The balance between markets and intervention

Introduction

Introduction

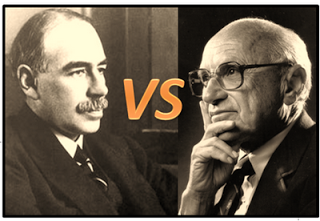

This is the last of the Development economics units and considers the strengths and weaknesses of both market based and interventionist approaches to development. As in most areas of macroeconomics there are two schools of thought, keynesian and free market economic views that unsurprisingly disagree over the most effective macroeconomic solutions for LEDCs. Under the old syllabus this page was covered under unit 4.8.Enquiry question

Are market based or interventionist approaches to development the most effective or might a combination of both provide the most effective formulae for development?

Lesson time: 2 hours

Lesson objectives:

Discuss the positive outcomes of market-oriented policies (such as liberalized trade and capital flows, privatization and .jpg) deregulation), including a more efficient allocation of resources and economic growth.

deregulation), including a more efficient allocation of resources and economic growth.

Discuss the negative outcomes of market-oriented strategies, including market failure, the development of a dual economy and income inequalities.

Discuss the strengths of interventionist policies, including the provision of infrastructure, investment in human capital, the provision of a stable macroeconomic economy and the provision of a social safety net.

Discuss the limitations of interventionist policies, excessive bureaucracy, poor planning and corruption.

Explain the importance of good governance in the development process.

Discuss the view that economic development may best be achieved through a complementary approach, involving a balance of market oriented policies and government intervention.

Teacher notes:

1. Beginning activity - begin with the reading activity and then discuss this as a class. (Allow 10 minutes in total)

2. Processes - technical vocabulary - the students can learn the background information from the reading activity, videos, activities and the list of key terms. (5 minutes)

3. Developing the theory - activities 2 and 3 involve a discussion of the merits and weaknesses of free market policies aimed at development. What is the balance between encouraging the free market and ensuring that governments regulate its worst excesses. (25 minutes)

4. Apply the theory - activity 4 - which growth policies could be considered keynesian and which free market? (10 minutes)

5. Link to TOK - is capitalism moral? (20 minutes)

6. Developing theory - activity 6 involves short responses based on a video of the negative externalities caused by unregulated growth in China. (10 minutes)

7. Link to the assessment - activity 7 consists of a paper two type (a - d) questions on this topic. (40 minutes)

Key terms:

Free market development policies - policies aimed at promoting economic growth / development through market mechanisms e.g. privatisation, deregulation of markets, low taxation, free trade, low government intervention in business, floating exchange rates and an absence of capital controls.

Interventionist development policies - policies aimed at promoting economic growth / development through government intervention e.g. investments in human and physical infrastructure, protectionist trade policies, exchange rate intervention and regulation of monopolies.

Activity 1: Reading activity - brief history of development approaches

Between the end of the second world war and the beginning of the 1980s, development within LEDCs was primarily focused on interventionist approaches. The trade policy promoted by the IMF, as well as development economists, centred on import substitution, interventionist policies, regulation and the nationalisation of state assets. This became the standard policy of choice for many LEDCs, many of whom where governed by 'strong dictatorial leaders'.

Between the end of the second world war and the beginning of the 1980s, development within LEDCs was primarily focused on interventionist approaches. The trade policy promoted by the IMF, as well as development economists, centred on import substitution, interventionist policies, regulation and the nationalisation of state assets. This became the standard policy of choice for many LEDCs, many of whom where governed by 'strong dictatorial leaders'.

In the 1980s, however, saw a move towards free market, supply side economics in many developed nations, which then influenced macroeconomic thought within Developing economies. This school of thought was championed by Margaret Thatcher in the UK as well as Ronald Reagan in the USA. This process was further influenced by other factors.

The first of these was that by the beginning of the 1980s, a number of heavily indebted nations were looking for a further release of development funds to repay the interest on initial loans collected in the 1970s. Mindful that Mexico and a number of other LEDCs had by now either defaulted on earlier loans or were in danger of doing so, the IMF insisted that as a precondition all new development funding, LEDCs would have to implement a set of SAPs in order to be eligible for the finance.

The second factor was collapse of the Soviet Union during this period. With the USSR and its satellite systems abandoning state intervention, this undermined the effectiveness of state controlled economic systems. This also meant that a source of funds was removed, leaving the USA and its allies as the only source of finance available for LEDCs in need of funds.

Lastly, and perhaps most significantly a number of Developing economies in Asia, the so called Asian tigers of Japan, Taiwan, Singapore, Hong Kong and South Korea had successfully employed export led policies and encouraged FDI. This then became the model of best practise for other ambitious Developing nations wishing to progress.

By the end of the 20th century, however, while market based development approaches remain the model of best practise, many economists have started to raise concerns over an entirely free market approach. These include doubts over the ability of a completely free market approach to provide LEDCs with the adequate infrastructure to develop. Another concern was that while economists still promote an export led approach, there was a recognition that agricultural subsidies and tariff barriers within many Developed nations remain a significant barrier to development.

By the end of the 20th century, however, while market based development approaches remain the model of best practise, many economists have started to raise concerns over an entirely free market approach. These include doubts over the ability of a completely free market approach to provide LEDCs with the adequate infrastructure to develop. Another concern was that while economists still promote an export led approach, there was a recognition that agricultural subsidies and tariff barriers within many Developed nations remain a significant barrier to development.

Concerns also rose about some of the negative externalities associated with a free market approach. While this approach may increase economic growth it may do less for promoting development. An example of this being Nigeria which has seen significant economic growth in recent years but remains a nation with very high levels of poverty and low HDI. It was also noted that by adopting an entirely free market approach almost all of the development is concentrated on urban areas, doing little to alleviate poverty in rural areas, one of the primary millennium goals. This focus on urban environments also contributes to the externalities in urban cities, such as the growth of slum areas and the degradation of air and water quality in many cities within LEDCs.

Lastly, it was noted that while the Asian tigers benefited from an export growth policy and an increase in FDI, it was also observed that each of those nations also employed significant interventionist approaches in areas such as developing specific products for exports.

Lastly there was a recognition that the one size fits all approach to the SAPs of the 1980s should instead be replaced by policies appropriate to each individual LEDC. Furthermore that any development policy much recognise the importance of areas such as fair trade, debt relief, more effective targetted aid and effective governance and political stability.

Activity 2: The free market

The following two videos paint a very different picture of free market capitalism. Watch both and then discuss which of the two arguments you find most convincing.

Video 2

Activity 3: The importance of strong institutions to help regulate free market excess

The following video highlights the importance of strong institutions in regulating the excesses of the free market and promoting development. After watching the video highlight the institutions required to help a nation develop.

Successful institutions include some run by private enterprise, e.g. private businesses generating wealth as well as public services required to work along side those e.g. health, education and infrastructure.

Activity 4

Complete the following table, indicating the differences between free market and keynesian economic theory?

| Keynesian economic policies | Free market economic policies |

Import substitution Protectionist trade policies Exchange rate intervention Regulation Nationalisation of government industries Government intervention in export markets to promote specific products | Export led growth Growth through FDI Privatisation of national industries Deregulation Structural adjustment policies Poverty reduction policies of the IMF and World bank |

Export led growth

Growth through FDI

Import substitution

Privatisation of national industries

Protectionist trade policies

Exchange rate intervention

Deregulation

Structural adjustment policies

Regulation

Nationalisation of government industries

Poverty reduction policies of the IMF and World bank

Government intervention in export markets to promote specific products

Activity 5: Theory of knowledge: Is capitalism moral

Watch the following videos and then decide:

Video 1

Video 2

Activity 6: Negative externalities of unrestrained economic growth - a focus on China

The following video focuses on some of the negative externalities of unrestrained economic growth in China. After the following video answer the questions that follow:

(a) Explain why the high rates of air and water pollution in many Chinese cities represent a negative externality to unregulated free market growth.

Free from government intervention business and consumers will only consider their private costs and benefits when making any production / consumption decision and so the MPB for demerit goods (such as pollution) will normally exceed MSB.

(b) Illustrate the negative externality on a suitable diagram, showing the size of the welfare loss.

Free from government intervention the MPC of production ≠ MSB. As the diagram illustrates the production of certain harmful good and services is greater

Free from government intervention the MPC of production ≠ MSB. As the diagram illustrates the production of certain harmful good and services is greater

than the socially optimum level of Qso.

In an unregulated free market economic development and possibly even growth is likely to be hindered by the over production of demerit goods. The private sector / free market also relies on the the public sector to fund human and physical capital projects which it needs to produce the goods and services that the economy needs.

Activity 7: Link to the assessment (paper two type)

Developing Asian and African countries lead with fastest GDP growth in the world

Ethiopia, Turkmenistan, Mongolia, Uzbekistan, China, India, Laos, Rwanda: these are the nations that have shown the most sustained and robust GDP growth among close to 200 routinely surveyed by the IMF.

Over the past two decades, Ethiopia has been made improvements to its infrastructure and encouraged greater private-sector involvement and FDI from multinational businesses in an attempt to transform its agriculture-based economy into a manufacturing hub. The nation has also remained committed to the structural reforms that its economy was required to complete as part of its structural adjustment package. Greater deregulation, increased flexibility in the labour market and a reduction of trade barriers have become part of its policy towards development.

Turkmenistan’s autocratic government has continued relying on its natural gas resources but dwindling commodity prices, lack of diversification and an unfriendly business climate paint the picture of a country now facing an economic crisis. Exports of cotton, natural gas and gold provide significant revenues to Uzbekistan, but its government has done little to modernize the economy. China and India are continuing their march towards domination of the global economy while Lao and Mongolia are taking a page from their old playbook and turning themselves into thriving manufacturing hubs.

Rwanda, with its extensive economic development and poverty reduction programmes, including social programmes for the poor also shows what efficient and democratic political institutions can do to a country once ravaged by civil war and genocide: turn it into an economic miracle.

It is not too hard to see which nations have made plans for long and widespread GDP growth, and which ones draw on finite resources and a business as usual-ways of doing things. It will be interesting to see how they all fare ten years from now.

GDP growth in selected countries:

2013-2014 | 2015-2016 | 2017-2018 | 2019-2020 | |

Ethiopia | 10.4 | 9.8 | 7.9 | 6.9 |

Rwanda | 4.7 | 4.4 | 4.8 | 3.4 |

Sub-Saharan average | 4.8 | 1.7 | 2.75 | 0.5 |

Questions:

(a) Define the terms in the passage:

i. Infrastructure (line 3) [2 marks]

An explanation including two of the following:

- essential facilities (capital) and services such as roads, airports, sewage treatment, water systems, railways, telephone and utilities e.t.c.

- reduces the cost / increases efficiency of economic activity

- usually supplied by the government

- necessary for economic activity.

ii. GDP (line 14) [2 marks]

Stands for gross domestic product and represents the total value of all goods and services produced in an economy over a period of time.

(b) i. Calculate the average level of growth for the three regions in the table. [3 marks]

Ethiopia - 8.75%

Rwanda - 4.33%

Sub-Saharan average - 2.44%

ii. Explain how GDP (line 14) is calculated. [2 marks]

Can be calculated by either the expenditure method, output method or the income method.

(c) Explain using a diagram the impact of the increased FDI on Ethiopia. (line 4) [4 marks]

A rise or right shift in LRAS curve or the PPF curve plus a rise in AD. With an explanation that foreign investment is a component of AD, resulting in a rise in total output.

(d) Explain using an appropriate diagram the impact of the ‘improvements to infrastructure and greater private-sector involvement’ on the economy of Ethiopia (line 4). [4 marks]

A rise or right shift in LRAS curve or the PPF curve plus a rise in AD. With an explanation that government investment is a component of AD, resulting in a rise in total output.

(e) Illustrate using an appropriate diagram the role of reduced trade barriers to the development of Ethiopia. [4 marks]

A diagram showing the world supply of goods and services and the domestic supply and demand of products, with the tariff reduction illustrated by a shift downwards in the world supply curve resulting in a new equilibrium, plus an explanation that the new equilibrium offers Ethiopian consumers greater choice and lower prices.

(f) Using a Lorenz curve diagram, explain the likely change in Rwanda’s income distribution as a result of its 'poverty reduction programmes' (line 13). [4 marks]

2 marks for correctly drawing a fully labelled Lorenz curve diagram with a shift of the curve inwards towards the line of equality and 2 marks for an explanation that as a result of its poverty reduction programmes, the income distribution has become more equal as shown by the inward movement of the curve (or a reduction in the area below the line of equality).

(g) Using information from the text/data and your knowledge of economics, discuss the argument that economic development can best be served by a combination of interventionist and market-oriented policies. [15 marks]

Responses should include some of the following:

A definition of economic development

An explanation of market-oriented and interventionist policies e.g.

- deregulation

- increased flexibility in the labour market

- free trade policy (line 7)

Identification and explanation of interventionist policies:

- infrastructure improvements (paragraph 3)

- new social programmes for the poor

- poverty reduction programmes (paragraph 15)

market-oriented policies may lead to:

- higher private investment through FDI (paragraph 4) will lead to economic growth, which may or may not translate into economic development

- lower or higher unemployment, depending on the type of policy

- benefits of free trade (paragraph 7 include greater choice, lower prices, higher consumer surplus) that may enhance peoples’ standards of living

- efficient allocation of resources

- higher economic growth, which may or may not translate into economic development

- more inequality which hinders economic development

- externalities associated with mining which worsen the standards of living of workers and third parties

- insufficient provision of infrastructure and other merit goods

Interventionist policies may lead to:

- increased equality (lower Gini coefficient)

- reduction in the poverty rate (paragraph 8)

- opportunity cost issues

- provision of infrastructure

- reduction in the informal and untaxed sectors.

The best responses must show awareness of the ways in which market-oriented policies and government intervention impact upon economic development (not simply discuss the advantages and disadvantages of the two strategies).

IB Docs (2) Team

IB Docs (2) Team