Unit 2.11(2) Market power - Perfect competition(HL)

Perfect competition is a theoretical model of how a market behaves under the conditions of the purest form of competition. There are no examples of pure perfect competition but the characteristics of perfect competition can be observed in agricultural markets where the industry is made up of large numbers of small producers.

- Assumptions of perfect competition

- Determining price and output in perfect competition

- Total, average and marginal revenue

- Profit maximisation

- Explanation and diagrams of normal profits, abnormal profits and losses

- Efficiency in perfect competition

- Evaluation of perfect competition

Revision material

The link to the attached pdf is revision material from Unit 2.11(2) Market power - Perfect competition(HL). The revision material can be downloaded as a student handout.

The link to the attached pdf is revision material from Unit 2.11(2) Market power - Perfect competition(HL). The revision material can be downloaded as a student handout.

Nature of perfect competition

Perfect competition is a theoretical model of how a market behaves under the conditions of the purest form of competition. There are no examples of pure perfect competition but the characteristics of perfect competition can be observed in agricultural markets where the industry is made up of large numbers of small producers. For example, the market for oranges in Australia can be used as an example of a market that has conditions that are similar to perfect competition, and this is the example we will use to illustrate perfect competition in this chapter.

Assumptions of perfect competition

Large number of small buyers and sellers

There are a large number of small buyers and sellers in a perfectly competitive market and no one buyer or seller can influence market price or output. For example, 1,900 commercial farms in Australia grow and produce oranges. Because each individual firm only makes up a small fraction of the market output they cannot affect the market price and output. We also assume that there are a large number of buyers so they cannot influence the market price and output either.

Homogenous products

Firms in the market sell a homogenous product which means there are no differences between the goods and services supplied by different firms. In theory, the orange farmers all sell the same quality and type of orange and they all offer the same quality of service to their customers. This means the buying decisions of consumers of oranges are made purely on price and not on any other factor such as the quality of the product.

Perfect knowledge

There is perfect knowledge on the part of buyers and sellers so that all agents in the market know about the prices being charged by all the producers in the market. This means no firm can charge a different price in the market without consumers or other firms in the market knowing about the different prices being charged.

No barriers to entry or exit

There are no barriers to entry or exit present in the market. This means the costs of setting up in the market are not higher than the normal costs of setting up in a market and there are no additional costs associated with leaving the market. This means, for example, that orange growers can acquire the land, capital and labour needed to set up and produce oranges without incurring any extra costs or restrictions associated with entering the market. Firms in the market will only incur the normal costs of leaving the market when they shut down production.

Implications of the assumptions

The assumption of perfect competition is important in determining how perfectly competitive markets behave because they affect the decisions made by consumers and producers in the market. The assumptions are particularly important in determining the demand and supply conditions in the market and how the market price is determined.

Price and output in perfect competition

Market price

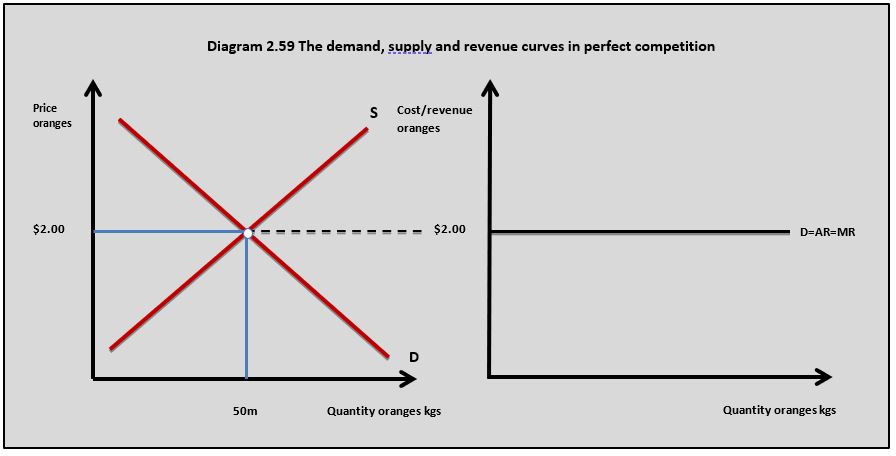

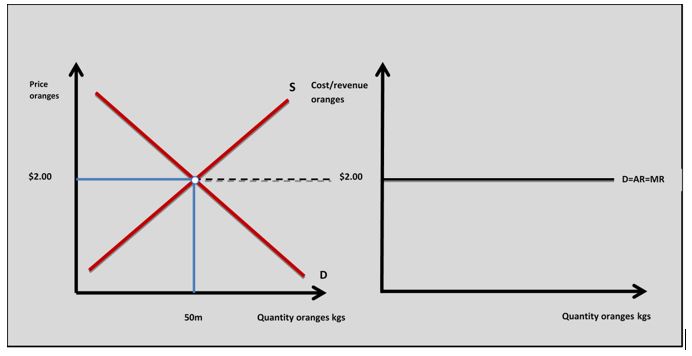

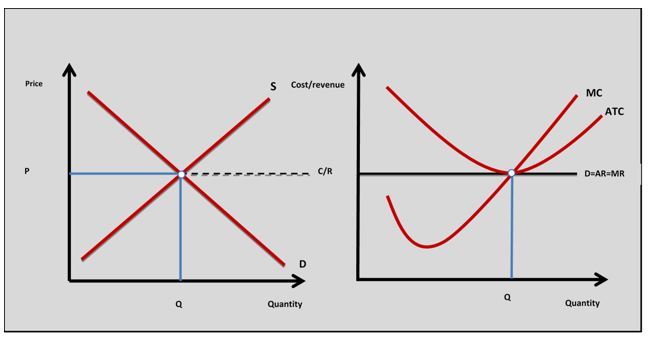

In perfect competition, demand and supply determine the market price and output. Diagram 2.59 shows how the market demand and supply for oranges determine the price and output in the market. The demand curve in the market is based on the law of demand and is the sum of the demand curves of all the individual buyers in the market. The supply curve is based on the law of supply and is derived from the sum of all the marginal cost curves of the individual firms in the market.

The demand curve facing the firm

The market price is the price each firm in the perfect market has to charge or take. If the firm tries to charge more than the market price then the quantity demanded will fall to zero because consumers can buy exactly the same product from an alternative supplier at the market price. There is no incentive for firms to charge less than the market price because they can sell all they want at the market price. The assumptions of the model mean that firms are price takers and face a perfectly elastic demand curve. This is shown in diagram 2.59.

In Australia, orange growing is a significant part of the agricultural industry in South Australia, Victoria, New South Wales and Queensland. There are over 28,000 hectares of oranges trees in these states and around 1,900 growers. Many of the oranges grown in Australia are sold in the Sydney Produce Market, which is the largest fresh fruit and vegetable wholesale market in Australia and one of the largest in the world. Australian oranges are sold in the domestic market and also exported.

In Australia, orange growing is a significant part of the agricultural industry in South Australia, Victoria, New South Wales and Queensland. There are over 28,000 hectares of oranges trees in these states and around 1,900 growers. Many of the oranges grown in Australia are sold in the Sydney Produce Market, which is the largest fresh fruit and vegetable wholesale market in Australia and one of the largest in the world. Australian oranges are sold in the domestic market and also exported.

Oranges are healthy food and are bought by households as part of their regular grocery shopping. But a high proportion of oranges sold are also bought by businesses who use them to manufacture fruit juice and other processed food products.

Questions

a. Using the assumption of perfect competition, explain why the orange market in Australia can be used as an example of perfect competition. [4]

The orange market can be used as an example of perfect competition because:

- There are many small producers in the market

- Oranges are close to being a homogenous product

- Levels of knowledge amongst consumers and producers are high

- There are low barriers to entry to the orange market for new entrants.

b. Using a diagram, explain the implications of the assumptions of perfect competition for orange producers. [4]

The assumptions of perfect competition (many buyers and sellers, perfect knowledge, homogenous product and no barriers to entry or exit) mean firms have to charge the market equilibrium price for the oranges they sell. This means the firms in the orange market face a perfectly elastic demand curve for the goods they sell and this is shown in the diagram.

Investigation

Research the orange market in another country. Find out how many growers there are and the industry's importance to the economy of the country you have chosen.

Revenue

Revenue is the income a firm receives from selling its good or service. There are three ways of expressing the revenue a business receives:

Total revenue

Total revenue (TR) is the total income a business receives and is calculated as:

- price x quantity = total revenue

- P x Q = TR

Average revenue

Average revenue (AR) is the revenue per unit of output sold by a firm and is calculated as:

- total revenue / output = average revenue

- TR / Q = AR

- AR = P

Marginal revenue

Marginal revenue is the change in total revenue when one more unit of output is sold and is calculated as:

- change in total revenue / change in output = marginal revenue

- ∆TR / ∆Q = MR

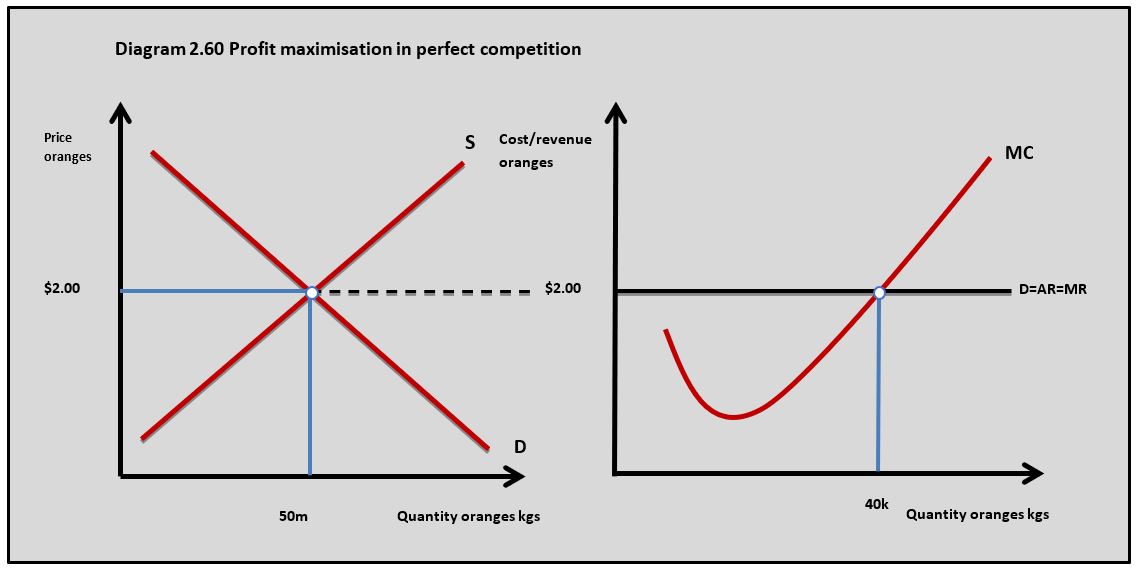

With the perfectly elastic demand curve, the firm faces in perfect competition the price the firm receives is equal to average revenue and marginal revenue. The demand curve the firm faces can be expressed as:

D = AR = MR

In the orange market example, each farm has to charge $2.00 per kilo which equals the average revenue and marginal revenue for each firm in the market.

Output

Classical economic theory assumes firms in the industry aim to profit maximise which means they produce where marginal cost equals marginal revenue when marginal cost is rising. In diagram 2.60 the firm produces 40,000 kgs of oranges per month to profit maximise. Adding together the total output of each producer in the market gives a total market output of 50 million kgs per month.

Equilibrium

Short-run equilibrium

The industry will be in short-run equilibrium when demand equals supply. This means an equilibrium price and output in the industry, but this equilibrium situation can change if abnormal profits or losses are being made by firms in the market.

Long-run equilibrium

Similar to short-run equilibrium this is the output where market demand equals supply, but firms in the market are all making normal profit. Because there are no abnormal profits or losses in the market means there are no pressures on market price and output to change.

Profits and Losses

Normal Profit

Normal profit is the minimum profit firms need to earn to remain in a particular market. It represents the resource cost of enterprise as a factor of production. Entrepreneurs who enter the orange market will need a certain level of profit to reward them for the risk of setting up production in the market. This means normal profit is included as part of the firm's total cost of production.

Normal profit is achieved when total cost is equal to total revenue or average total cost equals average revenue:

ATC = AR

Diagram 2.61 shows firms in the perfect market for oranges where each producer is earning normal profit.

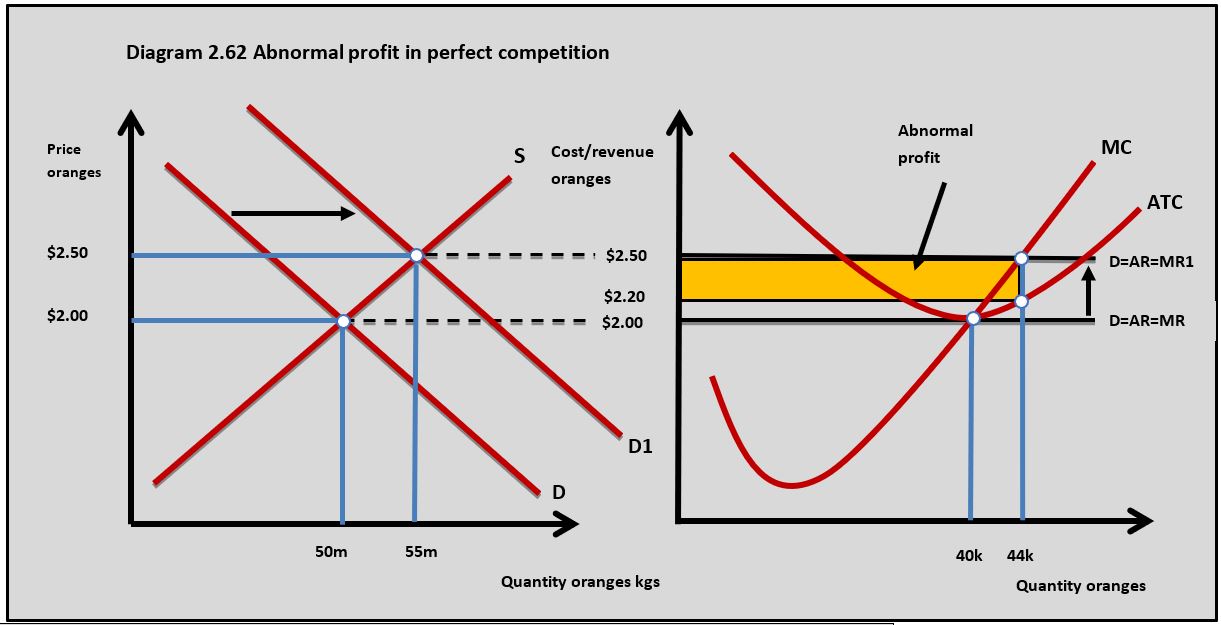

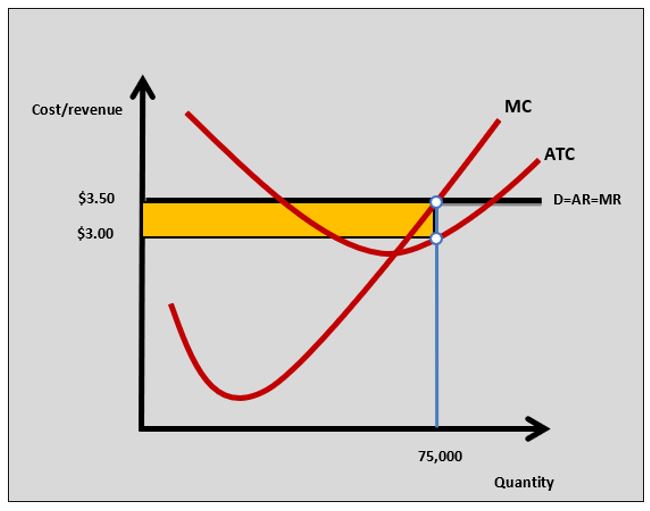

Abnormal profits

Abnormal profit is earned by a firm when the entrepreneur earns more than the minimum profit required to keep the firm in the industry. This means total revenue is greater than total cost:

(AR > ATC) x Q.

In the orange market example, an increase in demand for oranges from D to D1 causes the market price to rise from $2.00 to $2.50 and this means individual firms in the industry are receiving a higher price which results in AR rising above ATC leading to abnormal profits.

In diagram 2.62 this can be calculated as:

$2.50 - $2.20 = $0.30 per unit

$0.30 x 44,000 = $13,200 total abnormal profit.

New firms see this as an opportunity to make abnormal profits and enter the orange market. This leads to an increase in market supply which causes the market price to fall reducing the abnormal profit of the existing producers until firms stop entering the market and profits return to normal.

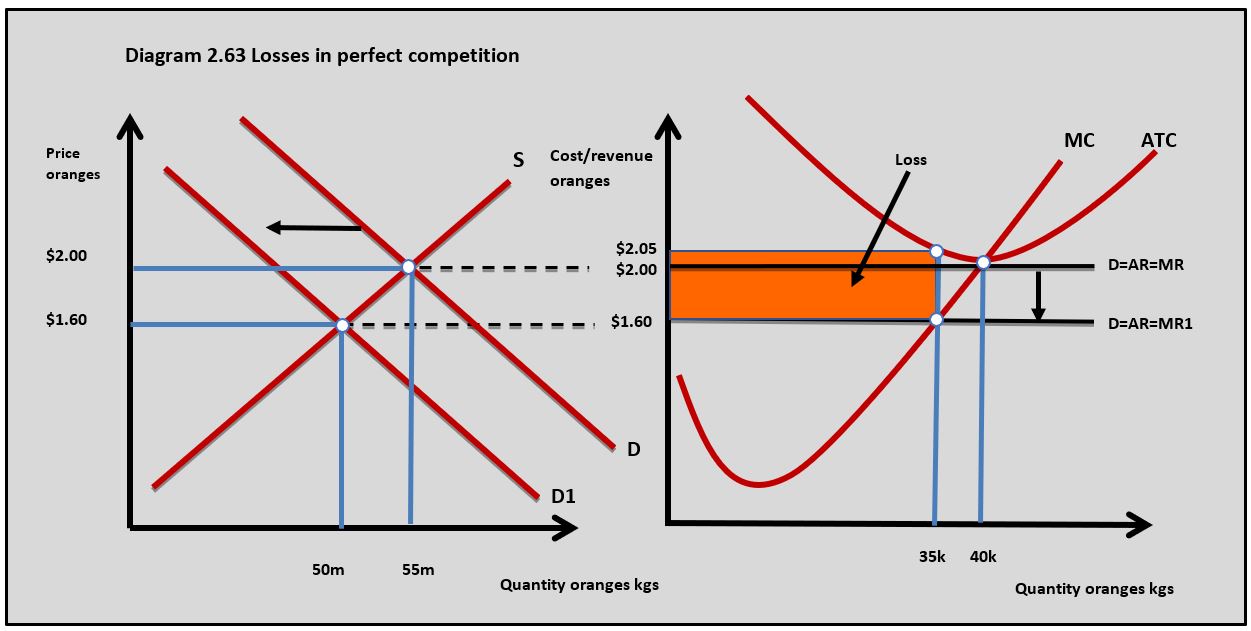

Losses

Losses occur when total cost is greater than total revenue which can be expressed as:

(ATC > AR) X Q.

This means firms are making less than normal profit so entrepreneurs will start to leave the industry because they are not making enough profit to keep them in the market. Diagram 2.63 shows how a fall in market demand from D to D1 for oranges leads to losses as the market price falls from $2.00 to $1.60 and average revenue falls below average total cost.

In diagram 2.63 this can be calculated as:

$2.05 - $1.60 = -$0.45 per unit

-$0.45 x 35,000 = -$15,750

As firms leave the industry market supply falls, price rises and the profit for the remaining firms in the industry will return to normal.

More and more consumers in countries across the world are consuming increasing amounts of olive oil. It is seen as a healthier option than other vegetable oils and butter. The growing number of people adopting plant-based diets has also accounted for the trend. This is ‘boom time’ for olive growers who are benefiting from higher prices, revenues and profits.

More and more consumers in countries across the world are consuming increasing amounts of olive oil. It is seen as a healthier option than other vegetable oils and butter. The growing number of people adopting plant-based diets has also accounted for the trend. This is ‘boom time’ for olive growers who are benefiting from higher prices, revenues and profits.

The global market for olives is forecasted to grow at 4.5% per annum over the next five years. The market is seeing an increasing number of farmers switching production from other crops to produce olives to take advantage of rising profits.

Questions

a. Explain why firms such as olive growers would be described as price takers in a perfectly competitive market. [4]

In a perfectly competitive market, the equilibrium price is determined by demand and supply and this is the price olive growers have to charge (take). If a firm charged a price above the market equilibrium price quantity demanded would fall to zero because the market has a large number of competitors, homogenous products and perfect knowledge.

The table sets out cost, price and revenue data for a firm in the olive market.

Output (units) | Price | Total revenue | Total cost | Marginal cost |

10,000 | $5.00 | $55,000 | ||

15,000 | $5.00 | $70,000 | ||

20,000 | $5.00 | $95,000 | ||

25,000 | $5.00 | $140,000 |

b. Using the data in the table calculate the following:

(i) Total revenue at each level of output. [2]

(ii) The marginal cost at output levels 15,000, 20,000 and 25,000. [2]

(iii) The profit maximising output. [2]

(iv) The profit at the profit maximising output. [2]

Output (units) | Price | Total revenue | Total cost | Marginal cost |

10,000 | $5.00 | $50,000 | $55,000 | |

15,000 | $5.00 | $75,000 | $70,000 | $3 |

20,000 | $5.00 | $100,000 | $95,000 | $5 |

25,000 | $5.00 | $125,000 | $140,000 | $9 |

Profit maximising output (MC = MR) 20,000 units

Total profit: $100,000 - $95,000 = $5,000

(v) State the type of profit the firm is making at the profit maximising output. [1]

Abnormal profit

c. Using a market diagram for olive oil, explain what would happen to the market as a result of the type of profit earned by firms in the industry. [4]

Abnormal profit in the olive market will attract new producers into the industry. Because there are no barriers to entry in perfect competition there will be free movement of new entrants into the market. The diagram shows how this will cause the market supply to increase, the equilibrium price to fall and the industry output to increase.

Investigation

Research the olive market in a country to see whether it is behaving in the way the theory of perfect competition would predict.

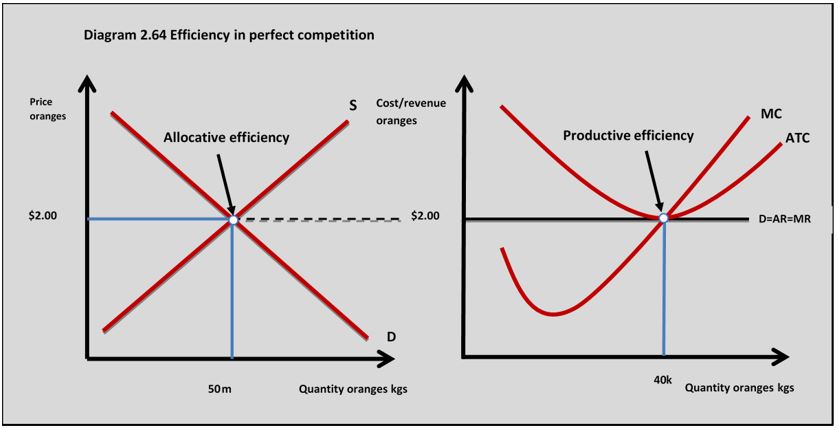

Efficiency in perfect competition

Productive (technical) efficiency

Productive efficiency is achieved when all firms in the industry are producing where they achieve the highest output per unit of resource input. This means each firm in the market is producing at the profit maximising output at the minimum point of average total cost:

MC = minimum ATC

This is achieved in perfect competition when firms are making normal profits, but not abnormal profit or losses. This is shown in diagram 2.64 at output of 40,000 kgs.

Economists believe that the pressure of intense competition which exists in perfect competition forces firms to be productively efficient. If a firm cannot achieve the minimum average total costs of its competitors it will make losses and be forced out of the market. Productive efficiency is achieved when the firm is making normal profit, but it will not be achieved when the firm is making abnormal profit (output is above the productively efficient level) and losses (output is below the productively efficient level). This is shown in diagrams 2.62 and 2.63.

Allocative efficiency

Allocative efficiency is achieved when resources are allocated in a market to maximise the social/community surplus. This occurs when market demand equals market supply. We assume there are no positive or negative externalities in the market. Allocative efficiency is shown in diagram 2.64. This is achieved in all profit-making situations in perfect competition. This occurs because no single firm can affect the market price and all firms are forced to charge the market price. If one firm tried to charge a price above marginal cost the demand for their product would fall to zero.

Evaluation of perfect competition

Perfectly competitive markets will lead to productive and allocative efficiency in the long run. This means all resources are being used efficiently and the market will maximise the welfare of consumers and producers. However, the model has some weaknesses:

- No markets fully achieve the strict conditions of perfect competition. There will always be some differences in the goods sold by different producers and some barriers to entry are likely to exist in every market for some producers.

- Only a small number of industries in an economy come close to being perfectly competitive. Many markets in the economy exist with conditions that are completely different to perfect competition. For example, markets are often dominated by large businesses that account for a high proportion of total market output. It is difficult to believe perfect competition would be the most efficient market structure in the car industry.

- Perfect competition might achieve the allocative and productive efficient output in the long run, but the goods and services sold in the market offer no real choice to consumers because of the assumption of homogenous products. For example, imagine a perfect market for shoes where all the shoes in the market are exactly the same.

- The model makes no allowance for positive or negative externalities which will affect welfare in society.

There was a 43% increase in Opium production in Afghanistan last year. Increasing global demand, combined with good farming conditions has led to a significant increase in the output of Afghanistan’s poppy growers. The UN Office on Drugs and Crime (UNODC) said there was a 10% increase in the land given over to opium production. ‘The market is certainly expanding’ said one UN official.

increase in Opium production in Afghanistan last year. Increasing global demand, combined with good farming conditions has led to a significant increase in the output of Afghanistan’s poppy growers. The UN Office on Drugs and Crime (UNODC) said there was a 10% increase in the land given over to opium production. ‘The market is certainly expanding’ said one UN official.

Afghanistan is the world's largest producer of opium, which is the main ingredient in heroin. The crop is illegal in Afghanistan but it controlling production is very difficult. It is a very profitable crop for poorer farmers and it is supported by the Taliban who tax it to fund their military activities.

Questions

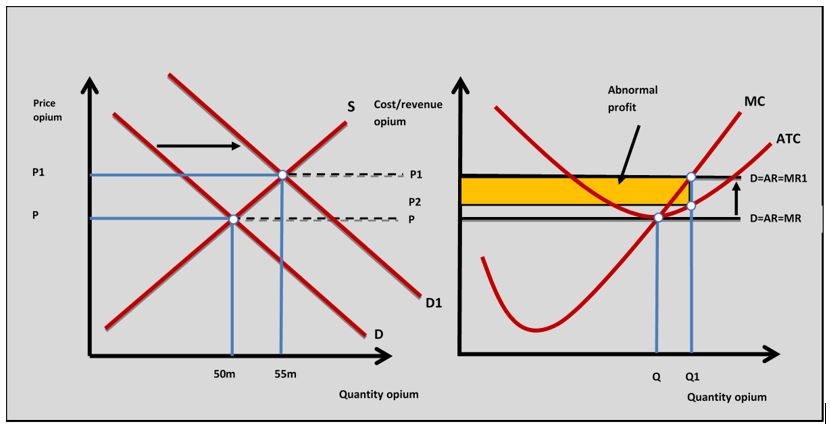

a. Explain the impact an increase in demand would have on the market price and output of opium in the short run and long run assuming the market is perfectly competitive. [10]

Answers might include:

- Definitions perfect competition, short-run and long-run

- A diagram to show the impact of an increase in demand for opium. This is shown in the diagram below where an increase in the demand for opium in Afghanistan leads to abnormal profit.

- An explanation that an increase in demand for opium leads to abnormal profits in the opium market in the short run which is shown by the yellow shaded area in the diagram.

- An explanation that in the long run, the abnormal profit in the opium industry would attract new entrants into the opium market which would lead to an increase in market supply and result in a fall in the market price. The fall in price would cause profits in the market to fall back to normal in the long run and firms would stop entering the market.

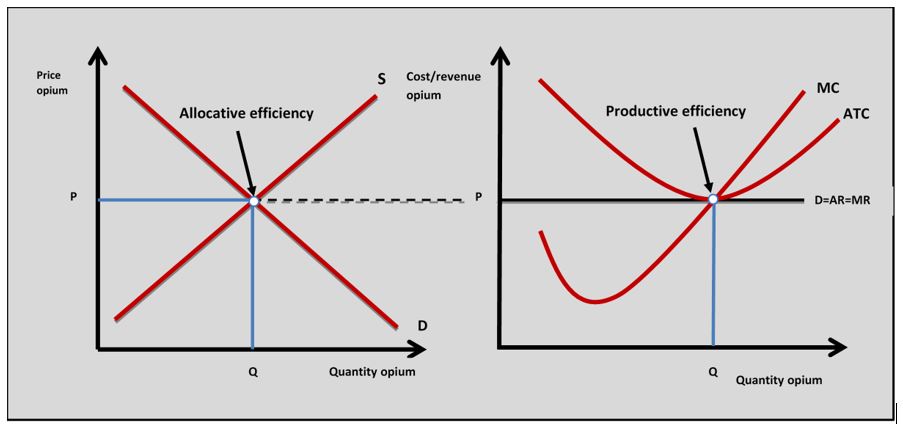

b. Using a real-world example, evaluate the view that perfect competition always leads to an efficient allocation of resources. [15]

Answers might include:

- Definitions of productive efficiency, allocative efficiency and allocation of resources. *Possible to refer to the definition of perfect competition in part a.

- A diagram to show efficiency in perfect competition.

- An explanation that perfect competition always achieves allocative efficiency in theory because the market price and output are set by demand and supply which maximises the consumer and producer surplus (community or social surplus). This is shown in the market part of the diagram.

- An explanation that productive efficiency is achieved in perfect competition when all the firms in the industry are making a normal profit and they are producing where MC equals ATC. This means ATC is minimised and output in the industry is maximised per unit of resource input.

- A real-world example could include a discussion of efficiency in the opium market.

- Evaluation might include discussion of situations when perfect competition does not 'always' lead to productive efficiency if firms are making abnormal profits or losses. There could also be some discussion of the limitations of the assumptions of perfect competition and how this might limit market efficiency in reality such as products not being homogenous or some barriers to entry existing. In the case example, the market might achieve allocative and productive efficiency but the external costs associated with opium production and consumption are likely to reduce welfare in society.

Investigation

Research the opium market further in Afghanistan and try and understand its importance to the Afghan economy.

Which of the following is not an assumption of perfect competition?

There are no barriers to entry in perfect competition.

Which of the following is not true about the demand and revenue the firm faces in perfect competition?

When a firm increases price in perfect competition Qd and TR would fall to zero.

At which output does the firm always achieve profit maximisation in perfect competition?

Which of the following is not true in the diagram?

At the equilibrium price, the consumer and producer surplus is maximised so the community/social surplus is maximised.

Which of the following would be the best definition of abnormal/supernormal profit?

Using the data provided, which of the following options is the abnormal profit the firm earns?

AR:

AVC:

AFC:

Output: 25,000 units

(

Which of the following is least likely to be true when firms are making losses in a market?

When TC = TR the firm is making a normal profit.

Which of the following is true about the information in the diagram when the firm is profit maximising?

ATC = AVC + AFC which means AVC must be less than ATC assuming there are fixed costs of production.

Which of the following are not equal on a perfect competition diagram when all the firms in the industry are profit maximising and making abnormal profit?

When a firm is making abnormal profit in perfect competition marginal cost is above average cost.

A profit-maximising firm in perfect competition is producing 10,000 units a month and making normal profit. Which of the following statements is least likely to be true?

When the firm is making normal profit ATC equals AR.

IB Docs (2) Team

IB Docs (2) Team