Fiscal policy

-1.jpg) Introduction

Introduction

This page considers the way that governments collect tax revenue as well as how they spend that revenue on a range current expenditures, capital expenditures and transfer payments.

Enquiry question

How do changes to government expenditure and / or taxes influence the level of aggregate demand in an economy. Can fiscal policy help close an inflationary or deflationary gap?

Lesson time: 70 minutes

Lesson objectives:

Lesson objectives:

Explain how changes in the level of government expenditure and/or taxes can influence the level of aggregate demand in an economy.

Explain using a diagram how expansionary fiscal policy can help an economy close a deflationary (recessionary) gap.

Explain using a diagram how contractionary fiscal policy can help an economy close an inflationary gap.

Explain how factors including the progressive tax system and unemployment benefits, which are influenced by the level of economic activity and national income, automatically help stabilize short-term fluctuations.

Evaluate the effectiveness of fiscal policy in promoting economic activity in a recession, including the presence of time lags, political constraints, crowding out, and the inability to deal with supply side causes of instability.

Evaluate the view that fiscal policy can be used to promote long-term economic growth (increases in potential output) indirectly by creating an economic environment that is favourable to private investment, and directly through government spending on physical capital goods and human capital formation, as well as provision of incentives for firms to invest.

Teacher notes:

1. Beginning activity - begin with the opening video which takes 10 minutes to watch and then complete activity 1 and 2 based on the information contained in the video. (Allow 20 minutes in total for the two activities and the video)

2. Processes - technical vocabulary - the students can learn the background information from each of the videos attached to the activities on this page and the list of key terms. Allow 10 minutes for the key terms.

3. Questioning the theory - complete the short response activity 3, which addresses the limitations of any fiscal policy measure. (10 minutes)

4. Applying knowledge - activity 4 develops the argument, applying the theory to the US economy at two different time periods. (10 minutes)

6. Developing the theory - activity 5 and 6 consider whether it is possible for new US President Trump to simultaneously improve both AD and LRAS, through private funded infrastructure projects. (10 minutes)

7. Final reflection - activity 7 contains a section paper one style examination question. (10 minutes)

Key terms:

Key terms:

Fiscal policy - refers to the use of government spending and tax policies to influence economic conditions, including demand for goods and services, employment, inflation and economic growth.

Expansionary fiscal policy - examples of this would include decreasing taxes and / or increasing government expenditures, implemented to fight recessionary pressures. A decrease in taxes means that households have more disposal income to spend, while a rise in government spending provides and injection into the circular flow of national income.

Contractionary fiscal policy - examples of this would include increasing taxes and / or reducing government expenditures, implemented to fight inflationary pressures. Both policies take money out of the circular flow of national income.

Spending multiplier - represents the multiple by which GDP increases or decreases in response to an increase and decrease in government expenditures and investment.

Automatic stabilisers - so called because they act to stabilise economic cycles and are automatically triggered without additional government action. Within fiscal policy this includes personal income taxes, which automatically fall as the national income declines and transfer payments such as unemployment insurance and welfare payments.The activities on this page are available as a PDF at: ![]() Fiscal policy

Fiscal policy

Activity 1: Applying fiscal policy

Use the information from the following video to answer the questions in activities 1 and 2.

(a) In times of sluggish economic activity governments can manipulate aggregate demand by what combination of taxation and / or government spending?

Reducing taxation and / or raising government spending

(b) Explain the difference between expansionary and contractionary fiscal policy?

Expansionary fiscal policy would include decreasing taxes and / or increasing government expenditures and are used to fight recessionary pressures. Contractionary fiscal policy involves increasing taxes and / or reducing government expenditures and are used to fight inflationary pressures.

(c) When a government increases its spending on transfer payments, public services and other spending items, how does this multiply throughout the economy?

This money then filters down to other sectors of the economy, as those dependent on the public sector spend their disposable income on goods and services in the economy.

(d) When a government reduces tax rates, how does this multiply throughout the economy

When a government reduces the level of income tax or sales tax, private consumption is encouraged, raising AD. Likewise a fall in corporation tax (tax on company profits) will encourage greater investment levels.

(e) The diagram to the right illustrates an economy with a recessionary gap of $80 bn, at point A The government understands from previous fiscal spending measures that the MPC of this nation is 0.5. Calculate the size of the initial rise in government spending required to fill the output gap.

Multiplier = 1 / 0.5 = 2. Therefore the gap can be filled with an initial spend of $ 40 Bn.

(e) How might the economy's automatic stabilisers resolve some of the output gap without any need for direct government intervention?

The examples in the video include out of work benefits which increases AD through increases to C and G, without the government directly intervening.

Activity 2: Closing a recessionary

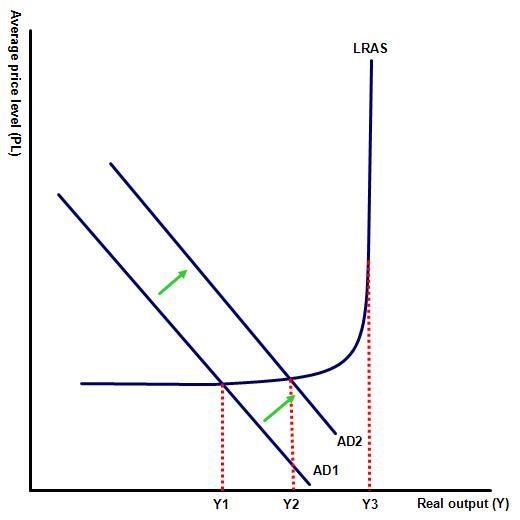

(a) Draw keynesian and classical / laissez faire LRAS curves, representing an economy with a recessionary gap.

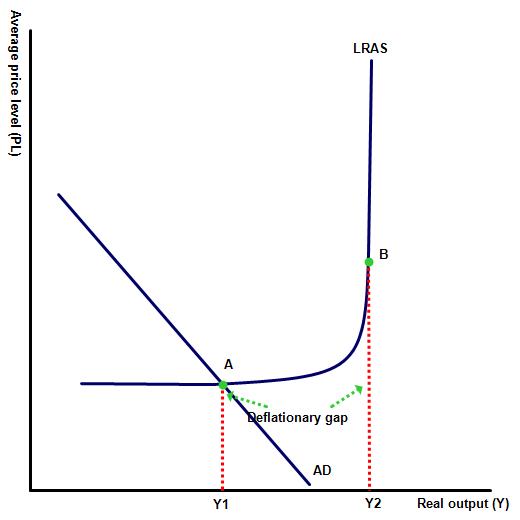

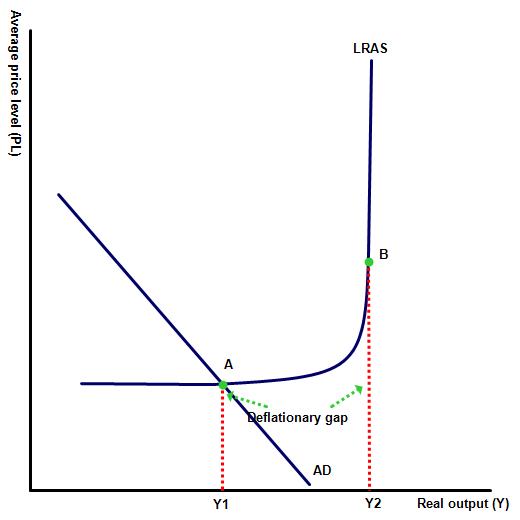

Keynesian

Classical / laissez faire model

(b) Illustrate the effect of a fall in either taxation or a rise in government spending on the two diagrams you have drawn?

Keynesian

Using a keynesian LRAS curve, a rise in AD will lead to a rise in real output and a reduction in the size of the deflationary gap - at Y1 there is spare capacity in the economy.

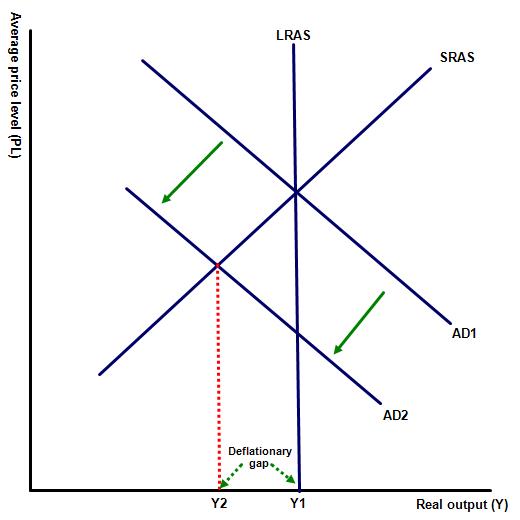

Classical / laissez faire model

Under the classical LRAS model, a rise in AD will not lead to a rise in real output, long term, because of the level of crowding out in the economy. The rise in real GDP will be short term only.

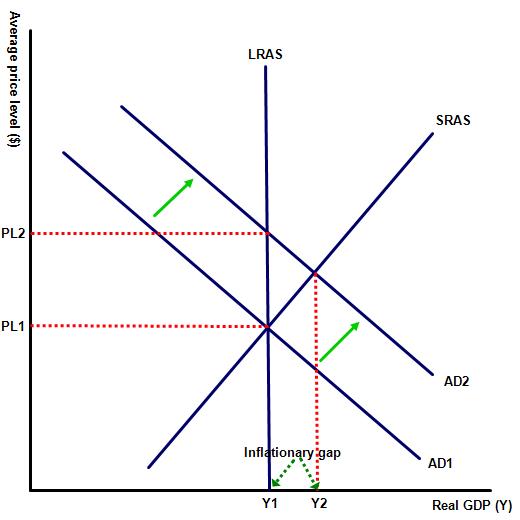

(c) Draw keynesian and classical / laissez faire LRAS curves, representing an economy with an inflationary gap.

Keynesian LRAS

.jpg)

Free market LRAS

(d) Explain the effect of contractionary fiscal policy on the two diagrams you have drawn?

As the video highlights a rise in tax rates or a fall in government spending will reduce AD back to AD1 and the inflationary gap will close. Free market economists, however, suggest that this would happen anyway, without any government policy required because of the economy's natural stabilisers.

Activity 3: Limitations of fiscal policy

Use the information from the video to identify the limitations of fiscal stimulus packages

According to the video fiscal policy is most effective in a recessionary gap. To be effective it would need to be timely, targetted and time specific. The opportunity cost of an unemployed worker is very low so any new job created must be short term only.

The video also highlights the time lags involved - administrative, planning and legislative delays, plus the trickle down effects which all takes time.

Automatic stabilisers therefore are more effective e.g. in times of sluggish economic activity higher welfare payments and lower taxes will automatically kick in.

Another weakness is that it may be difficult to ensure that the new jobs created go to unemployed workers, not those already in work.

Activity 4: TOK Is all demand created equally?

(a) Watch the following video and argue whether governments should be as concerned about the type of goods and services that the economy is creating, as they are about the size of demand in the economy?

As the video describes, when an economy is suffering from low levels of AD due to a fall in consumer confidence and a sluggish economy, governments typically should employ stimulus measures to increase the level of activity in the economy. This could be achieved by reducing income taxes, increasing government spending or more quantitative easing, which is the electronic printing of cash. However, what many might miss is that raising demand to close a recessionary gap might well create more jobs and income for their citizens but will it necessarily improve their standard of living?

(b) Does the above suggest that governments would be better employed increasing government spending than reducing taxes when looking to adopt expansionary fiscal policy measures?

This depends on your opinion and probably your own political slant as well. Those on the Left of the political spectrum would tend to prefer government spending, on the grounds that this means that the government can control, to a large degree, what the additional spending is used for and which goods and services are produced - supporting the arguments of the video. However, those on the political Right of the spectrum would be more inclined to prioritise tax cuts because consumers are better determinants of their own welfare than a government decree.

Activity 5: Can fiscal policy promote long-term growth?

Can expansionary fiscal policy in the form of lower taxes and increases in government spending increase both AD as well as AS?

Reducing income taxes will increase consumption rates, one of the components of AD. Reduced income tax rates may also encourage individuals to work harder as they get to keep a larger share of their earned income. Government spending is a component of AD and when this rises it increases money into the circular flow. Government spending on infrastructure can also increase the aggregate supply curve. The key to this is in what an earlier video described as 'targetted' stimulus - making sure that the areas identified bring real benefits to the economy and are not just creating work for the sake of it.

Activity 6: Link to the paper one assessment

(a) Explain how a government can use fiscal policy to reduce the level of aggregate demand in an economy? [10 marks]

Command term: Explain

Command term: Explain

Key terms to define: AD, fiscal policy

AD is made up of C+G+I+(X-M) and a fall in any of these components will reduce aggregate demand levels.

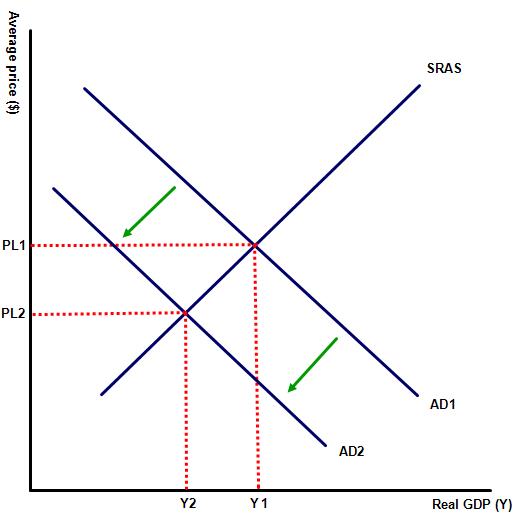

By raising taxes and or reducing government spending aggregate demand will fall because of a direct fall in private consumption and government spending.

Indirectly a third component, investment may also fall if firms feel less incentivised due to a reduction in economic activity.

A distinction should also be made between the immediate direct impact on AD and the secondary indirect impact on the level of AD, through the reverse multiplier.

(b) Using real world examples, evaluate the view that demand-side policies are the most effective method of increasing the level of national income. [15 marks]

Command term: Evaluate

The command term asks candidates to evaluate whether demand or supply-side policies are more effective in increasing the level of national income. Candidates must consider arguments in support of this statement followed by counter arguments, followed by a suitable conclusion based on the evidence provided.

Real world examples might include Japan and USA. Following the financial crisis of 2007-9, the USA economy benefited as a result of expansionary demand side policies, while Germany also recovered from recession, despite not adopting the same measures. Equally, Japan, over a long period adopted a series of expansionary demand side policies (through increased government spending and quantitive easing) but their economy remains stuck in a recessionary cycle - and with significant higher national debt levels as a result.

Responses should also include the following:

A definition of national income and demand-side policies. If this has already been defined in part (a) of the response then there is no need to repeat this definition. However, candidates are required to refer to this definition at the beginning of the section, in order to gain credit for it.

A definition of national income and demand-side policies. If this has already been defined in part (a) of the response then there is no need to repeat this definition. However, candidates are required to refer to this definition at the beginning of the section, in order to gain credit for it.

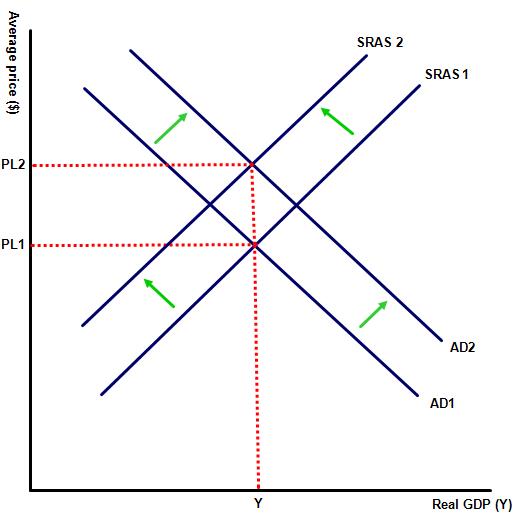

A recognition that demand side policies can be divided into fiscal and monetary policies, with an explanation that expansionary demand-side policies can increase the level of national income / economic growth by increasing one or more of either C, G, I or X.

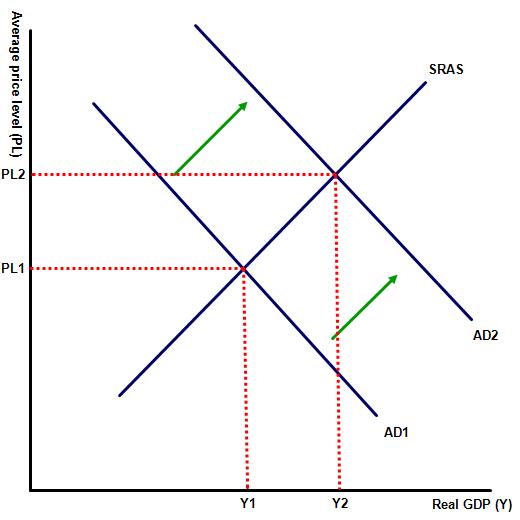

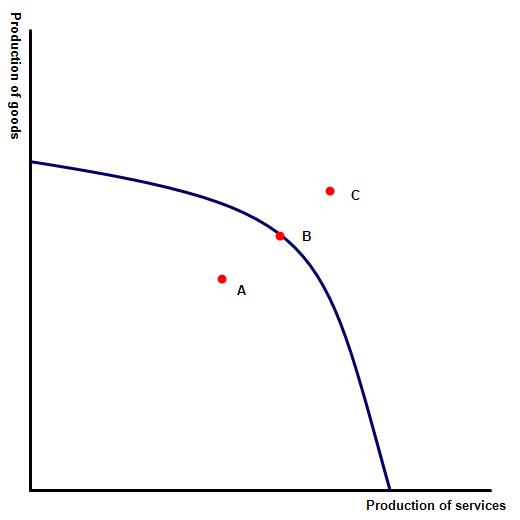

A diagram representing a right shift in AD as a result of expansionary fiscal or monetary policy. Examples might include a rise in government spending or a reduction in interest rates, leading to a rise in AD and an increase in national income from Y1 to Y2. Alternatively candidates may draw a PPF diagram showing a movement towards a point closer to the PPF maximum, shown on diagram two by a rise from point A to B.

Examples of different monetary and fiscal demand-side policies which can increase either consumption, government spending, investment or net exports.

On the other hand there are considerable disadvantages of governments using demand-side policies to stimulate economic growth. Examples of problems that may arise as a result of using demand side policies include time-lags, inflationary pressure, increased government debt, increased imports or crowding out. It should also be noted that demand side policies are only effective when their is spare capacity in the economy. Without available unemployed resources any rise in aggregate demand is likely to be inflationary only.

On the other hand there are considerable disadvantages of governments using demand-side policies to stimulate economic growth. Examples of problems that may arise as a result of using demand side policies include time-lags, inflationary pressure, increased government debt, increased imports or crowding out. It should also be noted that demand side policies are only effective when their is spare capacity in the economy. Without available unemployed resources any rise in aggregate demand is likely to be inflationary only.

.jpg) The response also needs to include a discussion of alternative policies that may be used to increase economic growth - supply side policies. This should start with a discussion of how national income can rise as a result of supply-side policies, with examples of supply side policies that may be effective e.g. improvements to infrastructure, investments in human capital as well as increased spending on research and development.

The response also needs to include a discussion of alternative policies that may be used to increase economic growth - supply side policies. This should start with a discussion of how national income can rise as a result of supply-side policies, with examples of supply side policies that may be effective e.g. improvements to infrastructure, investments in human capital as well as increased spending on research and development.

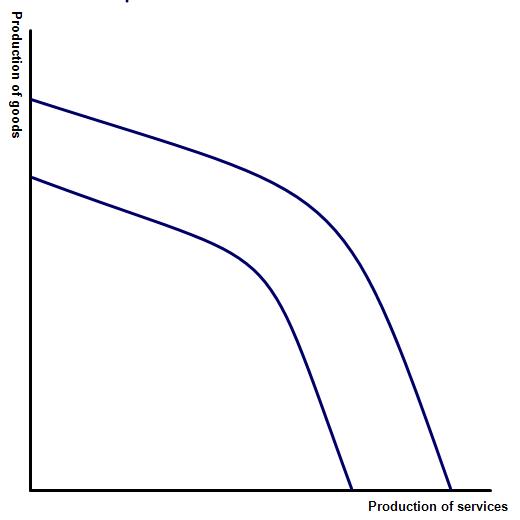

This can be illustrated by an AD/AS diagram (diagram 3), illustrating a shift in the AS curve and a rise in national income from Y1 to Y2 or a  PPC diagram illustrating a right shift in the PPF curve (diagram 4).

PPC diagram illustrating a right shift in the PPF curve (diagram 4).

A discussion of some of the disadvantages of governments using supply-side policies, e.g. time-lags, the cost of large scale investment projects and the uncertain effectiveness of lowering taxes.

Real world examples that might be used could include Japan and USA. Following the financial crisis of 2007-9, the USA adopted very aggressive expansionary demand side policies and the economy benefited as a result. By contrast Japan has adopted similar expansionary demand side policies but their economy remains stuck in a recessionary cycle - and with significant higher national debt levels as a result.

A conclusion with an evaluation of the above arguments in terms of short-term versus long-term consequences and the impact on different stakeholders. This section of the essay is also suitable for students to provide their own opinions on the effectiveness of demand side policies in raising economic growth. A suitable conclusion might be that demand side policies are straightforward to implement and are relatively effective in the short term, providing their is spare capacity in the economy. However, they do little to improve long term growth in the economy, which is best served by the implementation of supply side policies which have the ability to improve the quantity and / or quality of the available factors of production.

IB Docs (2) Team

IB Docs (2) Team