Unit 2.11(4) Market power - Monopolistic competition(HL)

Monopolistic competition is a form of imperfect competition. Many markets across the economy share the characteristics of monopolistic competition such as hairdressers, restaurants, plumbers and care homes. These markets are made up of a large number of firms accounting for a high proportion of total market output. The increased realism of the monopolistic competition model compared to perfect competition allows us to make more accurate predictions about the way markets of this type behave.

- Definition of monopolistic competition

.jpg)

- Assumptions of monopolistic competition

- Product differentiation

- Demand and revenue

- Explanation and diagrams of normal profit, abnormal profit and losses

- Efficiency in monopolistic competition

- Evaluation of monopolistic competition

Revision material

The link to the attached pdf is revision material from Unit 2.11(4) Market power - Monopolistic competition(HL). The revision material can be downloaded as a student handout.

The link to the attached pdf is revision material from Unit 2.11(4) Market power - Monopolistic competition(HL). The revision material can be downloaded as a student handout.

The nature of monopolistic competition

Monopolistic competition is a form of imperfect competition. Many markets across the economy share the characteristics of monopolistic competition such as hairdressers, restaurants, plumbers and care homes. These markets are made up of a large number of firms accounting for a high proportion of total market output. The increased realism of the monopolistic competition model compared to perfect competition allows us to make more accurate predictions about the way markets of this type behave.

The example we are going to use in this chapter to analyse monopolistic competition is hairdressers. There are some larger businesses in the market but most hairdressers in an economy are small, independently owned firms.

Assumptions of the model

Large number of buyers and sellers

The market is made up of a large number of small buyers and sellers in the market. Each firm has a small proportion of total market sales which means there is a low concentration ratio. This means each firm has very limited market power which is typical of the hairdressing market.

Barriers to entry

There are no barriers to entry into or exit from the market in monopolistic competition. Similar to perfect competition there are no costs or restrictions over and above the normal costs of new firms setting up in the market. There are also no barriers to exit that prevent firms from leaving the market. Setting up a hairdresser would mean renting a retail space which has to be fitted out with appropriate equipment and then hiring staff. This would be a relatively straightforward market to enter because there are no excessive regulations and costs associated with entering the market.

Differentiated products

Each firm in a market sells a product that is similar but slightly different to the products of other firms in the market. Hairdressers in a town, for example, offer similar services but can be differentiated in a number of ways, such as specialising in men or women's hair, the types of cuts offered and the style and layout of the premises. The picture shows examples of how different hairdressers can differentiate their services.

Each firm in a market sells a product that is similar but slightly different to the products of other firms in the market. Hairdressers in a town, for example, offer similar services but can be differentiated in a number of ways, such as specialising in men or women's hair, the types of cuts offered and the style and layout of the premises. The picture shows examples of how different hairdressers can differentiate their services.

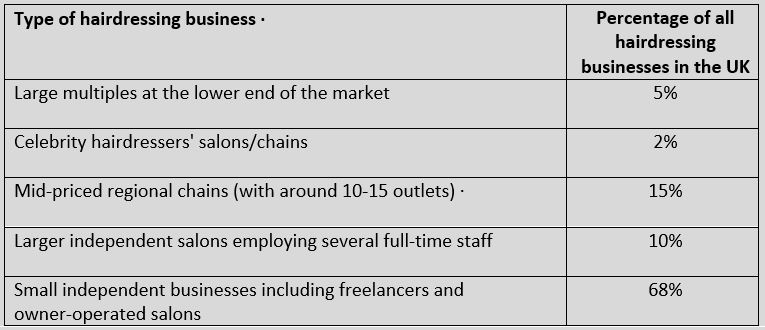

A report by the Department of Trade and Industry on the hairdressing sector in the UK gives gave the following information on the sector. The majority of hairdressing businesses in the UK are small businesses. It has been estimated that at least 68% of all salons in the UK are independently owned, single outlet businesses. Nearly 50% of all firms in this market sector are self-employed people. There are local and regional chains in the hairdressing business and also some larger multiple outlet businesses, but these represent a small percentage of the market.

Worksheet questions

Worksheet questions

Questions

a. Explain why the hairdressing market can be considered to be an example of monopolistic competition. [4]The hairdressing market is an example of monopolistic competition because:

- The market is made up of a large number of small firms.

- Hairdressers sell a differentiated product where each firm sells a service that is slightly different to other firms in the market.

- There are no barriers to entry in the hairdressing market because of the lack of regulation in the market and low set-up costs.

b. Explain how hairdressing businesses can differentiate their products. [4]

A hairdressing firm can differentiate their products by making their product different from other firms in the market through the cut styles they offer, the location of their outlet, the design of their outlet and the age/gender their business targets.

Investigation

Do some research into the hairdressing market in the place where you live. Is it a similar market structure to the national hairdressing market in the UK?

Demand and revenue in monopolistic competition

Demand curve

The differentiated product assumption of monopolistic competition has an important effect on the demand curve the firm faces in the model. Because each firm sells a product that is different to others in the market, they face a downward sloping demand curve and firms have some control over the price they charge. Firms in monopolistic competition are price makers rather than being price takers as firms are in perfect competition. For example, a hairdresser in a monopolistically competitive market could increase their price and not see quantity demanded fall to zero because their differentiated product will enable them to retain some loyal customers. If a hairdresser increases its price, some customers might stay with a hairdresser because they like the person that cuts their hair and the way they are looked after in the salon. If a firm in monopolistic competition reduced its price it will be able to attract some buyers away from other producers in the market.

Elasticity

Because there are many competing firms in the market selling differentiated products it will be relatively easy for buyers to substitute towards a firm’s product when its price falls and away from a firm's product when its price rises. This means the demand for the good or service of individual firms in the market is relative prices elastic. A change in price by a firm in monopolistic competition will cause a greater proportionate change in the quantity demanded for the good it sells.

Revenue

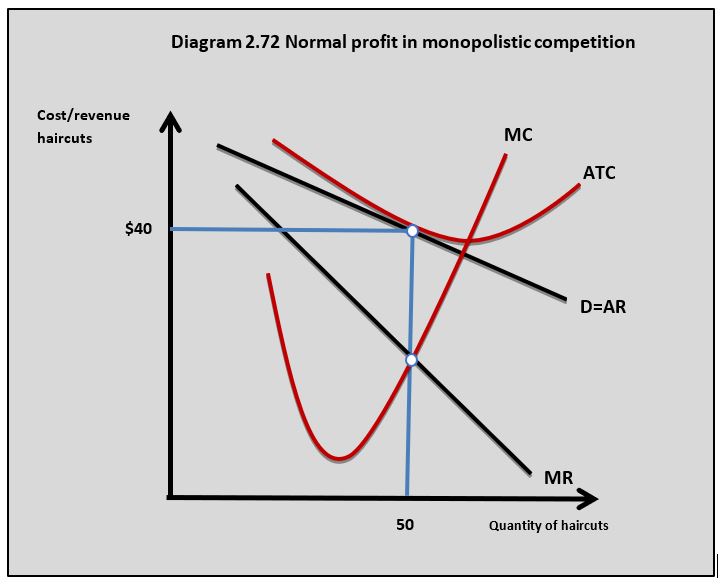

A downward sloping demand curve in monopolistic competition changes the revenue curves the firm faces. The table below sets out the total revenue, average revenue and marginal revenue for a firm in a monopolistically competitive market. Because the demand curve is downward sloping the average revenue and marginal revenue curves are separate and the marginal revenue is twice as steep as the demand curve and is negative when demand becomes price inelastic. This is shown in diagram 2.72.

.jpg)

Costs

The short-run cost curves of the firm in monopolistic competition are affected by the law of diminishing returns as they are in perfect competition. The marginal cost, average cost and average variable cost curves are always U-shaped.

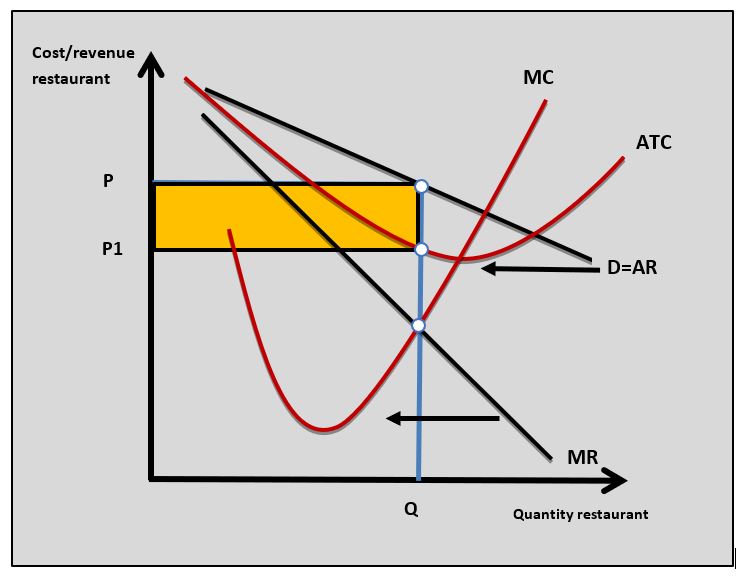

Profit maximisation

Firms aim to profit maximise in monopolistic competition and they achieve this by producing where marginal cost equals marginal revenue when marginal cost is rising. They then set their price based on consumer demand for that level of output. Price, output and profit maximisation are shown in diagram 2.72.

Profits and losses

Normal profits

Normal profit exists in monopolistic competition when total cost equals total revenue at the profit maximising output. In diagram 2.72 this will be where average total cost equals average revenue at the profit maximising output:

(AR = ATC) x Q

When firms in the industry are making normal profits, the market is in equilibrium which means entrepreneurs are making enough profit to keep their business in the market. In the hairdresser example, the firm is making normal profit at a price of $40 and an output of 50 haircuts.

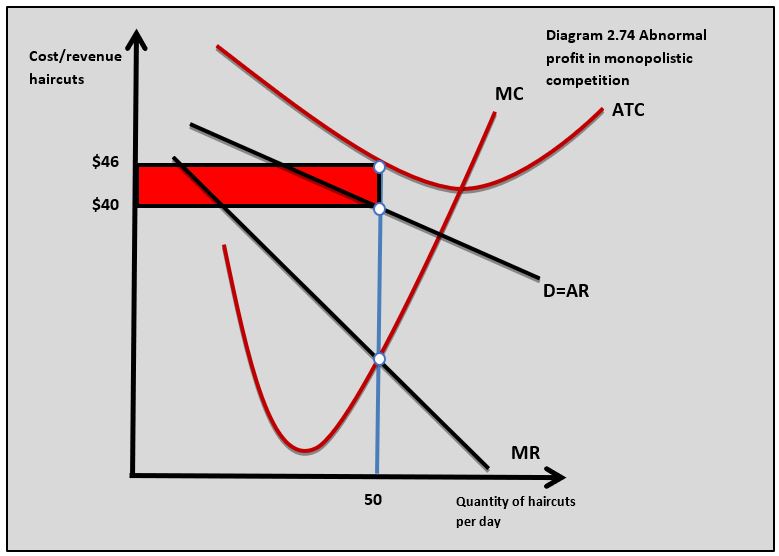

Abnormal profit

When firms in the market are earning abnormal profit total revenue is greater than total costs and the firm is making more than the minimum profit required to keep them in the market. In diagram 2.73 this is where average revenue is greater than the average total cost at the profit maximising output.

When firms in the market are earning abnormal profit total revenue is greater than total costs and the firm is making more than the minimum profit required to keep them in the market. In diagram 2.73 this is where average revenue is greater than the average total cost at the profit maximising output.

(AR – ATC) x Q = abnormal profit

In the hairdresser example, the abnormal profit is:

($40 - $32) x 50 = $400

Abnormal profit is a short-run equilibrium situation. In the long run, the abnormal profit attracts new firms into the market and as the number of firms in the market increases the demand curve for existing producers in the market decreases (shifts to the left) as new substitutes enter the market. New firms stop entering the market when the abnormal profit is competed away and all the firms in the market are earning normal profits. This is shown in diagram 2.73.

Losses

When firms earn losses in monopolistic competition it means the total cost is greater than total revenue and firms are not making the minimum profit required to keep producing in the market. In diagram 2.74 this is shown where the average total cost is greater than average revenue.

(ATC – AR) x Q = losses

In the hairdresser example the loss is:

($46 - $40) x 50 = $300

Losses are a short-run equilibrium situation. If firms in the market do not earn the minimum profit needed to keep them in the market (normal profit) they will leave the industry. As firms leave the market there will be less competition for existing producers and this will cause the demand curves for these firms to increase (shift to the right) returning the firms to normal profit in the long run.

A report on the leisure market in The Netherlands has estimated that $200m has been wiped off the value of the Dutch nightclub scene in the last five years. Is it true that party-goers in Amsterdam, Rotterdam and The Hague are leaving the dance floor in search of something new? Last year more clubs closed as people looked at new attractions such as indoor golf, trampolining, vegan dining and working out in the gym.

A report on the leisure market in The Netherlands has estimated that $200m has been wiped off the value of the Dutch nightclub scene in the last five years. Is it true that party-goers in Amsterdam, Rotterdam and The Hague are leaving the dance floor in search of something new? Last year more clubs closed as people looked at new attractions such as indoor golf, trampolining, vegan dining and working out in the gym.

Young people are looking for a new style of nightlife whether it is with food, games or exercise. Many Dutch nightclubs are small independently owned businesses that are struggling to adapt to changing consumer demand in the leisure market.

Questions

a. Outline why the demand for nightclubs has fallen in the Netherlands. [2]

There has been a fall in demand for nightclubs in the Netherlands because of a change in taste and preferences amongst Dutch consumers who are attracted by substitute products such as gyms, restaurants and indoor golf.

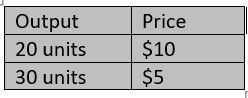

b. The following data is from a nightclub in the Netherlands:

- Average revenue $15

- Average variable cost $5

- Total fixed cost $51,840

- Average monthly attendance 4,320

Calculate the following:

(i) Total monthly revenue. [2]

4320 x $15 = $64,800

(ii) Average fixed cost. [2]

$51,840 / 4,320 = $12

(ii i) Total monthly loss. [2]

($15 - $17) x 4320 = $8,640

c. Using a diagram, explain what will happen to the nightclub market in the Netherlands in the long run if firms are making losses. [4]

.jpg) The loss in the nightclub market will mean some firms will leave the market. This will cause the demand curve for the firms that remain in the market to increase until profits return to normal. This is shown in the diagram where D and MR shift to the right.

The loss in the nightclub market will mean some firms will leave the market. This will cause the demand curve for the firms that remain in the market to increase until profits return to normal. This is shown in the diagram where D and MR shift to the right.

Investigation

Research the nightclub market in your country. Are there any similarities with the Netherlands?

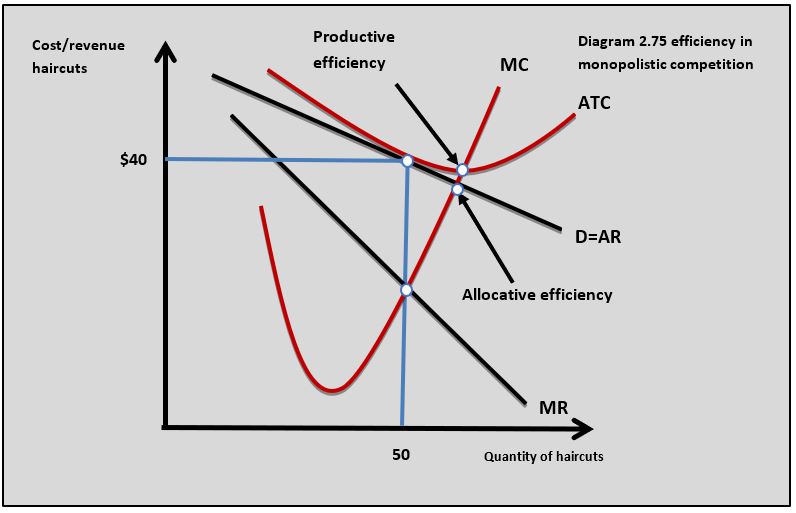

Efficiency in monopolistic competition

Productive (technical) efficiency

Productive efficiency occurs in monopolistic competition when all firms in the market produce at minimum average total cost where marginal cost equals average total cost at the profit maximising output. Unlike perfect competition, firms in monopolistic competition do not achieve productive efficiency because they do not produce where marginal cost equals average total cost. This is shown in diagram 2.75.

Allocative efficiency

Allocative efficiency is achieved when demand equals supply in the market or where firms set price equal to marginal cost and the community/social surplus is maximised. Unlike perfect competition, firms in monopolistic competition profit maximise by charging a price above marginal cost and producing an output below the allocatively efficient level. This means prices are higher and output lower than would be the case in perfect competition. This is shown in diagram 2.75.

Evaluation of monopolistic competition

Here are two judgements that can be made about monopolistic competition:

• In reality most markets are made up of businesses of different sizes and cost structures. Even where there are many small firms in the market large firms are likely to exist and will have more influence on the market than the smaller businesses.

• Although monopolistic competition is neither allocatively nor productively efficient compared to perfect competition it does offer the consumer more choice because firms sell a differentiated product. The homogenous products sold in a perfectly competitive market may have a lower price compared to monopolistic competition but the goods on offer from different producers would all be the same. Imagine being faced with a number of hairdressing salons offering exactly the same service.

As you walk through Brussels famous Grand Place your reach a network of narrow streets where every shopfront is a restaurant. Restaurant after restaurant where prospective diners are crowded around outside menus, looking at seafood on ice and being drawn in by enthusiastic waiters. The quality of the food is high and this small area of the city is world famous for its restaurants. Whether you are looking for Belgium’s favourite moules et frites or the best international fine-dining, it's all here.

As you walk through Brussels famous Grand Place your reach a network of narrow streets where every shopfront is a restaurant. Restaurant after restaurant where prospective diners are crowded around outside menus, looking at seafood on ice and being drawn in by enthusiastic waiters. The quality of the food is high and this small area of the city is world famous for its restaurants. Whether you are looking for Belgium’s favourite moules et frites or the best international fine-dining, it's all here.

Most of the restaurants are small independently owned firms with many being family-run. The restaurant market near the Grand Place could be best described as monopolistic competition.

Questions

a. Explain why firms in monopolistic competition cannot make abnormal profits in the long run. [10]

Answers might include:

- Definitions of monopolistic competition, abnormal profit and long run.

- A diagram to show abnormal profits in monopolistic competition and how demand falls as new firms enter the market in response to abnormal profit.

- An explanation of how abnormal profit attracts new firms into a market that is monopolistically competitive and how this causes the demand curve for existing firms in the market to fall and shift to the left as shown in the diagram.

- An explanation that new firms can enter the market because there are no barriers to entry in monopolistically competitive markets.

- Example of a monopolistically competitive market such as the restaurant market in Brussels.

b. Using a real-world example, evaluate the view that monopolistic competition is a less efficient market structure than perfect competition. [15]

Answers might include:

- Definitions of monopolistic competition (definition in part a could be referred to), perfect competition, productive efficiency and allocative efficiency.

- A diagram to show productive and allocative efficiency in monopolistic competition.

- An explanation that firms in monopolistic competition do not achieve productive efficiency by producing where MC = ATC (this is shown in the diagram) and that firms in long run equilibrium in perfect competition do achieve productive efficiency by producing where ATC = MC.

- An explanation that firms in monopolitic competition do not achieve allocative efficiency by not producing where MC = D (this is shown in the diagram) and that firms in perfect competition do achieve allocative efficiency by producing where D = S or D = MC.

- An example of inefficiency in monopolitistic competition such as the restaurant market in Brussels.

- Evaluation/synthesis might include discussion of the advantages of monopolistic competition over perfect competition such as differentiated products offering consumers more choice than the homogenous product in perfect competition. Discussion could also include the point that monopolistically competitive firms still face intense competition that pushes them to be efficient and the relatively unrealistic assumptions of perfect competition compared to monopolistic competition.

Investigation

Research the restaurant market in the town where you live to see whether it has the characteristics of monopolistic competition.

Which of the following markets is least likely to be described as monopolistic competition?

Car manufacturers are normally large firms and there are significant barriers to entry into the market.

Which of the following assumptions makes monopolistic competition different to perfect competition

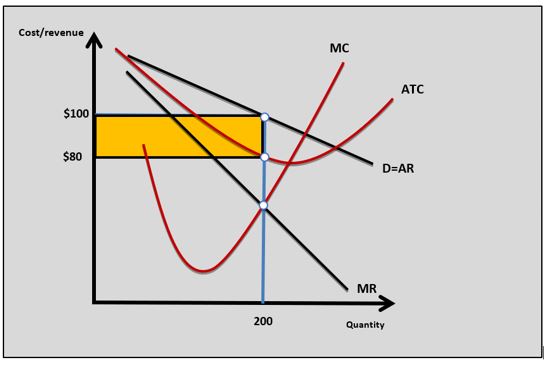

Using the following data, which of the following is the firm’s marginal revenue when the price falls from

20 x 10 = TR 200; 30 x

Using the diagram, which of the following is true?

The firm is making abnormal profit and this will attract new firms into the market.

Which of the following is untrue if firms in monopolistic competition are making losses?

Firms in the market are profit maximising. If firms reduce their output their losses will increase.

Which of the following is true when a firm in monopolistic competition is making normal profit?

Which of the following is least likely to be true in a monopolistically competitive market?

Average revenue is greater than marginal revenue in monopolistic competition.

The data sets out the cost and revenue for a firm in monopolistic competition:

AR

ATC

Output 17,000

Which of the following is not true?

(

Why will abnormal profits in monopolistic competition return to normal profit in the long run?

Abnormal profits mean that new firms will enter the market and the demand curve (AR) will fall because there are more substitutes for the firm's good.

A profit maximising firm in monopolistic competition is at an output 1000 and a price of

The profit maximisation output is where MC equals MR and the price is determined by the AR curve at this output.

IB Docs (2) Team

IB Docs (2) Team