Unit 2.11(5) Market power - Oligopoly(HL)

An oligopoly is a model of a market where a small number of large firms dominate the market. This can be expressed as a situation where the total revenue of a small number of large firms accounts for a high proportion of total market revenue. The rest of the market would be made up of small firms.

- Definition of oligopoly

.jpg)

- Concentration ratio

- Assumptions of oligopoly

- Interdependent decision making

- Barriers to entry

- Collusive oligopoly

- Demand and revenue

- Non-collusive oligopoly

- Game theory

- Efficiency in oligopoly

- Evaluation of oligopoly

Revision material

The link to the attached pdf is revision material from Unit 2.11(4) Market power - Oligopoly(HL). The revision material can be downloaded as a student handout.

The link to the attached pdf is revision material from Unit 2.11(4) Market power - Oligopoly(HL). The revision material can be downloaded as a student handout.

The nature of oligopoly

An oligopoly is a model of a market where a small number of large firms dominate the market. This can be expressed as a situation where the total revenue of a small number of large firms accounts for a high proportion of total market revenue. The rest of the market would be made up of smaller firms.

Concentration ratio

Oligopolistic markets are described as highly concentrated. This means the concentration ratio for a certain number of the largest firms in the market is a relatively high percentage of total market revenue. For example, the market for sports clothing and footwear in an economy might be dominated by four large firms. You would use a four-firm concentration ratio to measure the extent to which this is an oligopolistic market. The ratio would be calculated as:

total revenue of the 4 largest firms in a market / total revenue of the market x 100

The annual total revenue figures might be:

$980m / $1210m = 81%

This means the four largest firms in the sportswear market account for 81 per cent of total market revenue and we would describe this as an oligopolistic market.

The global sportswear market size was estimated at $119Bn last year and is expected to grow by 10.4% over the next 5 years. The increasing awareness of leading a healthy lifestyle and the health benefits of fitness activities, such as swimming, yoga, running, and aerobics are expected to keep the market growing. Nike is the market leader with sales of $39Bn, followed by Adidas $25Bn, Puma $6Bn and Under Armour $5Bn. Small and medium-sized enterprises make up the rest of the market sales.

The global sportswear market size was estimated at $119Bn last year and is expected to grow by 10.4% over the next 5 years. The increasing awareness of leading a healthy lifestyle and the health benefits of fitness activities, such as swimming, yoga, running, and aerobics are expected to keep the market growing. Nike is the market leader with sales of $39Bn, followed by Adidas $25Bn, Puma $6Bn and Under Armour $5Bn. Small and medium-sized enterprises make up the rest of the market sales.

There is a high concentration ratio among the 4 leading businesses in the market. Because of the global exposure of sports in the media, this is a very high-profile market. People identify with the leading brands that enjoy incredibly strong loyalty amongst consumers. Brand loyalty and awareness make this a difficult market for any new entrant to break into.

Questions

a. Define the term concentration ratio. [2]

A concentration ratio is the number of large firms in the market that account for a certain percentage of total market revenue.

b. Using the sales data in the text, calculate the four-firm concentration ratio. [2]

Nike $39Bn + Adidas $25Bn + Puma $6Bn + Under Armour $5Bn / $119Bn x 100 = 63%

c. Explain how brand loyalty might act as a barrier to entry into the sportswear market. [4]

Brand loyalty is where consumers continuously buy a particular product over time because they are attracted by its characteristics such as name, image and the positive experiences they receive from consuming the good. Brand loyalty is a barrier to entry because new entrants to the market find it difficult to attract brand loyal customers of the existing producers in the market.

Investigation

Discuss with your class the different sportswear brands they buy. Try to come up with reasons why the sportswear market is an oligopoly.

Assumptions of oligopoly

A small number of large firms

A small number of large firms account for a high proportion of total market revenue. The sportswear market which is dominated by Nike, Adidas, Puma and Under Armour is an example of this.

Barriers to entry

Barriers to entry and exit exist in oligopolistic markets. This means there are costs and regulations over and above the normal costs of entering or leaving a market. Barriers to entry in oligopolistic markets are similar to those in monopoly markets. The different barriers to entry that exist in markets are covered in Unit 2.11(3) on monopoly. Unit 2.11(3) Market power - Monopoly(HL)

In the sportswear market, the economies of scale achieved by the four largest firms along with brand loyalty and high expenditure on promotion all act as significant barriers to entry.

Differentiated products

Firms in oligopolistic markets sell differentiated products that are different from the goods sold by their competitors. This means oligopolistic firms face a downward sloping demand curve and are price makers rather than price takers. For example, the training shoes sold by Nike and Adidas are very similar but they are different in terms of design and brand image.

Interdependent decision making

Businesses in oligopolistic markets make interdependent decisions which means they make decisions based on how they believe other firms in the market are going to react to their decisions. This is unlike perfect and monopolistic competition where firms make decisions independently of one and other. For example, if Nike chooses to cut its price to increase market share then Adidas, Puma and Under Armour might respond by cutting their prices to protect their market share.

Collusive oligopoly

Collusion occurs in a market where firms share information about their price and output decisions. The most extreme form of collusion is a cartel where firms jointly decide to set price and output and by doing this they effectively act as a monopoly. This means the colluding firms attempt to maximise joint profits by setting price and output in the same way as a monopoly firm.

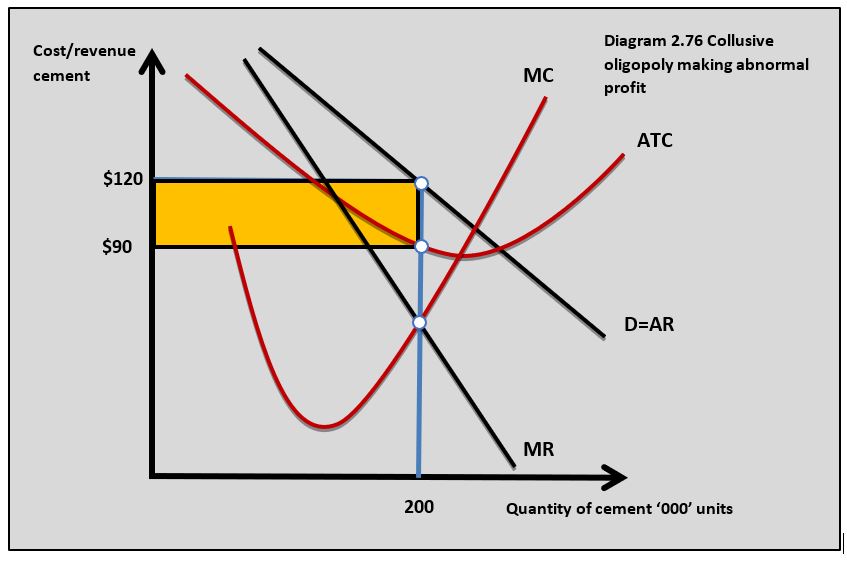

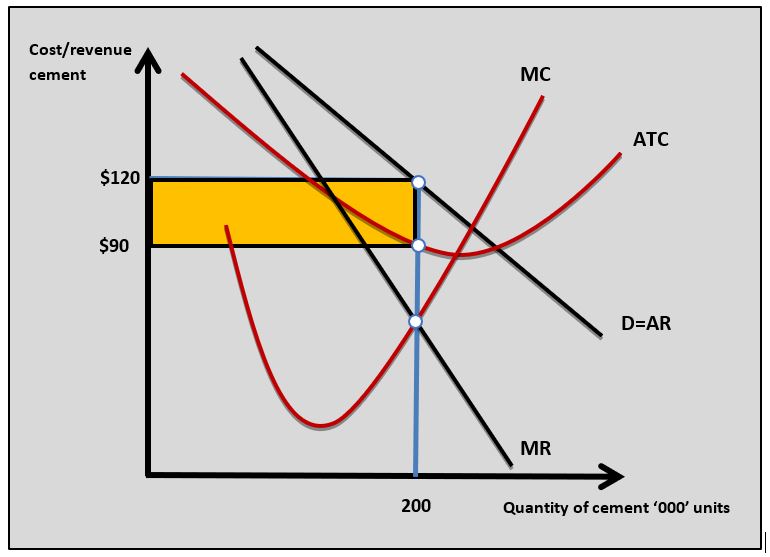

In an economy, for example, the cement market might be a cartel with 5 firms collectively agreeing to fix their output and charge the same price. When firms collude, they effectively act as a monopoly and the cement market can be analysed as if it was a monopoly. This means the firms in the market jointly produce where marginal cost equals marginal revenue when marginal cost is rising and then set price based on the demand curve. This is shown in diagram 2.76. In this example, the cartel in diagram 2.76 is earning abnormal profits equal to the yellow shaded area.

In an economy, for example, the cement market might be a cartel with 5 firms collectively agreeing to fix their output and charge the same price. When firms collude, they effectively act as a monopoly and the cement market can be analysed as if it was a monopoly. This means the firms in the market jointly produce where marginal cost equals marginal revenue when marginal cost is rising and then set price based on the demand curve. This is shown in diagram 2.76. In this example, the cartel in diagram 2.76 is earning abnormal profits equal to the yellow shaded area.

Conditions for collusion

For a collusive oligopoly to operate effectively the following conditions need to be in place:

- Firms are located closely together and there are good relationships between the producers so that firms find it easy to work together.

- There are a small number of firms involved in a collusive agreement. When there are too many firms in a cartel it is difficult to control output.

- Although there is product differentiation there are only small differences in the goods sold by individual firms. This means consumers make their buying decisions based on price rather than product quality. This means buyers are not attracted to one producer in the cartel ahead of the others and this makes it easier for producers to jointly supply the market.

The law and collusion

In most countries, collusive behaviour between firms is illegal because consumers pay a higher price for a lower output than would exist in a competitive market. In the UK, for example, the Competition Commission investigates and acts against collusive behaviour by firms.

Tacit collusion

Firms can use tacit collusion where they make decisions that influence price and output in a collusive way, but do not involve a formal agreement. Tacit collusion can involve price leadership where firms all change prices together but are led by one firm in the industry. For example, if there are six energy businesses providing gas and electricity in a market they will react in an interdependent way when setting prices by looking at each other's prices. Whilst they do not have a formal arrangement, they may change their prices in line with each other, so they do not compete on price. If one energy firm is the informal leader and they increase prices this will trigger an increase in price by other firms in the market.

Eleven members of an alleged Indian cement cartel were fined $784 million last week after being found guilty of fixing prices and exchanging commercially sensitive information. The court said the most telling evidence of cartel activity came from the minutes of the Indian Cement Manufacturers Association meetings which clearly showed the firms involved discussing prices and production capacity.

Eleven members of an alleged Indian cement cartel were fined $784 million last week after being found guilty of fixing prices and exchanging commercially sensitive information. The court said the most telling evidence of cartel activity came from the minutes of the Indian Cement Manufacturers Association meetings which clearly showed the firms involved discussing prices and production capacity.The court found there was compelling evidence of price-fixing amongst the firms involved. The businesses would share information about setting upper and lower price limits and agreeing on production targets to achieve this. The court went on to explain how cartel activity was artificially increasing the market price of cement, increasing the costs of construction firms.

Questions

a. Define the term collusion. [2]

Collusion occurs in a market when firms share information about their price and output decisions.

b. Explain why the nature of cement and the number of firms in the Indian cement market make them able to collude effectively. [4]

- Cement is a relatively homogenous product which means consumers are less likely to be brand loyal to a particular producer which makes it difficult for one firm to attract consumers away from the other firms which makes it easier to manage the cartel.

- There are a relatively small number of producers (11) in the Indian cement market so it is easier for them to cooperate in setting price and output.

c. Using a diagram, explain how collusion in the cement market means firms can earn abnormal profits in the long run. [4]

Collusion means firms in the cement market can control market output and act as a monopoly. This means the price can be set above ATC and abnormal profits can be earned. The abnormal profit can be sustained in the long run by barriers to entry restricting new firms from entering the cement market.

Collusion means firms in the cement market can control market output and act as a monopoly. This means the price can be set above ATC and abnormal profits can be earned. The abnormal profit can be sustained in the long run by barriers to entry restricting new firms from entering the cement market.

Investigation

Research into other incidents of cartel activity. Do you think consumers always lose out from cartel activity?

Non-collusive oligopoly

A non-collusive oligopoly is a market situation where the firms in the market do not enter into any formal or informal agreements with other firms in the industry. The behaviour of firms in a non-collusive oligopoly can be explained by using game theory.

Game theory

Game theory is a model of strategic behaviour that exists in an oligopolistic market. The model explains how businesses react to each other decisions in interdependent decision-making situations. The strategic element explains how firms plan their pricing decisions in response to their competitors.

Game theory example

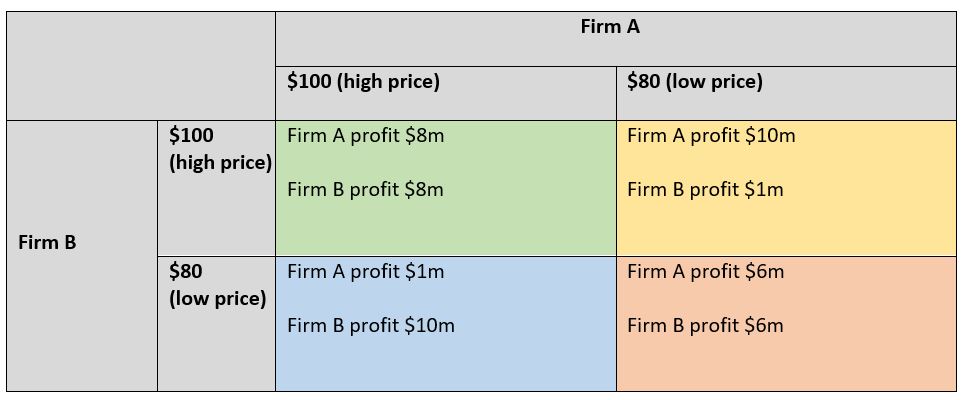

This is a game theory example where there are two firms selling cement in a market and making a pricing decision.

Assumptions of this game theory example are:

- Two firms dominate the cement market in a duopoly situation – Firm A and Firm B

- Each firm has an equal market share

- Each firm has the same costs

- The products sold by each firm are very similar, so consumers are making their buying decisions solely on price.

The different decision-making options of each cement producer in the market are set out in the table.

Firms A and B start with an initially high price with each firm charging $100 and making $8 million profit each. Because of a fall in demand in the market, both firms are thinking about reducing their prices.- Firm A is deciding on whether to decrease its price to $80 or to leave it at $100. If Firm A keeps its price the same and Firm B reduces its price, Firm A’s profits will fall to £1 million. This outcome is the worst situation for firm A.

- If Firm A reduces its price and Firm B keeps its price the same Firm A’s profits will rise to $10 million. This is the best outcome for firm A.

- If Firm A reduces its price and Firm B reduces its price, then Firm A’s profits fall to $6 million which is a fall in profit but not as much as the fall to $1 million so it is a better outcome.

- Given this matrix of outcomes, the least risk and the greatest return is for firm A to reduce its price.

- The same outcomes apply to Firm B, its least risk and greatest return are for it to reduce its prices.

- Given Firm A and Firm B's lowest risk outcome is to reduce price, both firms would reduce price and this would lead to a fall in their profits.

- This game theory example can be used to explain why firms in oligopolistic markets would like to collude and maintain their price at the current level. If the firms can use a formal or tacit agreement to keep their cement prices at $100 then it reduces the risk associated with pricing decisions and makes future planning easier for both forms.

Price rigidity

There is evidence that in oligopolistic markets prices do not change as much as they do in other markets in response to changes in demand and supply. This is known as price rigidity. The theory we have considered so far in oligopoly goes some way to explaining why this might be the case:

- If firms collude in markets and agree not to compete on price, then price changes are less likely when demand and supply change in the market. Oligopolistic firms that collude and act as a monopoly can increase their collective profits by fixing price and output.

- Game theory can be used to explain how strategic decisions by firms can reduce price changes. If firms make decisions on a ‘least risk’ basis then this will often mean not changing prices.

- Price rigidity can be explained by businesses in oligopolistic markets wanting to avoid price war situations where all firms in the market are reducing prices. The demand for an individual firm’s product might be relatively elastic, but demand for the product in the whole market is likely to be more inelastic. If the price of the product falls for all firms in the market, then the total revenue of all the firms will decrease.

Non-price competition

Because firms in oligopolistic markets are often reluctant to compete on price they choose to compete for customers through other activities that can attract consumers. Non-price competition might involve:

- Firms improve the quality of their products in the market so it attracts buyers. This can be in terms of product design, functionality, packaging and customer service. In the coffee shop market firms such as Starbucks, Costa Coffee and Café Nero do not compete that much on price, but they do compete on the quality of their shops, the coffee they serve and their customer service.

- Promotion and advertising is the way many oligopolistic businesses try to attract customers. The major sports goods firms, Nike and Adidas compete extensively in the market for sports clothing and equipment through activities such as promotional campaigns, sponsorship and product endorsement.

- Using a wide distribution network can give a firm a competitive advantage. The soft drinks manufacturer, Coca-Cola tries to make its goods as accessible as possible to potential buyers. This involves distributing their soft drinks through small shops, supermarkets, transport hubs, bars and restaurants, places of entertainment and vending machines.

Promotion and advertising have always been key themes of non-price competition. One development in promotion is the use of guerrilla marketing where businesses use stunts or events to create an interest in their brands. One famous guerrilla marketing campaign is Coca Cola’s happiness vending machine. Coca Cola set up a vending machine on a college campus in the US and then videoed people using the machine. The first person to put their money in and reach for a bottle gets one bottle, then another and another…. Another user receives flowers from the machine, someone else has their drink poured into a glass for them from the machine and so on.

Promotion and advertising have always been key themes of non-price competition. One development in promotion is the use of guerrilla marketing where businesses use stunts or events to create an interest in their brands. One famous guerrilla marketing campaign is Coca Cola’s happiness vending machine. Coca Cola set up a vending machine on a college campus in the US and then videoed people using the machine. The first person to put their money in and reach for a bottle gets one bottle, then another and another…. Another user receives flowers from the machine, someone else has their drink poured into a glass for them from the machine and so on.

It is a funny, entertaining video and it went viral on Youtube. It illustrates the way marketing or non-price competition has evolved in the digital age.

Questions

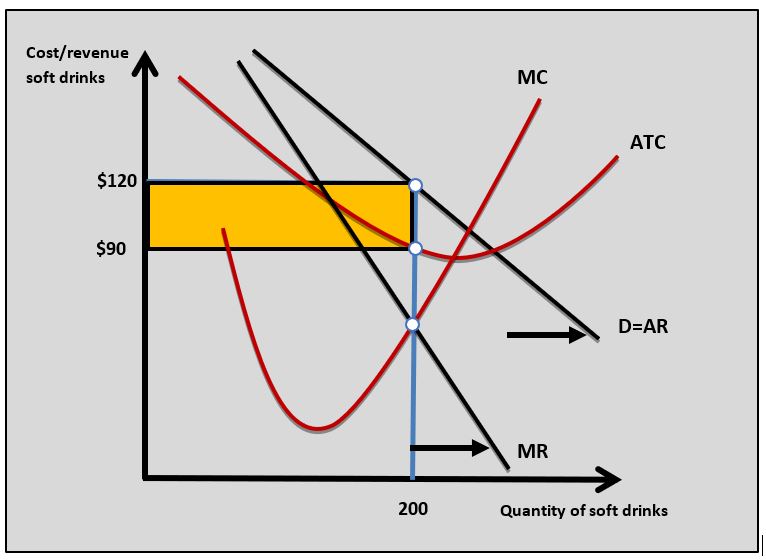

a. Explain how non-price competition can increase the demand for a firm's good in an oligopolistic market. [10]

Answers should include:

- Definitions of non-price competition, demand and oligopoly.

- A diagram to show an increase in demand in an oligopolistic market.

- An explanation that methods of non-price competition such as advertising, promotion, improvements in product quality and changes to distribution can affect consumer tastes and preferences and increase demand for a good or service.

- An explanation that as non-price competition increases the demand for a good in an oligopolistic market this can lead to or increase abnormal profit for the firm in the market. This is shown in the diagram.

- Examples of how non-price competition in an oligopolistic market can increase demand such as the soft drinks market with firms such as Coca-Cola and Pepsico.

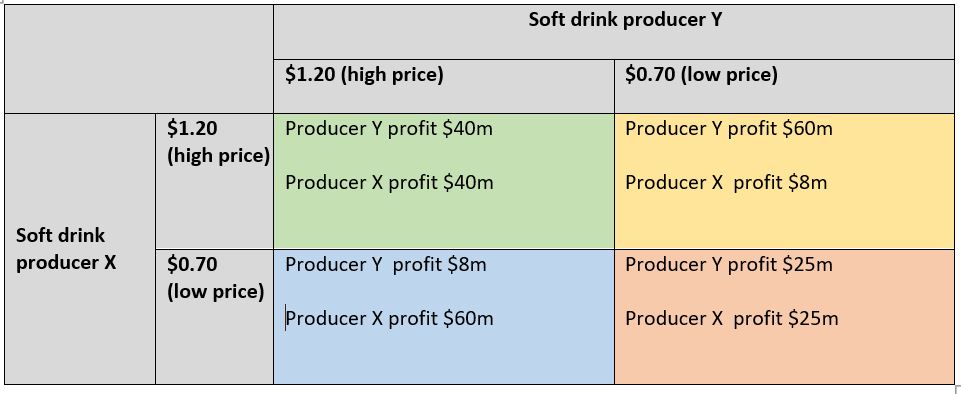

b. The table below sets out the profit-making situations for two producers in the soft drinks market who can consider reducing their prices.

Using game theory, explain which pricing decision Producer X and Producer Y would choose. [4]

Producer X and Producer Y both choose to reduce their prices in this situation because this is the least risky option for them. If either firm chose to keep their price the same and the other firm chose to reduce their price then they would see their profits fall from $40m to $8m. If they reduce the price they could see their profits rise to $60m if the other firm kept their price the same and if they both cut-price profits only fall to $25m.

Investigation

Investigate another guerrilla marketing campaign used by a firm to increase the demand for its products.

Efficiency in oligopoly

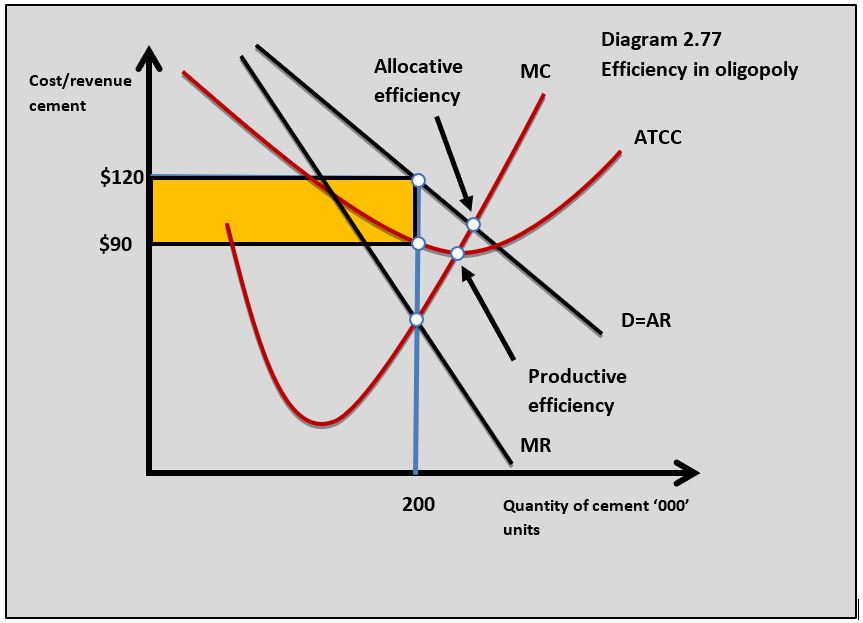

In our graphical analysis of efficiency in oligopoly, we are going to use the collusive oligopoly diagram to make judgements about allocative and productive efficiency.

Productive efficiency

Oligopolistic firms will not achieve productive efficiency because they produce on the downward-sloping portion of the ATC curve at the profit maximising output and do not achieve the lowest possible average total cost. This is shown in diagram 2.77. The pressure of competition in oligopolistic markets might make firms more productively efficient than in a monopoly.

Oligopolistic firms will not achieve productive efficiency because they produce on the downward-sloping portion of the ATC curve at the profit maximising output and do not achieve the lowest possible average total cost. This is shown in diagram 2.77. The pressure of competition in oligopolistic markets might make firms more productively efficient than in a monopoly.Allocative efficiency

Similar to monopoly and monopolistic competition the firms in an Oligopoly fail to produce at the point of allocative efficiency where marginal cost equals price which is shown in diagram 2.77. This means the consumer pays a higher price for a lower output than under perfectly competitive market conditions.

Oligopolistic markets also have price rigidity. This means prices do not change to reflect changes in relative scarcity in the same way as monopolistic and perfect competition. This means that prices may not fulfil their allocative and rationing functions as efficiently as they do in perfect and monopolistic competition.

The benefits of oligopoly

Economies of scale

Because the firms in oligopolistic markets are generally large they do benefit from significant economies of scale which generally makes their prices lower and output higher than in perfect and monopolistically competitive markets. A large retailer like Walmart will sell its goods at much lower prices than smaller retailers because of its economies of scale.

Barriers to entry

The barriers to entry enjoyed by Oligopolies yield profits that can be re-invested back into the business which gives consumers new products. In perfect and monopolistic competition abnormal profits are competed away which takes away the funds for innovation and reduces the reward for developing new products. Apple and Microsoft dominate their respective markets and they have produced new and better products as a result of the huge profits they re-invest back in their respective businesses.

Using the data which of the following is the total revenue of industry X?

Total revenues of the 3 largest firms in the industry: Firm A (

3 firm concentration ratio 86%

Which of the following factors makes it easier for firms to collude in a market?

Fixing price and output is easier for firms with close working relationships.

Which of the following is least likely to explain price rigidity in an oligopolistic market?

An increase in competition is likely to make prices more likely to change.

Which of the following is least likely to be a benefit of an oligopolistic market?

When price is greater than the marginal cost the market is not allocatively efficient.

Which of the following is most likely to be a benefit of an oligopolistic market?

Large firms in oligopolistic markets often benefit from economies of scale which lead to lower average total costs.

Oligopolistic markets are most likely to exist where?

Oligopolistic markets tend to have a high concentration ratio where a small number of firms account for a high proportion of total market sales.

Which of the following is least likely to be an example of non-price competition?

A 'buy one get one free' promotion campaign involves reducing the price of a firm’s goods if consumers buy a larger quantity.

Which of the following is most likely to be a characteristic of an oligopolistic market?

Which of the following is least likely to be a barrier to entry in an oligopolistic market?

High set-up costs are a barrier to entry into an oligopolistic market.

Which of the following is true about efficiency in oligopoly?

Firms are allocatively inefficient in oligopoly because profit-maximising firms do not produce where price equals marginal cost.

IB Docs (2) Team

IB Docs (2) Team