Profit and revenue maximisation in monopoly (HL only)

-1.jpg) Introduction

Introduction

This lesson focuses again on monopoly structures and asks whether operating a monopoly guarantees that a firm will make abnormal profit. It also considers examples of monopolies that do not prioritise profit as their over-riding objective.

Enquiry question

Will monopoly businesses always make abnormal profit? Are there examples of monopolists that prioritise other objectives, than maximising the return for their shareholders.

Lesson notes

Lesson notes

Lesson time: 45 minutes

Lesson objectives:

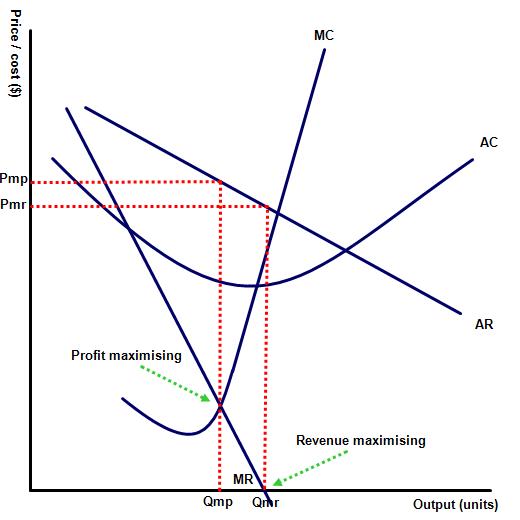

Explain, using a diagram, the output and pricing decision of a revenue maximising monopoly firm. Compare and contrast, using a diagram, the equilibrium positions of a profit maximising monopoly firm and a revenue maximising monopoly firm.

Calculate from a set of data and/or diagrams the revenue maximising level of output.

Teacher notes:

1. Beginning activity - begin with the opening revision activity and allow 5 minutes for your classes to complete the question. (5 minutes)

2. Processes - technical Vocabulary - the students can learn the key concepts through video and activity 1, which should take 10 minutes to go through and discuss.

3. Practise activities included on the handout should take around 20 minutes. These are a combination of short answer and diagrammatic exercises.

4. Final reflection exercise - contains a relevant paper one style question on this topic that your students can look at and discuss. This topic of course can be included on papers one and three of the examination and this page contains both types of questions to practise on. This activity could also be set as a homework or classwork exercise. (10 minutes)

Beginning activity

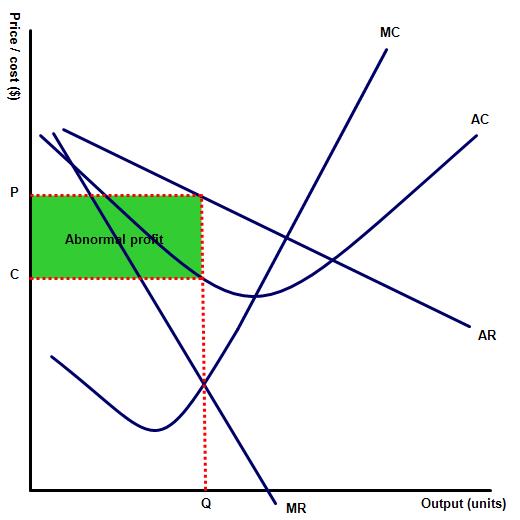

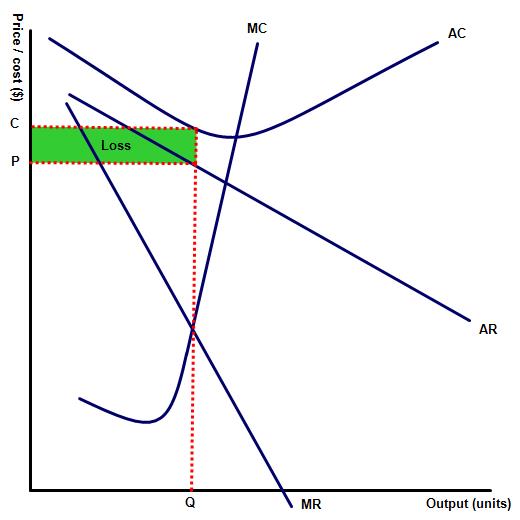

Draw two diagrams, one showing a monopoly firm making abnormal profits and the other a monopoly business that is making a loss.

Hint:

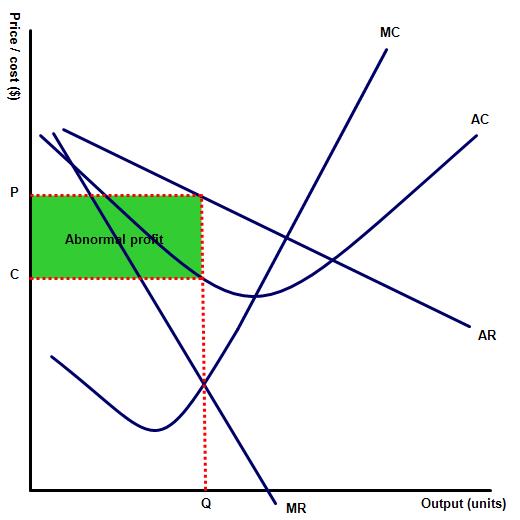

If you have drawn your diagrams correctly both firms should be producing at where MC = MR and both should also have a downward sloping demand / AR curve and a MR curve below the AR curve, cutting the X axis at the revenue maximisation output level. On both diagrams you should draw a line up from output Q to the AR line to derive the price at which the business is selling its products. The AC curve is drawn last and this determines whether or not the firm is making abnormal profit or a loss. To draw a loss making firm position the AC curve above so that at output Q the level of average cost is greater than average revenue. Similarly to illustrate a firm making abnormal profit simply draw the AC curve below the AR curve at output level Q. A monopoly firm making a normal profit could be illustrated by positioning the AC curve so that it touches the AR curve at output Q.

Key terms:

Key terms:

Profit maximising level of output - where MC=MR

Revenue maximising level of output - where MR = 0

Sales maximising level of output - where AC=AR.

Available as a PDF file at: ![]() Revenue and profit maximisation

Revenue and profit maximisation

Activity 1

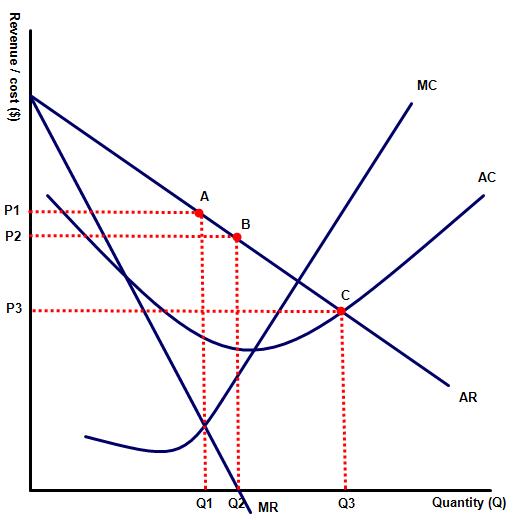

Watch the following short video and then illustrate the points on the diagram which represent the profit maximising, revenue maximising and sales maximising levels of output.

Profit maximising: MC=MR (A)

Profit maximising: MC=MR (A)

Revenue maximising: MR=0 (B)

Sales maximising: AC=AR (C)

Activity 2

Complete the following table by filling in the blanks. Identify the revenue and profit maximising levels of output.

| Price ($) | Units produced | Total revenue ($) | Total cost ($) | Marginal revenue ($) | Marginal Cost ($) |

| 6 | 65 | 390 | 200 | − | − |

| 7 | 60 | 420 | 210 | 6 | 2 |

| 8 | 55 | 440 | 230 | 4 | 4 |

| 9 | 50 | 450 | 260 | 2 | 6 |

| 10 | 45 | 450 | 300 | 0 | 8 |

| 11 | 40 | 440 | 350 | (2) | 10 |

Why might a monopolist decide to maximise revenue rather than profit?

Activity 3: TOK link

Which output level provides the optimum level for consumers?

This all depends on an individuals point of view. Many economists, politicians and consumers would argue (with justification) that the pursuit of profit rarely benefits any stakeholders other than the shareholders and that consumers would be better served by a firm maximising its revenue. In this way the consumer would normally enjoy higher levels of output and lower prices.

On the other hand others might argue (equally convincingly) that higher profits are necessary to encourage entrepreneurs to take risks and also to provide the funds required to invest in research and development, including product development.

Activity 4: Link to the assessment

Examples of relevant paper one question include:

Part (a) question

Explain how the creation of monopoly may increase the welfare loss in a society. [10 marks]

Command term: Explain

Key terms to define: welfare loss, monopoly power.

Responses should also include the following:

Responses should also include the following:

A brief explanation of how monopolies are able to use their dominant position in order to gain abnormal profits. Welfare loss, sometimes called deadweight loss occurs when the welfare of the society is not maximised, with firms producing below the allocatively efficient level, where MC = AR.

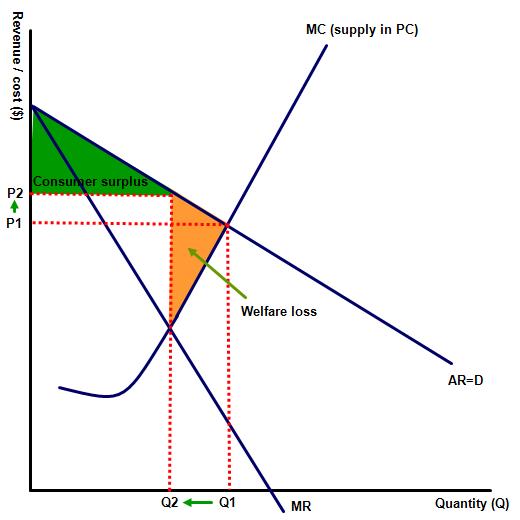

A recognition that in monopoly we normally assume that prices are higher and output lower due to the monopolist restricting supply to force prices (AR) above marginal cost. This is illustrated by the diagram showing equilibrium price (Pm) above the socially optimum level and output at Q2, below the allocatively efficient level of Q1. The level of abnormal profit enjoyed by the monopolist is made at the expense of the consumers, who are forced to pay a higher price than the marginal cost of producing the product.

Examples of excessive profit making by monopolies, for example the excessive profits made by some pharmaceutical firms, who have reportedly driven up the prices of vital life saving drugs in situations where they have been able to establish a monopoly position.

Part (b) question

Using real world examples, examine the role of barriers to entry in helping monopolies earn abnormal profit in both the short run and the long run. [15 marks]

Command term: Examine

Key terms to define: abnormal profit, barrier to entry, short run, long run.

Real world examples might include industries where the small number of firms operating in the market have successfully restricted access to the market by high entry barriers e.g. oil exploitation business, soft drinks companies (coke and pepsi) as well as examples of businesses that have maintained a virtual monopoly over a local market.

Responses should also include the following:

Responses should also include the following:

In all market structures businesses in the short run, though a combination of market conditions and external circumstances, will find themselves in a position where the business is making abnormal profit.

In perfectly competitive markets the absence of entry barriers will mean that the business returns to normal profit in the long run as new firms enter the market and force down the equilibrium price. However, In monopoly the abnormal excessive profits can be retained because firms in those industries are able to maintain high barriers to entry which prevents new entrants from joining the industry and maintains market supply at the same level.

Similarly when the industry is facing difficult trading conditions and making a loss or even normal profit the monopolist is able to force up prices by restricting supply. As the only firm in the industry their own supply is the same as the industry supply. This is represented by output level Q on the diagram which provides abnormal profit for the business.

Examples of barriers to entry include legal, financial, brand loyalty, economies of scale as well as natural monopolies. Because of the command term examine, in this response candidates would also be expected to consider the validity of the arguments presented and reach a conclusion as to how important barriers to entry are in ensuring abnormal long run profits.

IB Docs (2) Team

IB Docs (2) Team