John Maynard Keynes

Lesson notes

Lesson notes

This lesson contains information on Keynes, the man himself. I believe that this is a good time in the syllabus to provide a biography of the man's work but similarly there may also be teachers who prefer to introduce this earlier in the syllabus, before they focus on the AD / AS sections of the course.

Beginning activity

Consider the following, your economy is in recession - wages and prices are falling. Each day more workers are laid off and the economy is caught in a downward cycle. Many workers either unemployed or in fear of losing their job, and naturally many are reluctant to make any significant purchases, forcing down aggregate demand in the economy further. Investors, for their part are now reluctant to invest in new machinery or more staff.

Start by illustrating the above on a suitable diagram.

Hint:

You should have drawn either an AD / AS diagram with a fall in AD and a recessionary gap or a PPF diagram, showing the economy moving to a point inside of the PPF curve.

In classical economic theory economists believe that in such a situation the economy will naturally correct itself but how long will this take? How long did the following recessions take before the economy fully recovered?

- the early 1980s recession

- the early 1990s

- the great recession of 2007, sometimes called the financial crisis.

In each case the economy took around 5 - 6 years to recover and it for this reason that Maynard Keynes encouraged governments to abandon convention economic theory and instead spend big to save a troubled economy. His theory was simple, forget waiting for the economy to recover, because in the long run we are all dead and instead when private sector consumption and investment is falling governments should increase their own public spending in order to compensate.

Watch the following short video, from the previous page, which describes the life and theories of the great man, John Maynard Keynes before reading the section below:

John Maynard Keynes (1882 - 1946)

John Maynard Keynes (1882 - 1946)

Maynard Keynes was a British economist whose ideas on government manipulation of aggregate demand made him perhaps the most influential macro economist. His theories have also been widely used by governments, most recently following the financial meltdowns of many economies in the period after the 2008 banking collapse.

One of the most influential men of the 20th century, his ideas are the basis for the economics school known as keynesian economics and its various offshoots today. He was voted one of the 20 Great Britons by the British Public and by Time Magazine as one of the top 100 most influential people of all time. The Economist magazine described him as ‘Britain's most famous 20th century economist’.

Lord Maynard Keynes whose thesis statement the Quantity Theory of Money challenged conventional Economic Theory and formed the basis of Economics from the Great Depression until the Oil crisis of the 1970's and again post 2008.

Prior to the 1930's, conventional economic theory stated that all governments should adopt a ‘laissez faire’ approach to economics, allowing market forces to determine economic cycles. Keynes, however, spearheaded an economic revolution, arguing that aggregate demand determined the overall level of economic activity and that inadequate aggregate demand led to periods of high unemployment.

Prior to the 1930's, conventional economic theory stated that all governments should adopt a ‘laissez faire’ approach to economics, allowing market forces to determine economic cycles. Keynes, however, spearheaded an economic revolution, arguing that aggregate demand determined the overall level of economic activity and that inadequate aggregate demand led to periods of high unemployment.

Keynes rejected the conventional wisdom that the ‘boom and bust’ cycles of the economy were inevitable and out of the governments ability to control. He advocated the use of fiscal and monetary measures to reduce the adverse effects of slow downs in the economic cycle. He argued that in recession when GDP activity is slow, consumption falls which leads inevitably to rising unemployment levels. Workers who are then out of work or in fear of losing their jobs will then cut back on consumption, hitting company profits further, leading to further falls in investment, employment and consumption. Keynes believed that it was up to governments to stimulate demand levels back up by raising their own  spending levels to compensate for any gap in private consumption. Once consumer confidence and investment levels have returned Keynes then argued that the (borrowed) money could be paid back out of higher tax revenues.

spending levels to compensate for any gap in private consumption. Once consumer confidence and investment levels have returned Keynes then argued that the (borrowed) money could be paid back out of higher tax revenues.

Keynes died in 1946; but, during the 1950's and 1960's, the success of his economic policies meant that almost all Western governments adopted his policies, leading to the term keynesian economics which became a byword for any economic policy objective which involved using government stimulus to diminish the impact of a recession.

During the 1970's, when a series of economic shocks, caused in part by rising oil prices, began to affect most Western economies, his influence was reduced. Many governments rejected his policies and instead adopted less interventionist policies. This was particularly true in America where a series of leading economists such as Milton Freedman rejected the notion that governments could regulate the business with fiscal policy.

However, with the advent of the global financial crisis in 2007 / 2008, the American and European governments once again turned to his theories to rescue their economies from the damage caused by the global financial crisis. President George W. Bush of the United States, Prime Minister Gordon Brown of the United Kingdom, and other heads of governments adopted aggressive stimulus packages to rescue their economies.

Available as an editable worksheet at: ![]() John Maynard Keynes

John Maynard Keynes

Link to the assessment in paper one

An example of a relevant paper one question includes:

Part (a)

Explain two factors that might lead to increased levels of economic growth in an economy. [10 marks]

Command term: Explain

Command term: Explain

Key terms to define: demand side policies, supply side policies, fiscal policy, monetary policy, economic growth

Economic growth maybe a result of increases in aggregate demand in the economy, through either expansionary fiscal or monetary policy or an increase in aggregate supply, leading to improvements in the quantity and quality of the factors of production.

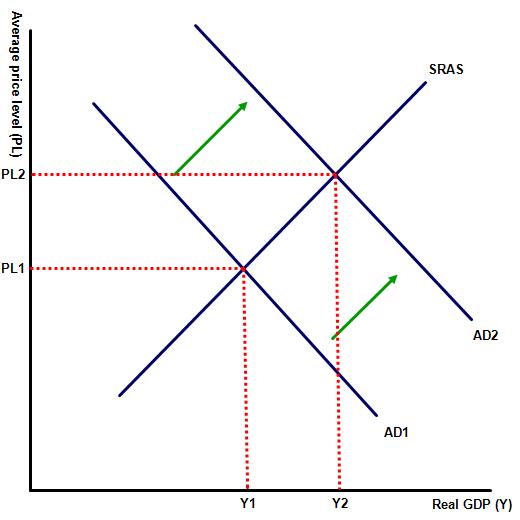

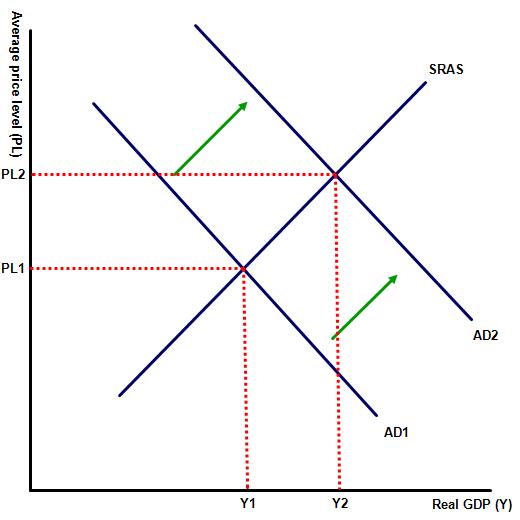

An increase in aggregate demand is represented by diagram 1 illustrating a rise in aggregate demand from AD1 to AD2 and a new equilibrium showing a rise in real GDP from Y1 to Y2.

Examples of factors that can increase economic growth through rises in aggregate demand, e.g. a rise in government spending or private consumption, investment or an increase in net exports.

Examples of factors that can increase economic growth through rises in aggregate demand, e.g. a rise in government spending or private consumption, investment or an increase in net exports.

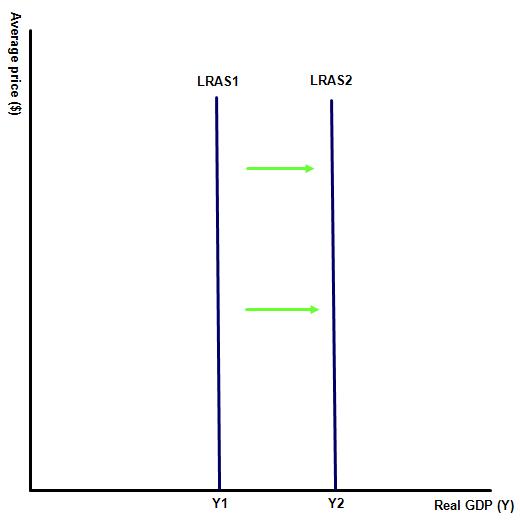

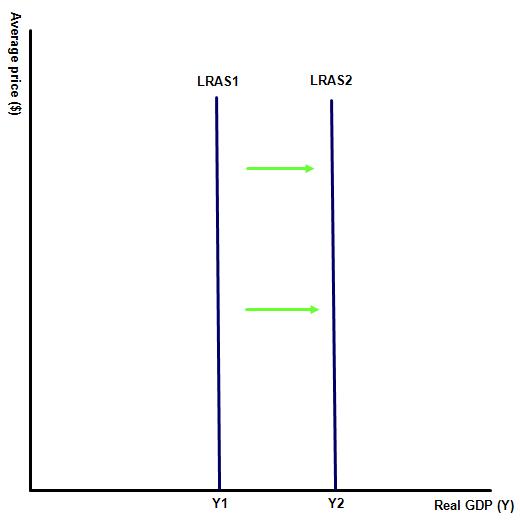

Diagram 2 shows a rise in real GDP from Y1 to Y2 brought about by a rise in the long run aggregate supply curve from LRAS to LRAS2.

Examples of factors that increase economic growth through rises in aggregate supply include increased levels of investment and / or improvements to physical, human and natural capital; rises in productivity or an increase in the size of the labour force through changes to labour laws.

Part (b)

Using real life examples, evaluate the view that demand-side policies are the most effective method of increasing the level of national income. [15 marks]

Command term: Evaluate

Command term: Evaluate

Key terms to define: demand side policies, supply side policies, fiscal policy, monetary policy, economic growth

The question requires a response which considers both demand and supply-side policies and describes how effective each is in increasing the level of national income. Responses must consider both arguments in support of this statement followed by counter arguments.

Responses should also include the following:

A recognition that demand side policies can be divided into fiscal and monetary policies, with an explanation that expansionary demand-side policies can increase the level of national income / economic growth by increasing one or more of either C, G, I or X, illustrated on the diagram by a rise in AD from AD1 to AD2 and an increase in real national income to Y2. Examples of different monetary and fiscal demand-side policies which might be effective include cuts to taxation, an increase in government spending, lower interest rates or quantitative easing.

The response should then consider the disadvantages of demand-side policies, including time-lags, inflationary pressure, increased government debt, increased imports or crowding out.

Responses should then discuss alternative policies that may be used to increase economic growth e.g. supply side policies. Examples of supply side policies that may be effective in raising national output include improvements to infrastructure, investments in human capital as well as increased spending on research and development. This can be illustrated by an AD/AS diagram, showing a right shift in the LRAS curve from LRAS1 to LRAS2 or on a PPF diagram by a right shift in the PPF curve.

Responses should then discuss alternative policies that may be used to increase economic growth e.g. supply side policies. Examples of supply side policies that may be effective in raising national output include improvements to infrastructure, investments in human capital as well as increased spending on research and development. This can be illustrated by an AD/AS diagram, showing a right shift in the LRAS curve from LRAS1 to LRAS2 or on a PPF diagram by a right shift in the PPF curve.

Responses should also consider some of the disadvantages of governments using supply-side policies, e.g. the time-lags for the policy is effective, the cost of large scale investment projects and the uncertain effectiveness of lowering taxes.

Real world examples that might be used could include Japan and USA. Following the financial crisis of 2007-9, the USA adopted very aggressive expansionary demand side policies and the economy benefited as a result. By contrast Japan has adopted similar expansionary demand side policies but their economy remains stuck in a recessionary cycle - and with significant higher national debt levels as a result.

The command term evaluate also requires a conclusion which considers the impact of both supply and demand side policies in the short-term versus the long-term consequences and the impact on different stakeholders.

Student discussion point

Divide your class into two groups who will each have 5 minutes to argue one of the following two statements. At the end provide feedback to each group and have each member of the class vote on which of the arguments are most convincing.

Statement 1: In a period of recession or sluggish economic activity, keynesian stimulus packages offer the best policy for a government to employ?

Statement 2: Keynesian stimulus packages will not be effective in improving the state of the economy?

Hint:

The students should consider both the advantages and disadvantages of keynesian demand side policies, as well as their short and long term impact on the economy. Responses which state that keynesian demand side policies will be ineffective in the long run should also provide an explanation of alternative policies, such as supply side policies. Supporters of keynesian demand side policies must address the effect of the multiplier as well as the impact on public sector debt.

Additional information about the great man is available at: ![]() 7 things you didn't know about Keynes

7 things you didn't know about Keynes

IB Docs (2) Team

IB Docs (2) Team