Monetary policy

Introduction

Introduction

This will look at monetary policy and how governments can employ monetary policy measures to influence the aggregate demand curve.

Enquiry question

How do central banks, through changes to interest rates, exchange rates and the money supply influence the level of aggregate demand in an economy. Can monetary policy help close an output gap?

Lesson time: 70 minutes

Lesson objectives:

Lesson objectives:

Describe the role of central banks as regulators of commercial banks, bankers to governments and responsible for interest rates and exchange rates in order to achieve macroeconomic objectives.

Explain, using a demand and supply of money diagram to explain how equilibrium interest rates are determined, outlining the role of the central bank in influencing the supply of money.

Explain how changes in interest rates can influence the level of aggregate demand in an economy.

Explain using a diagram how easy (expansionary) monetary policy can help an economy close a deflationary (recessionary) gap.

Explain using a diagram how tight (contractionary) monetary policy can help an economy close an inflationary gap.

Evaluate the effectiveness of monetary policy through consideration of factors including the independence of the central bank.

Teacher notes:

1. Beginning activity - begin with the opening scenario which considers how monetary policy would work on a desert island. (Allow 5 minutes to discuss this scenario)

2. Processes - technical vocabulary - the students can learn the background information from the videos attached to the activities on this page, the list of key terms and activities 2 and 3. Allow 20 minutes for both activities.

3. Applying the theory - activity 4 starts with a short news clip from the US news, predicting a small rise in interest rates in the coming week. How does this decision effect some of the stakeholders involved in the decision? (10 minutes)

4. Questioning the theory - complete the short response activity 5, which addresses the limitations of any monetary policy measures. (10 minutes)

5. Developing the theory - activities 6 and 7 look at how even small changes in monetary policy can effect disposable incomes in the UK, while activity 6 develops the argument by looking at the money multiplier. (15 minutes)

6. Final reflection - activity 10 contains a section paper one style examination question. (10 minutes)

Key terms:

Monetary policy - a demand-side policy with the Central Bank using changes in the money supply or interest rates to affect AD.

Central bank - the governments bank and has ultimate control over the supply of money in the economy e.g. The Federal Reserve Bank.

Central bank - the governments bank and has ultimate control over the supply of money in the economy e.g. The Federal Reserve Bank.

Base rate or discount interest rate - the interest rate that Central banks charge commercial banks for short term loans. This is used by governments to influence interest rates in the economy. If a Central bank lowers the rate at which lends money to commercial banks then this should also be passed onto to consumers in the form of lower rates.

Expansionary monetary policy - an expansion of the money supply through reduced interest rates and / or quantitative easing. This is used to stimulate the economy by reducing the cost of borrowing, which in turn encourages private consumption and investment.

Contractionary monetary policy - a contraction of the money supply through higher interest rates and / or lowering the money in circulation. This is used to fight inflation by increasing the cost of borrowing, which in turn decreases GDP and dampens inflation.

Quantitative easing - another example of expansionary monetary policy and can be used when short-term interest rates are at or approaching zero. In QE a central bank purchases government securities or other securities from the market in order to increase the money supply and encourage lending and investment.

The activities on this page are available as PDF at: ![]() Monetary policy

Monetary policy

Beginning exercise

Suppose you are stuck on a desert island with your current class. You quickly pick up skills to make life better on the island. Some of you become fishermen, farmers, hunters e.t.c while a number of you learn how to build simple beach huts and become relatively wealthy individuals. The collective value of your output is equal to the island GDP. You begin trading with each other but quickly realise the limitations of a barter economy. You then get together and collectively agree that the small, limited blue pebbles, which you can find on the island will be used as currency. These are collected and placed in a central bank. The new monetary system works well and the individual in charge of administering the pebbles is well thought of. One day this individual decides that the economy needs a boost. He mixes some blue die and colours a number of the white pebbles blue in what he hopes will be a boost to the economy. Indicate the likelihood of this monetary venture being successful?

Hint:

As crazy as the idea sounds initially it might work quite well. The monetary stimulus may speed up economic activity by forcing businesses to raise their production levels to cater for the rise in demand for their goods services. However in the long run having too many new blue pebbles chasing broadly the same number of products as before will simply push up the general price level, not the level of economic growth.

Amazingly such a monetary policy has been implemented on several occasions by governments, most famously perhaps by German governments in the 1920s and 1930s. The following presentation illustrates the impact of this through a series of photographs taken at the time: ![]() German inflation

German inflation

Activity 2: The money supply

Start by watching the following video based on the movie 'despicable me' and then complete the activities that follow:

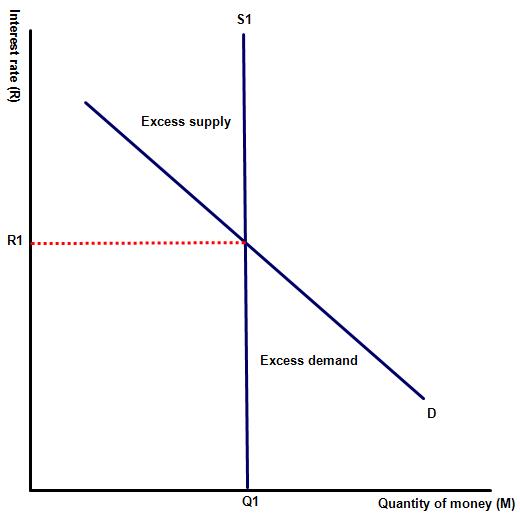

(a) The diagram to the right illustrates the market for money, with the price of money equal to rate of interest in the economy.  Explain how during an economic cycle the money market adjusts to reflect economic conditions?

Explain how during an economic cycle the money market adjusts to reflect economic conditions?

When the economy is growing we would expect to see a shift upwards in the demand for money, as private consumers and businesses seek to borrow money to finance their purchases. This will lead to a rise in the interest rate in the economy which will reduce the demand for money and slow down economic activity.

Similarly, when the economy is operating poorly demand for loanable funds will fall and interest rates will reduce, encouraging firms and consumers to borrow more and speed up the rate of economic activity in the economy.

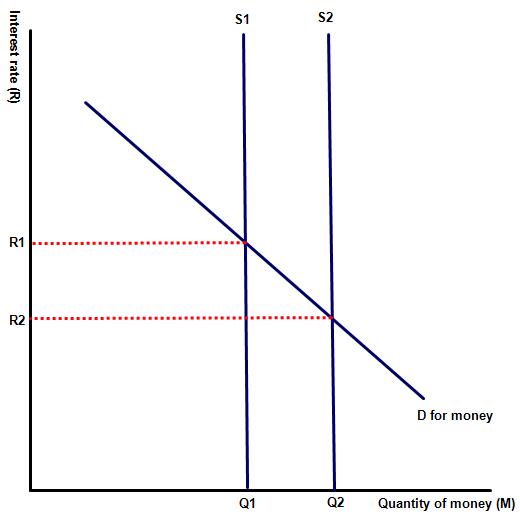

(b) Illustrate what happens to the market for money when the government increases the supply of money in the economy by quantitative easing or reducing the reserve rate?

The supply of money will shift to the right, reducing the rate of interest in the economy - this would be an example of expansionary monetary policy.

The supply of money will shift to the right, reducing the rate of interest in the economy - this would be an example of expansionary monetary policy.

Activity 3: Using monetary policy to close an output gap

Use the information in the video to complete the following tasks.

(a) The video claims that during recession the government may choose to implement expansionary monetary policy to raise aggregate demand. Which three monetary policies does it identify to satisfy this objective?

Lowering interest rates by reducing the reserve rate (the rate of interest that central banks lend money to commercial banks), reduce the reserve requirements, allowing banks to lend money out more easily or use open market operations. This means purchasing bonds on the open market to increase the supply of money in the economy.

(b) How does lowering interest rates in the economy raise the money supply and increase aggregate demand?

Lower interest rates encourages consumers to spend more of their income and also encourages businesses to invest. Saving, which is a substitute for consumption and investment is less profitable when interest rates are lowered.

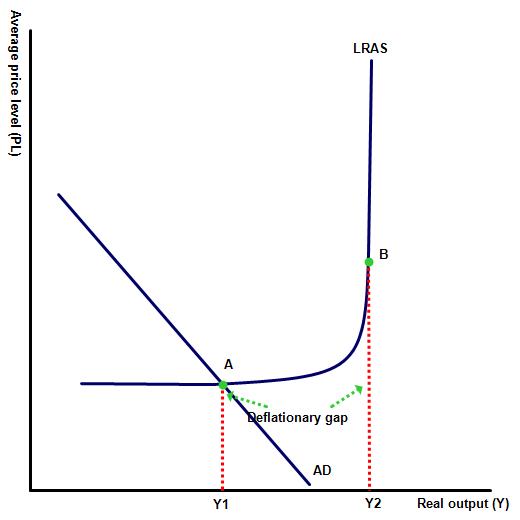

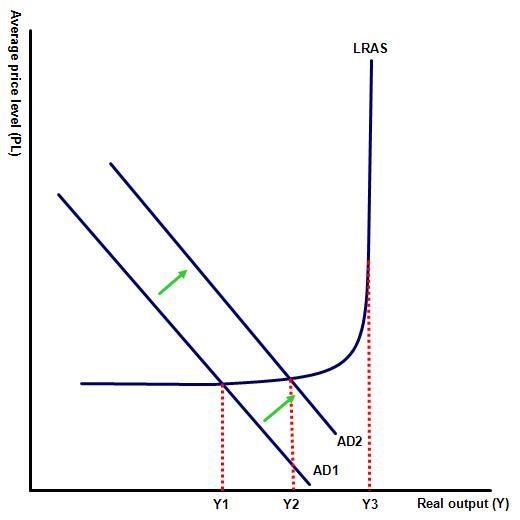

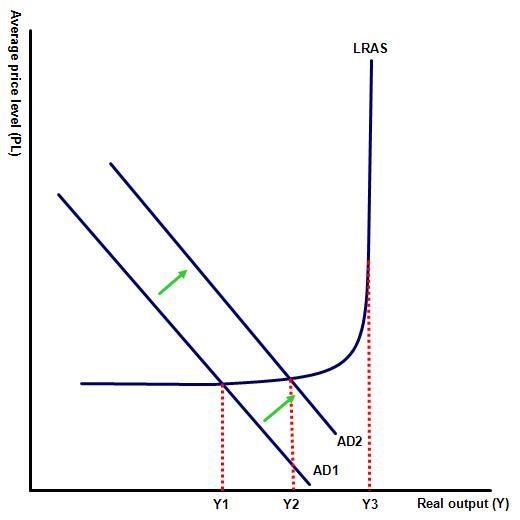

(c) Draw keynesian and classical / laissez faire LRAS curves, representing an economy with a recessionary gap.

Keynesian

Classical / laissez faire model

(d) Illustrate the effect of expansionary monetary policy on the two diagrams you have drawn?

Keynesian

Using a keynesian LRAS curve, a rise in AD will lead to a rise in real output and a reduction in the size of the deflationary gap - at Y1 there is spare capacity in the economy.

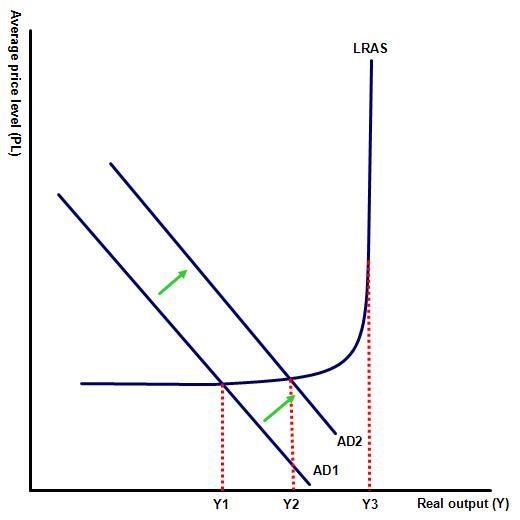

Classical / laissez faire model

Under the classical LRAS model, a rise in AD will not lead to a rise in real output, long term, because of the level of crowding out in the economy. The rise in real GDP will be short term only.

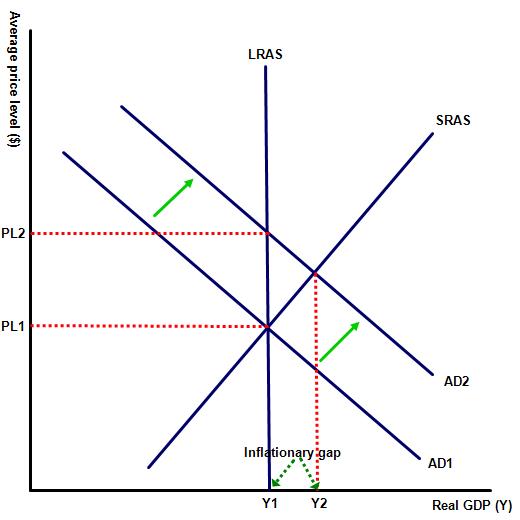

(e) Draw keynesian and classical / laissez faire LRAS curves, representing an economy with an inflationary gap.

Keynesian LRAS

.jpg)

Free market LRAS

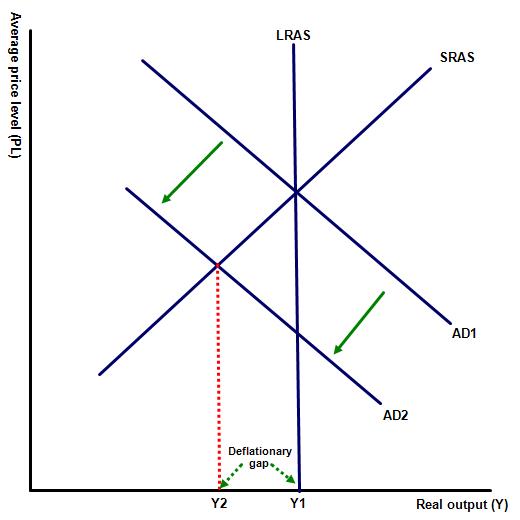

(f) Explain the effect of contractionary monetary policy on the two diagrams you have drawn?

As the video highlights contractionary monetary policy will reduce AD back to AD1 and the inflationary gap will close. Free market economists, however, suggest that this would happen anyway, without any government policy required because of the economy's natural stabilisers.

(g) Explain what happens to either an inflationary or contractionary gap when the government chooses to do nothing and instead let the economy's natural stabilisers operate.

As the video highlights eventually the economy should return to normal because over time the price of factor resources - land, labour, capital e.t.c.will fall in price, reducing the operating costs for businesses and providing an incentive for businesses to expand their output. For example, in recession many workers will become unemployed and would be willing to work for a lower wage than previously. With demand for money being low interest rates would also naturally fall, without the government actually making it happen.

(h) Why did William McChesney Martin, former chairman of the Federal Reserve say that the job of monetary policy was to get a party started before 'taking away the punch bowl'

This remark referred to a central bank action to reduce the stimulus that it has been giving the economy, once the party was in full swing and no longer required central bank help.

Activity 4: How a change in interest rates affects different stakeholders

Watch the following short video and then describe the impact of higher interest rates on the following components of American aggregate demand?

- consumption

- investment

- government spending.

The video begins by stating that analysts expect a small rise in the central bank rate from 0.25% to 0.5%, which will then be passed onto the American public in the form of increased mortgage costs and higher interest charges on credit and store cards.

The video begins by stating that analysts expect a small rise in the central bank rate from 0.25% to 0.5%, which will then be passed onto the American public in the form of increased mortgage costs and higher interest charges on credit and store cards.

Brian Relling, co head of global strategy at Wells Fargo says that he does not expect there to be any negative impact on investment as a result of the rise in interest rates.

The government may be forced to make higher repayments towards their national debt which could act as a drag on other areas of government spending

Activity 5: The impact of interest rates on disposable income levels

The following data relates to the UK in 2018:

The average house price in the country was $ 300,000 and average incomes were $ 2,300 per month net of tax.

Complete the following table by filling in the missing blanks:

| Mortgage interest rate | Size of loan (UK average) | Monthly instalments (interest only) | Disposable income (net income - mortgage payment) |

| 3% (current) | $ 120,000 | $ 300 ((120,000x0.03) / 12) | $ 2,000 ($2,300 - interest payment) |

| 3.5% | $ 120,000 | $ 350 | $ 1,950 |

| 4% | $ 120,000 | $ 400 | $ 1,900 |

| 4.5% | $ 120,000 | $ 450 | $ 1,850 |

| 5% | $ 120,000 | $ 500 | $ 1,800 |

Use the above data to evaluate the statement that control of interest rates is one of the most significant economic weapons that a government possesses in its control of national income.

The importance of interest rates cannot be overstated. As the table above shows a rise in central bank interest rates from 3% to 5%, reduces monthly disposable incomes by $ 200. This is $ 200 that households then have to spend on goods and services. As consumption falls firms reduce their stock levels and cut back on workers, reducing incomes and employment further.

The importance of interest rates cannot be overstated. As the table above shows a rise in central bank interest rates from 3% to 5%, reduces monthly disposable incomes by $ 200. This is $ 200 that households then have to spend on goods and services. As consumption falls firms reduce their stock levels and cut back on workers, reducing incomes and employment further.

Higher interest rates also reduces investment levels as the opportunity cost of investing rises i.e. it becomes more expensive to borrow the money thus requiring a higher return to make the project successful. Alternatively if the investment is to be financed from a company's savings then firms can make more money from simply placing their savings in the bank.

All of this means that manipulating interest rates is probably more effective than changes to taxation in terms of the overall impact on consumption rates. For instance, in the example above the government would have to raise income tax rates considerably in order to reduce disposable income levels by the same amount.

Activity 6: Limitations of monetary policy

Use the information from the following video to answer the questions that follow:

(a) What difficulties does any central bank have in taking the correct course of action to reduce the size of an output gap in the economy?

The video identifies three challenges facing any central bank:

- the quality of any data they are relying on - revisions to data are commonplace and central banks cannot simply wait for the revisions to become available.

- time lags, typically 16 - 18 months between the data becoming available and the appropriate policy taking an effect.

- control of central bank is not absolute e.g. commercial banks may not pass on lower interest rates to the consumer.

(b) What are the risks of central banks getting monetary policy wrong?

By stimulating either too much or too little there is a very real risk of central banks storing up greater problems for the future. For example, the video argues that aggressive expansionary monetary policy in the late 1970s caused even bigger problems in the early 1980s.

Activity 7: Money multiplier (HL only)

The following video focuses on the multiplier - the first 3.50 minutes on the spending multiplier but the remainder of the video focus on the money multiplier. Use the information from the video to answer the questions about the money multiplier.

(a) What is the money multiplier?

The multiple by which money placed in the bank is used by banks to create loanable funds. The size of the multiplier depends on the reserve requirement e.g. 1 - reserve requirement.

(b) The reserve requirement in an economy is 10%. Calculate the total rise in the money supply created when the government purchases $10 billion worth of bonds.

$ 90 billion. With the $10 billion bond purchase the banks must hold back, meaning that the banks can take the other $9 and lend it out to consumers and businesses. However, each time they lend money out the bank must retain 10%, meaning that the total addition to the money supply is $9b x 10 = $90b

(c) Using the same reserve requirement what would be the total fall in the money supply when the government sells $ 15 billion worth of bonds.

$13.5 x 10 = $135 billion.

(d) A government decides to reduce the reserve requirement from 10% to just 7. Is this an example of expansionary or contractionary monetary policy?

Expansionary because it will allow banks to lend out more funds.

Activity 8: Link to the assessment in paper one

Activity 8: Link to the assessment in paper one

Examples of paper one questions on monetary policy include:

(a) Illustrate using a diagram how a government can use expansionary monetary policy to close a deflationary gap in the economy. [10 marks]

Command term: Illustrate

Key terms to define: expansionary monetary policy, deflationary gap

This response requires a response which uses a diagram to show the closing of a deflationary gap through rises in AD and an explanation of effective policies that a government could  employ to close a deflationary gap. These might include a fall in central bank interest rates or quantitative easing (electronic printing of money).

employ to close a deflationary gap. These might include a fall in central bank interest rates or quantitative easing (electronic printing of money).

This is likely to increase aggregate demand levels via a rise in consumption and investment, providing there is spare capacity in the economy – a cheap money policy encourages borrowing and reduces the incentive for households to save their disposable income.

Responses should also recognise that a rise in the money supply is also likely to lead to a fall in the price of the national currency, making exports cheaper and imports more expensive, potentially leading to a rise in net exports.

(b) Using an example from the real world, discuss why Keynes believed that an economy will remain stuck in a permanent deflationary gap, without the use of a government fiscal stimulus package. [15 marks]

Command term: Discuss

Command term: Discuss

Key terms to define: fiscal policy, deflationary gap

In this example the command term is discuss which means offer a considered and balanced review, which presents both sides of argument - keynesian and neo-classical.

Real world examples might include Japan and USA. Following the financial crisis of 2007-9, the USA economy benefited as a result of expansionary demand side policies, while Germany also recovered from recession, despite not adopting the same measures.

Responses can start with an explanation of why, according to keynesian economists, an economy may be permanently stuck in recession without government stimulus. For example according to keynesian economists, governments cannot simply wait for an economy to fix itself as in the long run ‘we are all dead’. A good example of this might be Japan in the 1990s, which remained stuck in a permanent deflationary gap, before adopting expansionary fiscal measures after the year 2000.

By comparison an example of when a government successfully adopted such a fiscal stimulus approach could be the US economy in 2007 - 2010, which many economists believe was rescued by keynesian stimulus policies.

This can be illustrated by a suitable diagram showing a rise in AD (closing of the deflationary gap) as a result of fiscal stimulus measures.

A recognition that because of the impact of the multiplier any stimulus package may end up being self financing, funded by future rises in economic activity and increased tax revenues.

On the other hand responses must also consider the neo-classical view which opposes keynesian economic theories.

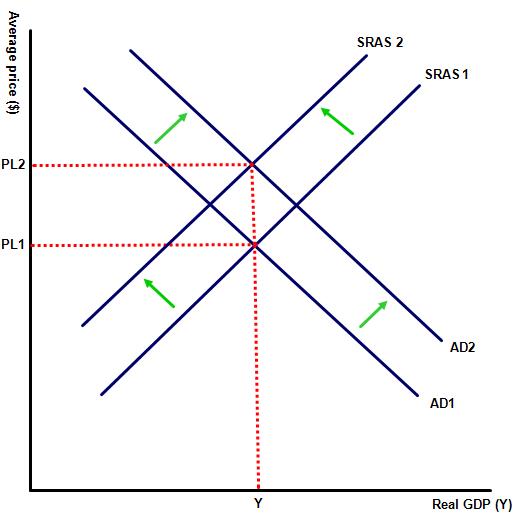

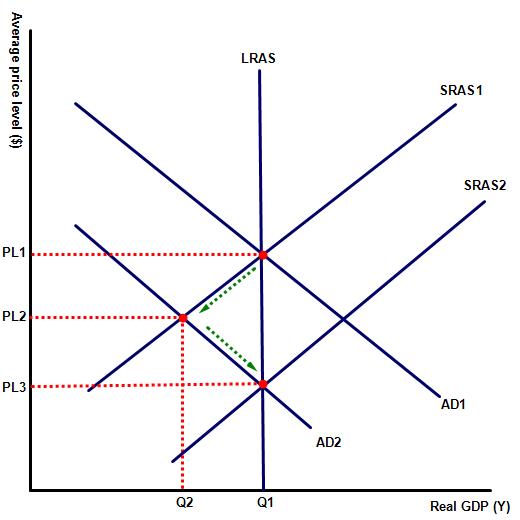

This should include an explanation of why, according to neo-classical economists, an economy in recession will automatically correct itself. This can be explained via a long run AS curve that inflationary / deflationary gaps are short term measures only and that without government intervention the macroeconomy will naturally clear at a new equilibrium level.

This should include an explanation of why, according to neo-classical economists, an economy in recession will automatically correct itself. This can be explained via a long run AS curve that inflationary / deflationary gaps are short term measures only and that without government intervention the macroeconomy will naturally clear at a new equilibrium level.

This is illustrated on the diagram, showing the economy's natural stabilisers correcting a deflationary gap. Initially aggregate demand falls from AD1 to AD2 and a deflationary gap is created from Q1, Q2. However, over time, as unemployment in the economy rises and the price of factor resources falls, indicated by a rise in aggregate supply from SRAS1 to SRAS2, a new long run equilibrium is established and the the economy clears at Q1.

Responses should also consider that any government decision will be influenced by whether they are looking for a short term fix, in which case they are likely to employ keynesian stimulus policies, or whether the government is looking for long term sustainable improvements in growth.

Responses should also discuss the impact of any stimulus package on other macroeconomic objectives e.g. the budget deficit and inflation.

Real world examples that might be used could include, which has adopted a series of expansionary demand side policies in order to stimulate economic activity, but their economy remains stuck in a recessionary cycle - and with significant higher national debt levels as a result. Another example might include Germany following the financial crisis of 2009. The government largely chose not to intervene in the economy, allowing the economy's natural stabilisers to take effect which they did - with the economy recovering in a short number of years.

IB Docs (2) Team

IB Docs (2) Team