Barriers to development in International trade

Introduction

Introduction

This page looks at how the international trading system sometimes acts as a barrier to economic development in LEDCs.Enquiry question

How do the following act as barriers to development for economically less developed countries - over-specialization on a narrow range of products, price volatility of primary products, inability to access international markets and long-term changes in the terms of trade (HL only).

Lesson time: 80 minutes

Lesson objectives:

Lesson objectives:

With reference to specific examples, explain how the following factors are barriers to development for economically less developed countries.

a. Over-specialisation on a narrow range of products

b. Price volatility of primary products

c. Inability to access international markets

With reference to specific examples, evaluate the following factor as a barrier to development for economically less developed countries.

a. Long-term changes in the terms of trade (HL only)

Teacher notes:

1. Beginning activity - begin with the opening activity, which contains short questions and a video. (Allow 20 minutes in total)

2. Processes - technical vocabulary - the students can learn the background information from the videos, activities and key terms which can be downloaded as a PDF.

3. Applying elasticity theory - activities 2 - 5 focus on the role that PES inelasticity and declining terms of trade have on development. Some of this might be suitable for HL students, focusing as it does on long term changes to terms of trade. (20 minutes)

4. Developing the theory - activities 6 and 7 contain short answer responses on whether developing nations are handicapped by WTO rules but also by farming subsidies paid by governments in the Developed world. (20 minutes)

5. Discussion - activities 8 - 10 focus on the question, does the Fairtrade organisation improve working conditions for farmers in developing nations? (20 minutes)

Key terms:

Key terms:

Primary product dependency - occurs when an LDC is dependent on producing and exporting primary commodities, which suffer from fluctuating prices and supply side shocks because of natural disasters and extreme weather conditions (hurricanes, tornadoes, droughts and tsunamis).

Declining terms of trade - the result of when the market for a nation's major export product declines, often quite sharply through circumstances beyond that nation's control.

OPEC - oil producing economic community, generally LEDCs or former LEDCs that rely on the export of oil / gas to finance the lion share of their budget.

Non convertible currencies - a national currency that cannot be traded officially on the world markets.

Agricultural subsidy - a government incentive paid to agribusinesses and farmers which then acts as a barrier to development. This subsidy paid to farmers in the Developed world makes their goods cheaper than food produced in the developing world, when under normally circumstances the LEDC might expect to have a comparative advantage.

The activities on this page are available as a PDF at: ![]() Barriers to development through trade

Barriers to development through trade

Activity 1: Overdependence on a narrow range of primary products

The table below illustrates the nations with the highest dependence on a narrow range of primary products (non-oil producing nations):

| Nation | Main export | % of total exports |

| Niue | Cocoa, bananas | 100 |

| Burundi | Coffee, green; tea; sugar refined | 99 |

| Malawi | Tobacco leaves | 87 |

| Ethiopia | Coffee, green | 84 |

| Zambia | Copper | 77 |

(a) Describe some of the problems faced by nations reliant on a narrow range of primary products?

Similar to the 'all the eggs in one basket' analogy, an over reliance on just one product makes a nation particularly to supply shocks or a sudden fall in demand for its main product. In the examples above nations derive almost their entire export revenue from a narrow range of products over which they have little or no control.

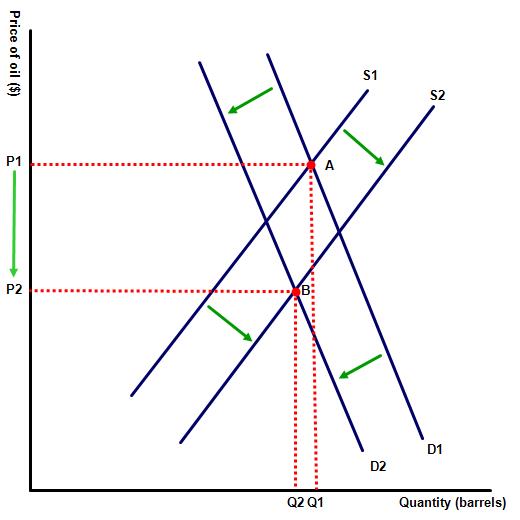

(b) Draw the market for a primary product, indicating the relative inelasticity of both PES and PED for many primary products. Indicate the effect on the market for the produce following a worsening of trade conditions.

The relative inelasticity of primary commodities further adds to the volatility of the good. In the diagram to the right the PES and PED of oil, like many primary goods is both PED and PES inelastic. Even a relatively small change in market conditions can lead to significant changes in market price (P1 to P2).

The relative inelasticity of primary commodities further adds to the volatility of the good. In the diagram to the right the PES and PED of oil, like many primary goods is both PED and PES inelastic. Even a relatively small change in market conditions can lead to significant changes in market price (P1 to P2).

(c) Why are primary commodities PES inelastic?

Agricultural products take one whole growing season to produce and so farmers in may LEDCs are unable to alter their production (in the short term) in response to a change in market conditions - similarly products like oil and minerals.

(d) The following video focuses on the market for coffee. Explain why the world coffee price is so volatile.

Since 2011, world prices have dropped by 50%. Some blame speculators, farmers and wholesalers when this is wide of the mark. The fall is the result of a large rise in supply brought on by government subsidies, which encouraged farmers to increase their output levels beyond the price that the market required.

(e) Why do governments choose to support agricultural markets?

The argument is that the agricultural market is too unstable, due to the vagaries of the weather, disease e.t.c. and therefor needs additional help.

(f) Evaluate the argument put forward in the video that the government should allow the market to exist without government intervention.

Matters to consider:

The long growing seasons, including the planning and planting stage, hence the low level of PES inelasticity.

The importance of the sector - no nation can exist without a food supply, but then is coffee an essential food?

Activity 2: A focus on Zambia

The following video focuses on Zambia, one of the world's largest exporters of copper.

(a) Describe the current state of the copper market in the nation.

Since 2011 copper has lost one third of value and 10,000 miners have lost the job since 2015. They have no control ovr the copper price.

(b) What policy is the current government pursuing in order to prepare ex-copper miners for life after copper.

The government is allocating land to ex-miners to allow them to become farmers.

Activity 3: A focus on Venezuela

The following video highlights the current economic difficulties facing the South American nation, a country with one of the world's largest reserves of oil on the planet.

Summarise the reasons for Venezuela's current economic collapse?

The reasons are of course complex but a major factor was an over-reliance on one product, which they no control over the price of. When the price was high the nation was able to finance its extensive social programmes but when the oil price fell the country had no other products to fall back on.

.png) Activity 4: A focus on OPEC nations

Activity 4: A focus on OPEC nations

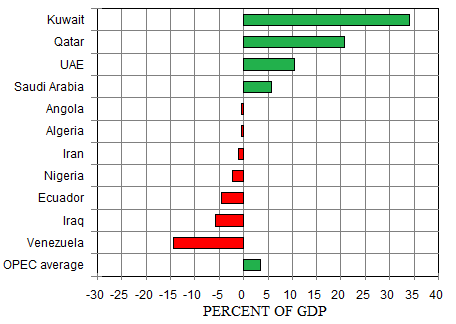

Examine the table in figure 6, taken from bloomberg.com which illustrates the minimum oil price needed for the leading oil nations to balance their budgets.

Investigate the current price of one barrel of oil and then answer the following questions:

(a) How many of the leading oil producers are currently able to balance their public spending budgets, given the current price of oil ($50 a barrel).

None, with Qatar, Kuwait and UAE the closest.

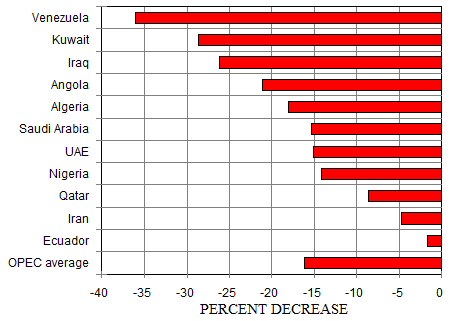

(b) Observe the two diagrams below and describe the effect of the current low oil price on the national budgets of the worlds leading oil producers.

Fiscal budget at $120 a barrel

Fiscal budget at $50 a barrel

At $120 a barrel we can observe that most of the leading oil producers had relatively balanced budgets. Kuwait, Qatar, the UAE and Saudi Arabia even ran healthy surpluses. Kuwait and Qatar even healthier ones and Angola, Algeria, Iran, Nigeria, Ecuador and arguably Iraq ran small but manageable deficits. Venezuela alone had a budget problem, although this was a result of economic mismanagement, not low oil prices.

Fast forward to 2016, which saw the oil price drop to just $50 a barrel and the picture is very different with the impact of the low oil price destroying previously healthy budgets. Only Qatar and Kuwait remained in surplus. Iran, Angola, Nigeria, Ecuador and the UAE ran deficits although not excessive, while the budget deficit of Algeria increased from a balanced budget to a deficit of almost 15% of GDP. Saudi Arabia, Iraq and Venezuela ran deficits equal to 20% of GDP.

Activity 5: Primary exports

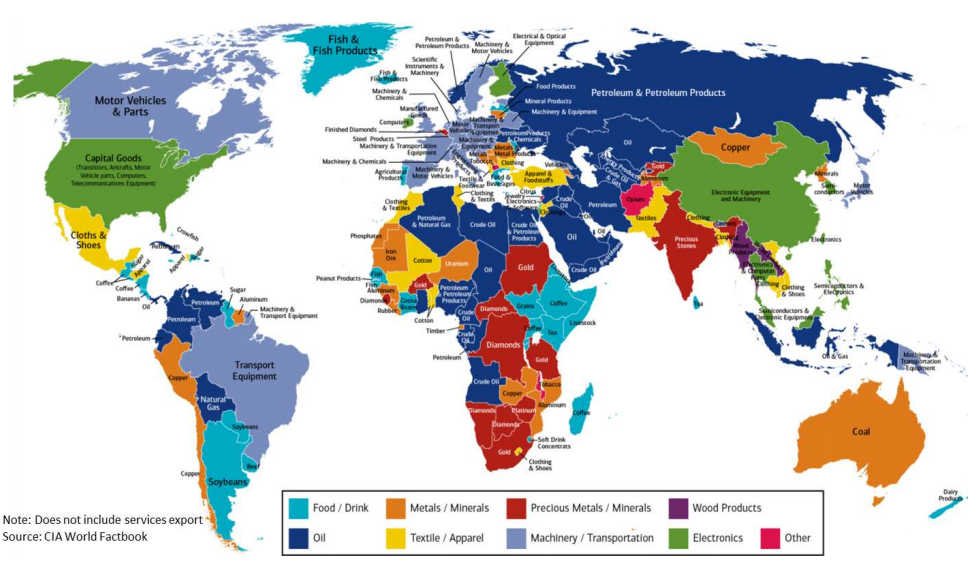

The diagram below illustrates the primary export of each nation. How many of those products would be considered PES inelastic primary goods?

Activity 6: The difficulty of accessing international markets

While Developing nations cannot compete with nations in the Developed world in the production of manufactured goods and financial services, LEDCs would normally be expected to have a comparative advantage in the production of agricultural products. Using information form the following table explain why the tariffs imposed by many Developed nations act as a barrier to this:

| Product | Average tariff % |

| Agricultural products | typically between 20 - 40 |

| Semi processed goods | typically between 10 - 20 |

| Manufactured goods | around 2.5 |

Under WTO rules the export of many manufactured goods are subject to an average tax of 2.5%. This relatively low tariff has benefited developing nations that have specialised in the production of manufactured goods, e.g. China and Vietnam, that then export those products to overseas markets. By contrast the tariff on many agricultural products is much higher.

Activity 7: Non convertible currencies

Many low income nations have non−convertible currencies which are almost worthless overseas. The following video illustrates one of those, the Cuban Peso.

(a) Explain why having a non-convertible currency acts as a barrier to development for many LEDCs.

Nations with unconvertible currencies find it very difficult to attract overseas investment and will also be forced to purchase all of their imports with a different currency. In extreme cases the currency can be almost worthless domestically as well as internationally.

(b) Investigate some of the worlds non-convertible currencies.

ARS Argentine peso

BRL Brazilian real

CLP Chilean peso

COP Colombian peso

EGP Egyptian pound

GTQ Guatemalan quetzal

IDR Indonesian rupiah

PHP Philippine peso

VEB Venezuelan bolívar.

Activity 8: Is free trade fair trade?

Use the information in the following video to answer the question, is free trade fair trade?

Agricultural subsidies

Agricultural subsidies

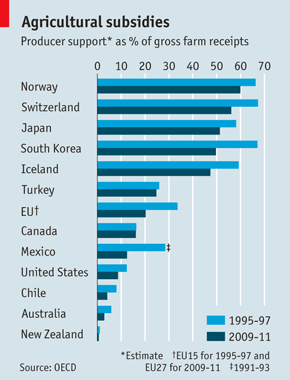

Government support for agriculture in the mostly rich countries of the OECD amounted to $252 billion in 2011, or 19% of total farm receipts. Although there is a move away from support linked directly to production, it is still about half of the total. The general trend is downwards: compared with the second half of the 1990s subsidies fell in all countries. But levels of support vary widely. In Norway, Switzerland and Japan, more than half of gross farm receipts in 2009-11 came from support policies; for producers in Australia, Chile and New Zealand, it was less than 5%. Commodity prices will stay high for some time, suggests the OECD, so markets will provide the farm income that many governments have tried to prop up.

Using the information from the article explain why the markets of many wealthier nations remained closed to produce from LEDCs?

Activity 9: Fairtrade organisations

The global food market has regularly been characterised by low incomes for farmers in LEDCs, receiving just a small fraction of the final selling price, with most of the difference ending up as profit for middlemen. The World Fair Trade Organisation (WFTO), formerly the International Federation of Alternative Traders (IFAT), started in 1989 with the aim of improving the income of farm producers in Developing nations, by linking them with distributors that offer a fair deal to the producer.

(a) Watch the following short video and then describe some of the core activities of the organisation.

The organisations core activities include:

- developing the market for fair trade

- building trust in fair trade

- speaking out for fair trade

- providing networking opportunities

- empowering the regions.

(b) Identify what the Fairtade organisation means for the following stakeholders:

- customers of Fairtrade

Fairtrade customers pay slightly higher prices for their produce but of course receive the piece of mind of supporting many low wage agricultural workers in poor nations.

- farm workers working for a fair trade farm

Those workers are more likely to receive higher wages and better working conditions.

- farm workers working on a farm not deemed 'fairtrade'

Theoretically speaking lower wages and poorer working conditions - though pay and conditions vary enormously throughout the world and not all agricultural workers will receive very low wages and poor working conditions.

(c) The following video from Economics professor Don Boudreaux provides an alternative view of the organisation, suggesting that rather than improving the lives of farmers and farm workers in LEDCs the Fairtrade organisation may even make the current situation worse. Watch the short video and then summarise his views.

(d) On balance do you agree with the criticisms of the organisation or not?

The professor claims that while good intentioned the organisation ultimately acts as an intervention on the market which prevents the market clearing. This means that protected workers (those working for a registered Fair trade farm) receive higher wages than the official market rate which reduces employment in those farms and discourages farmers from investing in agriculture, reducing employment further.

Activity 10: Fairtrade criticisms

The following short video details some of the criticisms of the organisation. How does this highlight the difficulties of running an organisation committed to improving working conditions throughout the developing world.

As the video highlights the organisation sometimes find it difficult to regulate a market which operates in many remote locations and therefore often lacks the control that it needs to regulate the market properly.

IB Docs (2) Team

IB Docs (2) Team