Independent central banks

Introduction

Introduction

This will look at monetary policy and how governments can employ monetary policy measures to influence the aggregate demand curve.

Enquiry question

Why do the central banks of some countries, rather than focusing on the maintenance of both full employment and a low rate of inflation, instead prioritise an explicit or implicit inflation rate target.

Lesson time: 70 minutes

Lesson objectives:

Lesson objectives:

Explain that central banks of certain countries, rather than focusing on the maintenance of both full employment and a low rate of inflation, are guided in their monetary policy by the objective to achieve an explicit or implicit inflation rate target.

Evaluate the effectiveness of monetary policy through consideration of factors including the independence of the central bank, the ability to adjust interest rates incrementally, the ability to implement changes in interest rates relatively quickly, time lags, limited effectiveness in increasing aggregate demand if the economy is in deep recession and conflict among government economic objectives.

Teacher notes:

1. Beginning activity - begin with the opening video which takes 6 minutes to watch and then complete activity 1 and 2 based on the information contained in the video. (Allow 15 minutes in total for the two activities and the video)

2. Processes - technical vocabulary - the students can learn the background information from each of the videos attached to the activities on this page and the list of key terms. Allow 10 minutes for the key terms.

3. Applying knowledge - activity 3 applies the knowledge to the UK's central bank which was mad independent 22 years ago. Has this period been successful for the bank? (10 minutes)

4. Developing the theory - activity 4 discusses if the independence of central banks is under threat and why? (10 minutes)

5. Final reflection - activities 5 and 6 look at what happens when the central banks get it wrong, focusing on the financial crisis of 2008. (20 minutes)

6. Inflation simulation - finish the lesson with this historical simulation. (5 minutes)

Key terms:

Central bank - the institution that manages the currency, money supply, and interest rates of a state or formal monetary union plus oversees the commercial banking system.

Independent central bank - one that operates independently of government control. The level of independence of course varies between nations with some more autonomous than others.

Independent central bank - one that operates independently of government control. The level of independence of course varies between nations with some more autonomous than others.

Macroeconomic objectives - control of inflation, maintenance of economic growth, low and stable unemployment and the external balance. It is the role of central banks to juggle the above objectives, based on targets set by government.

Tools of monetary policy (HL only)

Open market operations - central bank purchases or sales of government securities in order to expand or contract money in the banking system and influence interest rates.

Central bank minimum lending rate - the rate of interest which a central bank charges on its loans and advances. This then becomes the minimum rate of interest in the economy and affects customers because it influences prime interest rates for personal loans and mortgages.

Minimum reserve requirements - set for a six-week period and is called a maintenance period. The level is calculated on the basis of the bank's balance sheet prior to the start of the maintenance period. Banks have to make sure that they meet the minimum reserve requirement on average over the maintenance period.

Quantitative easing - an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to increase the money supply and encourage lending and investment.

The activities on this page are available as a PDF at: ![]() Central banks

Central banks

Activity 1: The role of the central bank

Watch the following short video and then explain some of the roles of the modern central bank.

Roles include:

Controlling the operations of commercial banks through the reserve rate.

Short term lending to commercial banks, which provides the central bank with control of interest rates in the economy - presuming that the high street banks then pass those funds onto the consumer.

Control of monetary policy by maintenance of low interest rates.

Securing the nation's gold reserves - the last resort should a nation require funds.

Maintain inflation within the target set by national governments.

(b) The maintenance of which key macroeconomic objective does the video include in its list of roles?

Maintenance of target inflation - implying that this is the key objective for any central bank.

(c) Why might governments give central banks the task of maintaining inflation, rather than other macroeconomic objectives e.g. low unemployment.

Many central banks are required to consider a range of macroeconomic objectives when deciding on their policy decisions, for example the Bank of England in 2016 maintained interest rates at historically low levels despite above target inflation, because of concerns that higher rates might destabilise other areas of the economy that were thought to be at risk. Banks that prioritise low inflation, however, do so because unlike politicians they do not need to be elected and so are therefore less likely to be swayed by short term expansionary policies aimed at securing popularity before an election campaign.

Activity 2: Central banks and inflation targets

The following table identifies some of the inflation targets set by governments / central banks around the world, a well as those nation's current inflation rate.

| Nation | Independent? | Inflation target 2020 % | Inflation rate 2020 % |

| Argentina | No | 0 - 8 | 54 |

| Euro zone | Yes | 2 | 0.51 |

| Japan | Partially | 2 | -0.01 |

| Russia | No | 4 | 4.91 |

| South Korea | Partially | 2 | 0.54 |

| Turkey | No | 5 | 14.7 |

| UK | Yes | 2 | 0.99 |

| USA | Yes | 2 | 1.36 |

Figures taken from: https://www.inflation.eu/en/inflation-rates/cpi-inflation-2020.aspx

(a) From the table above, outline the success of completely independent central banks in maintaining a low rate of inflation in the economy?

There would appear to be a direct correlation - the three highest rates of inflation belong to three nations where the central bank does not enjoy full independence. That said, many would argue that no central bank has complete independence because they are appointed by the same politicians that they represent.

(b) Why might independent central banks be more effective in keeping inflation low than central governments?

Central banks, unlike national governments, do not seek election every 4-5 years, making them less likely to be swayed by short term expansionary policies aimed at securing popularity before an election campaign.

Activity 3: A focus on the Bank of England

In 2017, the Bank of England celebrated 20 years of independence. Using the table below comment on the banks success in controlling inflation and secondly in securing economic growth.

| Time period | Inflation rate % | GDP growth % |

| 2015 - 2019 | 1.78 | 1.83 |

| 2011 - 2014 | 2.17 | 1.98 |

| 2007 - 2010 | 2.65 | -0.4 |

| 2002 - 2006 | 1.63 | 2.8 |

| 1998 - 2001 | 1.15 | 3.2 |

| 1994 - 1997 independence day | 2.41 | 3.3 |

| 1990 - 1993 | 4.95 | 0.63 |

| 1986 - 1989 | 4.39 | 4.2 |

| 1982 - 1985 | 5.24 | 3.18 |

| 1978 - 1981 | 13.2 | 1.28 |

The table would certainly support the notion that independent central banks are more effective at keeping inflation in check but not necessarily more effective at stimulating economic growth.

Average inflation rate pre-independence was 6.04, compared to 1.88% afterwards.

Average growth rates pre-independence was 2.51, compared to 2.11% afterwards.

Activity 4: Are independent central banks under threat

Watch the following short video and then explain why independent central banks are under threat from governments?

Hint:

Independent central banks and national agendas have different agendas. The job of a central bank is to manage the macro economy effectively, which often means raising interest rates to tighten lending conditions and reduce short term growth in the economy. While politicians no doubt understand this they do not operate in the long term. For example, President Trump and Tayip Erdogan of Turkey rely on a strong economy for their support base.

Activity 5: When expansionary monetary policy goes wrong

Many of you will be aware of the film, 'the big short' which centred on the financial collapse of many of the worlds leading banks in 2008. The following clip taken from the film explains how the chain of events were set in motion by a small group of investors realising that the market was vulnerable and placed large bets on the market failing.

Why were financial market so vulnerable at that time?

Prior to 2008 the world's major financial centres were largely unregulated with governments relying on the sector to regulate itself - which it failed to do. This was because the sector had become increasingly sophisticated in the range of products that it sold and governments, as well as the regulatory agencies they set up did not have a proper understanding of these products either. For example, in the short clip the products that the team were betting against contained some of the riskiest loans on the market, which were packaged together and sold on to investment banks all over the world.

Activity 6: Warren Buffett

The following short video contains Warren Buffett's view of the 2008 financial crisis. Summarise his views on the causes of the crisis as well as the governments response to it.

Warren Buffett compares the US economy to a runaway train with no brake and no end station. Bubbles were created in real estate with 40% of homes containing mortgages larger than the value of the home. The public, banks and governments were all culpable. Governments refused to adopt contractionary monetary policy when required and the banks themselves refused to reform themselves. The economy is now recovering slowly but it is a long process.

He predicts future crisis as there always have been remains positive about the US economy moving forward.

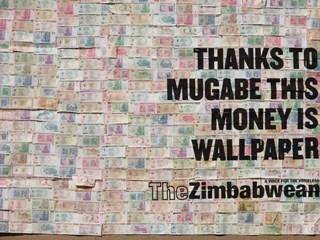

Activity 7: Inflation simulation

End the lesson with the following simulation:

IB Docs (2) Team

IB Docs (2) Team