Components of aggregate demand

Introduction

Introduction

This section looks at the components of aggregate demand and how changes in one or more of the components - C, G, I or (X-M) will change the level of aggregate demand.

Enquiry question

What are the components of aggregate demand and how changes in one or more of the components - C, G, I or (X-M) will change the level of aggregate demand.

Lesson time: 85 minutes

Lesson objectives:

Lesson objectives:

Explain how the AD curve can be shifted by changes in consumption due to factors including changes in consumer confidence, interest rates, wealth, personal income taxes (and hence disposable income) and level of household indebtedness.

Explain how the AD curve can be shifted by changes in government spending due to factors including political and economic priorities.

Explain how the AD curve can be shifted by changes in investment due to factors including interest rates, business confidence, technology, business taxes and the level of corporate indebtedness.

Explain how the AD curve can be shifted by changes in net exports due to factors including the income of trading partners, exchange rates and changes in the level of protectionism.

Teacher notes:

1. Beginning activity - begin with the opening activity and allow 15 minutes for your classes to complete this and discuss it.

2. Processes - technical vocabulary - the students can learn the key concepts through the handout containing the activities. Allow 25 minutes to go these activities and discuss.

3. TOK - activity 8 contains two short questions which asks students to consider the relationship between wealth / perception of wealth and income (10 minutes)

4. Applying knowledge - activity 9 contains a short video and your students can use the information contained in the video to consider the impact of interest rate changes on the some relevant stakeholders. (10 minutes)

5. Applying knowledge - activity 10 contains a very short case study taken from the Guardian newspaper in June 2015, one year before the Brexit referendum. Have your classes read the short column and then either answer the questions individually or discuss as a class. This is an interesting discussion point, why when employment were at record high levels did the UK consumer appear reluctant to consume? (15 minutes)

6. Final reflection - complete this lesson by watching the short video, which focuses on AD in the UK economy. What were the driving forces behind the UK economy at the time of the news item? (10 minutes)

Key terms:

Key terms:

Aggregate demand - the total spending in an economy consisting of consumption, investment, government expenditure and net exports. This is calculated by the formulae: C+G+I+(X-M).

Private consumption (C) - spending by households on domestic consumer goods and services over a period of time.

Government spending (G) - public sector spending whether by national or local governments. This includes spending on public services such as health, education, public transport, defence and infrastructure projects.

Investment (I) - expenditure by firms on capital equipment and is an injection into the economy.

Net exports (X-M) - the value of exports (ie export revenues) - value of import (ie import expenditures).

Budget deficit - when total government expenditure exceeds it's revenue.

Budget surplus - when government revenue exceeds it's expenditure.

Beginning activity: A game to introduce the components of aggregate demand

To complete this game you will need to prepare the following:

On opposite sides of your classroom place the following posters: rise in AD and fall in AD. Then the two remaining walls place one poster which says 'increase' and on the last remaining wall place the word 'decrease'.

On opposite sides of your classroom place the following posters: rise in AD and fall in AD. Then the two remaining walls place one poster which says 'increase' and on the last remaining wall place the word 'decrease'.

Present each player with a component of AD card - private consumption, investment, government spending, exports and imports. Each person starts the game in the middle of the room, which represents the economy in equilibrium.

Steps of the game

1. Explain the rules of the game and then provide each student with a AD component slip.

2. Read through potential changes to macroeconomic conditions, e.g. a rise in interest rates, fall in income tax e.t.c. After you read each instruction, each player will initially move towards the wall labelled increase or decrease, if appropriate. After which the players must decide whether the net result of their movements will lead to a rise in AD or a fall?

Example 1 - a rise in interest rates would mean that the students representing C and I would move to the wall labelled 'decrease' and the students holding the G cards would remain in the centre of the classroom. Those holding either X or M cards would have to decide the likely impact of the rate rise on their own actions.

The game can be contained for as long or as short a period as appropriate and can be extended to include the impact of the changing macroeconomic conditions to changes in production costs (AS) as well as the cost of each cost of action, e.g. the impact on the budget deficit, external balance e.t.c.

The activities on this page are available as a PDF file at: ![]() Components of AD

Components of AD

Activity 1: Private consumption (C)

Activity 1: Private consumption (C)

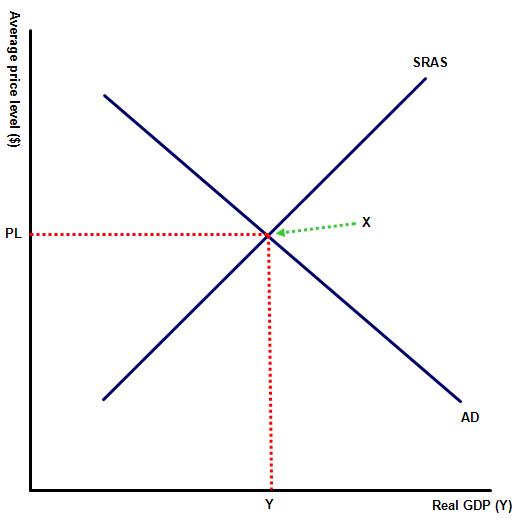

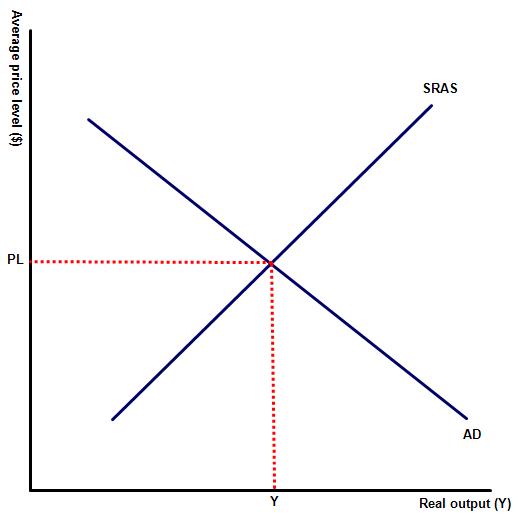

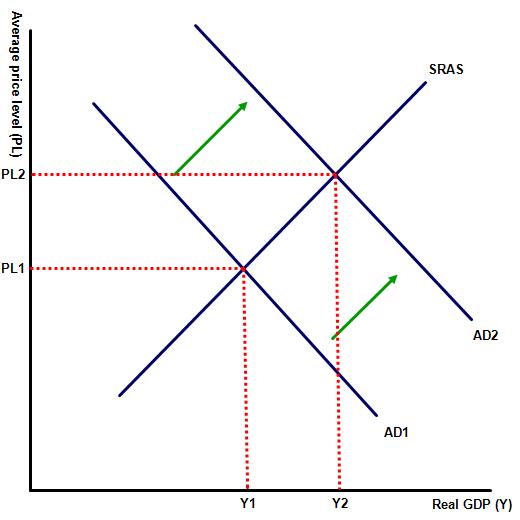

An economy experiences a rise in aggregate demand, as a result of a rise in private consumption (C) in the economy.

(a) Illustrate this on the diagram to the right.

(b) Explain some of the factors that may have led to a rise in spending levels within the economy?

Private consumption can be influenced by a number of different factors, the most significant are changes to income levels, changes in interest rates, changes in wealth as well as a change in expectations / consumer confidence or a change in personal circumstances due to indebtedness.

(c) Indicate the change in both price level and real GDP, resulting from the rise in AD

A rise in both variables.

(d) Explain the relationship between private consumption and the rate of interest in the economy?

.jpg) Private consumption and the rate of interest are inversely related. Many purchases of durable goods are made with borrowed money or at least partly with borrowed money. Therefore, lower interest repayments make it more affordable for consumers to purchase more goods and services.

Private consumption and the rate of interest are inversely related. Many purchases of durable goods are made with borrowed money or at least partly with borrowed money. Therefore, lower interest repayments make it more affordable for consumers to purchase more goods and services.

Lower interest rates also reduces the incentive for individuals to deposit their money in banks.

Activity 2: Government spending (G)

Watch the following short videos and then answer the question 'What contribution do governments make towards running a successful economy?'

And now for the opposing viewpoint, the video contains language that some may find offensive.

Hint:

The response to this question depends on the respondents political leaning. Those on the Right of the political spectrum will generally reject government involvement in the economy, claiming that it is wasteful and inefficient - and there are plenty of examples of failed government projects to support this view.

On the other hand there are sectors of the economy which the private sector simply cannot accommodate effectively and the health, education and transport sectors are probably examples of this. Those sectors provide essential public services which help run the economy more effectively, but not everyone can afford to pay for them. Funding for these merit goods can only realistically come from government funding and so the most effective economies involve the public and private sectors working together.

Activity 3: Budget surplus / budget deficits

Study the following table, which relate to 2022 and then answer the questions which follow:

Rank | Country | Revenues | Expenditures | Deficit/surplus | Deficit/surplus as a % of GDP |

1 | USA | 5,923,829 | 9,818,534 | (3,894,705) | (18.73) |

2 | China | 3,622,313 | 5,388,814 | (1,766,501) | (11.88) |

3 | Germany | 1,729,224 | 2,038,247 | (309,203) | (8.18) |

4 | Japan | 1,666,454 | 2,362,676 | (696,622) | (14.15) |

5 | France | 1,334,944 | 1,609,710 | (274,766) | (10.77) |

6 | UK | 966,407 | 1,400,776 | (434,369) | (16.36) |

7 | Italy | 863,785 | 1,103,721 | (239,936) | (12.98) |

1. Why might the leading countries be running budget deficits?

1. Why might the leading countries be running budget deficits?

The majority of the G7 nations have experienced relatively slow rates of economic growth in recent years. Therefore many will have seen a fall in tax revenues, while at the same time transfer payments in the form of welfare benefits will have risen as the level of unemployment rises.

2. What actions can a government take in order to correct their budget deficits?

In the short term it is very difficult to correct a budget deficit. Many nations can only raise taxes, or reduce spending levels at the beginning of the financial year. In extreme cases a government may introduce an emergency budget but this is extremely unusual. This means that any deficit will have to be financed by additional borrowing, a measure that will further increase borrowing costs. In the long run governments will need to reduce spending levels and / or raise taxation levels. This is particularly difficult when economic growth is slow, as Greece and Italy are currently finding.

Activity 4: Private investment (I)

Activity 4: Private investment (I)

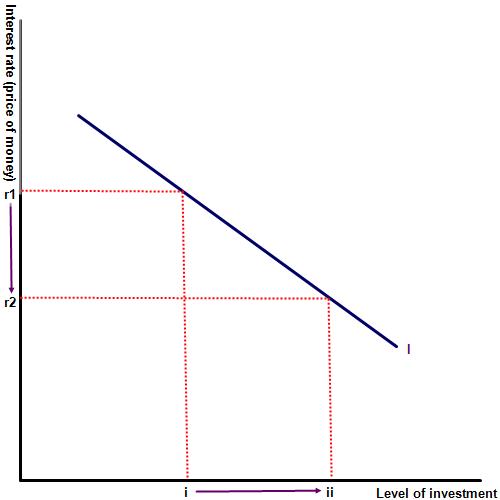

The diagram to the right illustrates the relationship between the price of money (interest rate) and the level of investment in the economy.

(a) Explain why the relationship between the two variables is inverse?

Many businesses will need to borrow at least some of the money required to purchase the capital they require. Therefore, when interest rates rise the cost of capital investment also rises.

Secondly, for those businesses that do not need to borrow the funds to finance their investment, the rate of interest represents the opportunity cost of any investment. In other words, the capital required to make any investment purchase could instead earn interest in the bank. Therefore, the higher the rate of interest that a firm receives on their savings the higher the opportunity cost of any investment.

(b) Suggest some other factors which might determine the level of investment in any economy.

Changes in national income, technological change, expectations / business confidence, corporation tax rates, the level of savings, availability of finance from banks and government policy - among others.

(c) Which of the following is not a type of investment?

- an individual placing their savings in the bank to collect interest

- an individual purchasing shares in a company in the hope of making a profit in the future

- a business purchasing a piece of machinery which is used in the production process.

The answer is the first one - an individual placing their savings in the bank. This is not considered investment as there is no risk element to the transaction, instead it is just called saving. This is what makes the rate of interest an important determinate of investment because saving and investment are effectively substitutes for each other.

Activity 5: The importance of investment

The following table which shows the level of investment as a % of gross domestic product and then answer the questions which follow:

| Country | Investment as a % of GDP | Average rate of economic growth 2005 - 2022 % |

| Greece | 12.7 | (1.0) |

| USA | 12.8 | 1.7 |

| EU | 17.8 | 1.0 |

| Thailand | 28.5 | 5.0 |

| India | 29.9 | 7.0 |

| Qatar | 30.6 | 13.0 |

| Belarus | 32.8 | 6.0 |

| China | 46.1 | 8.5 |

1. Using a piece of paper and graph paper plot the above data to show the correlation between the level of investment in an economy and the level of economic growth.

2. Discuss the extent to which the two variables are correlated and outline potential reasons why?

There is a clear correlation between the two variables but perhaps not a perfect correlation, suggesting that there are other factors which determine a nation's ability to create additional income. These include the quality of a country's factors of production and the strength of its legal, political and financial institutions.

Activity 6: Net exports (X-M)

(a) Complete the following sentence by adding in the missing words:

____________ are goods and services produced in one country and purchased by residents living in a different nation. By contrast, ________ are products produced overseas and purchased by domestic residents. Net exports therefore is made up of ________ minus ________ and is the fourth determinant of ___________ ___________.

Exports, imports, exports, imports,aggregate demand.

(b) What factors influence a nation's net exports?

A nation's productivity, trade policy, exchange rates, resource endowment, technology, foreign currency reserves, inflation, and consumer preferences - both at home and abroad.

Activity 7: Net trade

Study the following table and then answer the question which follows. All the information relates to 2022.

Nation | Exports M$ | Imports M$ | Net trade M$ |

China | 2,723,250 | 2,055,590 | 667,660 |

USA | 2,123,410 | 2,707,543 | (584,133) |

Germany | 1,669,994 | 1,131,857 | 538,137 |

Japan | 785,366 | 634,577 | 150,789 |

UK | 770,479 | 871,859 | (101,380) |

France | 733,165 | 769,225 | (36,060) |

Netherlands | 711,505 | 596,097 | 115,408 |

India | 676,200 | 710,200 | (34,000) |

1. Calculate the trade net trade balance for each country.

2. Which of the above nations should be concerned about the size of their net trade balance?

China, Germany, Netherlands and South Korea on the above list have a significant current account surplus (exports > imports) while the USA and UK head the list of nations with significant deficits. None of the four nations with surpluses will be overly concerned about their net trade surplus. China particularly has made the achievement of a high net trade surplus a central plank of economic policy.

China, Germany, Netherlands and South Korea on the above list have a significant current account surplus (exports > imports) while the USA and UK head the list of nations with significant deficits. None of the four nations with surpluses will be overly concerned about their net trade surplus. China particularly has made the achievement of a high net trade surplus a central plank of economic policy.

For the UK and USA particularly their trade deficits are much more worrying. A large net trade deficit will act as a significant drag on those economies. The deficits will have to be financed by purchases of foreign currency through either overseas borrowing or by the sale of assets, such as luxury housing and shares in domestic firms.

Activity 8: Link to TOK

Activity 8: Link to TOK

(a) Describe the difference between wealth and income? To what extent does a person's wealth or perception of wealth influence private consumption?

Hint:

Consumption decisions to a large extent are determined as much by a perception of wealth as they are actual disposable income. If a person feels wealthy and crucially feels confident about their future wealth prospects they are much more inclined to purchase high value luxury items such as a new car. This compounds the problems caused by recession or a slowdown in the economy.

(b) A family purchase a house in a fashionable area of their home city. They purchase it for $ 250,000 and three years later the houses in the area have risen by 30% to $ 325,000. Does this represent a rise in the households real wealth?

In pure monetary terms the family have earned $ 75,000 in profit over three years. However, in real terms the profit may be minimal because in order to cash in their profit they would need to sell their home. In this situation they would have nowhere to live and to purchase another property would also cost them 30 % more than it did three years ago.

Activity 9: Applying knowledge

Watch the following short video and then describe the impact of a rise in interest rates on the following stakeholders:

- a young couple wishing to purchase their first home

- firms which import a large proportion of the raw materials used in the production of their final product

- a retired couple with significant savings in the bank

- firms in the tourist industry.

As the video outlines the impact of a rise in interest rates on the housing market is significant and no more so than for young, first time buyers wishing to get on the property market. A rise in interest rates could reduce the ability of the couple to purchase a house as their income may no longer be sufficient to make the new (higher) mortgage payments.

On the other hand our retired couple, who probably own their home outright, rely on the interest they receive from their savings. They will welcome the higher return that they now enjoy on their savings.

Activity 10: Link to the assessment

Part (a)

Illustrate using an AD / AS diagram how a fall in interest rates can lead to a rise in national income in an economy. [10 marks]

Command term: Illustrate

Command term: Illustrate

Key terms to define: AD, AS, national income

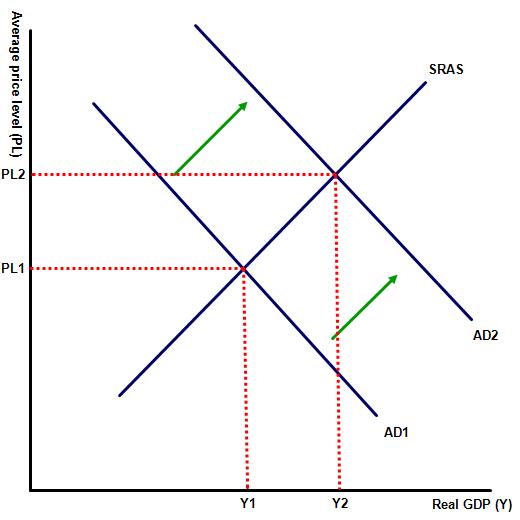

Aggregate demand is derived from the sum of private consumption, government spending, investment and net exports. A rise in any of these components will increase aggregate demand. When a nation reduces the rate of interest in an economy both consumption and investment levels are likely to rise. This is because lower interest rate will discourage saving and makes consumers likely to spend more of their disposable income. Disposable income levels may also rise as households see a fall in their mortgage and other debt repayments. In terms of businesses, a fall in interest rates should also boost spending on new machinery as the price of capital falls and the return on placing their surplus capital in banks falls, encouraging businesses to invest.

As consumption and investment are two of the components of AD a nation would expect to see a rise in economic activity, all other things being equal. This is represented on the diagram by a rise from Y1 to Y2.

Part (b)

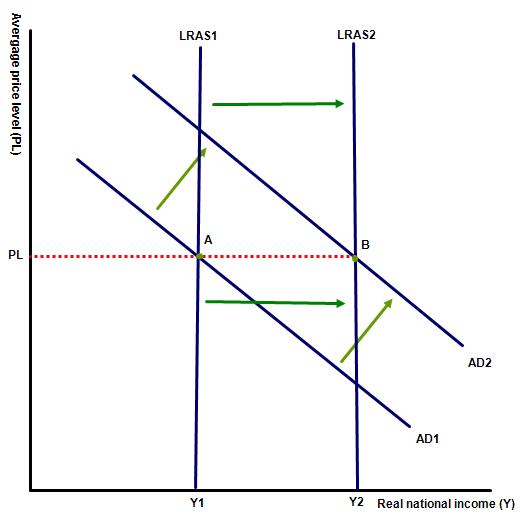

Using a real world example, evaluate the view that increased investment is the key to maintaining long term economic growth. [15 marks]

Command term: Evaluate

Key terms to explain: investment, economic growth

With the command term evaluate, responses must consider the extent to which this statement is true or not?

Real world examples might include nations such as S.Korea, China or Qatar that have seen high rates of investment resulted in high rates of economic growth.

Given the command term in this example the response needs to evaluate the role of investment in maintaining long term growth, i.e. how important to long term growth is sustained high investment levels.

As one of the components of aggregate demand, a rise in investment levels will increase AD levels, all other things being equal. This is illustrated on the diagram by a rise from AD1 to AD2.

At the same time greater levels of investment would also increase the productive capacity of the nation through a rise in the quantity and or quality of the factors of production, illustrated on the graph by the rise from LRAS1 to LRAS2. Investments in physical and human capital have a track record of successfully maintaining high rates of economic growth in a nation, represented on the diagram by a rise in national income from Y1 to Y2.

A good example of this being China that has consistently maintained a very high level of investment relative to GDP and witnessed spectacular growth rates as a result. Other nations that have diverted significant resources towards investment e.g. South Korea and Japan have also enjoyed significant high rates of economic growth.

Responses also need to recognise that while investment is important in determining growth other factors are also significant and that high level of investment are insufficient on their own. Other factors would need to be considered such as the strength of a nation's institutions and access to natural resources. Responses should also recognise that the type of investment is also important with investments in human research being perhaps the most effective.

Responses could end with a consideration of which comes first growth or investment - do high levels of

investment cause economic growth, or does high levels of growth stimulate higher levels of investment.

IB Docs (2) Team

IB Docs (2) Team