Profit & loss account

"Money can't buy happiness but it can make you awfully comfortable while you're miserable"

- Clare Boothe Luce (1903 - 1987), American author and politician

The profit and loss account shows a firm’s profit (or loss) after all production costs have been subtracted from the organization’s revenues, each year. It is also known as the statement of profit or loss or income statement. The prescribed IB format for the profit and loss account for profit-making entities is shown below:

Format of the P&L account for a for-profit organization

Statement of profit or loss for (Business name), for the year ended (date)

$m | |

Sales revenue | 700 |

Cost of sales | (350) |

Gross profit | 350 |

Expenses | (200) |

Profit before interest and tax | 150 |

Interest | (10) |

Profit before tax | 140 |

Tax | (25) |

Profit for period | 115 |

Dividends | (35) |

Retained profit | 80 |

Source: adapted from Business Management guide, page 59 (May 2022)

Note: If using or referring to old exam papers and mark schemes (final exams 2023), please note that the above prescribed format may result in different figures and answers. For example, the term "net profit" is no longer used throughout Unit 3 of the syllabus. Hence, use resources for the previous syllabus with some caution.

Teachers can also download a poster showing the format of the profit and loss account by clicking the icon below.

This poster has been created ans shared by IB educator Maria Pardo, who teaches at American School of Valencia in Spain. Many thanks for sharing this on InThinking, Maria!

Sales revenue is the money an organization earns from selling goods and services. It can also include other revenue streams.

Costs of sales (COS) are the direct costs of production, such as the cost of raw materials, component parts, and direct labour. COS are also known as cost of goods sold, i.e., the cost of production paid by the business for the goods and services that it sells. The formula for calculating COS is: Opening stock + Purchases – Closing stock.

Gross profit refers to the profit from a firm’s everyday trading activities. It is calculated by the formula: Sales revenue – Cost of sales.

Expenses are a firm’s indirect costs of production, e.g. rent, management salaries, marketing campaigns, accountancy fees, bank interest charges, travel expenses, utilities, repairs and maintenance, and general insurance. Note that both interest and tax are not included in this section of the P&L account, despite being expenses. This is because both interest and tax costs that the firm has no control over as interest rates and tax rates are determined by the government. By excluding these expenses in this part of the P&L, it is easier to make historical, inter-firm and international comparisons.

The profit before interest and tax section of the P&L shows the value of a firm’s profit (or loss) before deducting interest payments on loans and taxes on corporate profits.

The profit for period section of the P&L account shows the actual value of profit earned by the business after all costs have been accounted for, i.e., profit after interest and tax. The profit (after interest and tax) belongs to the owners of the business, so can then be distributed between the shareholders/owners and/or bee kept in the business as a source of internal finance.

Tax refers to the compulsory deductions paid to the government as a proportion of a firm’s profits. In the above example, corporation tax is 10% of a company’s profits.

Dividends are the payments from a company’s profit (after interest and tax) paid to the shareholders (owners) of the company. The amount of dividends paid to shareholders as a whole is determined by the company’s board of directors. The amount of dividends paid to an individual shareholder depends on the number of shares held by the individual.

Any funds left over from profits (after interest and tax) that is not paid to shareholders is kept within the business for its own use. This is called retained profit. It is a vital internal source of finance for most businesses.

Note: Where profit and loss account is given in case studies or examination questions, it will be presented in the prescribed format shown above. Students need to be familiar with this layout, which is not provided as a template in the formula sheet. Despite various names for this set of final accounts, the term to be used in IB assessment in the presentation of the profit and loss account (or income statement) is statement of profit or loss.

The IB also uses a prescribed format for the profit and loss account (income statement) of non-profit business entities, as explained in the video below:

Prescribed format of the P&L account for a non-profit organization

Statement of profit or loss for (name of NPO), for the year ended (date)

$m | |

Sales revenue | 700 |

Cost of sales | (350) |

Gross surplus | 350 |

Expenses | (200) |

Surplus before interest and tax | 150 |

Interest | (10) |

Surplus before tax | 140 |

Tax | (0) |

Surplus for period | 140 |

Retained surplus | 140 |

Source: adapted from Business Management guide, page 60 (May 2022)

Top tip!

Notice the prescribed format for the P&L account uses the term "profit" for-profit entities and "surplus" for non-profit entities. This is simply because profit belongs to the owners of for-profit organizations, such as entrepreneurs and shareholders, who are legally entitled to a share of any profit earned by the business. By contrast, in non-profit organizations, any financial surplus is kept within the business for its operations, rather than distributed between shareholders.

These differences are shown in the table below.

For-profit entities | Non-profit entity |

Gross profit | Gross surplus |

Profit before interest and tax | Surplus before interest and tax |

Profit before tax | Surplus before tax |

Profit for period | Surplus for period |

Retained profit | Retained surplus |

One other important difference to note is that dividends are not recorded in the P&L for non-profit entities. This is because dividends are distributed to owners of for-profit businesses as a financial reward for their investment in the limited liability company.

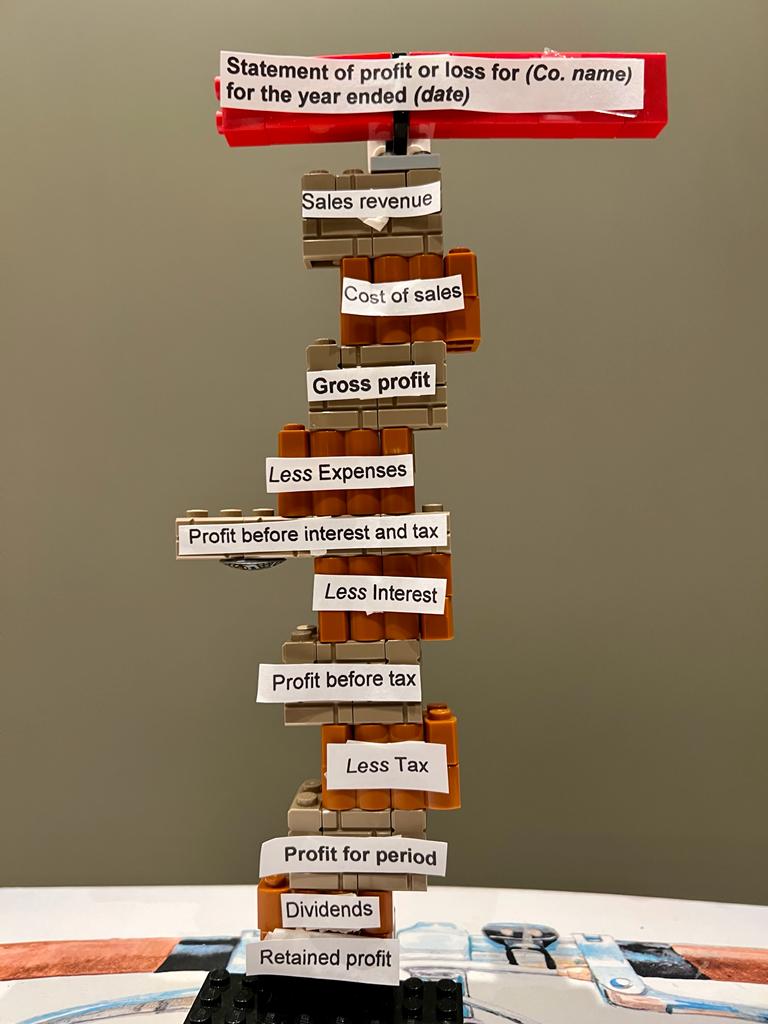

ATL Activity (Communication and Thinking skills) - Lego Profit & Loss Accounts

Here's one of my students' favourite activities for the Finance and Accounts section of the syllabus. Each group will need a set of Lego bricks with the various components of the Profit & Loss account stuck to the bricks. Students should work in groups of 2 - 3 and construct the P&L account by stacking Lego bricks in the correct order.

The first group to get the Lego bricks in the correct order is the winning team; but support each group to ensure they get the answer (the correct order of constructing the P&L account).

Here's an illustrative example, using the IB's prescribed format for the statement of profit or loss (photo from a recent IB Workshop):

The photos below have been shared by IB educator, Adam Whiting, with his students at King George V School, English Schools Foundation, in Hong Kong.

Profit and Loss account Hexagons

If you don't have access to Lego blocks, then try this idea from Rachel Proffitt, who teaches at the International School of Prague.

Rachel gives her students large yellow hexagons with the various components of the Profit and Loss account. These are given in a mixed order. Students work in teams to get each item in the correct order, using the hexagons to construct a complete income statement.

.jpg)

The first team to complete the task correctly gets some stickers (or any other sort of prize you choose).

The second part to this activity (when the whole class is ready to move on) is to give each team a set of smaller green hexagons, as shown in the photo above. They repeat the activity with the larger yellow hexagons but this time need to place the smaller green hexagons in the correct order. This part of the activity is more challenging and will take students a little longer. However, it should also lead to some great discussions.

Again, stickers are awarded to the winning team.

To use this activity in class, download the Profit and Loss Account Hexagons here. Please note the hexagons already appear in the correct order for your reference.

Return to the Unit 3.4 - Final accounts (some HL only) homepage

Return to the Unit 3 - Finance & accounts homepage

IB Docs (2) Team

IB Docs (2) Team