Unit 4.1 Benefits of international trade

The consensus of most economists is that free international trade is beneficial to the different stakeholders in the economy. Evidence suggests households, firms and governments have all gained from the increase in international trade that has taken place over time.

- Benefits of international trade include increased competition, lower prices, greater choice, access to resources, access to foreign exchange, new markets for producers, economies of scale, greater productive and allocative efficiency

- Importance of opportunity cost in trade

- Absolute advantage (HL)

- Comparative advantage (HL)

- PPC curves to show productive and allocative efficiency (HL)

- Calculation of opportunity cost ratios in absolute and comparative advantage (HL)

Revision material

The link to the attached pdf is revision material from Unit 4.1 Benefits of international trade. The revision material can be downloaded as a student handout.

The link to the attached pdf is revision material from Unit 4.1 Benefits of international trade. The revision material can be downloaded as a student handout.

The benefits of trade

The consensus of most economists is that free international trade is beneficial to the different stakeholders in the economy. Evidence suggests households, firms and governments have all gained from the increase in international trade that has taken place over time.

The benefits of free trade can be looked at in the following terms:

Availability of goods and services

On a basic level, international trade means consumers and businesses can access goods and services that cannot be produced domestically. For example, consumers in Scandinavian countries would not have access to any of the following primary products without international trade: coffee, cocoa, diamonds and citrus fruit.

Increased competition

As economies have become more open over time the volume of world trade has increased and markets have become more competitive. Businesses from different countries have entered different markets and increased the level of competition in those markets. This benefits consumers as more competition in markets reduces prices and offers them a greater choice of goods and services to buy. Sweden, for example, has one major car manufacturer, Volvo. With free international trade, Swedish buyers can now choose makes and models from car manufacturers across the world. The increased competition in the Swedish car market can also lead to lower car prices.

Productive efficiency

Greater international competition in domestic markets from foreign competition can mean domestic producers strive to be more productively efficient. Competition is likely to encourage all producers involved in international trade to try and produce at the lowest possible cost per unit to make them competitive.

Allocative efficiency

International trade means countries can access goods and services that they are relatively inefficient at producing. For example, Country A can produce tomatoes all year round if it uses greenhouses and creates artificial growing conditions. The cost of producing tomatoes in this way is high, especially if you consider it in terms of the opportunity cost of resources used. If tomatoes are imported from Country B, a lower-cost producer, then the resources used to produce tomatoes in Country A can move to produce another good they are more efficient at producing such as potatoes.

Learning

Firms involved in international trade can gain by learning from the production techniques of foreign competitors. Over the last 30 years, large numbers of manufacturing firms have become more efficient by adopting Japanese production techniques such as Just-in-Time stock control and Total Quality Management.

Access to markets

Exports markets offer firms a huge increase in potential revenues compared to only selling in their domestic markets. The US car manufacturer, Tesla is one of the fastest-growing car brands in the world. Being able to export its cars globally increases its potential revenues dramatically compared to just selling its cars within the United States.

Economies of scale

Because firms can increase sales by exporting to international markets it means they can increase production and achieve economies of scale as a result of this. The unit costs of producing a Samsung smartphone will fall as it increases its scale of production to meet world demand rather than just selling to the domestic South Korean market.

Production costs

Being able to access imported inputs such as raw materials and components is important for businesses in an economy. For example, a car manufacturer needs to source inputs for production and being able to do this at a lower cost means they can produce cars more cheaply. In some cases, a country may not be able to access a particular raw material so being able to import them is essential. Japan, for example, has relatively limited access to raw materials so it needs to import inputs for its manufacturing businesses.

Source of foreign exchange

For many developing countries trade is a crucial source of foreign currency. By selling exports to the US, for example, a country earns US dollars which can be used to buy imported capital equipment from the US which can facilitate investment and long-term growth.

South Korea is one of the world’s great trading nations. Last year international trade accounted for 83% of its GDP. The country’s main exports are electrical equipment (15% of total exports), vehicles (6.8%), petroleum (5.8%) and ships (4.2%). Much of South Korea’s trading strength comes from large conglomerates businesses called Chaebols that have a huge presence in international markets. The largest chaebols are Samsung, LG, Hyundai, and SK Group.

South Korea is one of the world’s great trading nations. Last year international trade accounted for 83% of its GDP. The country’s main exports are electrical equipment (15% of total exports), vehicles (6.8%), petroleum (5.8%) and ships (4.2%). Much of South Korea’s trading strength comes from large conglomerates businesses called Chaebols that have a huge presence in international markets. The largest chaebols are Samsung, LG, Hyundai, and SK Group.

The power of South Korea's presence in international markets can be illustrated by Samsung’s performance in the mobile phone market where it sold 292 million units worldwide last year. South Korea’s trading performance has delivered a high standard of living for its population and taken many people out of poverty. Its GDP per capita is $46,452 which ranks it 29th in the world.

Questions

a. Explain how Samsung would have benefitted from access to markets and economies of scale as a result of international trade. [4]

Access to international markets would have benefitted Samsung through:

- Increased revenues because selling to overseas countries means there are more consumers to sell their products to.

- As the business produces more to meet increased demand from overseas markets it will achieve economies of scale which will reduce its average cost.

b. Explain how production and allocative efficiency might be improved in the Korean economy as a result of international trade. [4]

- Allocative efficiency can be improved in the Korean economy when goods produced inefficiently in Korea can be replaced by imported goods from other countries that can produce those goods more efficiently.

- Productive efficiency can be improved by importing lower-cost raw materials and components which can reduce business costs for Korean producers.

Investigation

Research into the trading position of another country and analyse the benefits free trade might have brought to the country.

The theory of specialisation (HL)

The economic theory behind the benefits of specialisation and trade was explored by the Economist David Ricardo in his book The Principles of Political Economy and Taxation (1817). The theory makes the case for specialisation and trade.

Absolute advantage

Absolute advantage occurs in an international trade situation when one country is more productively efficient than another country in producing a good. To analyse the theory, we need to assume the following:

- A two-country model. In this case, Country X and Country Y

- Two goods are produced by each country. In this example, wheat and lemons

- There are constant opportunity costs as production changes between the two goods

- There are zero transport costs

- Factors of production can be easily switched between the production of the two goods.

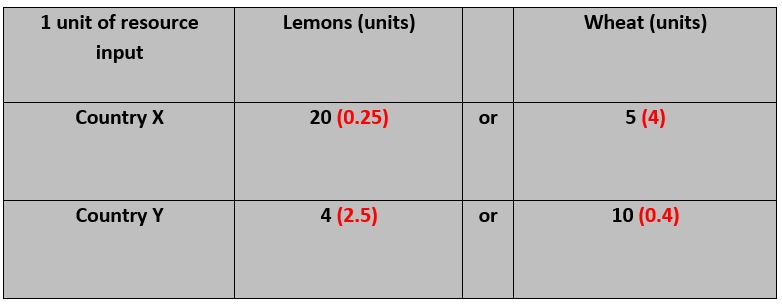

In the table below absolute advantage exists between Country X and Country Y because Country X can produce lemons more efficiently than country Y and country Y can produce wheat more efficiently than country X.

The table below sets out the relative outputs of the two goods Country X and Country Y can produce from one unit of resource input (this is a mixture of factors of production):

- Country X can produce 20 units of lemons or 5 units of wheat

- Country Y can produce 4 units of lemons or 10 units of wheat.

Based on the principle of absolute advantage, the countries should choose to specialise in producing the goods they are more efficient at producing and then trade them for the products they are not as efficient at producing rather than not trading and producing both products themselves. By trading with each other Country X and Country Y can have access to lemons and wheat at a lower opportunity cost than if they tried to produce the goods themselves.

- For Country X the opportunity cost of producing a unit of wheat is 4 lemons (20/5 = 4) and the opportunity cost of producing a unit of lemons is 0.25 units of wheat (5/20 = 0.25).

- For Country Y the opportunity cost of producing a unit of wheat is 0.4 lemons (4/10 = 0.4) and the opportunity cost of producing a unit of wheat is 2.5 units of lemons (10/4 = 2.5).

The opportunity costs of producing each good by Country X and Y are shown in brackets in the table.

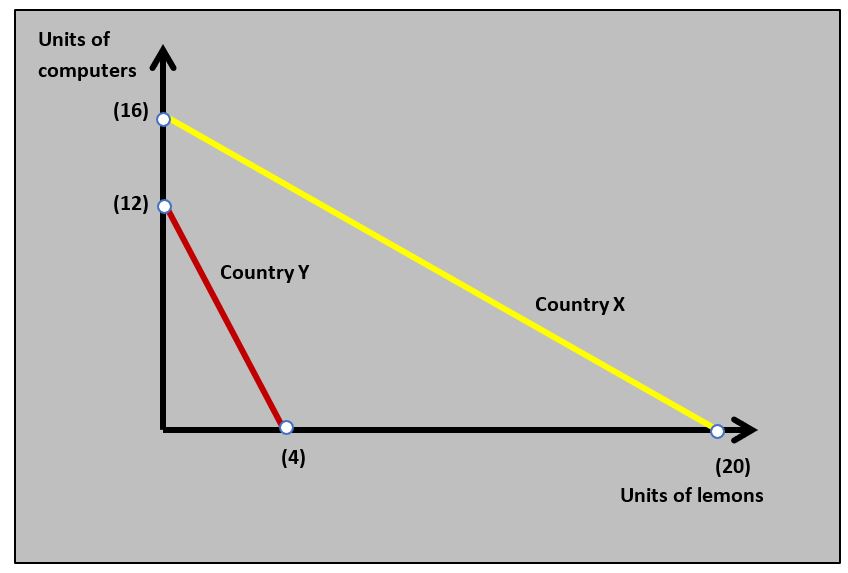

Diagram 4.1 show the production possibilities curves of Country X and Country Y producing lemons and wheat.

Diagram 4.1 show the production possibilities curves of Country X and Country Y producing lemons and wheat.

Comparative advantage

Comparative advantage is where one country has a lower opportunity cost of producing a good than another country. In our two-country model, Country X could be more productively efficient than Country Y in producing both goods but there would still be efficiency benefits from trade because the countries have different opportunity costs of producing the two goods.

.jpg) The table sets out the relative amounts of lemons and computers that can be produced by Country X and Country Y.

The table sets out the relative amounts of lemons and computers that can be produced by Country X and Country Y.

The principle of comparative advantage can be expressed in terms of opportunity cost ratios.

- If Country X chooses to produce an extra unit of lemons it has an opportunity cost of 0.8 units of computers (16/20 = 0.8) foregone (the opportunity cost for producing an extra unit of each good is shown in brackets), but if it produces computers the opportunity cost is 1.25 units of lemons (20/16 = 1.25), so Country X should specialise in lemons.

- For country Y the opportunity cost of producing 1 unit of lemons is 3 units of computers (12/4 = 3), but if it produces computers the opportunity cost is only 0.33 units of lemons (4/12 = 0.33), so it should specialise in computers.

Diagram 4.2 shows the production possibility curve for Country X and Country Y which are producing computers and lemons. The diagram illustrates the comparative advantage that Country X has over Country Y in Lemons and Country Y has over Country X in computers.

Diagram 4.2 shows the production possibility curve for Country X and Country Y which are producing computers and lemons. The diagram illustrates the comparative advantage that Country X has over Country Y in Lemons and Country Y has over Country X in computers.

Impact of absolute and comparative advantage on stakeholders

The efficiency gains made by countries from specialisation can lead to lower prices for consumers and businesses buying inputs. For example, if Country X specialises in lemons and produces them more efficiently this will lead to cheaper lemons for consumers and businesses.

Reality of specialisation

Specialisation is based on a country’s resource endowments. For example, South Korea has a huge consumer electronics sector (Samsung, LG, etc) because of the investment it has made in the capital and skilled labour in this sector. Whilst governments can shape industrial policy to support specialisation it is essentially a market-driven process. In our example, Country X has a larger lemon industry than Country Y because it has more appropriate resources for Lemon production. Country X’s soil, weather, skilled labour and capital give it significant supply-side advantages over Country Y in the production of lemons. This, along with the high demand for Country X’s lemons, will lead to its specialisation in lemons.

It is also worth remembering that Country X and Country Y will still produce some amount of both Lemons and Computers it is just that specialisation means the industries will be of different sizes

Evaluation of absolute and comparative advantage

The theory of absolute and comparative advantage can be used to explain the gains countries get from specialisation in international trade. It can also be used to explain the industrial structure countries have. For example, the reasons why Germany has a large car industry and the UK has a large financial services sector.

Weaknesses of the model

- Specialisation is more complex than the two-industry two-country model. Countries produce goods and services in most industrial sectors and trade these goods and services across the world.

- Specialisation takes place within market sectors. The German car industry specialises in high-quality, mass-produced brands like BMW and Mercedes, whereas the South Korean mass-produce mid-market brands like Kia and Hyundai.

- The gains from specialisation are constantly changing. As a country’s manufacturing sector develops over time it may develop a comparative advantage in another sector.

- As specialisation occurs in a country and an industry grows productive efficiency may improve as the industry benefits from economies of scale.

Lionel Messi is probably the best footballer in the world and arguably the best footballer of all time. The talismanic Barcelona number 10 has won everything possible at club level. His pace, skill and vision, along with his football intelligence make him feared by opponents.

Lionel Messi is probably the best footballer in the world and arguably the best footballer of all time. The talismanic Barcelona number 10 has won everything possible at club level. His pace, skill and vision, along with his football intelligence make him feared by opponents.

Messi does not own one car he owns a fleet! His cars included: Ferrari, Scaglietti Spider, Maserati, Audi Q7 and an Audi R8. Messi estimates it would take him 5 hours to clean all his cars. A student called Xavier who lives across the street from Messi has asked if he can clean the cars instead of doing Deliveroo work which would earn him $30. Xavier is not as efficient as Messi at cleaning the cars and it will take him 6 hours to clean the cars instead of Messi’s 5. Xavier has asked to be paid $60 to clean the cars for Messi.

Does Messi clean his own cars or let Xavier do them?

We can use the theory of comparative advantage to explain why Messi should pay Xavier to clean the cars even though Xavier is less efficient. In the same 5 hours Messi would spend cleaning his cars, he could work for Adidas (Messi’s biggest sponsor) filming a TV commercial that will pay Messi $250,000.

If Messi decided to clean his own cars the opportunity cost would be giving up the $250,000 he could earn from doing the Adidas commercial. Messi would be better off paying Xavier $60 to clean his cars and doing his commercial work for Adidas. Xavier should choose to clean the cars because the opportunity cost of doing this is the $30 he gives up if he worked for Deliveroo.

This example illustrates the concept of comparative advantage. Messi has an absolute advantage over Xavier in cleaning his cars, but he still gains by letting Xavier clean the cars because Messi’s opportunity cost of cleaning the cars ($250,000) is greater than Xavier’s ($30). As long as Messi pays Xavier more than $30 and less than $250,000 they are both better off.

Questions

a. Define the term comparative advantage. [2]

Comparative advantage is where one country has a lower opportunity cost of producing a good than another country.

b. Consider the production data for the two countries in the table.

(i) Outline the reason why Country A has an absolute advantage in wheat and cars. [2]

Country A is more efficient at producing both wheat and cars because it can produce more wheat and more cars from 1 unit of resources than Country B.

(ii) Calculate the opportunity cost of Country A and Country B producing wheat in terms of cars foregone. [2]

(iii) Calculate the opportunity cost of Country A and Country B producing cars in terms of wheat foregone. [2]

Answers are shown in the table.

.jpg)

(iv) Using the data in the table, explain which good Country A and Country B should specialise in. [4]

- Country A should specialise in wheat because it has a comparative advantage in its production because the opportunity cost is lower in producing wheat in terms of cars foregone.

- Country B should specialise in cars because it has a comparative advantage in its production because the opportunity cost is lower in producing cars in terms of wheat foregone.

c. Using a real-world example, evaluate the view that free trade is always good for consumers. [15]

Answers might include:

- Definition of free trade.

- A diagram to show comparative or absolute advantage. This is shown in the PPC diagram.

- An explanation of the benefits of comparative and absolute advantage and how they increase productive efficiency and this leads to a fall in average costs which can reduce prices for consumers.

- An explanation that free trade increases consumer choice and reduces prices as new firms can enter a domestic market from abroad and increase competition for domestic producers.

- An explanation that firms become more innovative in international markets as they learn from foreign competitors and this develops new products for consumers.

- An example of the benefits to consumers from the South Korean case example.

- Evaluation might include discussion of the disadvantages of free trade for consumers of free trade if multinational companies force domestic firms out of the market which reduces choice and increases prices. Free trade may also lead to a fall in the quality of products entering a market.

Investigation

Choose another highly paid celebrity and see if you can develop your own example. You could use cutting the grass, cleaning the house and painting a fence as possible examples.

The theory of specialisation in international trade centres on the way trade increases the efficiency of the way resources are used and allocated in a country. The global trade in energy is a good example of this. The world's major oil producers Saudi Arabia, Russia, Nigeria and Venezuela have the efficiency advantage in oil production. They have specialised in the production and export of oil and used the income from this to import goods from cars to mobile phones. But this is changing with the movement away from fossil fuels to renewable energy. The efficiency advantage of renewables lies in countries like Iceland, Norway, Kenya and Uruguay and these may well be the major exporters of energy in the future.

Which of the following is least likely to be a benefit of free trade?

Free international trade can cause structural unemployment when domestic firms face increased competition.

Which of the following is the most likely to be beneficial for a domestic firm when its market is opened up to foreign competition?

Increased foreign competition means domestic firms can learn from their foreign competitor's methods.

Using the data in the table, which of the following is true?

For Country A the opportunity cost of producing cheese is calculated as 40/20 = 2 units

4. Using the data in the table, which of the following is not true?

The opportunity cost of Country B producing 1 unit of smartphones is 5 units of strawberries.

Which of the following best explains why comparative advantage exists in a country?

A country's factors of production determine its productive efficiency.

Which of the following is not a weakness of the theory of comparative advantage?

Using data from the diagram, which of the following is correct?

.jpg)

The opportunity cost of Country X producing one unit of good B is 20/10 = 2 units of good A

Which of the following is least likely to be a benefit of increased free international trade?

Increased free trade can lead to more foreign competition for domestic producers which may lead to increased structural unemployment.

Countries A and B trade freely with each other. Country A exports luxury cars and imports smartphones. Country B exports smartphones and imports luxury cars. Assuming there are no transport costs or economies of scale, which of the following statements is most likely to be true?

If country A exports luxury cars it will have a lower opportunity cost in the production of luxury cars and this is where its comparative advantage lies.

Which of the following is the best definition of comparative advantage?

IB Docs (2) Team

IB Docs (2) Team