The role of spending and taxation on inequality

(1).jpg) Introduction

Introduction

This lesson continues to focus on the level of income inequality within a country, focusing on the role that progressive taxes play in reducing the level of inequality in the economy. This is a good opportunity to discuss some of the strengths and weaknesses of progressive and regressive tax systems. One of the advantages of a progressive tax system is that the burden of tax falls heaviest on high income earners. This means that governments with high progressive tax regimes will generally also have lower levels of income inequality.

Lesson time: 90 minutes

Lesson objectives:

Lesson objectives:

Distinguish between progressive, regressive and proportional taxation, providing examples of each. Explain that direct taxes may be used as a mechanism to redistribute income.

Calculate the marginal rate of tax and the average rate of tax from a set of data. (HL only)

Evaluate government policies to promote equity (taxation, government expenditure and transfer payments) in terms of their potential positive or negative effects on efficiency in the allocation of resources.

Explain the term transfer payments, and provide examples, including old age pensions, unemployment benefits and child allowances.

Teacher notes:

1. Beginning activity - start with the opening question on tax evasion and take 5 minutes to discuss the implications of this.

2. Processes - technical vocabulary - students can learn the content watching the videos, reading the key terms and then completing each of the activities on this page.

3. Applying the theory - activity 2 and 3 focuses on the effectiveness of the role of taxation on income distribution. (10 minutes)

4. More application of theory - activity 4 and 5 are HL only activities and require students to use the theory to calculate the tax paid by different income earners. (15 minutes)

5. Developing the theory - activity 6 and 7 begins the second part of this lesson, on the issue of fairness. Just because progressive tax systems place a larger burden on the rich does this really make them fairer? What are strengths and weaknesses of progressive tax systems. Activity 6 is best completed as a class discussion rather than completed individually. (15 minutes)

6. Applying the theory - activity 8 develops this argument further and considers the difficulties governments face in trying to raise further taxes on the wealthiest individuals and corporations in a global world. (15 minutes)

7. TOK exercise - activity 9, should we be able to choose how are taxes are spent? (10 minutes)

8. Reinforcement exercises - activity 10

9. Reflection activity - contains an example of a paper one type question, which you can either print off or project onto the whiteboard. Allocate 10 minutes for this activity.

Key terms:

Progressive taxation - a tax where the burden paid increases as a households income rises. It means that the higher the wage a person earns, the higher their average rate of tax is.

Regressive taxation - a tax where the burden paid falls as a households income rises. Regressive taxes take a larger percentage of individuals on low

Proportional taxes - taxes where the burden falls equally on both low and high income households. Proportional taxes will apply the same % tax burden, regardless of the level of income earned.

Transfer payments - payments made by governments in the form of welfare benefits and public subsidies for which no money, goods, or services are received.

Universal basic income - a governmental public program for a periodic payment delivered to all on an individual basis without means test or work requirement. The income provided would be unconditional, automatic, non-withdrawable, paid on an individual basis and delivered as a right.

The activities on this page are available as a handout at: ![]() Role of spending and taxes on equality

Role of spending and taxes on equality

Beginning question

Estimate how much money do you think is currently deposited in off shore bank accounts, used as a way of avoiding paying tax? Explain the implications of this for governments trying to use taxation to fund a fairer society?

A report for the BBC claims that the figure could be $ 21tn - just under a quarter of the total world income in 2018. This number could almost certainly make an enormous difference to many governments but makes many reticent about imposing high taxes on their wealthiest citizens for fear that they will simply move their money off shore.

Activity 1: The impact of taxation on income inequality in the USA

Watch the following youtube video, from economist David Weissel, on the impact of taxation on income inequality in the USA. After watching the video read explain the extent to which progressive taxes and transfer payments by governments contribute to a more equal distribution of income.

Progressive taxes such as income and corporation tax certainly contribute towards a more equal society, though vast inequalities still remain within many nations. This is because the burden of progressive taxation falls disproportionately on the wealthiest households, while more recipients of transfer payments tend to be poor - out of work benefits, child credits, pension e.t.c.

For an interesting take on this question why not read the following article appropriately named: ![]() How to legally scam welfare?

How to legally scam welfare?

Activity 2: Types of taxation

Complete the following table:

Type of tax | Progressive | Proportional | Regressive |

Sales tax | √ | ||

Income tax | √ | ||

Corporation tax | √ | ||

Property tax (flat rate) | √ | ||

Duty on cigarettes and alcohol | √ | ||

Fuel / petrol taxes | √ | ||

Per capita taxes | √ | ||

Luxury taxes e.g. on second homes | √ | ||

Capital gains tax | √ |

Activity 3: Progressive v regressive taxation systems

A government is considering switching its tax revenue base from a progressive to a regressive taxation system. As part of this the government wishes to reduce income tax rates and corporation tax rates. The main plank of this will be a reduction in the top rate of income tax from the current 60% to 45%. Instead they will raise sales taxes, especially on demerit goods such as alcohol, petrol and tobacco products.

Outline arguments in support and against this policy. Consider a range of stakeholders in your response.

There are two main arguments in support of the change in policy. Firstly, regressive taxes such as sales tax do not discourage hard work and enterprise. Unlike progressive taxes, where the more that an individual works and the higher wage that they earn, the more that an individual pays in tax, under regressive tax systems hard work and success are not penalised.

Secondly, sales taxes enable the consumer to choose whether to purchase the good or service or not and hence whether to pay tax or not? Sales taxes are probably also easier to collect than income and corporation taxes.

The disadvantage of this change in policy is that regressive tax systems are unfair in the sense that the burden falls heaviest on low income households. Is this fair?

Activity 4: How does a marginal tax system work? (HL only)

The following table includes income tax rates in a range of countries:

Country | Income tax rate (highest income earners) |

Belgium | 64% |

Sweden | 60% |

USA | 55% |

Russia | 38% |

Turkey | 35% |

Czech Republic | 22% |

Bulgaria | 10% |

Saudi Arabia | 2.5% |

UAE | 0% |

Does this mean that residents of Belgium and Sweden lose more than half incomes in tax?

In reality they do not. This is because most countries use a marginal taxation system so that the tax rate gets progressively higher the more you own. Therefore, in reality wealthy residents only pay 60 or 64% on the highest part of their incomes. The following table, showing the tax rates in Sweden illustrates this:

Yearly income earned (US $) | Marginal tax rate |

Up to $ 2,690 | 0% |

$ 2,690 - $ 62,140 | 31% |

$ 62,140 – $ 88,130 | 51 % |

Over $ 88,130 | 56 % |

This means that an individual lucky enough to be earning $ 100,000 per year in Sweden will actually pay a tax rate of 38.34%

This is calculated by:

(0% x $ 2,690) + (31% x $ 59,450) + (51% x $ 25,990) + (56% x $ 11,870) which comes to $ 38,331.6 in income tax or a total tax rate of 38.34%

How much would an individual pay in tax if they earned an income of $ 50,000?

(0% x $ 2,690) + (31% x $ 47,310) = $ 14,666

Activity 5: A comparison of two tax systems (HL only)

Two nations, Turkey and Germany have the following income tax rates:

| Level of income per year (Eur) | Germany % | Turkey % |

| up to 8,653 | 5.5 | 35 |

| 8,654 - 53,665 | 19.5 | 35 |

| 53,665 to 254,446 | 42 | 35 |

| over 254,446 | 45 | 35 |

1. To what extent are the taxation systems of Germany and Turkey progressive?

Germany's income tax system is progressive, Turkey's is proportional.

2. Outline the level of income tax paid by the citizens of the two countries at the following income levels?

| Level of income per year (EUR) | Germany | Turkey |

| 12,500 | (8,653 x 5.5%) + (3,847 x 19.5%) = € 1,226 | 12,500 € x 35% = 4,375 |

| 25,000 | (8,653 x 5.5%) + (16,347 x 19.5%) = € 3,664 | 25,000 € x 35% = € 8,750 |

| 75,000 | (8,653 x 5.5%) + (45,012 x 19.5%) + (21,335 x 42%) = € 18,214 | 75,000 € x 35% = € 26,250 |

| 150,000 | (8,653 x 5.5%) + (45,012 x 19.5%) + (96,335 x 42%) = € 49,714 | 150,000 € x 35% = € 52,500 |

| 250,000 | (8,653 x 5.5%) + (45,012 x 19.5) + (196,335 x 42%) = € 91,714 | 250,000 € x 35% = € 87,500 |

| 400,000 | (8,653 x 5.5%) + (45,012 x 19.5) + (200,781 x 42%) + (145,554 x 45%) = € 159,081 | 400,000 € x 35% = € 140,000 |

3. Outline one advantage of the tax system of both nations?

Germany of course has the 'fairer' progressive tax system which means that the income paid is dependant on the income that a person earns. This system taxes wealthy households progressively more and reduces the level of income inequality in the economy - as stated in earlier sections of the site.

By contrast the more proportional Turkish tax system provides individuals with a greater incentive to work harder as they get to keep a larger share of what they earn - at high rates of income. For example a young family that is considering taking on a second job might be discouraged from doing so under the German system - if the second job increased their wage to a level were a higher rate of income tax had to be paid.

Activity 6: So is progressive taxation fairer?

Watch the following short video and then decide for yourself.

The answer to this question depends entirely on an individuals perception of fair? On one hand it could be argued that progressive tax systems on income are entirely fair. This is because the amount of tax paid depends on someone's ability to pay. Individuals with little or no income would pay no tax.

On the other hand some economists disagree with this assertion and state instead that all individuals should pay the same amount of tax. After all, why should a hard working and successful person pay more tax simply to subsidise payments for low income households, who may be making little attempt to find work themselves.

Of course this assertion makes the assumption that all wealthy people are hard working and similarly all those on low incomes are lazy and choose not to work - a statement that is clearly untrue

Activity 7: Different tax rates across the world

The following table illustrates income tax and sales tax rates rates for a number of nations:

| Country | Income tax rate (average wage earners) | Tax rate (high earners) | Sales tax |

| Belgium | 42.80% | 40.40% | 21% |

| Germany | 39.90% | 39.90% | 17.5% |

| UK | 24.90% | 43.72% | 8 - 20% |

| USA | 22.70% | 40.55% | 6 - 12% |

| Mexico | 9.5% | 29.40% | 16% |

| Saudi Arabia | 0% | 3.14% | 5% |

Source: //www.bbc.com/news/magazine-26327114

a. Explain why there might be significant variations between income and sales tax rates between different countries?

In a lot of the European countries tax rates and social security contributions are high but the provision of benefits by the state tends to be very generous compared to countries in other parts of the world. If you fall ill or become unemployed the state will contribute and there are also generous pension arrangements.

b. What are the advantages and disadvantages of governments collecting tax revenue from sales tax rather than income tax? Explain your answer from the viewpoint of both high income earners as well as from the viewpoint of those on lower incomes.

Countries will make individual decisions on how to collect taxes. The advantage of using sales tax as a method of collecting taxes is that they are easier to collect than income taxes. This is a particularly attractive option in many LEDCs where revenue collection is difficult due to the size of the informal economy. Secondly, collecting tax revenue from sales taxes is not a disincentive to work hard. which is the case for income tax rates, where individuals pay a greater level of tax the more that they earn.

Activity 8: Laffer curve

Many governments throughout the world have gone on record as saying that the reduction of income inequality is an economic priority. Others have gone further and stated that they are prepared to levy very high punitive tax rates on the wealthiest households within the society, as part of this policy objective. A socialist government in 1970s UK even famously stated that he wanted to 'squeeze the wealthy until the pips squeak'.

Despite such claims many governments have refrained from imposing such measures and if anything progressive tax rates have fallen throughout the world, noticeably so for the highest income earners. Why is this, watch the following short video and then explain why don't all socialist / left leaning governments impose high rates of taxation on their wealthiest citizens?

One of the reasons for this is that extracting tax revenue from the wealthiest members of a society is actually more difficult that it sounds with legal tax avoidance methods common place and a whole army of 'tax experts' set up to ensure that the richest individuals and corporations can successfully reduce their tax burden by employing legal measures - for a fee. The balance to strike for any government therefore is to set tax rates high enough so that the treasury collects sufficient revenue to finance its public spending commitments but not have tax rates so high that tax payers prefer to employ a tax expert to avoid paying it.

One of the reasons for this is that extracting tax revenue from the wealthiest members of a society is actually more difficult that it sounds with legal tax avoidance methods common place and a whole army of 'tax experts' set up to ensure that the richest individuals and corporations can successfully reduce their tax burden by employing legal measures - for a fee. The balance to strike for any government therefore is to set tax rates high enough so that the treasury collects sufficient revenue to finance its public spending commitments but not have tax rates so high that tax payers prefer to employ a tax expert to avoid paying it.

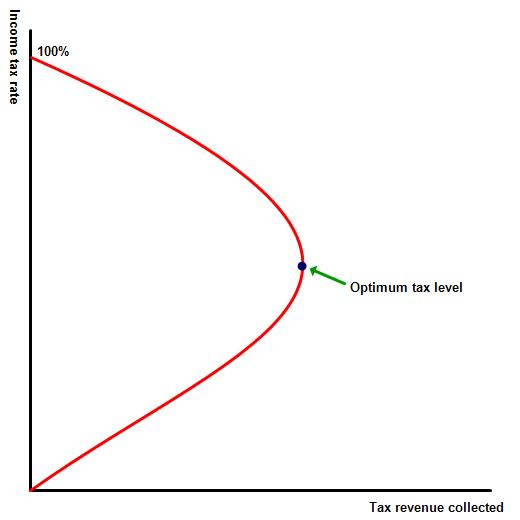

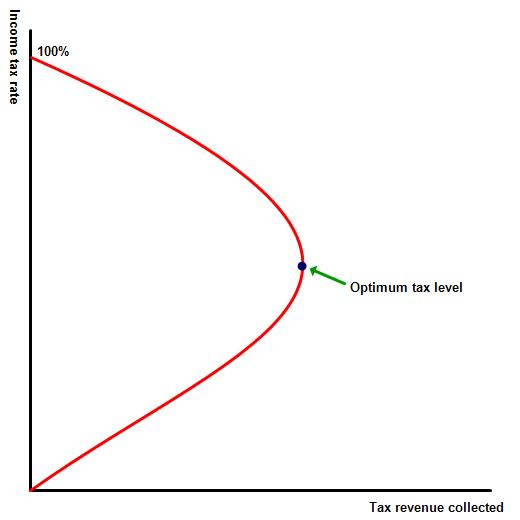

This can be illustrated by the Laffer curve, designed by Arthur Laffer, illustrates the relationship between the income tax rate and the level of tax revenue collected. At 0% tax, the level of tax collected is 0. As the government raises the income tax rate then the level of taxation revenue rises until an optimum point, around 45%. After which if the government tries to raise tax rates further individuals will simply stop paying tax, even by illegal means. The optimum rate of income tax, therefore, would appear to be around 45%. At an income tax rate of 100% the level of tax revenue would also be zero.

Further reading on the relationship between income tax and the amount of tax revenue collected:

TOK exercise

One of the common issues in any election concerns the issue of taxation and spending. Specifically how tax revenues are collected and more importantly how much is collected and secondly where it is allocated. Government spending on the military as well as welfare and public services are hotly debated election topics.

Take a look at the following short video and then answer the question, should citizens get the right to decide how their tax revenue is spent? This is best completed as a group exercise where the two groups take opposite view points.

Activity 9: Revision questions

(a) Do high income households benefit from transfer payments as well as households on low incomes?

Quite likely, a wealthy family for instance may be more likely to stay in education longer and also live longer – thus receiving a state pension for a longer period of time. On the other hand the wealthiest individuals pay significant sums in tax but use less public services. They may for instance pay for their children to attend private school, enjoy private medical treatment and not use public transport. Alternatively they may not?

(b) Explain the possible impact on income distribution when a government changes from a progressive direct tax system to a regressive indirect taxes?

Such a move by any government is likely to make for a less equal distribution of income in the nation. This is because direct taxes are examples of a progressive taxation system, the burden of which falls primarily on wealthy households - at least in absolute terms.

By contrast indirect taxes are examples of a regressive taxation system, the burden of which falls primarily on low income households - at least in proportional terms. Moving from one tax system to the other, therefore, will increase the tax burden of low income households and reduce the burden on wealthier households.

So why would a government consider such a policy change?

For the simple reason that regressive taxation systems, while increasing inequality levels within a society, have the advantage of providing an incentive for individuals to work harder and innovate by allowing those who benefit from their endeavour to keep a larger proportion of their income.

Activity 10: The universal basic income

Watch the following short video on Finland, a nation one of the first to trial a universal basic income. One year later has it worked?

One advantage of the system is that it allowed him the flexibility to retrain and / or start a business. Under the old welfare system that would be impossible because the recipient would lose their welfare benefits by doing so. Another advantage is that the system is less bureaucratic than the traditional welfare systems, which are means tested.

Disadvantages of the system include the fear that it may create yet more low paid, low skilled jobs. The system would also be very costly and is it really right that this payment would be provided to all - even the richest members of a society?

Activity 11: Link to the assessment

An example of a relevant paper one question:

(a) Explain why free market economic systems have a less equal distribution of income. [10 marks]

Responses should include the following:

A definition of a free market system and income distribution.

A definition of a free market system and income distribution.

An explanation of why free market economic systems may be less equal in terms of income distribution.

A recognition that in free markets that all factors of production are controlled and owned by private individuals, the low progressive tax rates (the burden of which falls primarily on high earners) present in free market economic systems as well as an absence of transfer and other welfare payments. The recipients of transfer and other welfare payments are more likely to be low income households.

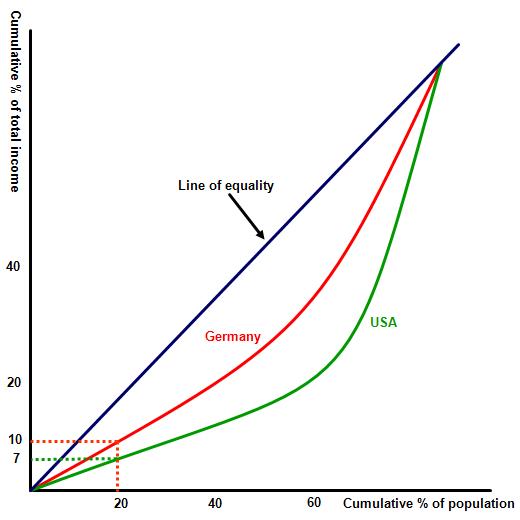

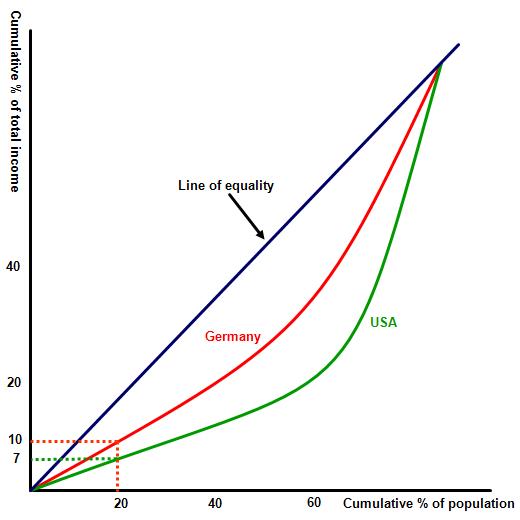

A suitable diagram such as a Lorenz curve, showing a less equal distribution of income in market economic systems, such as the USA, compared to a more mixed economic system such as Germany. For example on the diagram the poorest 20% of the population in USA own collectively less than the lowest 20% of earners in Germany.

A recognition that income inequality is measured by the gini co-efficient. We would expect to see a higher gini co-efficient within free market economic systems.

Responses should conclude with a comparison of economies with a high gini co-efficient such as USA and a low co-efficient, e.g. Germany.

(b) Using real life examples, evaluate different government policies, which promote greater income equality, in terms of their effects on efficiency in the allocation of resources. [15 marks]

Command term: Evaluate

In this example the command term evaluate requires candidates to make a judgement on the validity of the above statement. Responses should also include an overall conclusion, based on the evidence submitted.

A relevant real world example might include a comparison of the efficiency of largely free market economies, such as Hong Kong or USA with nations that implement extensive government policies aimed at reducing income inequality e.g. many EU nations.

Responses should include the following in their response:

A definition of income equality and economic efficiency.

A definition of income equality and economic efficiency.

A discussion of different policies which may be employed to reduce income inequality levels. Examples include a greater use of progressive taxes and transfer payments. Governments can reduce income inequality by increasing progressive taxes, the burden of which falls primarily on high income households, as well as increasing government spending on transfer payments. Dealing with high taxes first, particularly progressive taxes such as income or corporation tax, economic theory dictates that raising the rate of income tax will be effective in reducing income inequality, but it may not be effective in improving economic welfare. The Laffer curve on the right illustrates the relationship between the % rate of income tax and the level of tax revenue collected. As governments have discovered to their cost in the past, once the level of tax rises past its optimum point, tax revenue will fall as individuals will simply work less, reducing the effectiveness of any income inequality reduction policy.

Similarly, while increasing the level of transfer payments e.g. public sector wages, pensions, sickness payments and out of work benefits, is likely to improve income equality, with the recipients of such payments more likely to be from low income households, the policy may also provide a disincentive to work. This is because some recipients may simply  choose to collect benefits, rather than looking for employment.

choose to collect benefits, rather than looking for employment.

In other words policies which are effective in reducing income equality may also reduce economic efficiency by providing a disincentive to work or set up a business as the burden of progressive taxes will always fall heaviest on those who benefit from working hard to increase their disposable income.

This is illustrated by the next two diagrams diagrams. The first on the left, illustrates the Lorenz curve for two different nations. The red line represents Germany, which implements a range of policies aimed at poverty and income inequality reduction, including a rise in progressive taxes and transfer payments. The green line represents the USA which does not – leaving this up to the free market. Unsurprisingly Germany experiences lower levels of inequality, represented by a smaller Gini coefficient, but as a consequence may experience from a loss of efficiency.

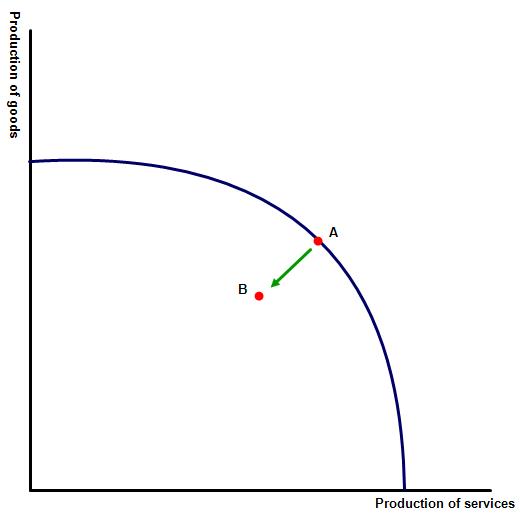

The second diagram, to the right, illustrates this, illustrating a production possibility frontier, with point A drawn on the edge of the PPF curve and representing an economy running efficiently and point B lying within the boundary of the PPF. The loss of economic efficiency, resulting from a rise in progressive taxes and transfer payments, is represented by a move from point A to point B on the diagram.

The second diagram, to the right, illustrates this, illustrating a production possibility frontier, with point A drawn on the edge of the PPF curve and representing an economy running efficiently and point B lying within the boundary of the PPF. The loss of economic efficiency, resulting from a rise in progressive taxes and transfer payments, is represented by a move from point A to point B on the diagram.

The mark bands for using a real world example can be accessed by providing examples of where such policies have been used. This might include, for instance, a comparison of two countries such as Sweden and USA. Alternatively responses might include an example of where a government has implemented poverty reduction policies and seen a fall in inequality as a result.

The essay should finish with an evaluation on the impact of income equality policies on a range of different stakeholders. Relevant stakeholders might include entrepreneurs, low paid workers, high paid workers as well as the recipients of social benefit payments.

IB Docs (2) Team

IB Docs (2) Team