Veblen goods and super luxury goods

-1.jpg) Introduction

Introduction

Until now on the IB economics course it has been assumed that the relationship between the price and quantity demanded of all products is inverse. While this is true for the vast majority of goods and services, there are a small number of products which have a different relationship, which we will now identify.

This page focuses on identifying the small range of super luxury goods which also have positive price elasticity. Students will sometimes confuse veblen goods with other luxury goods. The distinction needs to be made that while most luxury goods will be YED elastic, only a small number of these will also have a PED greater than 0.

Enquiry questions

Why do some goods and services have a positive rather than inverse relationship between selling price and quantity demanded.

Is the trend by some members of the Uber rich to use their vast wealth to acquire conspicuous symbols of wealth an example of rational consumption? Similarly is Bill Gates (and others) decision to dedicate their entire fortunes to causes aimed at improving the lives of the poorest in the Developing world, rational or not?

What is the difference between speculative purchases and simple conspicuous consumption?

Teacher notes

Teacher notes

Lesson time: 1 hour

Lesson objectives:

Develop an understanding that while most products have an inverse relationship between selling price and quantity demanded, there are a small number of super luxury goods and services which provide an exception to this rule and demand for the product increases in response to a rise in price. The exercises on conspicuous consumption, Bill gates and speculative purchases of luxury property are also be potential TOK exercises.

Teacher notes:

1. Opening activity - start with the beginning activity on veblen goods and ask your students 'what is the craziest veblen purchase that they have ever made?' The video complements the handout which you can print off and distribute to your classes.

2. Processes - technical Vocabulary - your classes can learn the required vocabulary watching the video and studying the class handout which follows. In total the first two activities need only take 15 minutes.

3 and 4. Reinforcement activities - attached to the class handout is activity three and four. Activity 3 particularly is a fun exercise on conspicuous consumption. Can you classes guess the price of the 4 veblen goods on the handout? I then follow this exercise with a discussion of why those goods can command such outrageous price tags - quality or conspicuous consumption? I also use this exercise to make the link with TOK. For example is it rational for the Uber rich to use their vast wealth to acquire conspicuous symbols of wealth? Is it rational for Bill Gates to dedicate his entire fortune to his Foundation, aimed at improving the lives of the poorest in the Developing world?

5. Final reflective activity - project the final activity onto the whiteboard, which consists of a short video on the recent trend of purchases of high end property by Chinese residents. Is this an example of speculative purchasing or simply another example of conspicuous consumption?

1. Beginning activity

Begin by watching the following short video and respond to the question which follows:

So the question is, what is the craziest veblen purchase that you have ever made?

Exceptions to the normal demand function

In economics we can identify a small range of goods and services that appear to contradict the normal rules of economics, in providing an exception to the normal demand curve. Unlike the vast majority of goods and services which have a negative relationship between price and quantity demand, a small range of goods have a positive price elasticity. In other words as the price of a these goods rises consumers purchase more of the good or service, not less. Similarly as the price falls consumers will purchase less of the product. Two examples of such a product are veblen and speculative goods and we can look at both products in more detail now.

Veblen goods

Veblen goods

Veblen goods are super luxury goods and their intrinsic value comes from their worth or snob value rather than their functional use. Consider the following: You are getting engaged and your partner offers you a choice of two engagement rings. Both look very similar but one costs $ 10,000 while the other costs just $ 1,000. Which of those would you ask your new partner to purchase? For those of you who chose the identical looking $1,000 diamond ring then you have my respect. After all this is what a rational consumer would do - purchase the cheaper ring and use the money saved to pay for your married life together.

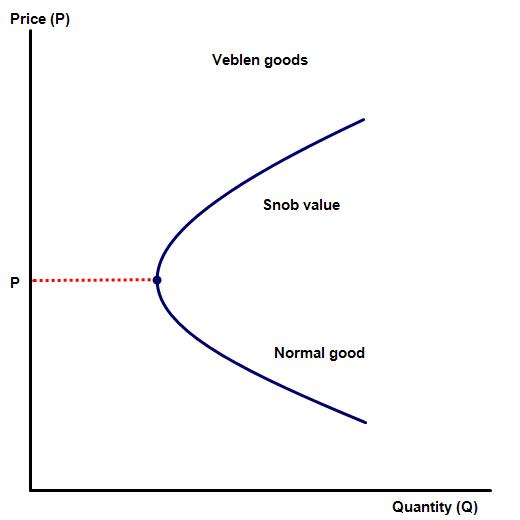

However, many of you will have chosen the more expensive ring for the snob value and prestige that the more expensive ring provides. As a result of this the $10,000 really is worth 10 times as much as the cheaper ring. This is shown by the  diagram above and to the right. As the diagram illustrates the demand schedule for a veblen good is kinked. At a very low price the quantity demanded is high. As the price rises, for the good, quantity demanded initially falls but then as the price reaches P1, the snob value effect takes over and quantity demand will rise, following further rises in price.

diagram above and to the right. As the diagram illustrates the demand schedule for a veblen good is kinked. At a very low price the quantity demanded is high. As the price rises, for the good, quantity demanded initially falls but then as the price reaches P1, the snob value effect takes over and quantity demand will rise, following further rises in price.

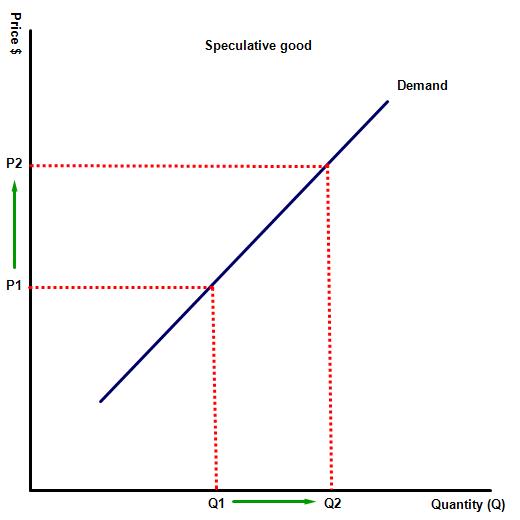

Speculative goods

Speculative goods represent another of the exceptions to the normal demand rule. Speculative goods are goods where many consumers purchase the good in the hope of gaining a profit if the price rises in the future. Examples of this might include gold, some jewellery or even prime London or New York properties. In these examples consumers may believe that a rise in price of a product means that further price rises in the future are likely. Of course many veblen goods are also purchased for speculative reasons, while some goods purchased in the hope of increased future profit also come with significant snob value / cache when purchased.

The above can be accessed as a PDF at: ![]() Veblen

Veblen

3. Activity on conspicuous consumption

Many of you will be aware of the term conspicuous consumption, which was described by economist Thorstein Veblen as consumption by the rich designed to signal their great wealth to others.

The ultimate veblen list - how much do each of these goods cost?

The ultimate veblen list - how much do each of these goods cost?

Guess the price of the following veblen goods.

a. A Reinast toothbrush, made from solid titanium?

This ultimate super luxury good solid sells for $4,200 - it is unlikely to get your teeth any cleaner than a $2 toothbrush from Walgreens.

b. A Chopard 210 karat wrist watch - shown top left?

This 18-karat gold pocket watch made by Patek Philippe for banker Henry Graves Jr. in 1933 required five years to design and build. As of December 2016 it was on sale for $ 26 million.

c. 5 pieces of raw fish five (shown on the right) prepared by Filipino chef Angelino Araneta Jr?

c. 5 pieces of raw fish five (shown on the right) prepared by Filipino chef Angelino Araneta Jr?

This was sold for $1,978.15, back in 2010.

d. A top of the range cocktail at swish Gigi's restaurant in Mayfair, London?

The Grace Jones cocktail, containing an 1888 Samalens Vieille Relique Vintage Bas Armagnac will set you back £ 8888. This special cocktail was created for Grace Jones and for the uber rich who 'don't need to ask the price.

4. Link to TOK

1. To what extent is the consumption of veblen goods an example of rational consumption?

1. To what extent is the consumption of veblen goods an example of rational consumption?

Rational consumption is when a consumer purchases goods and services providing them with the maximum utility for their money. In economics the price of any good or service comes from supply and demand and so for the vast majority of us, with a limited budget, the consumption of such items would make no economic sense. Why spend our scare resources on an item which takes up a very large part of our disposable income? However, for the Uber rich this rule does not apply because the rules of scarcity do not apply? Perhaps for some members of the Uber rich utility comes from showing off your wealth to the world?

2. Bill Gates, the worlds richest man and his wife set up a Foundation in the year 2000, with the aim of helping to fund improvements in healthcare in the poorest parts of the world. Last year the foundation's assets were reported to be valued at more than $34.6 billion. Is this an example of rational consumption?

According to sources the $34.6 billion spent by the worlds richest man and his family has made little dent in his family fortune. According to many calculations it would take 218 years, spending $1 million a day to blow through their entire life savings.

Final reflection Activity 5

Begin by watching the following short video and respond to the question which follows:

Why are so many Chinese families investing in Vancouver properties, despite a rise in price levels? Is this an example of speculation, investing money to make money or simply another example of conspicuous consumption?

The video identifies three factors which are driving the boom in the Toronto housing market, amongst foreign purchasers. The first is a supply factor. Unlike some other western cities there are no restrictions on foreign ownership of property. However, there are also two demand factors which are contributing to the boom in house prices. The first is migrant families looking for a better place to live. But a significant part of the market is also being driven by wealthy investors who believe that the sharp rise in property values is a sign that this rise will continue, providing those investors with a profit in the future. In other words rather than reducing levels of quantity demand for housing higher prices in the housing market have actually increased demand levels. This would also imply that while there is an element of conspicuous consumption in the purchases - after all these are high end luxury purchases, many of the purchasers are also hoping to make money from the purchase.

IB Docs (2) Team

IB Docs (2) Team