Why will firms in perfect competition achieve allocative efficiency in both the short run and the long run.

Lesson notes

Lesson notes

Lesson time: 85 minutes

Lesson objectives:

Explain the meaning of the term allocative efficiency. Explain that the condition for allocative efficiency is P = MC (or, with externalities, MSB = MSC).

Explain, using a diagram, why a perfectly competitive market leads to allocative efficiency in both the short run and the long run.

Teacher notes:

1. Beginning activity - begin with the opening question and allow 10 minutes for your classes to answer the question and then discuss it. (10 minutes)

2. Processes - technical Vocabulary - the students can learn the key concepts through the first two activities, which should take 15 minutes to go through and discuss.

3. Discussion activities 3, 4 - the importance of allocative and productive efficiency - which is more important? (15 minutes)

4. Linking efficiency theory to the macro economy, is activity 5 (10 minutes)

5. revision activity, activity 6 is included on the handout should take around 15 minutes.

6. More detailed explanation of why allocative efficiency is represented where price = marginal cost? (10 minutes)

7. Final reflection exercise - contains two relevant section A, paper one style questions on this topic that your students can look at and discuss. This topic of course can be included on papers one and three of the examination and this page contains both types of questions to practise on. This activity could also be set as a homework or classwork exercise. (10 minutes)

Beginning activity

Consider two firms - a small family run business selling kebabs and other snacks and the second a large restaurant chain. Which is the more efficient and why?

Hint:

The answer depends on what we mean by efficiency? In some ways we could consider the smaller, family run business to be the more efficient. The business is unlikely to make large profits and will probably also keep waste to a minimum. On the other hand they will not be receiving any benefits from economies of scale. So the larger firm, as a result of employing mass production techniques, may end up producing at a lower production cost than the smaller firm. From an economics perspective, however, many economists would consider the large business to be inefficient for two reasons:

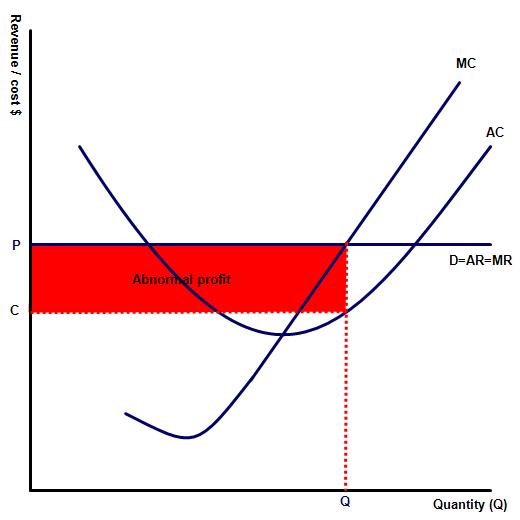

Firstly, do not need to be efficient. With an element of control over price they can cover up any efficiencies by simply raising prices to protect their profit margins. Secondly, they are likely to make abnormal profits which reduces allocative efficiency in the economy over all. Normally in economics abnormal profits are a signal for other businesses to enter the market and drive down prices but larger businesses can prevent this by employing barriers to entry.

Key terms:

Allocative efficiency: When a firm is producing at the socially optimum level of output and is equal to where AR = MC. This is because the price of any product reflects the value that consumers place on the worth of the good or service. Therefore, when the two points intersect the value of the product (selling price) equals the value of the resources required to produce the good or service, including the opportunity costs of production.

Pareto optimality: When a firm is allocatively efficient and so it becomes impossible for one person to be better off without this making another worse off.

The activities for this lesson can be accessed as a PDF file at: ![]() Efficiency

Efficiency

Activity 1: Drawing the diagrams

Illustrate the point of allocative efficiency on a diagram.

Activity 2

Are the following firms allocatively efficient in the short run?

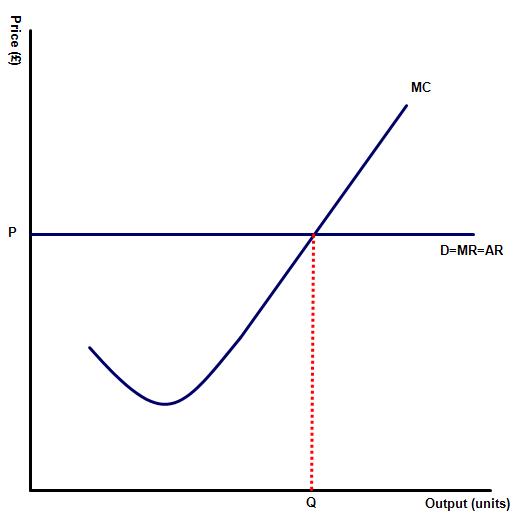

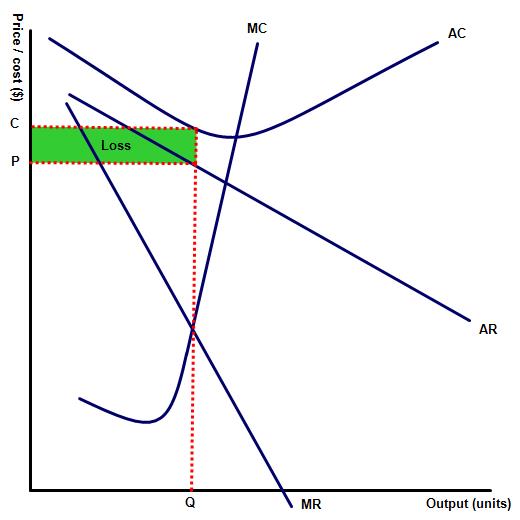

Diagram 1 is allocatively efficient because AR = MC.

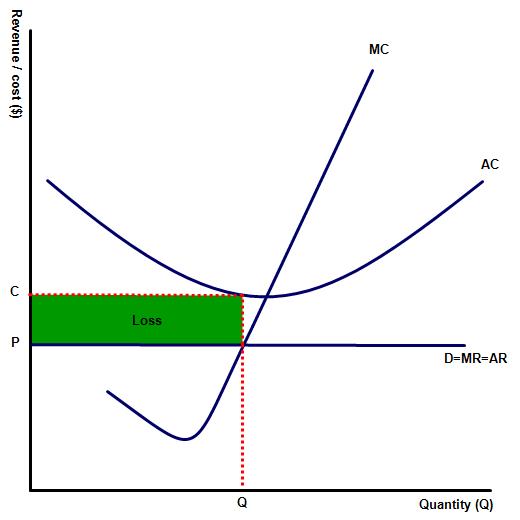

Diagram 2 shows a business that is allocatively efficient.

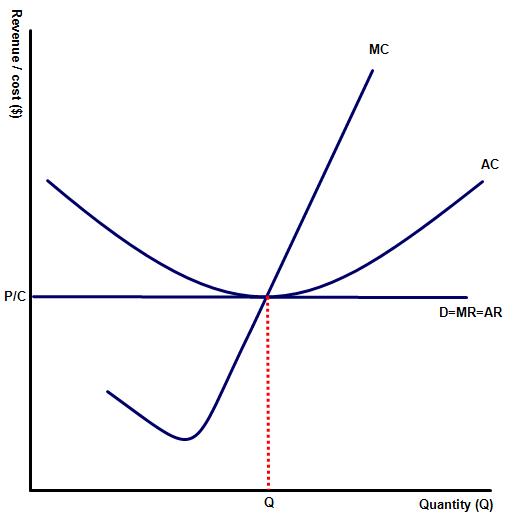

On the third diagram MC = AR so it is allocatively efficient, where the firm is producing at output Q.

Lastly, diagram 4 is AR ≠ MC so not allocativel efficient. You may also have noticed that the diagram is not a perfectly competitive diagram.

Activity 3: Applying efficiency to the wider economy

Activity 3: Applying efficiency to the wider economy

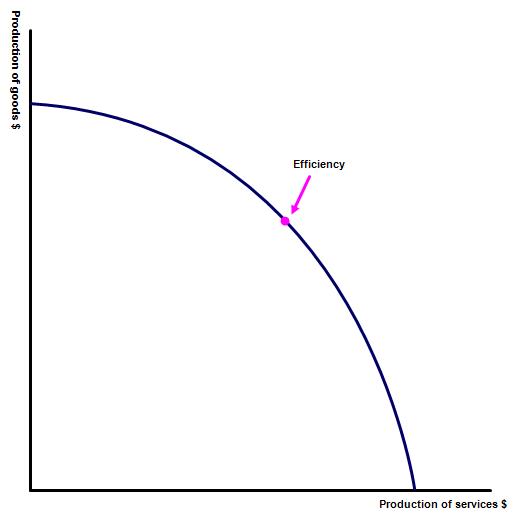

An economy is producing at a point along its maximum PPC curve. Does this mean that the economy is allocatively efficient?

No, this does not mean that the economy is allocatively efficient. The PPF only shows potential output, and allocative efficiency is concerned with how goods are distributed in society.

Activity 4

Fill in the missing spaces to complete the table

| Abnormal profits possible? | Losses possible? | Allocative efficiency | |

| Perfect competition SR | yes | yes | yes |

| Perfect competition LR | no | no | yes |

| Oil company SR | yes | yes | no |

| Oil company LR | yes | yes | no |

5. Final activity: Link to the assessment

Examples of paper one (part a) questions on efficiency in perfect competition might include:

a. Explain why in perfect competition the MR and AR curves are perfectly elastic. [10 marks]

Command term: Explain

Responses should include the following:

Key terms to define: Marginal revenue, average revenue

Key terms to define: Marginal revenue, average revenue

In perfect competition all firms are price takers and not price makers. With hundreds or perhaps thousands of competing firms in the market, all selling a homogenous product and no brand loyalty, individual firms are unable to influence market supply or equilibrium price and instead must 'take' the prevailing market price (price P on the diagram). At this price firms can sell as much of the product as they wish and so there is no advantage to be gained by lowering prices. Similarly any firm in the market trying to raise prices in the hope of making an abnormal profit will instead see their demand / sales fall to zero as perfect knowledge exists in the industry and no brand loyalty exists.

Economic theory normally dictates that MR will fall at twice the rate of the AR but in this example the AR does not have a slope. Each individual is so small that any change to their output will have no bearing on the overall market supply.

IB Docs (2) Team

IB Docs (2) Team