The role of foreign direct investment (FDI)

Introduction

Introduction

This page looks at the role that foreign direct investment plays in promoting economic development. Under the old syllabus this page was covered under unit 4.5.Enquiry question

How does direct investment from overseas MNCs impact on the level of development in an LEDC. Are Western consumers prepared to pay more for their consumer goods so that working conditions in LEDCs improve?

Lesson time: 2 hours (HL) plus 30 minutes for the paper two exercise if completed in class

Lesson objectives:

Lesson objectives:

Describe the nature of foreign direct investment (FDI) and multinational corporations (MNCs).

Explain the reasons why MNCs expand into economically less developed countries.

Explain the characteristics of economically less developed countries that attract FDI, including low cost factor inputs, a regulatory framework that favours profit repatriation and favourable tax rules.

Evaluate the impact of foreign direct investment (FDI) for economically less developed countries.

Teacher notes:

1. Beginning activity - begin with the opening activity, which asks the question, how big are some MNC's compared to smaller nations. (Allow 10 minutes in total)

2. Processes - technical vocabulary - the students can learn the background information from the videos, activities and the key terms which can be downloaded as a PDF. (Allow 5 minutes to read the key terms)

3. Investigation brain storm - students to investigate / discuss in groups some of the reasons why MNCs might invest in LEDCs - allow 15 minutes for discussion.

4. Focusing on the enquiry question - activities 4 and 5 focus on the enquiry question, the benefits and costs of globalisation. (15 minutes)

5. applying the enquiry question - case studies 6 - 8 focus on the MNCs Apple and Nike. Do those businesses provide net benefits or net costs to the MNCs were they operate? Should workers employed in those subsidiaries in LEDCs be paid more? (20 minutes)

6. Developing the theory - activity 9 focuses on the coffee market, which a number of LEDCs export. Many commentators believe that the world coffee market disadvantages LEDCs. (25 minutes)

7. Activity 10 - considers whether MNCs pay their 'fair share' of taxes when they operate in LEDCs? What actions can governments in LEDCs take to increase the amount of tax paid by the MNCs that they host. (15 minutes)

8. Group exercise - activity 11 - are MNCs immune from criticism and is their overall net contribution to the world positive or negative? (10 minutes)

9. Final reflection: paper two type question on MNCs and economic growth. (30 minutes if completed in class)

Key terms:

Multinational company - a company with manufacturing plants in different countries. MNCs provide direct foreign investment to different nations. They can be done by either setting up a manufacturing plant in a foreign country or merging / acquiring a domestic business in a foreign country. It might also be in the form of a partnership with a domestic business.

FDI - an investment in the form of a controlling ownership in a business in one country by an entity based in another country.

The activities on this page are included as a PDF file at: ![]() The role of FDI

The role of FDI

Activity 1: How big are MNCs

Corporation | Host country | Industry | Revenue 2021 (Bn) | Employees (000s) |

Walmart | USA | Retail | $ 559.41 | 2,300 |

| Amazon | USA | Retail, Information Technology | $365.82 | 1,640 |

Sinopec | China | Oil / gas | $ 414.65 | 619 |

| Apple | USA | Electronics | $ 365.82 | 154 |

Royal Dutch Shell | UK / Holland | Oil | $ 396.56 | 81 |

| China National Petroleum | China | Oil | $ 392.97 | 1,382 |

| Saudi Aramco | Saudi Arabia | Oil | $355.90 | 76.42 |

| BP | UK | Oil | $ 303.74 | 73 |

Toyota | Japan | Car production | $ 227 | 344.11 |

Glencore | Switzerland | Commodities | $ 221 | 181 |

Question:

Research the GDP of different nations and answer the following question:

If Walmart were a country, what rank would it be in terms of GDP, presume that GDP equates to sales revenue?

Activity 2: Why might an MNC invest in an LEDC?

Initial brainstorming activity: In groups describe some of the reasons why multinational businesses may choose to establish production plants in other parts of the world:

Access to the local market which might otherwise be impossible if that nation has high tariff barriers.

Developing nations such as Brazil, India and China have significant domestic markets that many MNCs wish to gain access to.

In some cases the MNC is able to take advantage of cheap labour and lower production costs in the host nation.

Some LEDCs offer a more business friendly environment in terms of greater restrictions on organised labour, as well as lower environmental regulations.

A nation may be rich in mineral resources such as oil and gas and need the assistance of MNCs to exploit those resources.

Many of the largest multinational companies are oil companies such as BP and Exxon (Esso), as well car companies (for example, Ford, Toyota, Nissan and Volkswagen). Other well-known companies such as Coca-Cola, IBM and Sony are also defined as being multinational.

Activity 3: FDI in Africa

The following two videos focus on FDI into Africa. The first explains some of the reasons why MNCs have chosen to invest in the continent and predicts a bright future for the continent and the second explains some of the reasons for the more recent slowing of investment flows into Africa.

And now for a more negative recent outlook.

(a) Explain initially why MNVs were attracted to investing in the Africa continent.

Over a 10 year period GDP has tripled, from a low base, but this suggests the potential for growth. In resource rich nations much of the investment is focused on resource exploitation while more developed markets in South Africa for instance, the large domestic market has attracted firms such as Walmart and Burger King.

Trading blocs such as the east African bloc has been of particular interest to MNCs.

(b) Based on the second video explain some of the reasons that many MNCs appear to be reluctant to invest in the African continent.

Relatively low expected growth rates on the continent

Lack of trade between African nations

High levels of corruption / perceived corruption

Political uncertainty

Security concerns

Poor infrastructure especially transport and power generation

Low levels of human capital.

(c) Illustrate the impact of falling investment on a suitable diagram.

This would be illustrated by either a left shift (inwards) in either LRAS or PPF, as the potential output of the economy is reduced.

Activity 4: The benefits and costs of MNCs in developing nations

Watch the following short video and then answer the questions that follow:

(a) What is the definition of a MNC according to the International Labour Organisation?

One that has its headquarters (management) in one nation but then operates in other nations.

(b) Where do the following MNCs have their headquarters: Sony, Amazon, IKEA, HSBC, Walmart.

Sony - Japan, Amazon - USA, IKEA - Holland, HSBC - London, Walmart - USA.

(c) Describe some of the benefits to an LEDC of hosting a MNC.

Firstly multinational companies provide much needed sources of capital. This is often in the form of new technology to the host nation. The MNC will also often provide skills and knowledge which the country is also lacking.

Just as with tourism another advantage of MNCs is that the introduction of MNCs helps to upgrade communication infrastructure in the area. The improved infrastructure can then also be used by local residents.

Local residents also benefit from increased employment opportunities. While many of these positions may well be low skilled and low paid, those positions still provide an improvement in living standards compared to other opportunities in the area.

The host country will gain tax revenue from profits generated by the MNCs activities, as well as tax revenues from income and additional sales taxes. This can then be used to balance public expenditure.

The presence of MNCs may also reduce prices and increase consumer choice for domestic residents. This may be of particular benefit to the middle class of the host country.

When multinational companies emerge in a location this can also encourage other local businesses to locate to area, increasing economic activity further.

(d) Why do investments from MNCs provide much needed capital into an LEDCs.

Many LEDCs suffer from an absence of capital as they have low savings ratios. As a consequence many LEDCs are forced to adopt very high interest rates to attract foreign capital and compensate for this savings gap. Direct investment flows can help fill this gap.

(e) What disadvantages can an MNC bring to a developing country?

Many MNCs have been accused of exploiting workers in developing countries by offering low wages and inferior working conditions. Many MNCs will bring in their own management teams and use domestic labour for only basic assembly tasks that require limited training.

Many companies are also encouraged to relocate in an LEDC because of favourable tax incentives so in reality the host nation may see little of the profits generated.

While MNC investment does improve transport and communications infrastructure (often built at the host nation's expense) this is often designed to serve only the direct routes required by the company and not necessarily to provide benefit to local businesses.

Many MNCs also have particularly poor records on pollution as well the safety of their workforce. Other MNCs have also been accused of ignoring the environment in their quest for profits.

Lastly, MNCs will also repatriate the profits made back to the host nation, meaning that the economic benefit to the host nation may be minimal, according to some economists.

(f) Why might competition for overseas investment leave an LEDC particularly vulnerable to exploitation.

Governments in many LEDCs will be aware that to attract FDI they will have to offer a business friendly environment, given the risks involved and this would tend to leave many host nations open to exploitation.

(g) Outline the role of CSR (Corporate Social Responsibility) on MNCs relationship with the host nation.

Many MNCs are keen to develop and publicise a positive image of their business. For this reason many large businesses positively promote ethical policies, outlining their commitment to human rights, employee conditions, pay and their impact on the environment.

(h) So on balance do LEDCs benefit from overseas investment.

There is near universal agreement as to the positive impact of MNCs on growth and development in Developing nations. However, there are concerns as regards the impact on sustainability. The overall impact ultimately depends on the type of investment as well as the ability of the host nation to regulate the worst excesses of the MNC.

Activity 5

Use the information from the following video to answer the questions that follow on the costs and benefits of globalisation.

(a) Explain some of the reasons for the growth in trade / globalisation in recent decades.

Improvements in technology and reduced tariffs, generally driven by the West.

(b) According to the video the route to market is a long one and often involves production in many nations. What role do LEDCs generally play in the supply chain and which parts are usually (still) completed in Developed nations.

Much of the low value added and labour intensive parts are completed in LEDCs with more creative and high value production parts completed in Developed nations. This is consistent with comparative advantage theory.

(c) Explain the analogy of the cookie monster, the monster that cannot eat but yet continues to gorge himself on food.

The video states that many of the products produced in LEDCs are consumed in the West, a part of the world with an insatiable appetite for cheap consumer goods which they do not need and barely use.

(d) Describe the main benefit of globalisation identified in the video.

Removing people out of poverty, perhaps hundreds of millions of them.

Activity 6: Investigating supply chains

Investigate a route for any product from raw material extraction to final product, e.g. Apple purchases components and materials from various suppliers around the world. These include raw materials from Mongolia, Australia and Africa. These are then shipped to the assembling plant in China and from there products are shipped directly to consumers via UPS and Fedex.

Activity 7: A focus on Apple

In July 2017, Trump told the Wall Street Journal that Tim Cook had made explicit promises. "I spoke to [Cook]," said Trump. "He's promised me three big plants - big, big, big... We're gonna get Apple to start building their damn computers and things in this country, instead of in other countries."

However several weeks later Cook seemed far less committed to the concept than in the (possibly imaginary?) conversation with the president. Asked to respond on the comments, Cook changed the subject and started talking about the jobs Apple has created in the US - in app development and related industries.

Explain the above dilemma from the standpoint of both the US President, Tim Cook and the US consumer / voter.

As a President Donald Trump would clearly love more US manufactured goods made in the USA and this is also popular with US voters (as expressed during the 2017 election). However, it is far from clear that they (the voters) would be prepared to pay higher prices for their consumer products and even less clear that the CEO of any business would voluntarily put their company at a disadvantage by producing products in a high wage country than a low wage one.

Rassweiler claims that making all of the iPhone's parts in the U.S. would push the price of the iPhone's components from $190 to around $600, adding $400 to the price of a phone.

Activity 8: A focus on Nike

Start with the following short video and then answer the questions that follow:

(a) The video highlights one of the criticisms of NIke (and many other MNCs operating in LEDCs), that of low wages and poor working conditions. Study the following table on a comparison of wages earned by Nike employees around the world and then comment on the validity of this claim.

| Nation | Employees | Monthly Nike wage $s | National minimum wage $s | Benefits |

| South Africa | 660 | 31 | 19.66 | Some health and transport |

| Egypt | 600 | 32 | 27.2 | Full health |

| Bangladesh | 14,120 | 36 | 21.7 | Some meals, housing and health assistance |

| Vietnam | 43,142 | 74 | 34.88 | Full meals and health |

| India | 16,071 | 76 | 44.71 | Some meals, housing and health assistance |

| Cambodia | 2,021 | 82 | 57.11 | Some health |

| Dominican Republic | 3,995 | 100 | 68.21 | Full meals, housing and health assistance |

| China | 175,960 | 109 | 62-100 | Full meals, housing and health assistance |

Hint:

Nike pays significantly above the minimum wage in all of its subsidiaries so the accusations of outright exploitation are clearly wide of the mark but still much lower than would be the case if the products were made in the USA.

(b) Are you (as consumer) prepared to pay more for your trainers?

Activity 9: The real price of coffee

Use information from the following video to answer the questions:

(a) Why is the production of coffee so PES inelastic?

Very long production (growing lines) of several years and government subsidies designed to provide security for farmers.

(b) Why does the video predict that coffee prices are set to rise much higher?

Political pressure to reduce or even remove government subsidies over time, rising demand levels and a largely fixed supply of land available for production - coffee production requires a specific climate and soil to grow.

(c) Illustrate the market for coffee on a supply and demand diagram and show the effect of the changes predicted in the video.

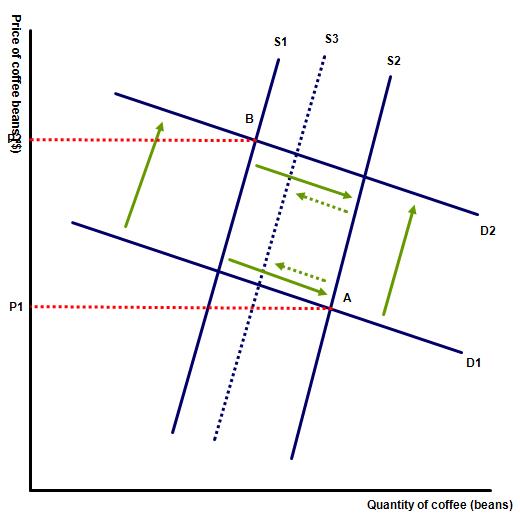

Note the low level of PES, with S1 representing the supply of the product without any subsidy, S2 the current situation and S3 the predicted supply if the level of subsidy is removed over time. Furthermore, the decrease in supply might be greater still if more individual coffee growers chose to walk away from their crop, as indicated in the video.

Note the low level of PES, with S1 representing the supply of the product without any subsidy, S2 the current situation and S3 the predicted supply if the level of subsidy is removed over time. Furthermore, the decrease in supply might be greater still if more individual coffee growers chose to walk away from their crop, as indicated in the video.

The video also suggests that demand for the commodity is likely to grow as the product is increasing in popularity, represented by D1 to D2 with the new price at P2.

As a result equilbrium will shift from A to B and a new price created of P2 (although the video is merely suggesting possible changes which cannot be guaranteed).

(d) Are you prepared to pay more for your coffee and how much?

Activity 10: Do MNCs pay their fair share of tax in LEDCs

(a) Watch the following short video and then answer the question above.

(b) What more can governments in LEDCs do to collect more tax revenue from MNCs?

Activity 11: Are MNCs immune from attack?

The following video suggests that MNCs have become immune from attack, with the profit motive taking priority over the social, environmental and human cost of globalisation. To what extent do you agree with this statement, consider from the viewpoint of the following stakeholders: consumers, workers employed in MNC subsidiaries, governments in LEDCs and structurally unemployed workers in the Developed world.

Hint:

Consider the tax revenue paid by MNCs

Low income families (in all parts of the world) whose real wages are increased by lower consumer prices

Local businesses in LEDCs unable to compete with cheap imported products

LEDCs such as China, South Korea e.t.c. who have benefited from inward investment

Reductions in absolute poverty rates throughout the world

Sustainability of development (pollution, inequality e.t.c.)

Unemployed factory workers in the 'rust belt'.

IB Docs (2) Team

IB Docs (2) Team