External growth methods

"We can't become what we need to be by remaining what we are."

- Oprah Winfrey (b. 1954), American television producer, author, and philanthropist

External growth (or inorganic growth) refers to the expansion and evolution of a business by using third party resources and organizations rather than relying on internal sources and activities. The five methods of external growth (inorganic growth) specified in the syllabus are:

- Mergers and acquisitions (M&As)

- Takeovers

- Joint ventures

- Strategic alliances, and

- Franchising.

An acquisition involves one company buying a controlling interest (majority stake) in another company with the agreement of the directors and shareholders of the target company. This means the buyer purchases enough shares in the target company to own more shares than any other shareholder, leading to a legal change of ownership. For example, in 2017 e-commerce giant Amazon bought Whole Foods, the American organic-food grocer for $13.7 billion. In September 2022, Adobe Systems Inc. spent $20 billion on its largest acquisition ever of Figma Inc., a collaborative design software maker founded in 2016.

A merger is similar to an acquisition but the two or more companies agree to form a single, larger company thereby benefiting from operating on a bigger scale. The original business entities in the merger agreement cease to operate in their former legal structure.

When a merger or acquisition occurs between two or more companies operating within the same industry (i.e. they are competitors), this is called a horizontal M&A. An example was the acquisition of The Body Shop by L’Oreal (the world’s largest cosmetics and beauty firm) back in 2006. Other examples of horizontal integration include:

Volkswagen buying Škoda (1994), Bentley (1998), Lamborghini (1998), Bugatti (1998), and Porsche (2012)

The merger of Exxon and Mobil (1999), to form the world's largest commercial energy company ExxonMobil

Tata Motors purchasing Jaguar Land Rover from Ford (2008)

Geely Holding Group purchasing Volvo Cars (2010).

The merger of US Airways and American Airlines, which created the world’s largest airline (2013)

Facebook buying Instagram (2012) and WhatsApp (2014)

Google's acquisition of Android (2005), YouTube (2006), Motorola Mobility (2011) and Fitbit (2021).

Top tip!

It is not necessary for a firm to acquire the entirety of another company. The the process of taking over another firm’s brands rather than the entire company is known as brand acquisition.

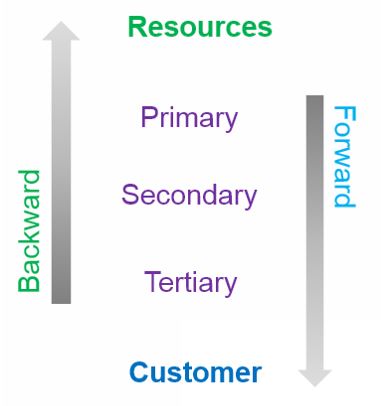

When an acquisition occurs between two or more companies operating in different stages of the production process, this is called a vertical M&A. If the purchaser buys a company closer to the consumer in the chain of production, this is known as a forward vertical M&A. A typical example is a manufacturer buying a retailer, such as a car manufacturer buying car showrooms (retailers that sell cars directly to private customers).

If the purchaser buys a company further away from the consumer in the chain of production, this is known as a backwards vertical M&A. An example is IKEA buying Baltic Forests in Romania back in November 2015 so as to control its supply of timber.

The categorisation of M&As depends on the industries in question

A fourth category of M&A exists, when two businesses in unrelated industries engage in a merger or takeover. This type of integration is known as a conglomerate M&A (or diversification, under the BMT 2 - Ansoff matrix model). For example, Berkshire Hathaway is one of the world’s largest multinational conglomerates, with operations in an array of industries, such as: property (real estate), insurance, diamonds, food processing, toys, confectionery, home furnishing, newspaper publishing, computing, clothing, aerospace, and airlines (it is the largest shareholder in United Airlines and Delta Air Lines). Another example is the Virgin Group, a global conglomerate with over 400 strategic business units from Virgin Atlantic or Virgin Wines. A conglomerate M&A is the riskiest method of external growth.

Case Study 1 - Examples of M&As

Some of the world’s largest companies were formed as the result of M&As of two or more large organizations. For example, Facebook acquired Instagram by paying $1 billion to buy the social media platform back in April 2012. This was, perhaps, a bargain as Facebook also bought WhatsApp in February 2014 for a staggering $19 billion and Oculus VR one month later for $2 billion.

It is common for the companies integrate through M&As to retain the names of the original businesses. Examples include:

- AOL and Time Warner

- Air France KLM

- Bank of America Merrill Lynch

- ExxonMobil

- Fiat Chrysler

- Glaxo SmithKline

- JP Morgan Chase

- Kraft Heinz

- Lloyds TSB

- Marks & Spencer

- Peugeot Citroën

- Royal Dutch Shell

Case Study 2 - LVMH

Moët Hennessy Louis Vuitton (LVMH) is a diversified French multinational corporation that specializes in the luxury goods industry. The company is headquartered in Paris, France. In 2020, LVMH bought American jeweller Tiffany & Co for $16.2 billion. This is the largest luxury brand acquisition in history, which adds Tiffany & Co. to LVMH’s huge product range including brands such as:

- Bulgari

- Christian Dior

- Fendi

- Givenchy

- Kenzo

- Louis Vuitton

- Marc Jacobs

- Moët & Chandon

- Sephora

- TAG Heuer

Case Study 3 - British Steel

British Steel faced huge challenges during the 2010s due to the declining demand for steel in Europe, intense competition from both India and China, and the company’s high level of debts. In December 2019, a deal was agreed with China’s Jingye Group to acquire British Steel for around £50m ($65m), which effectively saved approximately 4,000 jobs. Jingye Group announced it would invest £1.2bn ($1.56bn) over the next decade to upgrade British Steel's plants and machinery in Scunthorpe, North England. British Steel is the largest employer in Scunthorpe.

Like mergers, a takeover involves a company purchasing a controlling interest (majority stake) in another company. However, Unlike mergers and acquisitions (M&As), takeovers are almost always hostile in nature as they occur against the wishes of the owners of the target company. For example, in November 2022, Elon Musk took over Twitter, having bought the social media company for $44 billion. Musk, CEO of Tesla and SpaceX, immediately fired Twitter's CEO (Parag Agrawal) and chief legal officer (Vijaya Gadde). Within days, Musk also announced that around half of Twitter's labour force would be losing their jobs due to the need for cost savings as well as recouping some of the costs of the takeover.

Common mistake

Students often comment that a takeover occurs when a business buys 51% or more of the shares in another company. Technically, the purchasing company takes a controlling interest in the target company once it owns the majority of the shares, which can be less than 50% so long as it is the majority shareholder. Of course, purchasing 50% plus 1 share would guarantee overall control, but it is not always necessary to do this.

Mergers and acquisitions (M&As) share similar advantages and disadvantages as takeovers. These are outlined below.

Advantages of M&As and takeovers

These are relatively quick growth methods, especially if the organization wishes to enter new markets (with new/existing products in new/existing markets). They are all faster methods of expansion than internal growth and evolution.

Growth through M&A enables the newly formed company to benefit from greater economies of scale. For example, backward vertical integration enables the firm to gain from having direct access to its supplier, thereby cutting average costs of production (third party suppliers charge higher prices as they need to earn a greater profit margin).

M&As enable the larger organization to spread its fixed costs and risks, and to share its resources and expertise. This can improve the larger company’s chances of success.

The cost savings and synergies created by a merger or acquisition enables the organization to earn greater profits, gain market power, and increase its market share. Customers also benefit from the possibility of lower prices arising from the cost savings and synergies. This helps to enhance the company's competitiveness.

M&As provide opportunities for businesses to diversify, which enables them to enter new markets as well as to spread risks. For example, Coca-Cola's acquisition of Costa Coffee in 2018 allowed the soft drinks company to diversify into the mainstream coffee retail market during a time when there has been growing perception that its signature soft drinks are unhealthy.

A takeover can be friendly, rather than hostile, if the target company wishes to sell its controlling stake in the business to the buyer. This is usually because the target company is experiencing liquidity problems.

Customers can benefit from lower prices following a M&A

Disadvantages of M&As and takeovers

M&As are typically very expensive. For a company to buy out a rival firm is often unaffordable. Even for businesses that can afford M&As, the amount of money involved can be huge. For example, in 2014, Facebook bought WhatsApp for a staggering $19.3bn.

There is potential loss of management control of the company, especially in the case of a hostile takeover of the business. M&As often cause redundancies of senior managers. For instance, there is no need to have two separate marketing or finance directors from the integrated companies.

M&As are unsettling for many stakeholders. There is likely to be resistance of change from the workforce and trade union members, especially if an acquisition results in mass-scale job losses due to purchasing company’s desire to cut costs.

The newly formed company can be too large to manage efficiently, i.e. it may experience diseconomies of scale. This can happen due to several reasons, such as a lack of effective cost control, culture clashes, resistance to change, and a loss of focus on core business operations (in the case of vertical M&As or a diversification strategy).

There are likely to be challenges faced by employees who may need to adapt to new working practices, company policies, and management styles.

M&As do not always work, especially in the case of organizational culture clashes. Contrasting and conflicting management styles and organizational structures, for example, can cause major issues for creating a newly merged or acquired organization, especially if the core values of the companies are changed. It is a high-risk growth strategy, especially if the company pursues a diversification growth strategy.

As the firm becomes larger through an M&A, there could be a deterioration in customers loyalty due to less of a personalised / individualised service due to growth of the company.

Unlike strategic alliances and joint ventures as methods of external growth, M&As cannot be easily reversed if the new business venture goes wrong. Due to a combination of the above reasons, and according to research published in Harvard Business Review, about 80% of M&As result in failure (in terms of not being able to achieve the objectives of M&A). Hence, it tends to be a riskier external growth strategy than strategic alliances and joint ventures.

Business Management Toolkit

Examine how knowledge of the Ansoff matrix can help managers making decisions about mergers, acquisitions, and takeovers.

You might find it useful to refer to BMT 2 - Ansoff matrix prior to answering the above task.

A joint venture (JV) is an external growth method that involves two or more organizations agreeing to create a new business entity, usually for a finite period of time. The newly created business is funded by its parent companies. Examples of JVs include:

Caradigm – formed by Microsoft and GE (General Electric)

Fiat-Tata – formed by India’s Tata Motors and Italy’s Fiat Automobiles

Galvani Bioelectronics – formed by Google and GlaxoSmithKline

Hisun-Pfizer – formed by China’s Hisun and America’s Pfizer

Hong Kong Disneyland – formed by the Hong Kong SAR government and the Walt Disney Company

Sony–Ericsson – formed by Finland’s Ericsson and Japan’s Sony.

At the end of the pre-determined time period for the JV, there are three possible options:

The joint venture is dissolved (discontinued)

One of the parent companies buys out the JV

The JV project is extended for a period of time.

Advantages of joint ventures

As the JV is set up for a finite time, it can be dissolved at the end the project if needed, without compromising the operations of the parent companies.

The parent companies combine their expertise, technologies and financial resources, to create the new business, thereby increasing its chances of success. For example, more finance is raised than if the companies were to grow organically, and the financial risks are split between the parent companies.

Joint ventures are generally cheaper than M&As, which involve high legal and administrative costs. It is also quicker to form a JV than to go through with a merger or acquisition.

The parent companies can enjoy the benefits of growth without losing their individual corporate identities. At the same time, the JV can also create synergies from working with a partner company (such as the transfer of specialist skills), thus strengthening the position of both firms in the market.

For international joint ventures, the partner company can provide local knowledge to cope with any problems related to cultural differences and business etiquette in overseas markets.

Disadvantages of joint ventures

As with all forms of partnerships with other entities, there are possible conflicts and disagreements between the parent companies. This might be due to different organizational cultures and management styles. This can create communication and productivity problems, thus jeopardising the joint venture.

In the case of poor performance, a joint venture is more difficult to terminate than a strategic alliance. This is partly due to the legally binding responsibilities committed by the parent companies of the joint venture.

Many joint ventures are short-lived as they do not succeed or are purchased outright by one of the parent companies.

For joint ventures that do succeed, the parent companies have to share the profits.

Conflict can cause the end of a joint venture

In 2018, Volkswagen (VW) and Ford announced they would form a joint venture. Watch this short video and identify the key reasons why VW and Ford would want to form a joint venture despite being rivals in the same industry.

The two main benefits from this joint venture are:

Pool resources to develop electric cars and self-driving cars (the pooling of resources will help them gain economies of scale which will allow for cost savings in the R&D and production process)

To gain a first-mover advantage in the market for electric cars and self-driving cars (especially in response to competition from the likes of Google and Uber in the market for self-driving cars).

Strategic alliances (AO3)

Strategic alliances are created when two or more organizations join together to benefit from external growth without having to set up a new separate entity or to make major changes to their own business models. Examples include:

Apple and MasterCard (the first credit card company to offer Apple Pay)

Google and Luxottica (high technology for premium quality eyewear products)

General Motors and Lyft (a strategic alliance set up to develop a driverless car)

Spotify and Uber (riders can listen to their own playlists)

Star Alliance (one of the largest airline alliances consisting of 27 airlines)

Starbucks and PepsiCo (bottling, distributing and selling Frappuccino coffee)

Tata Coffee and Starbucks (coffee retailer / cafe operators in India).

There are 27 airline companies in the Star Alliance

For a strategic alliance to work, information sharing and genuine willingness to support other companies is vital. This includes a commitment to a common goal, the exchange of knowledge, and joint company events (partly to promote the SA). Strategic alliances are built on trust and a true desire to grow together.

Advantages of strategic alliances

As with a JV, members of a strategic alliance can benefit from the pooling of resources in a business project. This created synergies, such as the sharing of: industry expertise, research and development, financial resources, distribution channels, and the spreading of risks. For example, a SA in the airline industry (such as One World and Star Alliance) allows member airlines to expand into markets (cities and/or countries) where their current routes do not serve.

Businesses in a SA retain their individual corporate identities, without the expenses of establishing a new company with its own legal status (as in the case of joint ventures). This also means it is usually quicker to set up a SA than a JV.

As with a JV, a strategic alliance fosters cooperation rather than competition. In theory, if there is less competition, profits should rise.

There is greater flexibility with a strategic alliance than a joint venture because membership (of the alliance) can change without having to terminate the coalition.

Similarly, it is more straightforward to terminate a SA than a JV, or to demerge, if the alliance does not work out for whatever reason.

Disadvantages of strategic alliances

Unlike a JV, there are few barriers to entry and exit in a strategic alliance. For example, as it is much easier for members to pull out of a strategic alliance, they may be less committed. This can be destabilising for the business venture.

Many strategic alliances are only short-term agreements. This can limit the options for an organization’s external growth strategies.

As there can be numerous members in a SA, the business organization in question is exposed to the potential mistakes or misconduct of member firms in the alliance.

As with all cases of working with and relying on third parties, there is the potential of conflict and misunderstandings. Communication problems, divergent corporate cultures and perspectives, and mistrust are key reasons for the failure of many strategic alliances.

Franchising is a growth method that involves two parties, with the franchisor giving the licensing rights to a franchisee to sell goods and services using the franchisor’s branded or trademarked products. For this privilege, the franchisee has to purchase the licensing rights to use the brand name and business model of the established franchisor. In addition, the franchisee must also pay royalties to the franchisor, based as a pre-determined percentage of the franchisee’s sales revenues. They are also contractually obliged to respect and follow the corporate norms and practices of the franchisor's business model.

Franchising is hugely popular in the fast food, hotels and restaurants industries. The franchisees of these businesses are often sole traders who own and run a single unit, but they can also be partnerships or large business organizations.

As with all forms of businesses, establishing a franchisee can be very expensive. Franchisee need to make a significant up-front financial investment in the franchise. For example, to purchase a franchised McDonald's restaurant in the UK means having at least £100,000 ($130,000) in unencumbered funds (sources of finance that are free of debt or other financial liability). In addition, franchisees need to prove they can lead and work within the McDonald's framework to give both the franchisee and franchisor (McDonald's) the greatest chance of success. This screening process can take over 12 months, before a McDonald's franchise agreement is approved (see ATL Activity 3 below).

Case Study 1 - Franchises are everywhere...

Examples of businesses that use franchising as a growth model include the following:

7-Eleven, convenience stores

Avis Rent A Car, car rental

Baskin Robbins, food

Ben & Jerry’s, food

Burger King, fast food

Domino's Pizza, fast food

The Body Shop, beauty and cosmetics

FamilyMart, convenience stores

Hard Rock Café, restaurant

Hertz, car rental

Hilton Hotels & Resorts, hotels

Hotel Inn, hotels

InterContinental Hotels Group, hotels

KFC, fast food

Kwik Fit, car repairs and servicing

Kumon, education

L'Occitane en Provence, beauty and cosmetics

McDonald’s, fast food

Outback Steakhouse, restaurant

Pizza Hut, fast food

Starbucks, coffee

Subway, fast food

Supercuts, hair salon

Swarovski, jewellery

Travelodge Hotels, hotels

Western Union, finance

Advantages of franchising for the franchisor

Franchising is a faster method of growth than using internal growth. It is advantageous for the franchisor to use partner firms to purchase, own and run additional franchised outlets. This means franchising can actually be cheaper than internal methods of growth for the franchisor.

Franchisees fund the growth of the franchise as they pay an upfront fee to purchase the franchise license. In addition, the franchisor received royalties, usually calculated as a percentage of the franchisee’s sales revenues.

The franchisor benefits from selling the franchise agreement to someone who has been vetted and is more motivated to succeed than salaried managers employed to run a particular store, unit or outlet.

The franchisor, in its pursuit of growth in other geographical locations, can also again from the franchisee’s local knowledge.

Advantages of franchising for the franchisee

The success rate of franchising is very high in most industries. Franchisees gain access to a tried and test business model.

In many cases, the franchisee benefits from the brand recognition and brand loyalty established by the franchisor. Hence, there are opportunities for the franchisee to earn large profits. ATL Activity 3 below (McDonald's) shows that franchisees can become owners of some of the world’s most iconic brands / businesses.

Franchisees receive ongoing support and expert advice from the franchisor, such as upskilling training, market research findings, and legal advice. This improves the chances of success for the franchisees. For example, before a person is approved to operate as a McDonald's franchisee, they have to complete a comprehensive restaurant training programme for a minimum of 26 weeks.

They gain from the purchasing economies of scale of the franchisor, rather than facing much higher costs (of inventory, for example) if operating as a sole trader of a much smaller, independent organization.

Disadvantages of franchising for the franchisor

The franchisor’s corporate image and brand reputation is at risk if a franchisee is negligent and/or incompetent. Breaking the franchise agreement with such franchisees can be a both time consuming and costly.

Therefore, although not the owner of a franchised outlet, the franchisor still needs to ensure quality standards are met. This means the franchisor may need to closely monitor the operations of their franchisees; after all, their reputation and overall business model is at stake.

The franchisee, as the owner of the franchised unit, gets to keep the profits they generate. This would not be the case if the franchise chose to grow organically.

The franchise method of growth is not applicable to all businesses as they lack the expertise, resource and brand awareness to attract buyers (franchisees).

Disadvantages of franchising for the franchisee

Buying a franchise is usually very expensive. Even so, the process of applying for a franchise license is typically complex and time consuming. Even after paying for the start-up costs and running costs of the business, the franchisee must also pay a percentage of its sales revenues to the franchisor as royalty payments. This can cut a franchisee’s profit margins quite substantially.

The franchisee is constrained by the standards and practices set by the franchisor. The franchisee must follow the franchisor’s established business model, without scope for truly independent decision making or innovation.

Like the franchisor, each individual franchisee is at risk of a damaged reputation if another franchisee of the business makes a serious blunder.

To consolidate your understanding of this topic (External growth methods), have a go at the following ATL activities for this part of the course.

ATL Activity 1 (Thinking skills) - The 5-4-3-2-1 Quiz

For each of the following slides, students will be shown a different set of questions/tasks linked to franchises.

For each of the following slides, students will be shown a different set of questions/tasks linked to franchises.

Give them just 30 seconds to write down up to 5 different answers. They score 1 point for each correct answer, and get 1 bonus point for any answer that is unique in your class (i.e. not suggested by anyone else).

Here goes...

Round 1 - State 5 examples of franchises

Some possible answers:

7-Eleven, Baskin-Robbins, Burger King, Dunkin' Donuts, Domino's Pizza, Hard Rock Cafe, KFC, McDonald's, Nandos, Pizza Hut, Starbucks ...

Round 2 - State 4 advantages of operating as a franchise.

Some possible answers:

- Being your own boss of a well-known brand/franchise

- Less risk due to the tried and tested formula of running the franchise

- Easier to raise finance as the franchise is probably well-known

- Buying economies of scale as part of a large franchise network

- Marketing economies of scale from the franchisor

- Receiving expert advice and support from the franchisor

Round 3 - State 3 facts about franchising as a method of growth.

Possible answers could include:

- It tends to have a very low failure rate

- Franchise contracts are usually non-negotiable

- Not everyone qualifies to purchase a franchise, as the franchisor take a huge amount of risk selling their business name/brand/model to an independent buyer

- There are significant costs in running a franchise, including the expectation/requirement for the franchisee to reinvest profits back into the business

Round 4 - State 2 disadvantages of operating as a franchisee.

- It is highly costly to purchase a franchise, and to pay on-going costs such as royalties to the franchisor

- There is little control over the firm's marketing and product strategies, as these are determined by the franchisor

Round 5 - State 1 financial cost of franchising apart from the set-up costs.

Royalty payments to the franchisor, License fees; and Inventory costs (buying stocks from the franchisor).

ATL Activity 2 - Buying and running a McDonald's franchise

Take a look at the September and November 2013 issues of Business Review magazine (published by Philip Allan, Hodder Education) for two case studies on buying and running a McDonald’s franchise.

You can download the article here (permission for sharing these documents has been granted by Hodder Education):

Read more about franchising from a McDonald's franchisee in London (reproduced with the permission of McDonald's and Tonina Hoang, who became the UK's youngest McDonald's franchisee at the time she was approved as a franchisee).

ATL Activity 3 - The world's largest franchises

Take a look here to discover the world’s largest 100 franchise businesses.

Were you surprised by any that didn’t make the Top 10 in this list?

Students are likely to name at least some of the more well-known franchises mentioned in ATL Activity 1 above. There is also likely to be some local bias in their responses, as the list does not necessarily contain businesses that operate in their country. However, use this as an opportunity to discuss the key concepts in the role of franchising and organizational growth (creativity, ethics, sustainability, and change).

ATL Activity 4 - Inquiry task and the key concepts

Recommended time: 45 minutes (plus Homework time to prepare for the presentation).

Investigate the external growth of an organization of your choice. Outline the method(s) of external growth with consideration of any combination of the following:

- Mergers and acquisitions (M&As)

- Takeovers

- Strategic alliances

- Joint ventures

- Franchising

Consider the impact of any combination of the key concepts (creativity, ethics, sustainability, and change) on the growth of your chosen organization.

Share these findings with the rest of the class in a 5 minutes presentation during the next week's lesson.

ATL Activity 5 - Case Study: Chick-fil-A

This activity has been suggested by IB educator David Weyant. Watch this 8-minute video from the Wall Street Journal about how Chick-fil-A has built its rapid growth using an unconventional franchise model from the likes of McDonald's and Starbucks.

As you watch the video, take note of the strategies driving the company’s huge success, including the company's corporate culture and values.

Business Management Toolkit (BMT)

Discuss the importance of STEEPLE analysis for a firm's external growth strategies.

In March 2006, The Body Shop was sold for £652m ($892 million) to L’Oreal after shareholders of the French cosmetics and beauty giant voted in favour of a takeover bid. Six months later, L’Oreal announced plans to expand The Body Shop’s 2,000 stores to 5,000 outlets. The expansion was targeted mainly at new markets such as China, India, Brazil, Argentina and Chile. However, by the end of 2017, there were only around 3,000 stores globally.

Critics of the takeover argued that L’Oreal would harm the ethical image of The Body Shop. L’Oreal, however, claimed that they share The Body Shop’s ethical stance against animal testing. Instead the company tests products on artificially-produced human skin and volunteers from its workforce. The Body Shop was also criticised for selling the company because Nestlé (a key stakeholder in L’Oreal) had gained a poor reputation due to its unethical marketing of baby powdered-milk in low income countries.

In June 2017, The Body Shop was sold by L’Oreal to Natura (a Brazilian global personal care cosmetics group headquartered in São Paulo) for an agreed sum of £880 million ($1.2 billion). The deal was approved in September 2017.

The Body Shop was founded in Brighton, UK in 1976 by Dame Anita Roddick (1942 - 2007). Today, the company enjoys sales in excess of $1.4 billion and employs more than 10,000 workers.

| (a) | Define the term takeover. | [2 marks] |

| (b) | Use the case study to explain the difference between shareholders and stakeholders. | [4 marks] |

| (c) | Examine how different stakeholder groups are affected by the growth strategies at L’Oreal. | [6 marks] |

Answers

(a) Define the term takeover. [2 marks]

A takeover involves one company buying a controlling interest (majority stake) in another company, usually against the wishes of the target company. The purchasing company becomes the majority shareholder of the target company, thereby effectively taking over the business.

Award [1 mark] for a definition that shows some understanding of the term takeover.

Award [2 marks] for a clear and accurate definition that shows good understanding of the term takeover, similar to the example above.

(b) Use the case study to explain the difference shareholders and stakeholders. [4 marks]

Shareholders are the owners of a joint-stock company, such as L’Oreal. They have a direct interest in the activities and performance of the business and are, therefore, stakeholders of the organization. However, there are other stakeholders of an organisation that do not necessarily own shares in the business, e.g. employees, the local community, government and pressure groups. In other words, shareholders are stakeholders, but stakeholders are not necessarily shareholders.

Award [1 – 2 marks] for an answer that shows some understanding of the demands of the question. There is limited, if any, appropriate reference to the case study.

Award [3 – 4 marks] for a good answer that shows a clear understanding of the demands of the question, explaining the difference between shareholders and stakeholders in the context of the case study.

(c) Examine how different stakeholder groups are affected by the growth strategies at L’Oreal. [6 marks]

There are various stakeholders mentioned in the case study: L’Oreal, The Body Shop, Nestle, employees and shareholders. Possible impacts are outlined below:

Employees – Due to the expansion plans, there are likely to be more employment opportunities at The Body Shop. For some employees, this might include opportunities for personal growth and development, as well as job promotional opportunities.

Shareholders – in the short term, the funds used to acquire The Body Shop might reduce the profits of L’Oreal and therefore the amount it pays out in dividends. In the long term, the larger company may be able to award shareholders with greater returns (although The Body Shop has not been able to grow at the rate that L'Oreal had initially intended). Shareholders were also likely to have gained from the sales of The Body Shop to Natura, given that the company was sold for at least $308 million more in 2017 than when L'Oreal took over The Body Shop back in 2006.

Pressure groups – Animal-rights activists, for example, might campaign against the practices of L’Oreal. This could harm the company's corporate image, at least in the short term.

Rival firms – Competitors such as Revlon or Johnson & Johnson may be threatened by the increased market share and power of L’Oreal. They may respond by launching products to directly compete with The Body Shop in order to gain some market share.

Financial investors – Financial backers such as Nestle are likely to benefit from the larger scale operations of L’Oreal, especially if the company is able to succeed in overseas markets such as China, India,Brazil, Argentina and Chile.

Award [1 – 2 marks] for a vague or generic answer that shows a limited understanding of the demands of the question.

Award [3 – 4 marks] for an answer that shows good understanding of the demands of the question, with consideration of at least two stakeholder groups or if application of the case study is limited or superficial.

Award [5 – 6 marks] if there is a thorough examination of at least two stakeholder groups and how they are affected following the growth strategies of L’Oreal. There is appropriate use of terminology throughout the answer, and appropriate application of the stimulus material in the case study.

An acquisition involves one company buying a controlling interest (majority stake) in another company based on mutual agreement.

Brand acquisition is the process of taking over another firm’s brands rather than the entire company.

Franchising is a growth method that involves the franchisor giving the licensing rights to a franchisee to sell goods and services using the franchisor’s brands and trademarked products.

A joint venture (JV) is an external growth method that involves two or more organizations agreeing to create a new business entity, usually for a finite period of time.

A merger is similar but the two companies agree to form a single, larger company thereby benefiting from operating on a larger scale. By contrast, takeovers are almost always hostile in nature.

A strategic alliance is created when two or more organizations join together to benefit from external growth without having to set up a new separate entity or to make major changes to their own business models.

A takeover (or hostile takeover) involves one company buying a controlling interest (majority stake) in another company against the wishes of the target company.

Return to the Unit 1.5 - Growth and evolution homepage

Return to the Unit 1 - Introduction to Business Management homepage

IB Docs (2) Team

IB Docs (2) Team