Working capital

Working capital (AO2, AO4)

Cash is said to be the lifeblood of a business

Working capital (sometimes referred to as net current assets or circulating capital) refers to cash or other liquid assets available to an organization for its daily operations. Working capital is essential to pay for raw materials, utility bills, and staff wages and salaries. Hence, working capital enables the business to function and trade.

Working capital is a common measure of an organization's liquidity, efficiency, and overall financial health. It is recorded on the balance sheet as net current assets, i.e. the difference between the firm's current assets and its current liabilities:

Working capital = Current assets – Current liabilities

Current assets are the short-term assets (belongings) of an organization that can be relatively easy to convert into cash. Typical examples include cash, stocks (inventory), and debtors:

Cash refers to the money an organization has either “in hand” (at its premises) and/or “at bank” (i.e. in its bank account). Cash is the most liquid of current assets and is easily accessible to the business.

Stock (also known as inventory) refers the volume of goods that a business has available for sale, per time period. A firm's inventory is intended to be sold as quickly as possible, thereby generating cash for the business.

Debtors are a type of current assets, referring to individual or business customers that owe money to the organization because they have bought goods or services on trade credit. The usual trade credit period is between 30 and 60 days.

Current liabilities are the short-term debts of a business, which need to be repaid within twelve months of the balance sheet date. Typical examples include bank overdrafts, trade creditors, and short-term loans from financiers.

Bank overdrafts (or just overdrafts) allow customers to temporarily take out more money than is available in their bank account. This banking service enables pre-approved customers are used for very short term purposes and typically repaid within a few months in order to avoid high interest charges.

Trade creditors are the firm’s suppliers who have yet to be paid, as trade credit enables the business to buy now but pay later, typically within 30 to 60 days.

Short-term loans are advances (loans) from a financial lender, such as a bank, that need to be repaid within 12 months of the balance sheet date.

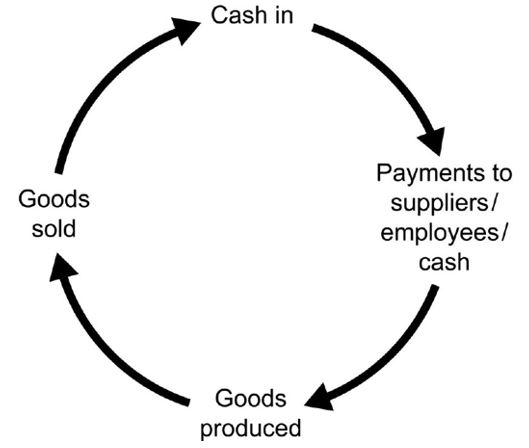

The working capital cycle of a business refers to the duration between the organization paying for the production costs of a good or service and it receiving the cash from customers purchasing the product.

The working capital cycle

For some businesses, the working capital cycle is very short (quick) as they receive cash immediately from their sales. For example, cash is commonly used in hair salons, convenience stores, and taxis. For other businesses, the working capital cycle is much longer (slow) due to the long production process and/or the high price of their products. For example, customers are likely to pay in instalments and/or purchase using credit terms for products such as Lamborghini super sports cars, Airbus aircraft, and diamond rings.

Diamond rings have a long working capital cycle

Positive working capital generally shows that a business is able to pay off its short-term liabilities very quickly. Negative working capital generally indicates the business is unable to do so. Therefore, businesses often have to borrow money (such as using bank overdrafts) during periods of negative cash flow. Short-term finance options, such as bank overdrafts and short-term loans, can enable the business to survive whilst it waits for cash inflows to materialise. The longer the working capital cycle (i.e. the longer inventory is left unsold), the more likely the business is to face a cash flow crisis.

Watch this short video to review working capital and the importance of the working capital cycle:

Return to the Unit 3.7 - Cash flow homepage

Return to the Unit 3 - Finance and accounts homepage

IB Docs (2) Team

IB Docs (2) Team