Government subsidies

Introduction

Introduction

Just as we have seen that the imposition of a sales tax impacts on the market equilibrium for a good or service, a subsidy on a product will do the same - as the first video on this page describes, a subsidy is effectively a reverse tax on a product. Again start with the same exercise where students list those items which their government currently subsidises and then suggest possible reasons why that subsidy is put in place?

The main aim of this lesson is for your students to really question why it is that governments subsidise certain goods and services and not others? How many of those subsidised goods can really be called 'merit goods' and hence benefit the citizens of that country?

Enquiry question

What are subsidies and what are the consequences of a government decision to place a subsidy on a good or service.

Teacher notes

Lesson time: 80 minutes

Lesson objectives:

Explain why governments provide subsidies, and describe examples of subsidies.

Draw a diagram to show a subsidy, and analyse the impacts of a subsidy on market outcomes.

Discuss the consequences of providing a subsidy on the stakeholders in a market, including consumers, producers and the government.

Plot demand and supply curves for a product from linear functions and then illustrate and/or calculate the effects of the provision of a subsidy on the market (on price, quantity, consumer expenditure, producer revenue, government expenditure, consumer surplus and producer surplus). (HL only).

Teacher notes:

1. Beginning activity, start with the opening questions, which you might need to guide your students with. For the video, prezi and opening questions should take around 20 minutes.

2. Processes - technical vocabulary - The students learn the content reading the class handout, which you can print off and handout to your class. Allow 15 minutes for this activity and the first two activities based on the technical vocabulary.

3. Reinforcement processes - the handout includes 2 reinforcement activities, where students can test their mathematical skills, calculating the impact of a subsidy for example, given a set of data provided, as well as short answer responses where they can apply their knowledge. (15 minutes)

4. Reflection activities - activities 5, 6 and 7 provides a reflection exercise. Ask your students to reflect on whether the goods subsidised by governments really benefit the society or not? (15 minutes). I would advise activity 7 to be completed as a group exercise as this works well.

5. Link to the assessment - this page contains a relevant paper one style question on this topic, which your students can read and draw a plan for completion. Time allowed for this activity should be between 10 and 15 minutes.

Beginning activity

Start by watching the following video, which explains the term subsidy and then answer the question which follows, before reading the class handout.

Question:

Which goods and services are subsidised by your government? Why does the government choose to subsidise those products? Consider the political as well as social and economic reasons.

Reasons include:

- reducing the price of certain basic items so that they are affordable for all income groups

- encouraging the consumption and production of desirable products e.g. education and health services

- improving the competitiveness of domestic businesses in overseas markets.

Key terms:

Key terms:

Subsidy - can be defined as support provided by the government, to encourage the production or consumption of a good or service.

Merit goods - goods or services which consumers will often undervalue but which governments believe provide positive externalities.

Opportunity cost - the cost of the subsidy in terms of the alternative opportunities foregone. Examples might include higher taxes or cuts to public spending elsewhere.

Government grants - a form of government subsidy provided to help new or struggling businesses, especially those in strategically important sectors such as bio-tech.

Guaranteed minimum payment - a type of subsidy guaranteeing a minimum price for a product, such as the one offered by many governments to farmers so that production levels are guaranteed.

Bail-outs - specific help provided to key industries when struggling financially e.g. the assistance provided to financial institutions and GM in the wake of the 2008 financial crisis.

Financial assistance - a type of government assistance paid in the form of a grant or loan to encourage businesses to set up in areas of high unemployment.

The activities on this page are available as a handout at: ![]() Subsidy

Subsidy

Activity 1

Activity 1

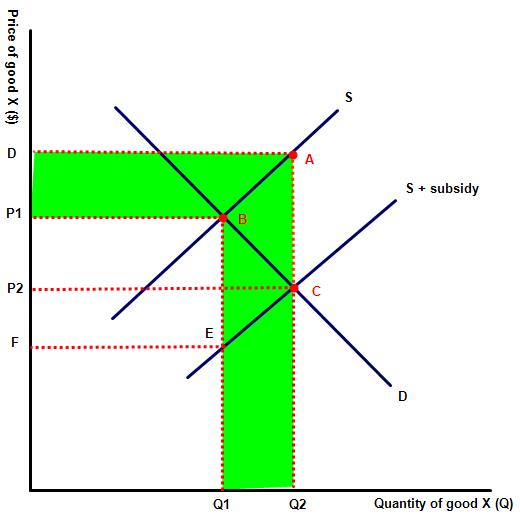

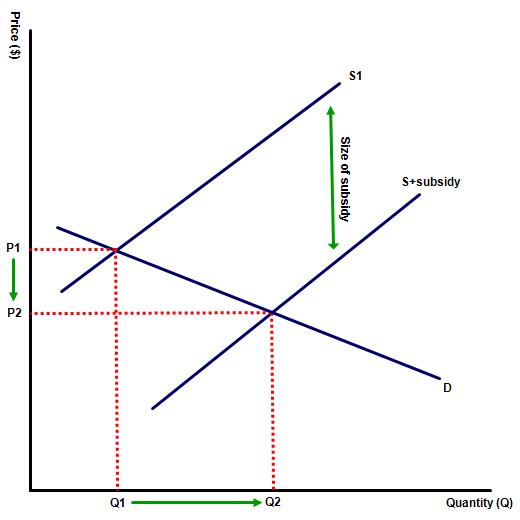

The diagram to the right represents the market for good X, a merit good.

(a) Indicate the original (without the subsidy) equilibrium price and output.

P1 with Q1 representing the equilibrium output.

(b) Complete the sentence by filling in the missing words:

Consumers benefit from a subsidy through lower prices, while producers benefit from higher revenue. The proportion of the payment enjoyed by both depends on the relative _____ and _____ of the product.

PED, PES

(c) Highlight from the diagram the following:

i. The increase in quantity demanded for the product

Q1 - Q2

ii. The new equilibrium price and output

P2 and Q2

iii. The new price paid by the consumer and the government

The consumer now pays P2 with the government contributing D-P2

iv. The size of the subsidy

A - C

vi. The increase in revenue enjoyed by the producer.

This is illustrated by the green shaded area.

Activity 2

Activity 2

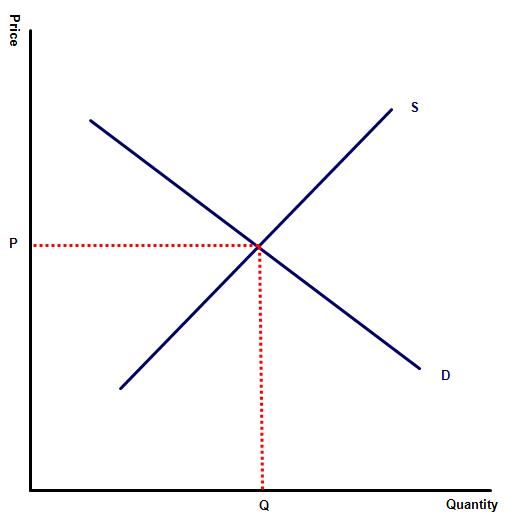

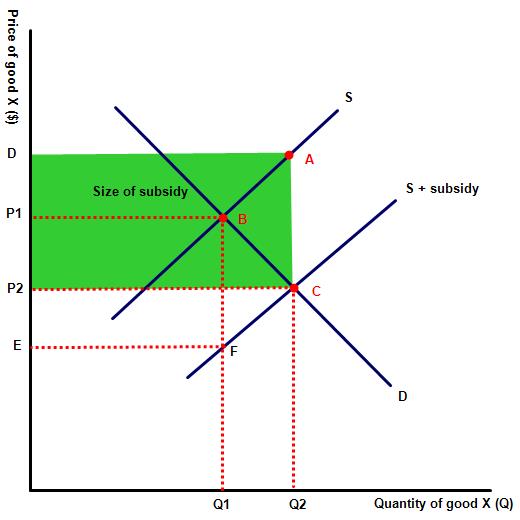

The diagram to the left represents the market for good X. The government then decides to intervene in the market for this product by providing a subsidy.

(a) Illustrate the impact of a flat rate subsidy on the market for this product.

(b) What is the new equilibrium level of output and price after the subsidy.

P2 and Q2

(c) Indicate the size of the subsidy and the total payment made to the industry.

A - C and the total cost to the government is illustrated by the green shaded area.

(d) How much does producer revenue increase by?

D x Q2 minus P1 x Q1

(e) Indicate the price of the good if the selling price had fallen by the whole value of the subsidy.

E

Activity 3

Activity 3

The impact of PED on a market subsidy

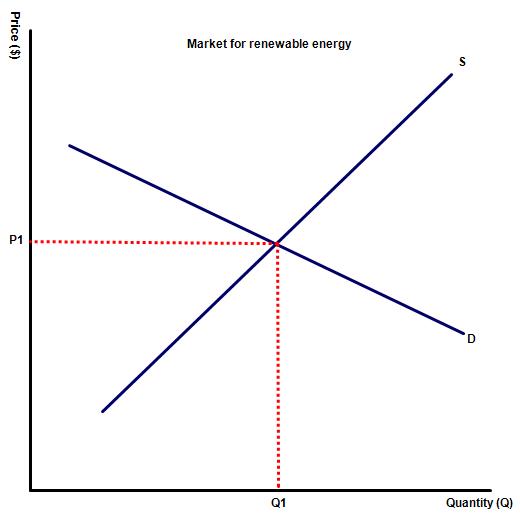

(a) The diagram to the right illustrates the market for a PED elastic product, renewable energy. Illustrate the impact on equilibrium price and output, following the application of a subsidy on the good.

(b) Following the subsidy which variable would we expect to see the largest change - quantity demanded or selling price?

Following a decision by the government to subsidise this product, to encourage consumption of renewable energy sources, sales of clean energy rises significantly - proportionately more than the relatively fall in price (Q1-Q2, rather than P1-P2).

(c) The next diagram illustrates the market for children's shoes, a PED inelastic good. Illustrate the impact on equilibrium price and output, following the application of a subsidy on the product.

(c) The next diagram illustrates the market for children's shoes, a PED inelastic good. Illustrate the impact on equilibrium price and output, following the application of a subsidy on the product.

(d) Describe the impact on both sales and price when a subsidy is applied to a PED inelastic good.

The subsidy has little impact on consumption levels, with the rise in quantity produced smaller than proportional to the fall in price - Q1-Q2, rather than P1-P2.

Activity 4 (HL only)

The demand and supply for domestic electricity consumption is identified on the following table:

Price (kw) $ | Demand | Supply pre-subsidy | Supply post-subsidy |

5 | 40,000 | 0 | 10,000 |

10 | 35,000 | 5,000 | 15,000 |

15 | 30,000 | 10,000 | 20,000 |

20 | 25,000 | 15,000 | 25,000 |

25 | 20,000 | 20,000 | 30,000 |

30 | 15,000 | 25,000 | 35,000 |

35 | 10,000 | 30,000 | 40,000 |

40 | 5,000 | 35,000 | 45,000 |

45 | 0 | 40,000 | 50,000 |

(a) Illustrate the above information on the following graph paper, highlighting the size of the subsidy provided by the government.

(b) Calculate the cost of the subsidy to the government.

25,000 x $10 = $ 250,000

(c) Outline the opportunity cost of the subsidy.

The alternative public services that could have been provided for $ 250,000 could have been spent on, or a reduction in tax for the same amount.

(d) Explain why the government may have chosen to provide the subsidy on electricity.

Activity 5: G20 governments still propping up fossil fuel exploration

In 2009, the G20 pledged to phase out 'inefficient' fossil fuel subsidies, yet research discovered that governments are still spending $88 billion every year supporting exploration – more than double what the oil and gas companies are investing. A breakdown of subsidy by country is illustrated below:

| Country | Size of subsidy in US$ per capita |

Saudi Arabia | 3,395 |

Russia | 2,334 |

USA | 2,177 |

China | 1,652 |

Canada | 1,283 |

Australia | 1,259 |

Japan | 1,240 |

Germany | 645 |

| UK | 635 |

(a) Consider the data represented in the table which illustrates the level of fossil fuel subsidy paid by G20 countries and illustrate the effect of the subsidy on both fossil fuels and firms producing alternative / renewable energy sources.

A subsidy on carbon based energy sources increases the quantity produced of fossil fuels, whilst reducing the consumption of renewable energy.

(b) State whether you believe that the OEDC nations should be subsidising fossil fuels?

Activity 6

When a government places a subsidy on a product both the producer and consumer benefits. However, there are losers in terms of opportunity cost. Governments can either reduce spending elsewhere or raise taxes.

Watch the short video on bread subsidies in Egypt and then answer the following questions:

(a) Outline the arguments for and against the Egyptian government providing a subsidy for bread?

The key term here is opportunity cost, the 6 cents that it costs the government to produce each loaf of bread will need to be financed out of either tax revenue or cuts in spending elsewhere.

(b) Is there a danger that simply subsidising a product encourages firms to be inefficient? What damage might be done to firms who are not receiving the subsidy?

Offering a subsidy to some firms and not others distorts the market. It can cause inefficiency in the firm receiving the subsidy and may also drive some other (perfectly healthy firms) out of business.

Activity 7: reflection exercise

Divide the class into two groups.

One group should spend 10 minutes compiling a list of some of the reasons that governments provide subsidies. The second group can then compile a similar list, detailing some of the arguments against government subsidies. Afterwards compare the two lists and decide overall whether or not governments are correct to implement a subsidy on certain products or not?

The reasons why a government will provide a subsidy to firms should include:

To lower the price of essential basic items such as fuel and basic food stuffs. In many parts of the middle east for instance, bread is a key part of the local diet. As such, given the low levels of income in many parts of the region, governments subsidise this basic food product so that it is cheap and widely available.

The second reason for providing a subsidy is to guarantee the production of essential services or products. We can see this in EU farming policy where farmers are provided with a subsidy to guarantee food production. Public services such as health,education, medicine and public transport are also provided free of charge or at least cheaply to the consumer at the point of sale.

A subsidy can also be used as a way of boosting economic growth by funding infrastructure projects.

Lastly, governments can provide a subsidy in order to help domestic firms from foreign imports. It can also be used to help reduce the price of domestic products so that they can gain market share overseas.

Arguments against subsidies

The opportunity cost of any subsidy i.e. could the money used in providing the subsidy be better spent elsewhere?

Some economists also argue that subsidies distort the working of the free market and often make the situation worse. This is particularly true when decisions are made for political rather than strictly economic or social reasons.

Lastly, some economists also argue that subsidies encourage inefficiency by artificially protecting inefficient firms who would otherwise be force to restructure.

8. Reflection activity

Identify whether a subsidy will always mean lower prices for consumers

This depends on price elasticity of demand, as the diagrams in the class handout illustrate. The more inelastic the demand curve the greater the consumer's gain from a subsidy. Indeed when demand is perfectly inelastic the consumer gains most of the benefit from the subsidy since all the subsidy is passed onto the consumer through a lower price.

When demand is relatively price elastic, the main effect of the subsidy is to increase the equilibrium quantity traded rather than lead to a much lower market price.

Activity 9: Link to theory of knowledge

Look again at the list of goods and services which your government subsidises and ask the question: ‘How many of those subsidised goods can really be called 'merit goods' and hence benefit the citizens of that country?'

Activity 10: Reflective activity - link to the assessment

Typical paper one questions on this topic include:

Part (a)

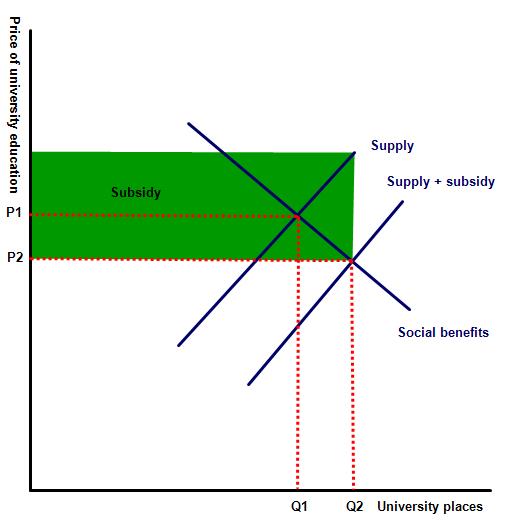

Illustrate using an appropriate diagram how a subsidy can increase the number of students applying to university. [10 marks]

Command term: Illustrate

Command term: Illustrate

This means use a diagram to explain how a government subsidy can increase the number of students applying to college or university.

Terms to define: subsidy, MSC, MSB, external costs and benefits.

As the diagram illustrates, the equilibrium number of students entering university in a free market would be represented by Q1. The equilibrium tuition price at this level is P1. After the subsidy the price falls to P2 and at this lower price the number of students applying to college is Q2.

Q2 represents the socially optimum number of students where MSC = MSB. The subsidy effectively internalises the externality, meaning ensuring that the social benefits enjoyed by society from higher student numbers are provided to students in the form of lower fees.

Part (b)

Using real life examples, evaluate the effectiveness of subsidies in encouraging the consumption of education and health services? [15 marks]

Command term: Evaluate

Key terms to define: subsidy, merit good, positive externality

Relevant real life examples include: nations who have been successful in raising access to both services through government intervention. Responses might consider, for example, the high life expectancy in many Western nations with subsidised healthcare compared to the US non-subsidised system. However, such an example would also need to recognise that differences in health levels may also be a result of cultural / economic factors and that the USA, with one of the highest higher education costs in the world, still has a very high take up at university.

As part (a) illustrates lower prices in the form of a subsidy will increase the consumption of the merit good to the socially optimum level, where MSC = MSB. Providing a subsidy internalises the externality and consumers end up paying the socially efficient price, which includes the external benefit.

However there are criticisms of such a policy:

- the opportunity cost of the subsidy payment - could the money used be better spent elsewhere

- some economists argue that subsidies distort market prices

- the cost of a subsidy falls on the tax-payer who themselves have derived no benefit from going to university

- the subsidy can protect inefficient colleges and discourage them from making important cost cutting measures.

Paper three

Paper three

Relevant questions from the paper three exam might include illustrating the impact of an indirect tax on a good or service, using a given set of data. Paper three questions on this topic might also require candidates to calculate the change in price / quantity demanded or the size of the consumer and producer surplus, after the provision of a government subsidy.

IB Docs (2) Team

IB Docs (2) Team