Current account (HL only)

Introduction

Introduction

This lesson looks at the consequences of a current account deficit or surplus and includes a discussion point on the consequences of the Chinese current account surplus, as well as the US equally large current account deficit. This lesson also focuses on the options available to a government or central bank as they attempt to solve a current account deficit.

Enquiry question

What are the consequences for a persistent current account surplus / deficit. Evaluate the effectiveness of government policies aimed at reducing the size of a nation's current account deficit / surplus.

Lesson time: 150 minutes

Lesson objectives:

Lesson objectives:

Explain why a deficit in the current account of the balance of payments may result in downward pressure on the exchange rate of the currency. Why might a surplus in the current account result in upward pressure on the exchange rate of the currency. (HL only)

Discuss the implications of a persistent current account deficit, referring to factors foreign ownership of domestic assets, exchange rates, interest rates, indebtedness, international credit ratings and demand management. (HL only)

Explain the methods that a government can use to correct a persistent current account deficit, including expenditure switching policies, expenditure reducing policies and supply-side policies, to increase competitiveness. (HL only)

Evaluate the effectiveness of the policies to correct a persistent current account deficit. (HL only)

Discuss the possible consequences of a rising current account surplus, including lower domestic and investment, as well as the appreciation of the domestic currency and reduced export competitiveness. (HL only)

Teacher notes:

1. Beginning activity - begin with the opening question and then discuss this as a class. (Allow 10 minutes in total)

2. Processes - technical vocabulary - the students can learn the background information from the videos, activities and the list of key terms. (10 minutes)

3. Applying the theory - activity 2 applies the theory of current account / surpluses to exchange rates. (10 minutes)

HL only activities:

4. Developing the theory - activities 4 - 6 develop the theory, considering the consequences of a current account deficit or surplus. (15 minutes)

5. Applying the theory - activities 7 - 8 applying the theory to USA and China, two nations at opposite sides of the international trading situation. (15 minutes)

6. Link to assessment - activity 9 is a paper two type question on Turkey. (70 minutes if completed in entirety).

Key terms:

Current account - the difference between the value of goods and services that a nation exports and the value of goods and services that it imports. This is made up of the visible trade balance, the invisible trade balance, net factor income from abroad and current transfers.

Current account - the difference between the value of goods and services that a nation exports and the value of goods and services that it imports. This is made up of the visible trade balance, the invisible trade balance, net factor income from abroad and current transfers.

Current account deficit - when a country imports more goods, services, and capital than it exports. It encompasses the trade deficit plus capital, net income and transfer payments.

Current account surplus - when a country exports more goods, services, and capital than it imports. It encompasses the trade surplus plus capital, net income and transfer payments.

Expenditure switching policies - policies aimed at diverting spending away from imported goods and services towards domestically produced goods, services and export products, e.g. competitive devaluations and trade barriers such as tariffs, quotas or administrative barriers.

Expenditure reducing policies - policies aimed at reducing demand in the economy and therefore limiting domestic spending on imports, e.g contractionary fiscal and / or monetary policies designed to reduce AD in the economy.

Supply-side measures - long term policies that might be effective in reducing a persistent current account deficit include economic reforms aimed at improving macroeconomic stability, investments in human capital and increasing competitiveness in fast-growing, high value industries such as bio-technology, engineering, finance and medicine.

The activities on this page are available as a PDF at: ![]() Current account

Current account

Activity 1

The following countries enjoy the world's largest current account surpluses:

China, Germany, Japan, South Korea, Netherlands.

The nations with the largest current account deficits are USA, UK, Brazil, Australia, Canada.

This is illustrated as follows:

| Nation | Current account surplus / deficit (billion $) | The manufacturing sector as a % of GDP | The tertiary sector as a % of GDP |

| China | 293,200 | 40.5% | 50.5% |

| Germany | 285,200 | 28.1% | 71.1% |

| Japan | 137,500 | 27.5% | 71.4% |

| South Korea | 105,900 | 39.8% | 57.5% |

| Netherlands | 80,990 | 24.1% | 73.2% |

| Canada | (51,380) | 28.6% | 69.6% |

| Australia | (56,200) | 26.6% | 69.4% |

| Brazil | (58,910) | 27.4% | 67.2% |

| UK | (123,500) | 21% | 78.3% |

| USA | (484,100) | 19.1% | 79.7% |

Suggest possible reason for this?

Hint:

The reasons are not entirely clear. All ten nations, or at least nine of them are wealthy successful nations so this cannot be an explanation. A significant difference however is in the role of manufacturing within each nations. The nations with the largest current account surpluses have significant manufacturing sectors. By contrast those with significant deficits have relatively small manufacturing sectors. The UK and USA, with the largest deficits by far, have very small relative manufacturing sectors. Their wealth comes from the success of their financial and service sectors and surely it is easier to export a manufactured good than a service? In other words a large tertiary sector can provide significant wealth to a nation but it is a difficult sector to sell around the world.

Activity 2: The effect of a current account deficit / surplus on exchange rate

Activity 2: The effect of a current account deficit / surplus on exchange rate

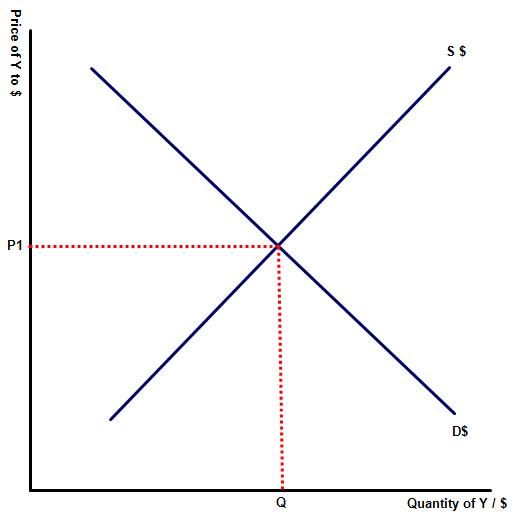

(a) The diagram to the right illustrates the market for $, relative to the Chinese Yuan in equilibrium. Illustrate the impact of a significant rise in imported goods and services into the USA, as well as a fall in exports to China.

The rise in import levels in the country would be represented by a rise in the supply of the currency, as the nation will have to place more of its currency on financial markets in order to purchase the foreign currency that it requires to import the goods and services that it needs.

The fall in exports would be represented by a fall in demand for $ because Chinese consumers must first purchase $ before buying goods and services from the US.

(b) Use your answer for (a) to explain how a deficit on a nation's current account is likely to impact on the market for a nation's currency?

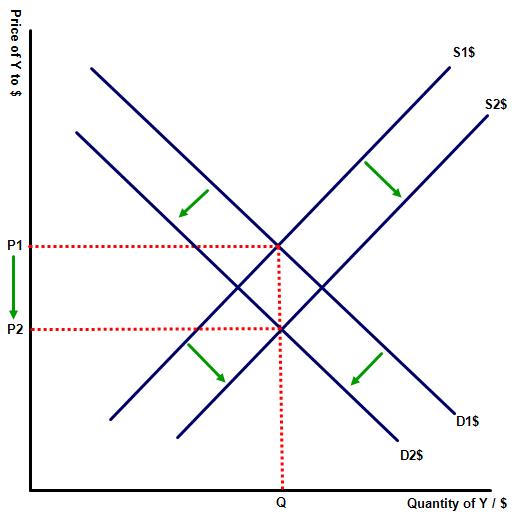

A current account deficit will result in downward pressure on the exchange rate of a nation and unless the nation also enjoys a similar sized surplus in its financial and capital accounts, the currency is likely to depreciate, illustrated on the diagram by (P1 - P2).

(c) Will a persistent deficit on the current account have a greater impact on a fixed exchange rate or a floating one?

Downward pressure on a nation's exchange rate will have a greater impact on a nation with a fixed exchange rate because this implies that the exchange rate is set at too high a level. Unless the nation also has a similar surplus, in its financial and capital accounts, the central bank will shortly run out of foreign currency reserves.

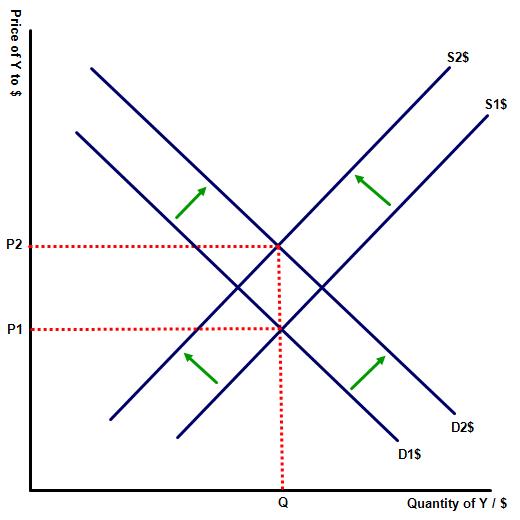

(d) On a demand and supply diagram illustrate the impact on the market for $s if the nation experiences a rise in demand for its exports and a fall in demand for the goods and services that it imports from overseas.

The fall in import levels in the country would be represented by a fall in the supply of the currency (S1$ - S2$), as the nation will have to place less of its currency on financial markets in order to purchase the foreign currency that it requires to import the goods and services that it needs.

The fall in import levels in the country would be represented by a fall in the supply of the currency (S1$ - S2$), as the nation will have to place less of its currency on financial markets in order to purchase the foreign currency that it requires to import the goods and services that it needs.

The rise in exports would be represented by a rise in demand for $ because overseas consumers must first purchase the $ before buying goods and services from the US.

(e) Using your answer for (d) explain how a long term surplus in a nation's current account will affect the currency value for a nation with a floating exchange rate system?

A current account surplus will result in upward pressure on the exchange rate of a nation and unless the nation also enjoys a similar sized deficit in its financial and capital accounts, the currency is likely to appreciate in value. This is illustrated on the diagram by a rise in the price of the $ from P1 to P2.

(f) Explain the likely impact of a nation with a fixed exchange rate that enjoys persistent current account surpluses over a period of time?

In a fixed exchange rate system a persistent surplus implies that the currency has been set at too low a value. In the short run the central bank can balance this out with a deficit in the financial and capital accounts. Long term, however, the government of this nation is likely to face pressure from over nations to raise its currency value, who may feel that the country is gaining an unfair advantage from an under valued currency. For those IB students who followed the American election campaign of 2017 this was a recurring theme of Donald Trump, who accused both China and Germany of benefiting unfairly from an undervalued currency.

Activity 3: Why has the US trade deficit with China not resulted in a revaluation of the Y and US$?

Watch the following short video and then summarise the findings.

As the video highlights, the US has a large persistent trade imbalance with China. This is balanced out by an equally large capital and financial account surplus. In other words the Chinese government takes the US $s that it acquires from its current account surplus and uses them to purchase financial assets in the US - without this the US would be forced to take extensive corrective measures which might hurt both nations.

Activity 4: The consequences of a current account deficit

When a nation has a significant current account deficit then this will have to be financed by a surplus on the capital account.

By each measure explain the weakness of the policy:

1. The central bank can boost the funds in its capital account by using the currency reserves that the central bank holds.

At some point those reserves will run out no matter how wealthy that nation is.

2. Finance the current account deficit by borrowing from overseas banks or financial institutions.

This is unsustainable long term as the loans will eventually need to be repaid and furthermore the loan repayments will add to the debits on the nation's finances.

3. Hot money flows, attracted by high interest rates.

The policy leads to lower levels of consumer demand and investment in the domestic economy.

4. Sale of domestic assets e.g. shares in private companies or purchases of assets such as housing. Cities such as central London, Vancouver, Los Angeles and Manhattan have seen significant numbers of overseas buyers.

Such a policy can push up the prices of expensive high end property in certain areas. Such a policy also leaves those nations vulnerable to overseas investors suddenly pulling their investment out of the country, should their priorities change.

Activity 5: The consequences of a current account surplus

What problems (if any) might a significant current account surplus present for a nation?

Other nations may decide to impose a tariff barriers or other protectionist measures on the nation with the surplus, e.g. Donald Trump's sanctions on China.

Nations with a sustained current account surplus, over a period of time, are likely to see upward pressure on the value of their currency, which may reduce international competitiveness.

Activity 6: Methods for correcting a persistent current account deficit

Activity 6: Methods for correcting a persistent current account deficit

Economists divide policies aimed at correcting a persistent current account deficit into two types: expenditure switching and expenditure reducing policies.

Expenditure switching policies e.g. diverting spending away from imported goods and services and towards domestically produced goods and services and export products. Examples include:

- a depreciation or devaluation of the nations currency

- protectionist measures including tariffs, quotas or administrative barriers.

Expenditure reducing policies e.g. contractionary fiscal and / or monetary policies aimed at reducing aggregate demand in the economy.

(a) Describe some of the weaknesses of the above policies

Expenditure switching policies

Competitive devaluations are likely to reduce demand for imported goods and services but will increase cost push inflationary pressures on the economy. Governments are also reluctant to impose protectionist measures on foreign products for fear of retaliation by other nations. Such policies are also in breach of WTO agreements or the rules of free trade agreement that a nation may be part of.

Expenditure reducing policies

May be very unpopular politically. Higher interest rates will increase a household's mortgage payments, credit card and other loan repayments and reduce economic activity.

(b) Explain which supply side policies a government might employ to improve the competitiveness of its products long term?

This includes economic reforms aimed at improving macroeconomic stability so that the nation is more attractive to inward investment, long term investment policies designed to raise productivity in the economy and diverting resources towards improving human capital and increasing competitiveness in fast-growing, high value industries such as bio-technology, engineering, finance and medicine.

Activity 7: A focus on the USA

The USA has the largest current deficits on the planet, by far, importing more goods and services than it exports over a number of decades. Watch the following 9 minute video about the US's trading position and then answer the questions which follow:

(a) Why is the USA's trade deficit so significant?

As both videos describe the US, once an industrial powerhouse, is no longer a major manufacturing nation and so exports comparatively few products for a successful nation. By contrast the thriving financial and service sectors mean that disposable incomes are high and therefore demand for foreign goods and services remains strong.

(b) Should the US be concerned about the state of its net exports?

Yes and no, while the commentator featured in the first video states that the USA's trading position is a significant cause for concern, some economists disagree. For example as the video highlights the main beneficiaries are not necessarily China but Wall Street and the American consumer, who benefits from cheap products, sometimes subsidised by the Chinese government, who provide subsidies for Chinese exporting businesses.

(c) What if anything can the US government do to reduce the size of their current account deficit?

Very little at least in the short term as the US is no longer an industrial power house. Of all the G7 countries the USA has the lowest % of output taken by the secondary sector. While the new president believes that he can fix America's trade problems by imposing tariffs on imported goods and services this may not be so easy.

(d) Will leaving the TPP change the US's trading position?

This is very hard to say and possibly yes as two of the USA's biggest trade deficits are with other TPP members - Japan and Mexico. However, trade with some TPP members is broadly equal or perhaps even slightly in surplus. Furthermore, some of America's biggest deficits are with Germany and China who would not be affected by America leaving the TPP.

(e) So how will America's trade deficit be resolved? Will it ever be resolved.

This is unclear and certainly while nations such as China are prepared to bank roll the US deficit then there is no immediate end in sight to the US's trade position.

Activity 8: A focus on China

Activity 8: A focus on China

An example of a country with a large current account surplus is China, which has built up large current account surpluses with most nations that it trades with. As a consequence of this surplus the Chinese central bank has built up large quantities of foreign currency - particularly US $ and Euros. To prevent the Chinese Yuan from rising the central bank uses their excess currency to purchase premium assets in the western world. This includes high end property as well as western businesses. China is also a significant lender of foreign currency loans to banks and western governments.

What consequences might this have for the following:

China

.jpg) By purchasing foreign assets China is preventing its currency from rising in value. This policy will be difficult to maintain over a long time period because many of those assets are already generating profits which then get repatriated, further adding to China's current account surplus.

By purchasing foreign assets China is preventing its currency from rising in value. This policy will be difficult to maintain over a long time period because many of those assets are already generating profits which then get repatriated, further adding to China's current account surplus.

Other consequences may well be that China's trading partners simply get tired of such an unequal trading relationship and start to impose taxes and or tariffs on Chinese products.

Unrest may also appear domestically from Chinese citizens who may wonder why all of their hard work and global domination of so many markets, has not led to comparable material improvements in their standard of living.

Western nations with large current account deficits

The current account deficit's of western nations have reached staggering levels. In 2015, for instance, USA recorded a current account deficit of $ 365.7 billion. Imports from China stood at $ 481.9 billion while exports to the country were just $116.7 billion. This was all financed by debt (which China owns a significant part of) as well as Chinese purchases of American assets. As this trend rises the current account deficit with China will widen further and the demand for US and European assets will continue to rise.

The current account deficit's of western nations have reached staggering levels. In 2015, for instance, USA recorded a current account deficit of $ 365.7 billion. Imports from China stood at $ 481.9 billion while exports to the country were just $116.7 billion. This was all financed by debt (which China owns a significant part of) as well as Chinese purchases of American assets. As this trend rises the current account deficit with China will widen further and the demand for US and European assets will continue to rise.

Nationalist governments in both continents may well see an opportunity to gain support by promising to reign in China's increasing influence. At some point too, America and the remainder of China's trading partners may have to start paying back more of the money borrowed. Can China really keep financing America's deficit indefinitely?

Further reading on this topic is available at: ![]() Who owns USA's debt?

Who owns USA's debt?

Activity 9: Link to the assessment (HL only)

In March 2018, Turkey's 12-month rolling current account deficit stood at $53.3 billion, according to the Bank’s report on balance of payments. Source: Daily Hurriyet

Typical paper two examination questions:

(a) Define the following terms:

i. current account deficit. (line 3) [2 marks]

Level | Descriptor | Mark |

0 | The work does not reach any of the standard described below | 0 |

1 | A vague response indicating that it is when import revenues > export revenues. | 1 |

2 | An accurate definition that it occurs when the flow of funds into the country, resulting from trade in goods and services, net flows of income plus other net transfers of funds is smaller than the flow of funds leaving the country. | 2 |

ii. 'hot money flows'. [2 marks]

Level | Descriptor | Mark |

0 | The work does not reach any of the standard described below | 0 |

1 | The idea that it relates to investors investing their money in foreign bank accounts. | 1 |

2 | An accurate definition that hot money flows refers to capital flows from international investors, hoping to make substantial gains from moving money into countries offering high interest rates. | 2 |

(b) i. Calculate the change in the size of the current account deficit and the value of the TL to the US$ between 2016 and 2018. [3 marks]

Current account deficit change (53.3 – 26.6) / 26.6 = 103.76%

Currency devaluation (6.13 – 3.37) / 3.37 x 100 = 81.90%

Mark as 2+2 (maximum marks 3)

ii. State two of the components of a nation’s balance of payments. [2 marks]

- Current account

- Capital account

Level | Descriptor | Mark |

0 | The work does not reach any of the standard described below | 0 |

1 | A response that includes one of the above | 1 |

2 | A response that includes both of the above | 2 |

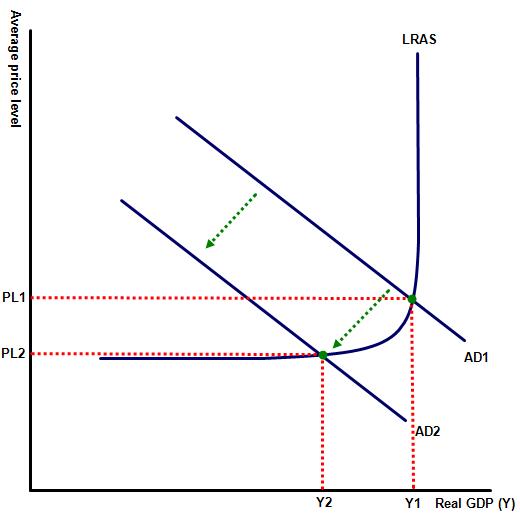

(c) Explain using an exchange rate diagram how a persistent current account deficit might impact on Turkey's exchange rate. [4 marks]

Level | Descriptor | Mark |

0 | The work does not reach any of the standard described below | 0 |

1 | For a response that explains that a persistent deficit on the current account is likely to experience downward pressure on the value of it's currency, as the number of people purchasing the currency to buy its exports will be lower than supply OR a diagram showing a fall in the TL resulting from either a fall in demand for TL and / or a rise in supply of TL | 1-2 |

2 | For a response that explains that a persistent deficit on the current account is likely to experience downward pressure on the value of it's currency, as the number of people purchasing the currency to buy its exports will be lower than supply AND a diagram showing a fall in the TL resulting from either a fall in demand for TL and / or a rise in supply of TL | 3-4 |

Axis should be labelled price of TL/$ or P and Quantity of TL, quantity or Q

(d) What policies might the Turkish government employ to reduce the size of its current account deficit in the short run. [4 marks]

Examples of relevant policies include, but are not restricted to:

- competitive devaluations (expenditure switching policies)

- import barriers (expenditure switching policies)

- contractionary fiscal or monetary policy (expenditure reducing policies)

Level | Descriptor | Mark |

0 | The work does not reach any of the standard described below | 0 |

1 | For a response that includes either expenditure switching or expenditure reducing policies | 1-2 |

2 | For a response that includes expenditure switching AND expenditure reducing policies | 3-4 |

(e) Suggest two reasons why Turkey’s current account deficit continues to grow despite the depreciation in the Turkish Lira. [4 marks]

Explanations might include:

- Marshall-Lerner condition i.e. the combined price elasticity of Turkey’s imports and exports are greater than 1

- The increase in export competitiveness has been eroded by higher rates of cost push inflation.

Other explanations may be relevant.

Level | Descriptor | Mark |

0 | The work does not reach any of the standard described below | 0 |

1 | For a response that includes one relevant reason | 1-2 |

2 | For a response that includes two relevant reasons | 3-4 |

(f) Illustrate using an appropriate diagram why higher central bank interest rates might arrest the decline in the value of the Turkish Lira? [4 marks]

Level | Descriptor | Mark |

0 | The work does not reach any of the standard described below | 0 |

1 | For an accurate diagram showing the supply and demand for the Turkish Lira, with a left shift supply and / or a right shift in demand for the Lira OR an explanation that following the rise in interest rates fewer Turkish people will choose to purchase overseas assets (hence the fall in supply) and more overseas citizens will place their savings in Turkish banks (hence the rise in demand for the TL). | 1-2 |

2 | For an accurate diagram showing the supply and demand for the Turkish Lira, with a left shift supply and / or a right shift in demand for the Lira AND an explanation that following the rise in interest rates fewer Turkish people will choose to purchase overseas assets (hence the fall in supply) and more overseas citizens will place their savings in Turkish banks (hence the rise in demand for the TL). | 3-4 |

Mark as 2 (diagram) + 2 (explanation). Incorrectly labelled diagrams can be rewarded with a maximum of 1. Suitable labels include: Price; P; price of TL or Price of TL / US$. The X axis should be labelled Q; quantity or quantity of TL.

(g) Using your knowledge of economics, discuss the consequences for the Turkish economy of a persistent current account deficit. [15 marks]

Command term: Discuss

In answering this question, candidates need to consider a range of arguments, factors, or hypotheses, supported by appropriate evidence.

Key term to define - current account deficit.

Examples of consequences include:

- A recognition that the long term deficit of Turkey is likely to be structural and therefore cannot be resolved by short term measures such as devaluation or central bank intervention.

- A recognition that any deficit on the current account will need to be financed by a surplus on the financial / capital account. This is likely to lead to the accumulation of more debt or increased foreign ownership of domestic assets.

- Without significant surpluses in the nation's capital account, which might be difficult for Turkey to access, the exchange rate is likely to devalue resulting in cost push inflationary pressures and a squeeze on real incomes.

- The deficit may also reduce the ability of the central bank to manage its monetary policy, for instance the central bank may be forced to raise interest rates to reduce the deficit, with negative impacts on other macroeconomic indicators.

- Similarly, the government may be forced to implement contractionary fiscal policies to reduce the size of the deficit, again impacting on economic growth and employment.

- A persistent current account deficit is likely to lead to a central banks foreign reserves being depleted.

Responses for question (g) should be graded according to the following mark bands:

Criteria | Mark |

There is no clear policy answer to the question but some limited:

| 1-2 |

There is a policy answer to the question with limited:

| 3-4 |

There is a clear policy answer to the question with satisfactory:

| 5-6 |

There is a clear policy answer to the question with good:

| 7-8 |

There is a clear policy answer to the question with excellent:

| 9-10 |

The case study is available as a PDF file at: ![]() Turkish Lira

Turkish Lira

Mark scheme ![]() Markscheme

Markscheme

IB Docs (2) Team

IB Docs (2) Team