Oligopoly (HL only)

Introduction

Introduction

This lesson focuses on the market structure of oligopoly and the characteristics that this market structure possesses. An effective way to teach this topic is to focus on a local business such as local petrol stations or supermarkets which may be a good example of a non-competitive oligopoly. Non-collusive oligopolies and the kinked demand curve are no longer part of the new syllabus but the oligopoly market structure remains.

Enquiry question

What are the assumptions of an oligopoly. How does this market structure differ from other structures in economics?

Lesson notes

Lesson time: 1 hour

Lesson objectives:

Lesson objectives:

Describe, using diagrams, the assumed characteristics of an oligopoly.

Explain and provide examples of the terms “collusion” and “cartel”.

Explain the term “tacit collusion”, including reference to price leadership by a dominant firm.

Teacher notes:

1. Beginning activity - begin with the opening activity and allow 10 minutes to complete the power point presentation and opening question. (10 minutes)

2. Processes - technical Vocabulary - the students can learn the key concepts through the key terms and the activities. (5 minutes)

3. Practise activities - included on the handout should take around 35 minutes. These are a combination of short answer, diagrammatic and case study exercises.

4. Final reflection exercise - contains a relevant paper one style question on this topic that your students can look at and discuss. This topic of course can be included on papers one and three of the examination and this page contains both types of questions to practise on. This activity could also be set as a homework or classwork exercise. (10 minutes)

Beginning activity

Start by taking a look at the following presentation ![]() Oligopoly and then write down a list of a few oligopolies operating in your country?

Oligopoly and then write down a list of a few oligopolies operating in your country?

Common examples include:

National mass media and news outlets are an example of an oligopoly, with 90% of U.S. media outlets owned by six corporations: Walt Disney, Time Warner, CBS Corporation, Viacom, NBC Universal and Rupert Murdoch’s News Corporation.

Another familiar example is operating systems for smart phones and computers. Apple iOS and Google Android dominate smart phone operating systems, while computer operating systems are overshadowed by Apple and Windows.

The car industry is another example with the leading auto manufacturers in the United States being Ford, GMC and Chrysler.

While there are smaller cell phone service providers, the providers that tend to dominate the industry are Verizon, Sprint, AT&T and T-Mobile.

The music entertainment industry is dominated by Universal Music Group, Sony, BMG, Warner and EMI Group.

Source: http://www.investopedia.com/

Key terms:

Oligopoly - a market structure where a small handful of firms dominate the industry, generally between 2 and 8

Concentration ratio - represents the market share held by the largest firms in the market. This is expressed as a formulae as CRx where X is the number of firms.

Interdependence - this describes the relationship between all firms within this market structure. Much like chess players are interdependent, each firm operating within an oligopoly will consider the actions of the other firms in the market before making their own decision.

Colluding - in a colluding oligopoly the participating firms will actively collude on prices. Under either an official agreement (called a cartel) or a more informal agreement, firms will set the same prices and agree output targets to determine market supply and push up price levels to their mutual advantage.

Available as a printable worksheet at: ![]() Oligopoly

Oligopoly

Activity 1

1. Investigate the following markets in the US: pharmaceuticals, beer manufacture, wine production, oil industry.

(a) Investigate the CR4 for each of the above industries. Represent this on a pie chart highlighting the % market share enjoyed by each firm.

(b) Which of the above industries is the most and least concentrated?

Hint:

The answer does not necessarily rely on the CRx ratio. For instance a market with a CRx of 70% but where the largest two firms, within that market, enjoy a market share of 65%, is more concentrated than an industry with a CRx of 80% but where the market share is evenly divided between each of the biggest 4 companies.

Activity 2

Watch the following short video and then answer the questions which follow:

(a) What is an oligopoly and why do some economists consider it to be dangerous?

An industry with a high concentration ratio, e.g, 75% and it is considered dangerous because of the risk of the firms acting together to drive up prices.

(b) Degree of concentration is measured by?

The concentration ratio or CRx.

(c) What does interdependence mean?

That each firm in the market is dependent on the actions of the others. Before completing any move they must first consider the likely reaction from the other firms in the industry.

(d) Explain the difference between overt and discrete collusion.

Overt collusion involved firms openly colluding with each other. Covert is more secret collusion.

(e) What is tacit collusion?

This is non official collusion but exits when firms within the same industry set standardised practices making competition more difficult e.g. each firm employing the same cost push pricing system.

(f) What are some examples of non-price competition described in the video.

Customer service, quality of workmanship, individual changes to product design, specific marketing aimed at product differentiation, loyalty cards.

(g) Why do many firms in oligopoly focus on non-price rather than price competition?

Non price-competition adds additional costs to a business but it is still cheaper than lowering prices, which is likely to lead to a price war, when competing firms react to the move.

(h) How do regulators use game theory to impose sanctions on businesses they suspect of price fixing?

Firms in oligopoly use game theory when determining their prices and regulators have the same information at their disposal. This means that they can impose a fine larger than the potential gain, in order to deter firms from employing the dominant strategy.

Activity 3

(a) Complete the following table for an oligopoly and then draw the diagram on the graph paper provided. Presume that FC in this example are 0.

| Output | Price ($s) | TR$ | TC$ | MC$ | MR$ |

| 4,000 | 8 | 32,000 | 16,000 | 4 | 8 |

| 8,000 | 7 | 56,000 | 24,000 | 2 | 6 |

| 12,000 | 6 | 72,000 | 40,000 | 4 | 4 |

| 16,000 | 5 | 80,000 | 64,000 | 6 | 2 |

| 20,000 | 4 | 80,000 | 96,000 | 8 | 0 |

| 24,000 | 3 | 72,000 | 136,000 | 10 | (2) |

| 28,000 | 2 | 56,000 | 184,000 | 12 | (4) |

(b) Using the information from the table, draw the diagram on the graph paper included.

Important note from a subscriber, when drawing the oligopoly diagram

'When the MC is less than ATC, ATC is falling.Whenever MC is greater than ATC, ATC is rising.When ATC reaches its minimum point, MC=ATC.' Johan Lindstrom, subscriber to InThinking

Activity 4: Oligopoly in practise - OPEC

Firstly read the following article and then answer the questions which follow:

Oil prices rise 6% after OPEC agrees to limit crude output

Oil prices settled up nearly 6% on Wednesday after the Organisation of the Petroleum Exporting Countries (OPEC) struck a deal to limit crude output. Its first agreement to cut production since 2008 follows a crash in the market on oversupply and will be finalised at its policy meeting in November.

OPEC reached agreement to limit its production to a range of 32.5m-33m million barrels per day (bpd) in talks held on the sidelines of the 26-28 September International Energy Forum in Algiers, group officials told Reuters. OPEC estimates its current output at 33.24m bpd.

The original article can be accessed from the ![]() Guardian

Guardian

Questions

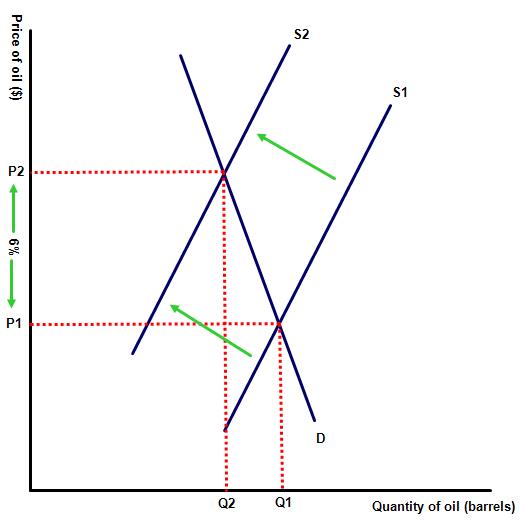

(a) Illustrate on a diagram why a cut in oil production has led to a 6% rise in price?

This is a simple supply and demand response. As market supply falls then price will rise. Responses should make a note of two characteristics of the oil market. Firstly oil is PES inelastic and so even a small cut in production targets will lead to significant rises in the price of oil. This is illustrated on the diagram by a greater than proportional rise in selling price in response to the reduction in output from Q1 to Q2.

This is a simple supply and demand response. As market supply falls then price will rise. Responses should make a note of two characteristics of the oil market. Firstly oil is PES inelastic and so even a small cut in production targets will lead to significant rises in the price of oil. This is illustrated on the diagram by a greater than proportional rise in selling price in response to the reduction in output from Q1 to Q2.

Secondly, as an oligopoly which controls 81% of world oil output, the nations of the oil producing economic community are price makers, not price takers.

(b) Illustrate using an appropriate diagram why oil producing nations benefit from collusion?

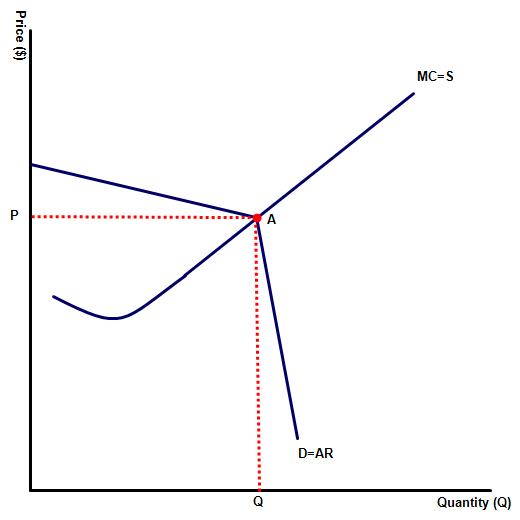

Without collusion the oil producing nations will be restricted by 'sticky prices'. This can be illustrated by the diagram on the left. The problem for oil producers is that if a nation unilaterally raises its price, to increase profit margins, then other nations are likely to maintain their price at the same level. The fall in quantity demand will be larger than the gain in revenue from the increase in price.

Without collusion the oil producing nations will be restricted by 'sticky prices'. This can be illustrated by the diagram on the left. The problem for oil producers is that if a nation unilaterally raises its price, to increase profit margins, then other nations are likely to maintain their price at the same level. The fall in quantity demand will be larger than the gain in revenue from the increase in price.

If the nation instead chooses to reduce prices then other nations will follow, leading to a small rise in sales only. Given that unlike some oligopolies the producers of oil cannot realistically differentiate their products, the only solution is to collude - work together to set the world price at a mutually beneficial level.

Activity 4 is available as a PDF handout at: ![]() OPEC

OPEC

Activity 5: Link to the assessment

Examples of paper one question include:

(a) Explain how oligopoly firms may increase their market share at the expense of their rivals. [10 marks]

Command term: Explain

Key term to define: oligopoly

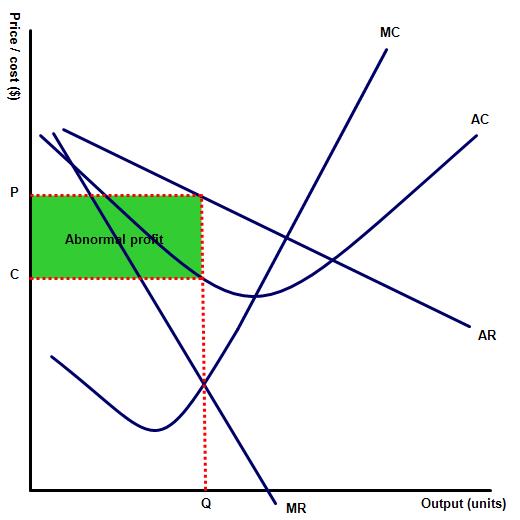

Responses should provide an explanation unable to compete on price, as firms in other market structures are able to do, oligopoly firms are forced to employ non-price competition methods in order to improve market share at the expense of their rivals. Examples include the acquisition or merger with a competitor, the use of product differentiation and advertising to create brand loyalty (non-price competition) e.t.c. This effectively turns a firm in oligopoly into a monopoly and so a suitable diagram hre would be a monopoly firm making abnormal profits.

Responses should also note that product differentiation is more difficult with businesses selling a largely homogenous product such as banks or petrol stations. By contrast, firms in car manufacture or technology such as Samsung and I phone have more scope to differentiate.

Examples of firms that has successfully used differentiation to increase their market share, e.g. coke has become the leading fizzy soft drinks manufacturer, as a result of a series of successful marketing campaigns designed to differentiate themselves from the rivals.

(b) Using real-world examples, evaluate the view that firms in an oligopoly enjoy more benefits from the structure than consumers. [15 marks]

Command term: Evaluate

Key term to define: oligopoly

Real life examples might include industries best served by oligopoly such as supermarkets or banking, where the gains from economies of scale are large and where there is genuine competition within the market. Responses should also include examples of where a market is poorly served by a lack of competition in the market, where perhaps prices are high and the quality of service offered low, such as in the oil industry or some food cartels.

The command term evaluate means prioritising each argument in terms of which is the more convincing, with the conclusion noting that consumers may benefit from any oligopoly structure, providing the economies of scale are large enough and then passed on to the consumer, in the form of lower prices. This is more likely to be the case in a non-collusive oligopoly or when producers in an oligopoly are trying to increase market share by starting a price war with their competitors

Responses should also include:

A recognition of the benefits that consumers enjoy from oligopoly markets. Examples include a recognition that due to price competition  consumers can sometimes enjoy low prices and greater product choice through non-price competition. In some cases, consumers may also benefit from price wars in the case of supermarkets or electronics manufacturers.

consumers can sometimes enjoy low prices and greater product choice through non-price competition. In some cases, consumers may also benefit from price wars in the case of supermarkets or electronics manufacturers.

An explanation of some of the benefits enjoyed by producers, which include potential gains from economies of scale as well as the ability to be price setters rather than price takers. These are unlikely to be passed on to the consumer and more likely to be taken by the producer in the form of abnormal profits, illustrated by the green shaded area in diagram 1.

Responses should also recognize that in the case of colluding oligopolies, where the firms successfully employ game theory, businesses may be able to force up prices by restricting supply within the industry.

IB Docs (2) Team

IB Docs (2) Team