Are Cryptocurrencies the new Tulipmania?

Introduction

Introduction

This page investigates Tulipmania, an asset which gripped the country of Holland in the 1600s. Many experts have compared Tulipmania with the modern asset of Bitcoin, an asset which hit the headlines at the end of 2017, as a result of staggering gains in its price, making a number of early investors millionaires overnight.

Moving into 2018 and 2019, many new investors are now purchasing the crypto currency for the first time, hoping to make some of the spectacular gains made by early investors. This steady stream of new investors has increased demand for the asset but will the price continue to rise or is it simply a fad, destined to fail and leave many investors with losses?

Enquiry question

Are crypto currencies an example of a speculative good, whose value and popularity will continue to rise or is it a fad, destined for failure?

Lesson time: 50 minutes

Lesson objectives:

To relate the economic concepts of supply and demand to the cryptocurrency market, a topical issue.

Teacher notes:

1. Opening research activity - start with the beginning activity, which is based on three stories which made the headlines in 2018.

2. Processes - background reading - your classes should read the handout on Tulipmania, before completing the question which follows. In total the first two activities should take 15 minutes.

3. Research activity - attached to the class handout are activities three and four. Activity 3 asks the students to research the price of cryptocurrencies and answer the enquiry question which follows: Is Bitcoin here to stay?

4. Final reflective activity - starting with the question, is Bitcoin a fad? the final activity investigates the extent to which cryptocurrencies, either now or in the future fulfil the necessary requirements to be a legal form or currency or not? In answering this question students should compare Bitcoin with other forms of currency.

1. Beginning activity

1. Beginning activity

Research the following stories about Bitcoin millionaires, all from January 2018, when the cryptocurrency was the subject of daily headlines.

Firstly the story of American rapper 50 cent, who became an accidental multimillionaire, thanks to a long forgotten payment in Bitcoins, early on in the artists career. Available at: ![]() 50c

50c

Next the story of two twins who became billionaires after investing $ 11m of their payout from Facebook, only to see its price soar. Available at: ![]() Winkeloff Twins

Winkeloff Twins

Lastly, Mr Smith (not his real name), who has spent the next few years of his life to travelling the World on the $25 Million profit that he made from Bitcoin. Available at: ![]() Mr Smith

Mr Smith

When Tulips cost more than a house

When Tulips cost more than a house

Tulipmania was perhaps the first mega bubble which gripped the country of Holland in the 17th Century. A brief history of Tulipmania is described here.

Early on in the 1600s, a Flemish painter Jan Brueghel the Elder painted a small but beautiful painting of a bunch of cut flowers in a glass vase. Painted in oils it enhanced the brightness and intensity of the hues. The photograph to the right is a copy of the original painting.

Extremely popular in the small European nation, the flower began to be exchanged amongst friends. Shortly afterwards, as the popularity of the flower grew, bunches of tulips were traded for money and the market continued to grow throughout the early 1620s.

This period also coincided with the nation becoming wealthier and without a modern banking system to invest their savings, many wealthy merchants instead invested in the tulip, or rather the tulip bulb. The price of bulbs increased rapidly and in 1623, 10 particularly rare and beautiful bulbs were sold for 12,000 Guilders – considerably more than the value of a smart townhouse in Amsterdam.

As the price continued to rise throughout the 1630s more and more investors purchased the product, not because they liked flowers or even intended to use them, but instead as an investment in the expectation that the price would rise further.

In 1633 a single bulb of Semper Augustus was valued at 5,500 guilders and by January of 1637, the price had doubled again to 10,000 guilders. At this time ten thousand gilders represented around 30 years of wages for an average Dutch family and sufficient also to purchase a luxury house in the fashionable canal area of Amsterdam, complete with a 100 foot garden. During that month tulip mania reached its peak, with some bulbs being traded up to 10 times during the course of a single day.

In 1633 a single bulb of Semper Augustus was valued at 5,500 guilders and by January of 1637, the price had doubled again to 10,000 guilders. At this time ten thousand gilders represented around 30 years of wages for an average Dutch family and sufficient also to purchase a luxury house in the fashionable canal area of Amsterdam, complete with a 100 foot garden. During that month tulip mania reached its peak, with some bulbs being traded up to 10 times during the course of a single day.

Then suddenly in early February 1637, the market for tulips collapsed. This was because most speculators could no longer afford to purchase even the cheapest bulbs. Demand disappeared and flowers tumbled to a small fraction of their former value, resulting in bankruptcy for many investors.

Activity

Using demand and supply analysis identify two similarities and two differences between the market for tulips and the market for Bitcoin and other cryptocurrencies.

Similarities

Similarities

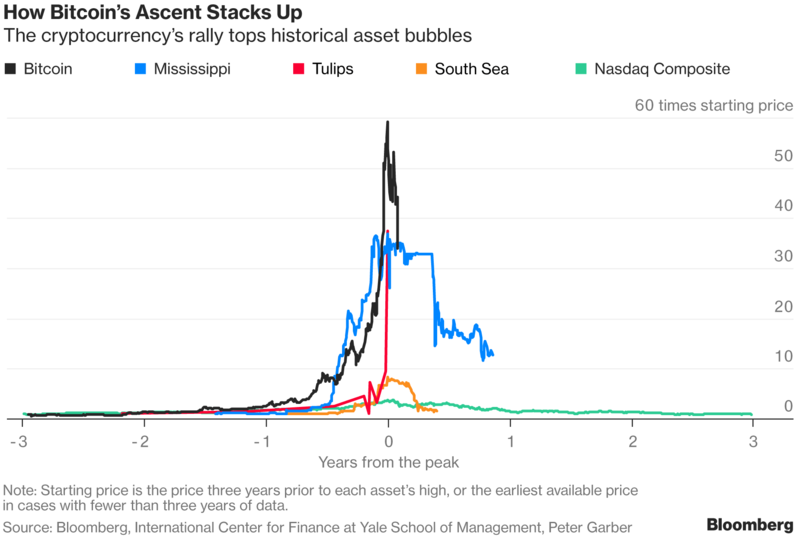

The one very obvious similarity is that Bitcoin and other cryptocurrencies are following a similar pattern that tulips and other bubbles have previously tread. The following chart identifies the classic Jean Paul Rodrigue standard bubble. According to this bubble chart Bitcoin would currently be in the middle of its Bull trap, a period characterised by a small recovery before the inevitable collapse in price.

Currently, as with Tulipmania many investors are purchasing the cryptocurrency for investment purposes, rather than any intention to use the coin. The currency still has very little actual uses and this is unlikely to change in the short term.

However, there are differences between the two markets. Firstly, Bitcoin, Etherium and other leading cryptocurrencies are largely fixed in supply, with the number of new coins issued strictly regulated. By contrast the supply of tulips was significantly more PES elastic as farmers could always grow more of the bulbs, forcing down its price.

Activity 3 Investigation

Investigate the price of Bitcoin at ![]() Coinbase or any of the other forms of crypto currency and observe the pattern in selling price between 2017 and 2019.

Coinbase or any of the other forms of crypto currency and observe the pattern in selling price between 2017 and 2019.

Between 1 January 2017 and 1 January 2018 Bitcoin rose by % 1,500, Litecoin (another form of crypto currency) by % 5,000 and Ethereum by % 15,000. In the same period the price of gold rose by a solid, if unspectacular % 11.75. Prices of all cryptocurrencies then fell throughout 2018 but still offered staggering returns for those investors wise enough to purchase their coins prior to 2017. By contrast, for those who invested in 2018, many will have made significant losses and will be hoping that the price of the asset rises so they can recoup the losses they incurred.

Activity 4: Is Bitcoin a fad?

Start by watching the following short videos and then answer the questions that follow:

And now for a different view:

Questions

1a. Evaluate the strengths and weaknesses of Bitcoin as a form of currency or as a method of purchasing goods and services.

The strengths of Bitcoin, highlighted in the first video, can be summarised as follows:

- Firstly, the technology itself is probably groundbreaking and others the potential for faster and cheaper payment systems than those currently operated by credit card companies or banks.

- The system is also entirely anonymous which appeals to a number of individuals, for instance philanthropic individuals wishing to make anonymous donations to charitable causes, or more cynically perhaps criminal organisations wishing to move their money around without detection.

- Unlike banks and credit card companies Bitcoin is a not for profit organisation which may provide customers with a cheaper way of making payments and money transfers.

- Using the coin is free and can be used without restrictions or regulations. The first video describes Bitcoin as allowing 'permissionless innovation'. The video compares the impact with the early versions of the internet which were primitive but eventually gave rise to companies such as Google and Facebook.

However as Professor Ross Anderson from the University of Cambridge explains, the coin also has weaknesses, e.g:

- Firstly the scale required for the currency to be used on a massive scale is considerable. For instance the second video highlights that already the processing power and internet speed required to make payments already makes it inaccessible in remote areas. One of the claims made by Bitcoin advocates is that it could open up access to payments in remote areas of the Developing world.

- Bitcon currently lacks the scale required to replace credit card or existing banking systems. For instance the current system processes transactions at a rate of approximately 1 per second. To replace existing payment systems would require speeds thousands times faster than this. This may become possible but then this would present the problems identified above (a problem of scale).

- Security, currently payment systems operate fraud recovery and customer service departments which are not available in Bitcoin. For instance if you lose or have your Bitcoin wallet stolen then the money is gone for ever and cannot be retrieved.

- Challenges recently highlighted in the media involving the risks of regulation by governments in China, South Korea and to a less extent the EU.

b. Complete the following table to explain the extent that Bitcoin can be considered a form of currency?

| Characteristic | Bitcoin | Artwork | Gold |

| Durable / portable | Yes | No | yes |

| Divisible | Yes | No | Yes |

| Convenient | Yes | No | Yes |

| Consistent | Yes as Bitcoin has an official price but this is currently very volatile | No | Yes |

| Must possess value in itself | No, the value derives only from the value that we place on it. | Yes | Yes |

| Limited in quantity | Yes, the supply is strictly limited | Yes | Yes |

| Accepted by all | Potentially yes | No | Yes |

c. Overall do you believe that Bitcoin is an asset currently worth investing in?

This is very difficult to say. For example, Nobel-winning economist Robert Shiller calls bitcoin a fad, comparing it to bimetallism in the 19th century. Similarly Warren Buffitt stated that he would not be investing in the crypto currency and warned anyone investing to be prepared to lose all of their investment.

By contrast, James Gorman, CEO of Morgan Stanley claimed that the currency had the potential to replace interbank transfers in the future. Similarly Cameron and Tyler Winklevoss, famously known for suing Mark Zuckerberg after claiming he stole their idea for Facebook invested $11 million of their payout into Bitcoin in 2013.

Available as a PDF file at: ![]() Tulipmania

Tulipmania

IB Docs (2) Team

IB Docs (2) Team