Keynesian v free market debate

Introduction

Introduction

This page contains a historical account of the most recent financial crisis to hit the USA and the measures employed to rescue their ailing economy. There are two significant questions to take out of this lesson. The first is why did America feel compelled to employ a vast fiscal stimulus package despite the anti keynesian rhetoric employed by some US law makers?

The second question to ask is: 'to what extent was the stimulus policy effective?'

Enquiry question

Were the keynesian stimulus policies employed by the US government effective in rescuing the economy during the 2008 financial crisis?

Lesson time: 1 hour

Lesson objectives:

Discuss why, in contrast to the monetarist/new classical model, the economy can remain stuck in a deflationary (recessionary) gap in the Keynesian model.

Teacher notes:

1. Beginning activity - begin with the opening prezi and video which takes 10 minutes to watch and discuss, briefly.

2. Processes - technical vocabulary - the students can learn the background information from the opening video and the handout. Allow 20 minutes to go and discuss the activities.

3. Group discussion - After reading the handout your class should attempt to answer the discussion point. (10 minutes

4. Developing the argument - activity 2 develops the argument, with a video that makes the claim that that rather than saving the world's largest economy, the stimulus employed merely masked the problem and may have simply deferred the problems to a later date - except with even worse consequences given the additional debt taken on by governments. (10 minutes)

5. Reflection - activity 3 contains a short video which compares the theory of Keynes to the 'broken window fallacy' created by French economist, Frederic Bastiat Is this a fair comparison of keynesian theories? (10 minutes)

Activity 1: The financial crisis

Watch the following short video which describes, in simple terms, the origins of the financial crisis. At the end of this video there is a handout for you to read. At the end of this lesson you should be able to answer the question: Why did America feel compelled to use keynesian stimulus measures to rescue the US economy and did these measures work? Would the economy not have fixed itself anyway as conventional economic theory dictates?

Did keynesian theory save the world’s largest economy?

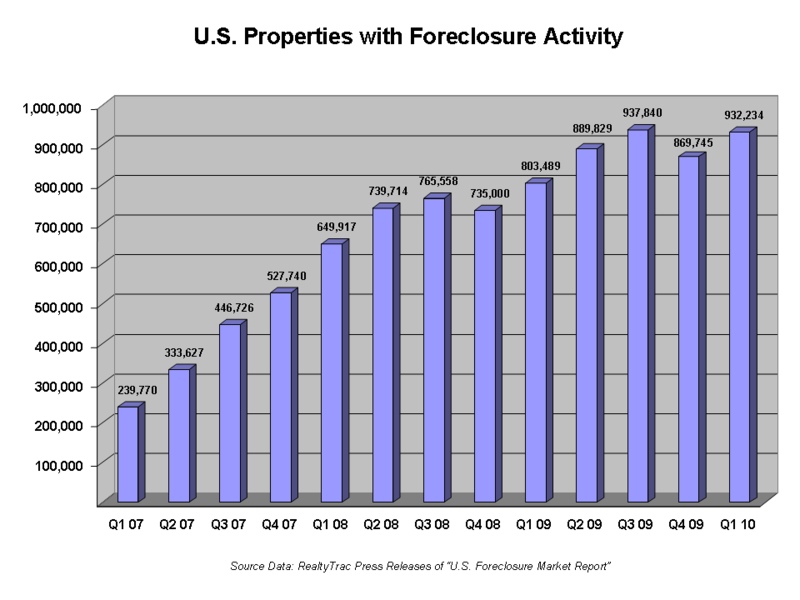

The United States, like many countries entered a severe recession in 2007, brought about in part, by a housing crash which left many people unable to afford the homes where they lived. This is illustrated in the first, showing the number of foreclosures. In other words the number of people forced to give up their homes as they were unable to repay their monthly mortgage payments.

The United States, like many countries entered a severe recession in 2007, brought about in part, by a housing crash which left many people unable to afford the homes where they lived. This is illustrated in the first, showing the number of foreclosures. In other words the number of people forced to give up their homes as they were unable to repay their monthly mortgage payments.

According to the National Bureau of Economic Research (NBER) the recession officially started in December 2007. Between February 2008 to February 2010, 8.7 million Americans lost their jobs and GDP contracted by 5.1%. This made this recession the worst (statistically) since the 1930’s Great Depression. The rate of unemployment rose from 4.7% in November 2007 to a peak of 10% in October of 2009.

The recession continued until the second quarter of 2009 when the economy finally bottomed out, in June 2009, before bumping along the bottom, neither growing nor contracting for a sustained period.

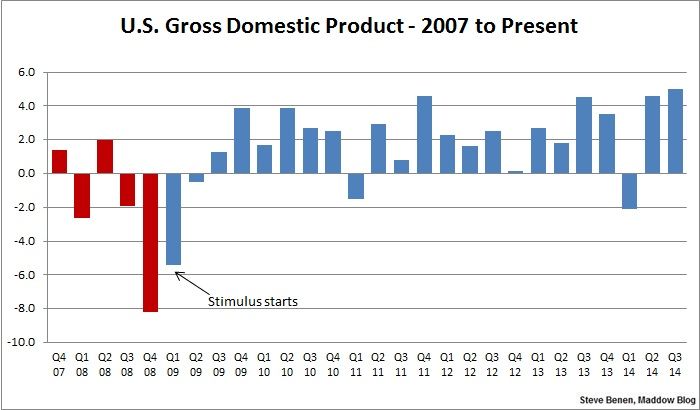

.jpg) The recovery from the worst of the recession in 2009 was particularly weak with only small and erratic gains in both GDP and job creation. It took two more years until 2011, for significant improvements in either to be observed. American household net worth fell from $68 trillion in June of 2007 to $55 trillion by the beginning of 2009. During the same period real median household income fell from $56,436 in 2007 to $51,758 by 2012. During the same period the poverty rate increased to 15% before dropping to 14.5% in 2013, still well above the historical average.

The recovery from the worst of the recession in 2009 was particularly weak with only small and erratic gains in both GDP and job creation. It took two more years until 2011, for significant improvements in either to be observed. American household net worth fell from $68 trillion in June of 2007 to $55 trillion by the beginning of 2009. During the same period real median household income fell from $56,436 in 2007 to $51,758 by 2012. During the same period the poverty rate increased to 15% before dropping to 14.5% in 2013, still well above the historical average.

While the recession officially ended in the second quarter of 2009, the weak economic recovery has led many to call this period a "Zombie Economy", so-called because it is neither dead nor alive.

How did the US economy recover?

The Federal Reserve acted quickly. Their first move was to adopt very aggressive expansionary fiscal and monetary policy measures. Interest rates were slashed to a historically low 0.25% at the end of 2008 and this low level was maintained until the autumn of 2015 when the Federal Reserve began a process of small rises in interest rates. The Federal Reserve adopted a quantitative easing policy and pumped $3.5 trillion of electronic money into the economy. The Obama administration also implemented large rises in public spending as well as tax cuts to try and stimulate consumer spending. Businesses in danger of collapse, such as some of the largest banks and General Motors were bailed out with public cash.

The Federal Reserve acted quickly. Their first move was to adopt very aggressive expansionary fiscal and monetary policy measures. Interest rates were slashed to a historically low 0.25% at the end of 2008 and this low level was maintained until the autumn of 2015 when the Federal Reserve began a process of small rises in interest rates. The Federal Reserve adopted a quantitative easing policy and pumped $3.5 trillion of electronic money into the economy. The Obama administration also implemented large rises in public spending as well as tax cuts to try and stimulate consumer spending. Businesses in danger of collapse, such as some of the largest banks and General Motors were bailed out with public cash.

Did the keynesian stimulus measures really work?

At first glance it would appear so. As table three above illustrates, following the government’s aggressive fiscal and monetary policy measures the rate of decline in the economy slowed almost at once, bottoming out only a few months after the start of the policy objectives. Furthermore, while the recovery was slow it gained momentum from 2010 onwards and there is little doubt that the government measures contributed to this. A combination of very low interest rates, reduced tax rates and quantitative easing prevented more house foreclosures and meant that the consumer economy at last started to recover. Thanks to the government bailouts more wholesale job losses within the banking system or at General Motors were avoided. The following table reflects this:

Year | Jobs created (millions) | Real GDP growth |

2010 | 1.06 | 2.5% |

2011 | 2.08 | 1.6% |

2012 | 2.24 | 2.3% |

2013 | 2.33 | 2.2% |

2014 | 3.12 | 2.4% |

By May 2014 statistically at least the economy had completely recovered. All of the jobs lost during the recession had been recreated and home values have also risen by 12%. In this same period median incomes have risen from $51,000 (2012) to $52,800 with more high- and mid-paying jobs created than low-wage jobs.

As of August 2015, the unemployment rate hit 5.1%, below the historical average of 5.6% with approximately 12,639,000 jobs added since February 2010.

So why is there any doubt that the keynesian stimulus policies rescued the US economy?

So why is there any doubt that the keynesian stimulus policies rescued the US economy?

The reason is very simple and revolves around the argument that we have no way of rewriting history and discovering what would have happened to the US economy, had the Obama administration stuck to free market principles and simply let the economy recover naturally.

Neoclassical economists would point out that the very low interest rates in this period would also have happened anyway as demand for loans would have fallen. Furthermore, the government would naturally have seen a fall in tax revenues, coupled with a rise in public spending as the economy contracted and government departments were forced to pay out more in transfer payments (payments to those without work or on low incomes).

Consider the following; while America adopted a massive stimulus package for the economy, the constraints of the European Central Bank prevented such measures. While the ECB did reduce interest rates close to zero there was no quantitative easing or electronic printing of money to rescue the German economy. Furthermore, unlike the US, Germany did not pursue an aggressive fiscal stimulus package either. Budget deficits remained reasonable during the whole period as the following diagram shows. Despite this, the German economy also recovered - perhaps not as quickly as the USA economy but real growth none the less.

Year | German real GDP growth | USA real GDP growth | German national debt as a % of GDP | USA national debt as a % of GDP |

Pre financial crisis (2007) | 68.5% | 75% | ||

2009 | -2.2% | -0.5% | 75% | 102% |

2010 | 1.6% | 2.5% | 80.3% | 105% |

2011 | 2.5% | 1.6% | 77.9% | 108.5% |

2012 | 1.6% | 2.3% | 79.7% | 110% |

2013 | 2.1% | 2.2% | 77.4% | 114% |

2014 | 1.4% | 2.4% | 75% | 119.5 |

Available as a class handout at: ![]() Keynes and the US economy

Keynes and the US economy

Student discussion

To what extent can it be argued that keynesian economic theory rescued the US economy?

While there are of course differences between the two economies of Germany and USA and so it is impossible to make an exact comparison two things can probably be derived from the above data. Firstly that the USA economy appeared to benefit almost immediately after the introduction of the fiscal and monetary stimulus package. However, Germany recovered at about the same, though at a slightly slower rate and without the debts that the American tax payer is now forced to repay for a generation at least.

Activity 2: Class discussion

Watch the following video and then answer the question, to what extent, rather than saving the US economy, did loose monetary policy in the period preceding the crisis, actually cause the financial crisis of 2007?

The author of this video claims that the Federal Reserve needed to create a housing bubble in order to replace the collapse of the Nasdaq in the early to mid 2000s. Paul Crogman, a keynesian economist claimed that this statement was meant as a joke but intentionally or not this is exactly what the Fed chairman Alan Greenspan did. Keeping interest rates at very low levels of just 1% throughout 2004 - 2006, despite many warnings that both the stock market and housing market were rising to dangerously high levels.

Just prior to the crash Alan Greenspan left his position and Bernavki was put it charge. His first act was to claim that the American economy remained strong and claimed to have 100% confidence in the Federal Reserves ability to control the economy. Within months the financial crisis started.

The author of this video is a member of Austrian economics, an anti keynesian think tank can be followed on Twitter: @AustrianMarkets

Activity 3: Final reflection

After watching the final short video, explain why some critics of Keynes have compared his theories to the 'broken window fallacy'?

In the broken window fallacy a young boy is praised for helping the economy by creating work and generating economic activity. In reality the additional activity was simply replacement activity and did not generate any additional wealth - despite the perception of doing so.

(b) Why might the stimulus policies employed by the US administration have created 'crowding out'?

The US government funded its stimulus programme through large scale borrowing as well as quantitative easing (electronic printing of money). The heavy borrowing will of course have to be paid back at some point - perhaps by future generations that received no benefit from the initial stimulus. That level of borrowing would also have increased interest rates in the economy, making it more difficult for private businesses to borrow funds for investment.

IB Docs (2) Team

IB Docs (2) Team