Changes in price and costs

Changes in price and costs (AO2, AO4)

This section of the syllabus requires students to understand the effects of changes in price or cost on the break-even quantity, profit and margin of safety, using graphical and quantitative methods (AO2, AO4).

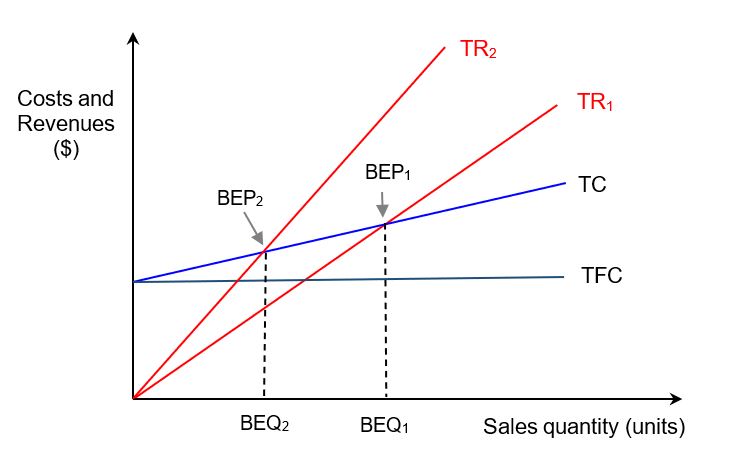

An increase in the selling price reduces a firm’s break-even level of output. Diagrammatically, the higher price results in a greater gradient of the total revenue line (from TR1 to TR2), as shown in the diagram below. This reduces the break-even quantity from BEQ1 to BEQ2.

Whether a higher price results in a greater or smaller margin of safety depends on the extent to which the increased price reduces demand for the firm’s products. The opposite is true for a reduction in price, i.e. the firm would have to sell more in order to break-even. This means that a higher price will raise the margin of safety (because the firm breaks even earlier). However, this assumes that the sales volume does not fall following the increase in price.

Higher costs of production (be they fixed and/or variable costs) will increase the break-even quantity. Diagrammatically, the total cost line would be steeper if only variable costs increase or be shifted upwards if there is an increase in the firm's fixed costs.

ATL Activity (Thinking skills) - 17 year old to make $1 million selling candles

How inspiring is this? Watch this short video clip about a 13-year old who struggled to find a part-time job but used his entrepreneurial skills to establish an eco-friendly candle business.

Brandon’s Candles is a candle business established in 2014. The company was founded by 13 year old Brandon Bechtel and became a $500,000 business by 2019. Brandon admits to luck and trial and error being important to be successful in business, but Brandon's Candles is now on target to earn $1 million in annual sales revenue.

Watch the video clip about Brandon's Candles and answer the following questions:

Questions

(a) What might have caused the break-even point of Brandon’s Candles to increase?

(b) What might have caused the break-even point of Brandon’s Candles to fall?

(c) What would the margin of safety of Brandon’s Candles have been like in its earliest years of operation?

(d) What is likely to happen to the margin of safety of Brandon’s Candles as sales revenue continue to increase?

Teacher only box

Answers

(a) What might have caused the break-even point of Brandon’s Candles to increase?

The “trials and errors” that Brandon describes in experimenting with label designs / styles and the various candle jars would have increased the company's fixed costs. Hence, this increases the firm's break-even point. Opening storefronts will also have increased the BEP of Brandon’s Candles due to an increase in its fixed costs.

(b) What might have caused the break-even point of Brandon’s Candles to fall?

Being a purely online retailer will have helped Brandon’s Candles to keep its fixed costs down (such as its rental costs). This helps to bring down the firm's break-even point.

(c) What would the margin of safety of Brandon’s Candles have been like in its earliest years of operation?

The margin of safety in the early years of Brandon’s Candles's operations would have been negative before the firm reaches break-even. Thereafter, the margin of safety is likely to be very low as the company tries to grow its business.

(d) What is likely to happen to the margin of safety of Brandon’s Candles as sales revenue continue to increase?

The high sales revenues of $500,000 in 2019 would have contributed to a much wider margin of safety. Similarly, as sales revenue reaches $1 million, the company's margin of safety is likely to continue to grow even higher.

Top tip!

Students must practice constructing break-even charts (preferably under timed conditions), as well as being able to explain the impacts of changes in price or costs on a firm's break-even quantity, profit, and margin of safety.

Use this website for additional support and to check the accuracy of your calculations and break-even diagrams: https://www.calcxml.com/do/breakeven-analysis

Return to the Unit 5.5 - Break-even analysis homepage

Return to the Unit 5 - Operations Management homepage

IB Docs (2) Team

IB Docs (2) Team