Unit 4.5 Exchange rates

An exchange rate is the price of one currency in terms of another set on the foreign exchange markets. Exchange rates are a very important aspect of international trade because international transactions involve currency exchange. Exchange rates also have a powerful influence over the macro and micro-economy.

- Floating exchange rates

- Determination of a floating exchange rate using demand and supply theory

- Factors affecting the demand for a currency

- Factors affecting the supply of a currency

- Depreciation and appreciation of a currency using exchange rate diagrams

- Consequences of changes in the exchange rate on the economy

- Fixed exchange rate system

- Advantages and disadvantages of floating and fixed exchange rates

- Managed exchange rate system

Revision material

The link to the attached pdf is revision material from Unit 4.5 Exchange rates. The revision material can be downloaded as a student handout.

The link to the attached pdf is revision material from Unit 4.5 Exchange rates. The revision material can be downloaded as a student handout.

Nature of exchange rates

An exchange rate is the price of one currency in terms of another set on the foreign exchange markets. Exchange rates are a very important aspect of international trade because international transactions involve currency exchange. Exchange rates also have a powerful influence over the macro and micro-economy. For example, a rise in the value of the US Dollar(US$) can:

- Increase the price of US exports and may cause an increase in the US trade deficit

- Cause the cost of imported goods to fall which might reduce inflation

- Make visiting the US more expensive for foreign tourists and negatively affect the US hotel industry.

Foreign exchange markets

The foreign exchange markets operate to provide foreign currency so that international trade can be financed. Importing US firms can, for example, buy Chinese Yuan(CYN) so they can pay for imported components from China. The currency markets are also very important for investment flows in the global economy. If an Indian business wants to invest in a European firm it will need to buy Euros from the foreign exchange markets.

Free-floating exchange rates

In a free-floating exchange rate, the value of a country’s currency is determined by the interaction of demand and supply in the foreign exchange markets. For example, the value of US$ against the Chinese Yuan (CNY) might be quoted as $1 = CNY7 or 1CNY = $0.14. The value of the US$ against CNY is determined by the interaction of demand and supply for the respective currencies. Diagram 4.13 shows the equilibrium exchange rate between the US$ and the CNY.

In a free-floating exchange rate, the value of a country’s currency is determined by the interaction of demand and supply in the foreign exchange markets. For example, the value of US$ against the Chinese Yuan (CNY) might be quoted as $1 = CNY7 or 1CNY = $0.14. The value of the US$ against CNY is determined by the interaction of demand and supply for the respective currencies. Diagram 4.13 shows the equilibrium exchange rate between the US$ and the CNY.

Demand for a currency

In order to examine the demand for a currency, we are using the demand for US$ from firms, households, and governments. The demand for a country’s currency (US$) can be derived from overseas firms and households wanting to use the currency ($US) to make the following transactions:

- Foreign buyers of US exported goods and services need to buy US$ to make the transactions. For example, a French buyer of Microsoft Office 365 supplied from America will demand US$.

- Foreign direct investment (FDI) into the US means investors will demand US$. For example, if a Chinese investor buys a US-based renewable energy business there will be a demand for US$.

- Portfolio investment is when individuals or firms invest funds in financial assets such as shares and bonds and this can create a demand for a currency. When a Saudi Arabian bank buys shares on the US stock market it creates a demand for US$.

- A high proportion of currency transactions are speculation by investors who want to make a profit on a change in the value of the currency. When speculators want to make a gain from holding funds in US$ they create demand for the $US.

The demand curve for a currency

The demand curve for a currency follows the law of demand and is downward sloping. As the value of the US$ falls (depreciates) against other currencies, the quantity demanded for it increases. For example, if the value of the US$ depreciates against the CYN from $1 = CYN7 to $1 = CYN6 it makes the price of US goods fall in China, Chinese investors will find FDI and portfolio investment in the US less expensive, and a relatively low value for the $US may be a speculative opportunity for investors. This is shown in diagram 4.13.

Supply of a currency

The supply for a country’s currency (US$) is derived from domestic firms and households (it also includes foreign holders of US$) wanting to use the currency (US$) to buy the currencies of other countries. When the US$ is used to buy, for example, CYN on the foreign exchange markets it creates a supply of US$. The supply of the US$ occurs from the following transactions:

- US buyers of imported goods and services need to buy foreign currency to make the transactions. For example, a US buyer of a BMW car uses US$ to buy the Euros needed to buy the car from Germany and more US$ are supplied to the foreign exchange markets.

- Foreign direct investment (FDI) by US businesses in overseas markets creates a supply of US$. For example, if a US investor buys a car production plant in Mexico it will buy Pesos and supply US$.

- Portfolio investment in financial assets such as shares and bonds being bought by US investors will create a supply of US$. If a US investment bank buys UK government bonds they will supply $US to the foreign exchange markets.

- When speculators who hold US$ want to make a gain by buying another currency this creates a supply of US$. For example, a US investor uses US$ to buy Euros because they expect the value of the Euro to appreciate.

The supply curve for a currency

The supply curve of a currency follows the law of supply. For example, the supply curve for the US$ is upward sloping because as the value of the US$ rises (appreciates) against the CYN it makes the price of Chinese goods in the US less expensive, US investors will find FDI and portfolio investment in foreign assets less expensive, and a relatively low value for the CYN may represent a speculative opportunity for US investors. This is shown in diagram 4.13.

Appreciation of the exchange rate

An appreciation in the exchange rate of a currency means its value rises against the value of another currency. For example, if the value of the US$ rises from US$1 = CYN7 to US$1 = CYN8 the value of the $US has appreciated against the CYN. An appreciation in the value of a currency will occur if either demand for the currency increases or the supply of it decreases.

Increase in demand

If the demand for the $US increases because there is greater demand for US exports the demand for US$ will shift from D$ to D$1 and the value of the $US will appreciate against the CYN from US$1 = CYN7 to US$1 = CYN8.

Decrease in supply

An appreciation of the currency can also occur if the supply of the currency falls. For example, if US banks reduce portfolio investment in overseas financial markets then less US$ are supplied to the foreign exchange markets and the supply curve of US$ shifts to the left from S$ to S$1 and the value of the US$ appreciates against the value of the CYN.

Impact of an appreciation on export prices

As the exchange rate appreciates domestic exports get more expensive in overseas markets. For example, if the US exports a $30,000 Dodge truck to China this is the export price at 1US$ = CNY7:

$30,000 x Y7= Y210,000

and 1US$ = CNY8:

$30,000 x Y8 = Y240,000

Impact of an appreciation on import prices

As the exchange rate appreciates the price of domestic imports falls. For, example, if the US imports smartphones from China at a price of CYN2800. This is the import price at 1US$ = CNY7:

Y2800 / Y7= $400

and 1US$ = CNY8:

Y2800 / Y8= $350

Impact of an appreciation of the exchange rate on macroeconomic objectives

An appreciation in the exchange rate can have the following effects on a country's macroeconomic objectives:

- An appreciation in a country’s exchange rate can reduce the rate of inflation as lower import prices lead to lower prices for consumers and lower costs for businesses.

- An appreciation in the exchange rate increases export prices which reduces the demand for exports and a decrease in import prices increases the demand for imports. Lower export revenues and higher import expenditure can lead to a fall in aggregate demand as the value of net exports decreases. This could reduce the rate of economic growth.

- If an appreciation in the exchange rate leads to a fall in aggregate demand and reduced economic growth and this could lead to a rise in unemployment.

- If an appreciation in the exchange rate leads to a fall in export revenue and a rise in import expenditure then the current account balance of payment may move towards a deficit.

The value of the Swiss Franc has increased significantly against all other major currencies over the last 15 years. It has performed particularly well against the Dollar and the Euro. This is partly due to the currency crisis that affected the Euro in 2013 and the low-interest rate policy adopted by the European Central Bank and the US Federal Reserve. Switzerland is a rich, stable economy that is attractive to portfolio investors. It also has an attractive banking sector that makes it a safe haven for investment funds from around the work.

The value of the Swiss Franc has increased significantly against all other major currencies over the last 15 years. It has performed particularly well against the Dollar and the Euro. This is partly due to the currency crisis that affected the Euro in 2013 and the low-interest rate policy adopted by the European Central Bank and the US Federal Reserve. Switzerland is a rich, stable economy that is attractive to portfolio investors. It also has an attractive banking sector that makes it a safe haven for investment funds from around the work.

Switzerland is a strong trading nation that runs a consistent balance of payments current account surplus which maintains the strength of the Swiss Franc. One downside of its strong currency is it makes it a very expensive country for tourists to visit. Switzerland is rated as one of the most expensive places for foreign visitors.

Questions

a. Define the term exchange rate. [2]

An exchange rate is the price of one currency in terms of another set on the foreign exchange markets.

b. Using an exchange rate diagram, explain why rising demand for Swiss exports will cause the Swiss Franc to appreciate. [4]

A rise in demand for Swiss exports will increase the demand for the Swiss Franc because buyers of Swiss exports will demand more Swiss Francs to buy more Swiss goods. This is shown by an increase in demand for Swiss Francs from D to D1 in the diagram.

A rise in demand for Swiss exports will increase the demand for the Swiss Franc because buyers of Swiss exports will demand more Swiss Francs to buy more Swiss goods. This is shown by an increase in demand for Swiss Francs from D to D1 in the diagram.

c. Explain the effect an appreciation of the Swiss Franc will have on the price of its exports and imports. [4]

- As the Swiss Franc appreciates the price of its exports will rise in overseas markets because foreign buyers will have to pay more for each Swiss Franc they buy with their own currency.

- As the Swiss Franc appreciates the price of its imports will fall on the domestic market because Swiss buyers have to pay less for the foreign currency they buy with Swiss Francs.

Investigation

Research into the reasons why the Swiss Franc is such a strong currency.

Depreciation of the exchange rate

Depreciation in a country’s exchange rate is a fall in the value of its currency against another currency. For example, if the value of the US$ falls from US$1 = CYN7 to US$1 = CYN6 the value of the $US has depreciated against the CYN. A depreciation in the value of a currency will occur if either demand for the currency decreases or the supply of it increases.

Decrease in demand

If the demand for the $US decreases because there is a less speculative demand for US$ this will shift D$ to D$1 and the value of the $US will depreciate against the CYN from US$1 = CYN7 to US$1 = CYN6.

If the demand for the $US decreases because there is a less speculative demand for US$ this will shift D$ to D$1 and the value of the $US will depreciate against the CYN from US$1 = CYN7 to US$1 = CYN6.

Increase in supply

A depreciation of the currency can also occur if the supply of the currency increases. For example, if American businesses increase FDI in overseas markets then more US$ are supplied to the foreign exchange markets and the supply curve of US$ shifts to the right from S$ to S$1 and the value of the US$ depreciates against the value of the CYN from US$1 = CYN7 to US$1 = CYN6.

Impact of a depreciation on export prices

As the exchange rate depreciates domestic export prices fall in overseas markets. For example, if the US exports Microsoft Office 365 to China. Here is the export price at 1US$ = CNY7:

$120 x Y7= Y840

and 1US$ = CNY6:

$120 x Y6 = Y720

Impact of a depreciation on imports prices

As the exchange rate depreciates the price of domestic imports rises. For, example, if the US imports steel from China at a price of CYN4200. Here is the import price at 1US$ = CNY7:

Y4200/Y7= $600

and 1US$ = CNY6:

Y4200/Y6 = $700

Impact of a depreciation of the exchange rate on macroeconomic objectives

A depreciation of the exchange rate can have the following effects on a country's macroeconomic objectives:

- A depreciation in a country’s exchange rate can increase the rate of inflation as higher import prices lead to higher prices for consumers and higher costs for businesses.

- A depreciation in the exchange rate decreases export prices which increases the demand for exports and an increase in import prices decreases the demand for imports. Higher export revenues and lower import expenditure can lead to a rise in aggregate demand which can increase the rate of economic growth.

- If a depreciation in the exchange rate leads to a rise in aggregate demand and increased economic growth, then this could cause a fall in unemployment.

- If a depreciation in the exchange rate leads to a rise in export revenues and a fall in import expenditure then the current account balance of payment may move towards a surplus.

The value of Turkish has plunged since January losing more than 34% of its value against the dollar. It was at record lows in late trading on Thursday evening falling to 6.30 Turkish Lira to the Dollar. The fall in the value of the Lira has been triggered by a political crisis, with the American government threatening Turkey with tariffs. Turkey has also got a growing debt crisis which is causing portfolio investors to take funds out of the country.

The value of Turkish has plunged since January losing more than 34% of its value against the dollar. It was at record lows in late trading on Thursday evening falling to 6.30 Turkish Lira to the Dollar. The fall in the value of the Lira has been triggered by a political crisis, with the American government threatening Turkey with tariffs. Turkey has also got a growing debt crisis which is causing portfolio investors to take funds out of the country.

A growing current account balance of payments deficit is adding to pressures on the currency. The falling value of the Turkish Lira is increasing inflationary pressure and Turkey's inflation rate has increased to 22%.

Questions

a. If the Turkish Lira falls from TL4.70 = $1 to TL6.30, outline why this is a depreciation in the value of the Turkish Lira against the US Dollar. [2]

The fall in the Turkish Lira from TL4.70 to TL6.30 means the cost of buying $1 rises from TL4.70 to TL6.30 which means the Turkish Lira is worth less relative to the US dollar.

b. Using the depreciation of the Turkish Lira from TL4.70 = $1 to TL6.30 calculate:

(i) The change in the US Dollar price of exported Turkish Soybeans costing TL4.50 per Kg. [2]

(TL4.50 / TL4.70 = $0.96) - (TL4.50 / TL6.30 = $0.72) = $0.24 (decrease)

(ii) The change in the Turkish Lira price of imported US motorcycles into costing $15,000 per unit. [2]

($15,000 x TL6.30 = TL94,500) - ($15,000 x TL4.70 = TL70,500) = TL24,000 (increase)

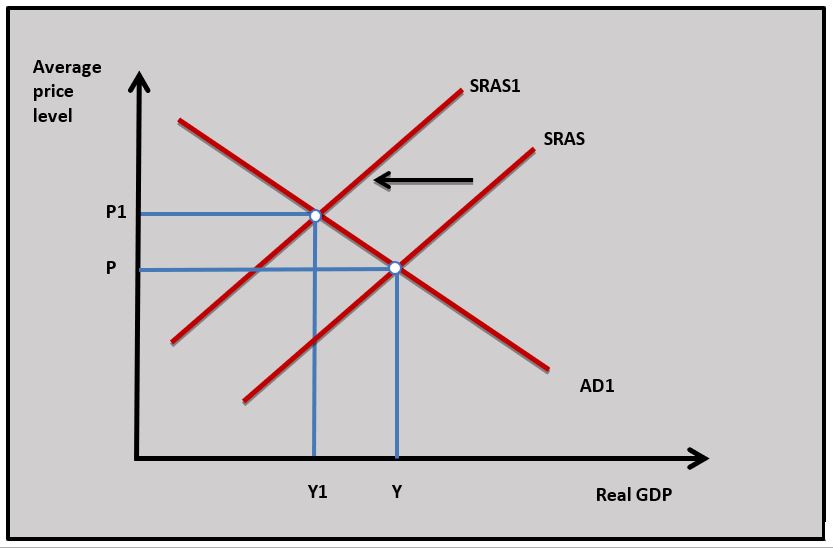

c. Using an AD/AS diagram explain the effect a depreciation of the Turkish Lira might have on Turkey's rate of inflation. [4]

As the value of the Turkish Lira falls the cost of imports coming into the Turkish economy rises and this adds to the costs of Turkish business which causes SRAS to fall and the SRAS curve shifts to the left from SRAS to SRAS1 on the diagram. The rise in the average price level from P to P1 increases Turkish inflation.

As the value of the Turkish Lira falls the cost of imports coming into the Turkish economy rises and this adds to the costs of Turkish business which causes SRAS to fall and the SRAS curve shifts to the left from SRAS to SRAS1 on the diagram. The rise in the average price level from P to P1 increases Turkish inflation.

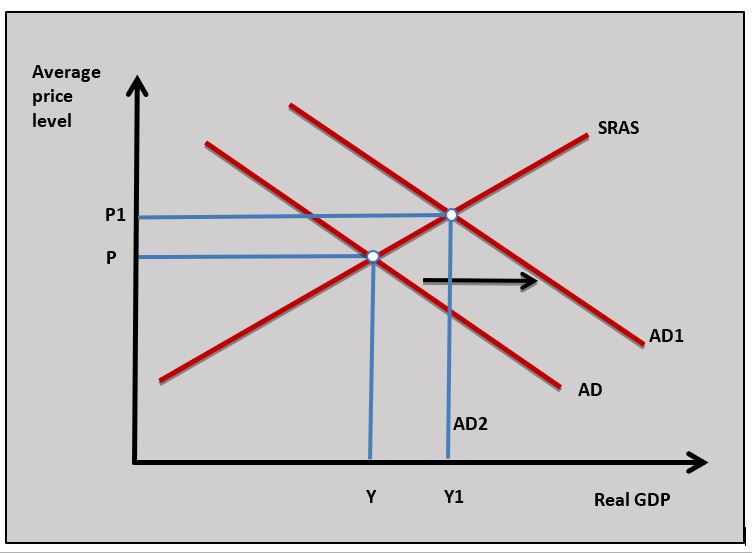

d. Using an AD/AS diagram explain the effect a depreciation of the Turkish Lira might have on aggregate demand. [4]

As the value of the Turkish Lira depreciates Turkey's export prices fall and its import prices rise which can lead to a rise in export revenues and a fall in import expenditure. The rise in export revenues and fall in import expenditures leads to a rise in net exports (X-M) which increases aggregate demand and this causes AD to shift to AD1 in the diagram.

As the value of the Turkish Lira depreciates Turkey's export prices fall and its import prices rise which can lead to a rise in export revenues and a fall in import expenditure. The rise in export revenues and fall in import expenditures leads to a rise in net exports (X-M) which increases aggregate demand and this causes AD to shift to AD1 in the diagram.

Investigation

Research into another country that has had a currency crisis.

Interest rates and the exchange rate

The movement of funds in foreign exchange markets is significantly affected by portfolio investment and speculation. Changes in interest rates have an important influence over portfolio investment and speculation in a foreign currency.

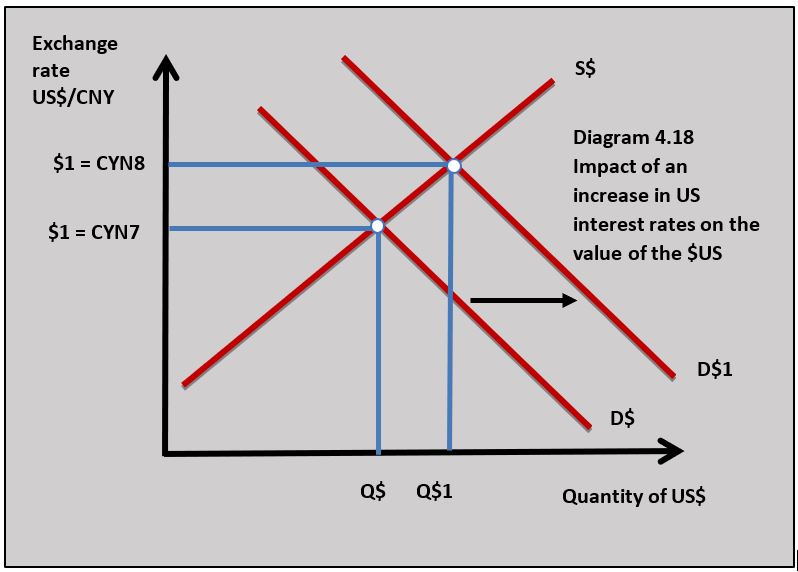

Increasing interest rates

To explain the impact of increasing interest rates on the exchange rate of a country’s currency the US$ is used as an example. If the US central bank, the Federal Reserve raises base interest rates then portfolio investors will move funds into US$ to take advantage of the higher returns they will enjoy in US interest-bearing assets such as US bonds and bank accounts. An increase in interest rates will also attract speculators who will buy US$ in anticipation of a rise in the value of $US and the opportunity to make a capital gain on the increase in its value.

The combination of portfolio investors and speculative demand for the $US will cause the demand for the US$ to increase from D$ to D$1 in diagram 4.18 and the value of the US$ will rise from $1 = Y7 to $1 = Y8.

Decreasing interest rates

This explanation of the impact of decreasing interest rates on the exchange rate of a country’s currency uses the US$ as an example. If US central bank, The Federal Reserve cuts base interest rates then portfolio investors will move funds out of US$ because of the reduced returns they earn in US interest-bearing assets such as US bonds and bank accounts. A decrease in interest rates will also cause speculators to sell US$ in anticipation of a fall in its value.

This explanation of the impact of decreasing interest rates on the exchange rate of a country’s currency uses the US$ as an example. If US central bank, The Federal Reserve cuts base interest rates then portfolio investors will move funds out of US$ because of the reduced returns they earn in US interest-bearing assets such as US bonds and bank accounts. A decrease in interest rates will also cause speculators to sell US$ in anticipation of a fall in its value.

The combination of portfolio investors and speculators selling the US$ will lead to an increase in the supply of the US$ from S$ to S$1 in diagram 4.19, and the value of the US$ depreciates from $1 = Y7 to $1 = Y6.

Fixed exchange rates

A fixed exchange rate is where the value of two or more currencies has exchange rates that cannot change against each other. For example, the Chinese government have in the past fixed the value of the CYN to the US$.

Maintaining the fixed rate

There were two ways of maintaining the value of a currency in a fixed exchange rate system. We will use the CYN being fixed to the US$ as our example to illustrate the way a fixed exchange rate system works. This is shown in diagram 4.20. When the central bank actively intervenes in the foreign exchange markets to increase the value of the currency it is called a revaluation and when it decreases the value of the currency it is called a devaluation.

Direct intervention

Direct intervention is where the central bank buys and sells the domestic currency to keep its value within set limits. In diagram 4.20, the CYN had pressure to rise above the fixed rate of $1 = Y7 because of a rise in demand from DY to DY1. In this situation, the Chinese central bank would sell the CYN increasing its supply from SY to SY1 to maintain the fixed rate against the US$. If there was pressure for the exchange rate to fall because the demand for the CYN decreased then the Chinese central bank will buy CYN increasing demand for the currency to maintain its value at $1 = Y7.

Interest rates

Interest rates can be used by the central bank to manage the currency by influencing portfolio investors and speculators. If there was pressure for the CYN to rise above its fixed rate of $1 = Y7 the Chinese central bank would decrease interest rates, this would cause investors who hold CNY to move funds into other currencies which increases the supply of CNY maintaining the value of the CYN at $1 = Y7.

Interest rates can be used by the central bank to manage the currency by influencing portfolio investors and speculators. If there was pressure for the CYN to rise above its fixed rate of $1 = Y7 the Chinese central bank would decrease interest rates, this would cause investors who hold CNY to move funds into other currencies which increases the supply of CNY maintaining the value of the CYN at $1 = Y7.

If the demand for the CYN fell and there was pressure for the CYN to fall below its fixed rate, the central bank would increase interest rates to increase the demand for the CYN and maintain its fixed value against the $US.

Advantages of a fixed exchange rate

- A fixed exchange rate makes it easier for exporters to forecast revenues and importers to forecast the cost of imported goods. By removing exchange rate volatility one of the key risks of international trade is taken away and this encourages free trade.

- A fixed exchange rate can help bring about low inflation. If the currency cannot devalue then import prices are less likely to rise. In addition, domestic producers cannot rely on a depreciation in their currency to maintain their competitiveness, which means they have to control their costs of production.

- The fixed system prevents a currency from becoming over or undervalued. If a currency becomes overvalued, then exporters find it difficult to compete in overseas markets. If the currency becomes very undervalued, then this can lead to rising import costs and inflation.

- A fixed system stops countries from competitively devaluing to give their exporters an advantage in international markets.

Disadvantages of a fixed exchange rate

- Once a country enters a fixed system it effectively gives up monetary policy as a tool of macroeconomic control. To maintain a fixed exchange rate interest rates have to be targeted at the exchange rate and not at growth, inflation or unemployment. For example, if there is pressure on CYN to fall against the US$ in a fixed system, the Chinese central bank might have to increase interest rates at a time when the economy might need low-interest rates because of falling economic growth.

- Large reserves of gold and foreign currency are needed for direct intervention in the foreign exchange markets. For example, if there is pressure on the value of the CYN to fall in a fixed system then the Chinese central bank might have to buy CYN using gold and currency reserves.

- Being in a fixed rate system means a country cannot use the exchange rate to try and correct a balance of payments current account deficit. Outside a fixed exchange rate system, a deficit country can allow its currency to depreciate which helps to reduce export prices and increase import prices to correct a deficit.

- Countries that have less efficient producers find it difficult to compete when their currency cannot depreciate and this can cause unemployment.

Monetary union

A monetary union system occurs when a single currency replaces individual currencies amongst a group of countries. This system has been introduced in Europe with a number of countries adopting the Euro.

The following countries are parts of the Euro Zone: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Portugal, Slovakia, Slovenia and Spain.

A monetary union can be looked at as the strictest form of a fixed exchange rate system and its advantages and disadvantages are similar to those of the fixed exchange rate system. It does, however, have the following additional advantages:

Price transparency

Consumers can see prices from different producers in the same currency which makes markets more competitive. For example, you can compare the price of a BMW car in France and Germany in Euros and not have to make an exchange rate conversion to make the price comparison.

Transaction costs

Firms and individuals involved in buying goods and services in a single currency area no longer have to change currencies to make payments. This means there is no longer a commission cost that has to be paid to banks and foreign exchange businesses and this reduces the cost of trade.

Managed exchange rates

Governments in many countries use an exchange rate system called a managed rate or managed float. This means they allow the exchange rate value of their currency to be determined by demand and supply, but governments will intervene intermittently through the central bank when currency movements are very volatile, or the currency gets over-valued or under-valued. For example, if the value of a country’s currency falls significantly because of an economic crisis then the central bank might step in by increasing interest rates and buying the currency on the foreign exchange markets to increase its value. This approach reduces the problems of being in a fixed exchange rate system but has the advantage of stopping big fluctuations in the value of the currency.

On Friday the  Nigerian central bank moved to devalue the Naira from N330 to $1 to N360 to $1. The recent fall in oil prices has caused a significant decrease in the country’s export revenues and there has been considerable pressure on the value of Naira.

Nigerian central bank moved to devalue the Naira from N330 to $1 to N360 to $1. The recent fall in oil prices has caused a significant decrease in the country’s export revenues and there has been considerable pressure on the value of Naira.

In recent years Nigeria has maintained a fixed exchange rate system against the US Dollar to control inflation. By removing support for the Naira and allowing it to fall, Nigerian exporters will become more competitive in international markets and this should increase export revenue. However, this may increase the risk of inflation.

Questions

a. Explain how the Nigerian central bank might have maintained the value of the Naira against the value of the US Dollar in a fixed exchange rate system. [10]

Answers should include:

Answers should include:

- Definitions of a central bank and fixed exchange rate.

- A diagram to show how the value of the Naira can be maintained against the US$ in a fixed exchange rate system.

- An explanation that the Nigerian central bank can use interest rates to maintain the value of the Naira against the US$ by increasing interest rates if there is pressure for the Naira to depreciate and increasing interest rates if there is pressure for the Naira to appreciate.

- An explanation that the Nigerian central bank could use direct intervention to maintain the value of the Naira against the US$. If there is pressure for the Naira to fall the central bank could use gold and foreign exchange rates to buy the Naira and if there is pressure for the Naira to rise the central bank could sell the Naira.

b. Using a real-world example, evaluate the benefits to a country of being in a fixed exchange rate system. [15] [HL]

Answers might include:

- Definition of fixed exchange rate system (in an examination where this definition is in part (a) it can be referred to instead of defining the term again).

- A diagram to show a fixed exchange rate system in a real-world example (in an examination where this diagram is in part (a) it can be referred to instead of drawing the diagram again).

- Use of a real-world example, in this case, the use of Nigeria.

- An explanation that being in a fixed exchange rate system can encourage free trade between the countries in the fixed system because the price of imports and exports are more stable.

- An explanation that a fixed system might reduce inflation because the value of the currency cannot fall to increase import prices.

- An explanation that a fixed system stops a currency from becoming over-valued (damaging to exporters) or under-valued (damaging to importers).

- Evaluation might include discussion of the disadvantages of being in a fixed exchange rate system such: as removing monetary policy to tackle inflation, growth and unemployment if it has to target the exchange rate; preventing a devaluation as a way of correcting a current account deficit; and it can damage domestic producers who rely on a devaluing currency to maintain their competitiveness.

Investigation

Investigate the way the Nigerian government intervenes in the foreign exchange market for the Naira.

Foreign exchange trading is a market that never stops - the value of the world's currencies are always changing. Individuals, businesses and banks can continuously buy and sell foreign currency 24 hours a day. When Asian markets close European markets open and when they close US markets open. Currencies are even traded at the weekend by banks and other institutions. If you look at the graph of a day's trading in a currency you can see how constant buying and selling means the value of a currency is constantly changing. Whilst the changes in the value of a currency throughout the day are normally quite small they do represent changes that affect everyone associated with currency transactions.

Foreign exchange trading is a market that never stops - the value of the world's currencies are always changing. Individuals, businesses and banks can continuously buy and sell foreign currency 24 hours a day. When Asian markets close European markets open and when they close US markets open. Currencies are even traded at the weekend by banks and other institutions. If you look at the graph of a day's trading in a currency you can see how constant buying and selling means the value of a currency is constantly changing. Whilst the changes in the value of a currency throughout the day are normally quite small they do represent changes that affect everyone associated with currency transactions.

Research a dramatic currency change in one day by a country's currency and think about the impact the change in the value of the currency had on the economy.

Which of the following would create a demand for the US$?

To buy land in California the Korean hotel business will need to buy US$ which creates demand for the US$.

Which option would best explain an increase in the supply of the $US?

As US portfolio investors buy Euros using US$ the supply of US$ increases.

If the value of US$ changes from

If the demand for the US$ had fallen the US$ would have depreciated against CYN.

Which of the following is most likely to cause a depreciation in the value of Country X’s currency?

FDI by a Country X business will increase the supply of Country X's currency and cause it to depreciate.

Which of the following is the least likely consequence of an appreciation in the value of Country A’s currency?

An appreciation in Country A' currency will make travel to Country A more expensive for tourists.

Which of the following methods would be the most effective way of maintaining a fixed exchange rate between Country X's currency and Country Y's currency when there was pressure for the value of Country X's currency to fall?

If Country X increases its interest rates investors and speculators will buy Country X's currency and increase the demand for it.

Which of the following best describes an exchange rate system where the central bank of a country intervenes intermittently to stop the currency from becoming over or under-valued.

If there were a large outflow of US$ from the US, which of the following is most likely to occur?

An outflow of funds from the US would increase the supply of US$ and cause the US$ to depreciate.

Which of the following is most likely to cause the value of Country Y’s currency to depreciate against the US$?

Falling incomes in the US might mean US citizens demand fewer imports from Country Y and demand less of Country Y’s currency.

The exchange between the Brazilian Real changes from

The value of Real has depreciated against the US Dollar because R7 is now needed to buy

IB Docs (2) Team

IB Docs (2) Team