Relationship between the PLC, investment, profit & cash flow

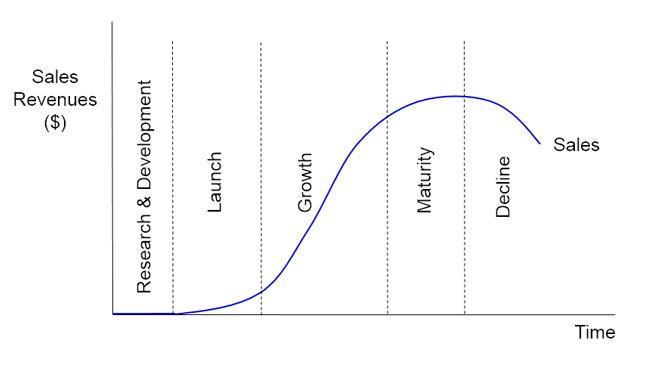

The product life cycle (PLC) is a model that shows the different stages that products typically go through from their research and development stage to their final withdrawal from the market. The phases in a product's life cycle (illustrated above) will have a direct influence on how much the business chooses to invest in the profit, as well as affecting the firm's profit and cash flow. These relationships are explained below.

However, it is important to first clarify the meanings of investment, profits, and cash flow.

In Business Management, the term investment refers to the purchase of fixed assets (such as equipment and machinery), with the intention of creating a financial return (profit) in the future. It is therefore often referred to as capital expenditure. Investment in a product often requires a large initial amount of cash (for example, to purchase the machinery needed for production), so this can have a negative impact on the organization’s cash flow. However, in the long term, the investment in the product may generate a profit for the organization, and improve its net cash flow (or its working capital).

Profit is the financial return from the trading activities of a business. It is found by total sales revenue of the product minus the total costs of production and related costs of the product. Hence, the formula for calculating profit is:

Profit = Total revenues – Total costs

Cash flow is not the same as profit because a profitable business can still face liquidity problems. This is because profit is declared if total sales revenues exceed total costs, whereas cash flow refers to the actual movement of money in and out of the organization. The timing of these cash flows depends of the product’s working capital cycle, so whilst it might be profitable, the firm can still experience cash flow issues.

In the short term, investment expenditure will negatively affect the firm's cash flow and its profit due to the higher costs involved. However, in the long term, capital expenditure used to fund a product, such as extension strategies, can improve the firm's cash flows and increase its profits. The challenge for managers is to strike the right balance between capital expenditure and revenue expenditure. This will largely depend on the various stages in the product's life cycle, as explained below.

(1) Research and Development (R&D)

.jpg)

Research and development (R&D) is the first phase in the PLC which involves investigating, designing, and developing a product before it is launched in the market. For most products, this phase is highly time consuming. The firm is likely to spend money on prototypes (trial products) as well as extensive market research in order to determine the probability of success of launching the product.

Test marketing will usually take place during this phase, which will also negatively influence profit and cash flow, which involves trialling the new product with a select group of customers to get constructive feedback and to make any necessarily changes prior to a launch. Hence, during this expensive phase of the PLC, investment expenditure is high and without any sales revenue, both profit and net cash flow will be negative.

(2) Launch (introduction)

Launch is the phase in the PLC that involves a product being introduced in the market. Most customers are not aware of the new product, so advertising and promotion are needed to boost and sustain sales. It also requires detailed marketing planning, further adding to the costs of investing in the product.

Sales will be relatively low during the launch phase because most customers will not necessarily be aware of the product’s availability. At the same time, costs will be high due to the spending needed to raise product awareness and to generate public interest. Examples include the costs of promotion and distribution. Therefore, the product is unprofitable during the launch stage of its life cycle, so the business is likely to experience negative cash flow.

(3) Growth

Growth is a phase in the PLC when sales revenue increases as the product becomes established in the market and the business gains market share. Competitors are likely to enter the market at this stage.

During stage of the product’s life cycle, sales revenue can increase quite rapidly. Growth occurs partly due to the spending on effective promotional strategies and distribution channels so that customer can purchase the product conveniently. The growth in sales revenue helps to improve the firm's cash flow position as well as profits.

(4) Maturity

Maturity is a phase in the PLC when sales revenue peak or plateau, as sales growth slows down and the business competes with its rivals in the market.

During this phase, sales revenues continue to increase although at a slower rate, especially if competitors have entered the market. During the maturity stage of the PLC, the business may have established market share as sales revenue will be near or at its peak. Both cash flow and profit will therefore be highly positive.

(5) Decline

Decline is the final phase in the PLC when sales revenue continually fall, leading to the eventual withdrawal of the product from the market.

During the decline phase, there is lower demand for the product, caused by changing consumer spending habits and preferences, as well as new replacement products being available on the market. Therefore, sales revenue, cash flow, and profit of the existing product will all fall during the decline phase. Investment for the product, including promotional expenditure, is discontinued.

The above relationships between the product life cycle, investment, profit, and cash flow are summarized in the table below.

The relationship between the PLC, investment, profit, and cash flow

Stage in the PLC | Level of | Level of profits | Cash flow position |

Research & Development | Extremely high | Loss | Highly negative |

Launch | Relatively high | Minimal, if any | Negative |

Growth | Moderate | Rising profits | Positive |

Maturity | Low | High | Highly positive |

Decline | Minimal, if any | Falling | Less favourable |

Business Management Toolkit

Discuss how Ansoff’s growth strategies can extend the life cycle for a product of your choice.

Be prepared to share your findings with the rest of the class.

Business Management Toolkit (HL only)

Explain how contribution analysis can be used to assist decisions about a firm’s product portfolio.

How might knowledge of contribution improve a firm's decisions about investments and therefore improve its profits and cash flow?

Return to the Unit 4.5 - The seven Ps of the marketing mix homepage

Return to the Unit 4 - Marketing homepage

IB Docs (2) Team

IB Docs (2) Team