Strategies for dealing with cash flow problems

“A little leak will sink a great ship.” - Portuguese Proverb

Cash flow problems arise when an organization has insufficient funds to run its business, i.e. when net cash flow is negative. Such problems can arise due to internal reasons (such as poor cash flow management) and external factors (such as changes in consumer preferences and tastes).

Examples of causes of cash flow problems include:

A lack of financial planning resulting in sales revenue being lower than expected

Poor credit control, which can lead to bad debts (debtors who are unable to pay for their purchases that have been bought on trade credit)

Poor cost control, resulting in costs of production being higher than budgeted

Poor inventory control, resulting in overstocking of products (which have cost money to purchase but have yet to be sold to customers)

Overtrading, i.e. the firm expanding too fast, which increases cash outflows, but not necessarily with the cash inflows

Seasonal fluctuations in demand for the firm’s goods and/or services

Unexpected events, such as a crisis or unforeseen costs that arise rapidly.

There are three general ways for an organization to improve its cash flow position: strategies to reduce cash outflows, strategies to increase cash inflows, and strategies that seek additional sources of finance.

1. Strategies to reduce cash outflows

Possible strategies to reduce cash outflows include:

Negotiate with creditors and suppliers to improve trade credit terms. Securing a longer credit period helps to delay cash outflows.

Pay for purchases of goods and services on trade credit, rather than using cash.

Opt for leasing capital equipment instead of purchasing such assets. Although this reduces the organization’s net assets on its balance sheet, it can provide much needed liquidity for the firm.

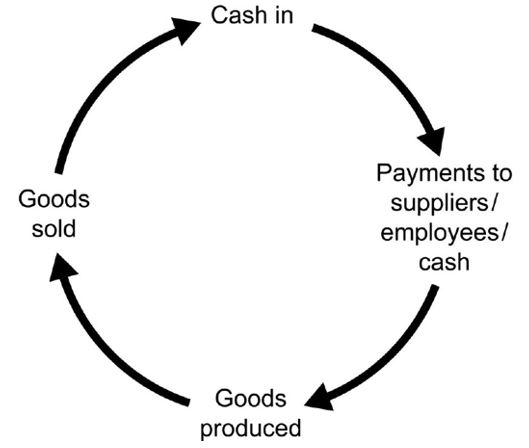

Reducing stock levels (inventories), as this can reduce cash outflows needed to pay for purchasing stocks. This is particularly important for organizations with a long working capital cycle.

Shortening the working capital cycle can improve cash flows

2. Strategies to increase cash inflows

Possible strategies to increase cash inflows include:

Raising prices of the products the business sells that have few substitutes or a high degree of brand loyalty. Loyal customers are not overly sensitive to higher prices, so this earns a greater profit margin for the business.

Reduce prices of the products the business sells that have a high degree of competition. This can help to attract customers from rival firms.

Reducing the credit period helps to improve the cash flow cycle, because customers buying on credit pay within a shorten time period. However, some customers may be unhappy about having to pay earlier, so may seek alternative providers that offer better credit terms.

Encourage debtors to pay their invoices early by offering discounts. This shortens the working capital cycle.

Improved marketing strategies to attract customers, raise brand awareness, boost sales and develop customer loyalty.

Use a debt factoring service to chase up outstanding debtors.

Although debt factoring has been explicitly removed from Unit 3.2 (external sources of finance) in the new syllabus (first exams 2024), it can still be useful to know this in the context of strategies for dealing with cash flow problems.

3. Strategies to seek additional sources of finance

Possible strategies to seek additional sources of finance include:

Businesses will often rely on bank overdrafts or bank loans as additional finance when faced with a liquidity problem. These external sources of finance can help the business during times of negative net cash flow, or when it experiences a negative closing balance. However, external finance incurs interest repayments, which can harm cash outflows.

Secure finance from sponsorships, donations or financial gifts. This can help to boost cash inflows, thereby improving the cash flow position. However, these sources of finance are not easily accessible to most businesses.

Selling shares in a limited liability company in order to raise additional sources of finance. Whilst this could bring in additional cash, it can be an expensive operation, and such option is not available to sole traders and partnerships.

In the worst-case scenario, an organization could sell its fixed assets to raise additional finance. For example, the business could sell off its underused or out-dated assets. In June 2020, British Airways decided to sell some of its multi-million-dollar art collection in order to raise cash to help it get through the crisis caused by the coronavirus pandemic.

Top tip!

When answering exam questions about how an organization can improve its cash flow position, avoid generic statements such as improving cash inflows, reducing cash outflows, or looking for alternative finance. Context is important, not just content. Make sure you write your answers in the context of the case study.

You may find this poster useful as a revision tool or classroom poster display. It has been created by Reshmika S V who studies at Chinmaya International Residential School, India. Many thanks for Reshmika and her teacher Rashmi Unnikrishnan for sharing this with the InThinking community!

Return to the Unit 3.7 - Cash flow homepage

Return to the Unit 3 - Finance and accounts homepage

IB Docs (2) Team

IB Docs (2) Team