Efficiency ratios (HL)

Efficiency ratios are used to measure how well the resources of a business are used in order to generate income from the firm’s capital. In other words, efficiency ratios examine the use of an organization’s resources in terms of its assets and liabilities.

There are four efficiency ratios specified in the IB DP Business Management syllabus:

Stock turnover ratio (or inventory turnover ratio)

Debtor days ratio

Creditor days ratio

Gearing ratio

These four efficiency ratios are used to measure how well a business uses its financial resources. Such ratio analysis can to a business to improve its operational efficiency, including:

looking at ways to reduce the time it takes the business to collect cash payments from its customers (debtors days ratio)

improving its inventory control (stock control ratio)

improving its relationship with suppliers and trade creditors (creditor days ratio), and

managing its level of affordable debt (the gearing ratio).

It is important for managers to be in control of their operational efficiency as this directly affects their costs and hence level of profitability. For example, businesses need to manage their level of stocks (inventories), although this will differ in different industries. For instance, batteries and candles sold at IKEA are likely to require replenishing at a faster rate than for large furniture items such as beds, wardrobes and sofas. IB Mathematics, Theory of Knowledge, and Extended Essay textbooks published by Hodder Education are likely to need replenishing at a faster rate than for IB Economics or IB Geography. Large supermarket chains, such as Walmart and Carrefour will have very high stock turnover, so operational efficiency is essential for these businesses.

Essentially, when businesses are efficient in their use of resources, they become more competitive, profitable, and successful.

Click on the relevant tabs below to access notes and practice questions on each of these efficiency ratios.

The stock turnover ratio is an efficiency ratio that measures the number of days it takes a business to sell its stock (inventory), i.e. how quickly the stock is sold and needs to be replenished.

Alternatively, the stock turnover ratio can show the number of times during any given period of time (usually a year) that the business needs to restock or replace its inventory.

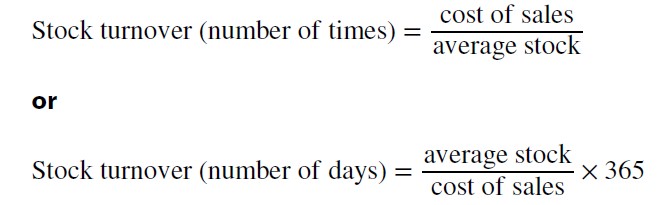

The stock (inventory) turnover ratio is calculated by using one of two formulae:

So, for example, it can be concluded that a business with $10,000 of average stock levels during the year and with total cost of sales (COS) valued at $200,000 has essentially sold its inventory twenty times over, i.e. $200,000 / $10,000 = 20 times.

Another way to view situation is this is that it takes an average of 18.25 days (or 19 days to the nearest who number) for the business to sell its average level of stocks (inventories), i.e. ($10,000 / $200,000) × 365 = 18.25 days.

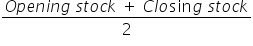

Note that if the value of a firm's average stock level is not explicitly stated, this can be found by using the formula:

The stock turnover ratio will vary between businesses and industries. For example, we would expect the inventory turnover ratio (number of times) to be much higher for large supermarket chains, such as Target and Tesco, than high-end jewellery makers such as Tiffany & Co. or De Beers Jewellers.

By contrast, businesses that sell perishable goods (such as fresh milk or fresh flowers) rely on a high stock turnover rate (number of times). This is because any unsold stocks cannot be stored so need to be disposed as when their sell-by date has expired.

A third scenario is businesses that do not hold much if any inventory. Examples include online learning platforms (such as private online tuition services), insurance companies, and online media companies with digital content only (such as Netflix or Spotify). For these businesses, the stock turnover ratio is less relevant as a financial ratio because they do not need to hold any stocks for sale, i.e. the services providers do not hold physical stocks as their businesses are predominantly based on selling intangible products.

Exam Practice Question 1

Ayad Construction Co. has cost of sales (COS) valued at $60,000. The company started the trading year with stocks valued at $50,000. It had closing stock at the end of the trading year valued at $20,000.

Calculate Ayad Construction Co.’s stock turnover ratio. [2 marks]

Answer

Average stock = (Opening stock + Closing stock) ÷ 2 = ($50,000 + $20,000) / 2 = $35,000

Stock turnover ratio = $60,000 ÷ $35,000 = 1.71 times

Alternatively, stock turnover ratio = [($50,000 + $20,000) / 2] /$60,000 = ($35,000 / $60,000) × 365 = ($50,000 / $25,000) × 365 = 212.92 days (accept answers that show 213 days)

Award [1 mark] for the correct working out and [1 mark] for the correct answer.

Accept either method of calculating the stock turnover ratio.

Exam Practice Question 2

Nightingale Café has cost of sales (COS) valued at $161,000. The café started the year with stocks valued at $15,000 and at the end of the year the closing stock was $20,000.

Calculate the stock turnover ratio for Nightingale Café, expressed in terms of number of times per year. [2 marks]

Answer

Average stock = (Opening stock + Closing stock) ÷ 2 = ($15,000 + $20,000) / 2 = $17,500

Stock turnover ratio = COS / Average stock level

Hence, Nightingale Café's stock turnover ratio = $161,000 ÷ $17,500 = 9.2 times

Award [1 mark] for showing appropriate working out, and [1 mark] for the correct answer.

As an efficiency ratio, the stock (inventory) turnover ratio helps managers to monitor the effectiveness of their stock control. Managers can improve the stock turnover ratio in various ways, including:

Getting rid of obsolete (outdated) inventory in order to reduce the firm’s stock levels

Supplying a narrower range of products, thereby simplifying the amount of stocks that the firm needs to hold and control

Implementing a just-in-time (JIT) stock control system, which means the firm does not need to hold any stocks (of raw materials and component parts) as these are ordered and delivered only when needed.

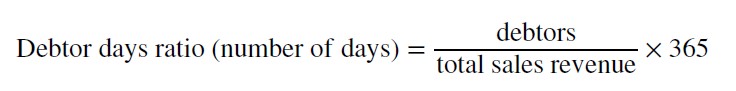

The debtor days ratio is an efficiency ratio that measures the average number of days an organization takes to collect debts from its customers (as they have bought goods and services on trade credit but have yet to pay for these). The debtor days ratio measures the average debt collection period for a business. This means the time it takes, on average, for the firm to collect money owed from its customers who have bought products on credit terms.

The debtor days ratio is calculated by using the formula:

The ratio enables managers to gauge how efficient a business has been in managing the credit that it gives to customers. Effective credit control is important for a business to control its cash flow and liquidity position.

As a general rule, the lower the value of the debtor days ratio the better it is for the firm. This is because a low debtors day ratio shows that the firm is efficient in getting debtors to pay on time. This helps to improve the firm’s working capital cycle.

By contrast, a high debtor days ratio means that customers are being given more credit than the firm can afford, given that this delays cash inflow for the firm. This is because credit sales account for a larger proportion of the firm’s sales revenue.

There are numerous ways for a business to improve its debtor days ratio. These essentially involve getting paid earlier and/or having better control over which customers qualify for credit. These methods include:

Creating incentives for customers to pay by cash rather than credit, such as giving customers a discount if they pay by cash and/or charging customers interest if they pay using credit terms.

Shortening the credit period given to customers. For example, by reducing the credit period from 60 days to 30 means customers have to pay one month earlier than before. This helps to reduce the debtor days ratio, i.e. the business receives payment from customers at an earlier date.

Improved credit control by using stricter criteria for those wanting to purchase products using trade credit. For example, the business might choose to offer credit only to customers with a proven track record of having paid their invoices in a timely manner.

Exam Practice Question 3

Cabinets Limited sells 1,500 units of output at a unit price of $60. The company has debtors valued at $20,000. Calculate Cabinets Limited’s debtor days ratio. [2 marks]

Answer

Sales revenue = Price × Units sold = $60 × 1,500 = $90,000

Using the debtor days ratio, the average debt collection period = ($20,000 ÷ $90,000) × 365 = 81.11 days

Accept answers that state 82 days

Award [1 mark] for the correct answer, and [1 mark] for showing suitable working out.

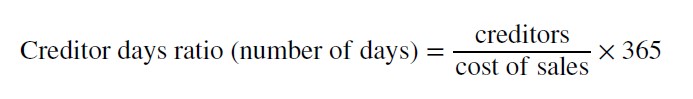

The creditor days ratio is an efficiency ratio that measures the average number of days an organization takes to repay its creditors (suppliers who the business has bought products from using trade credit, so have yet to pay for these).

The creditor days ratio calculates the length of time it takes a business, on average, to pay its suppliers for items that have been bought on credit. The formula for calculating this is:

As a general rule, a business that can delay making payment of its outstanding invoices plus any short term debts can improve its own cash flow position. However, in the long term, interest charges for late payments or imposed on the loans can be costly. Hence, it is important for businesses to have effective credit control, which is why the creditor days ratio is important.

There are numerous ways for a business to improve its creditor days ratio. These methods include:

Negotiating an extended credit period with the firm’s suppliers

Looking for different suppliers who offer preferential trade credit agreements

Using cash to pay for inventories (cost of sales), instead of over-relying on trade credit.

Exam Practice Question 4

Explain how an increase in the value of a firm's trade creditors is likely to affect its creditor days ratio. [2 marks]

Answer

An increase in the value of trade creditors will tend to increase the creditor days ratio. This is because the firm has bought more items (cost of sales) using trade credit and/or the timing of payments to its creditors has been deferred. Hence, the firm takes longer to pay its trade creditors.

Award [1 mark] for suggesting that the creditor days ratio is likely to increase. Award a further [1 mark] for the explanation.

Exam Practice Question 5

Wok Express sold inventory valued at $240,000. The restaurant has trade creditors valued at $25,000.

Calculate the creditor days ratio for Wok Express. [2 marks]

Answer

Cost of sales (COS) = $240,000

Creditor days ratio = ($25,000 ÷ $240,000) × 365 = 38.02 days = 39 days (accept answers that state 38 days, although 38.02 means the 39th day in practice)

Award [1 mark] for the correct answer and [1 mark] for showing appropriate working out.

The gearing ratio is an efficiency ratio that measures the extent to which an organization is financed by external sources of finance. In other words, it is loan capital expressed as a percentage of the firm’s total capital employed. The gearing ratio is measured by using the formula:

![]()

where:

Non‐current liabilities refers to loan capital, and is recorded on the balance sheet.

Capital employed is the sum of non‐current liabilities and equity (also shown on the balance sheet).

It is not uncommon for businesses to rely on using external sources of finance (such as medium to long term loans to fund its operations, growth, and evolution. However, debts need to be managed efficiently. As an efficiency ratio, the gearing ratio indicates the degree of financial risk that a business can afford to take by measuring the extent to which the firm’s capital employed is financed by external borrowing.

Exam Practice Question 6

Cost Less Grocers has an existing mortgage of $1.5 million. The company has share capital valued at $2.5m and retained profits of $0.5 million. Calculate the gearing ratio for Cost Less Grocers. [3 marks]

Answer

Capital employed = Retained profit + Share capital + Long term liabilities, i.e. the sum of internal and external sources of finance

Capital employed = 0.5m + $2.5m + $1.5m = $4.5 million

Gearing ratio = (Loan capital / Capital employed) × 100

Gearing ratio = $1.5m ÷ $4.5m = 33.33%

Award [1 mark] for the correct calculation of Costless Grocers’s capital employed.

Award [1 mark] for the correct gearing ratio, and [1 mark] for the correct working out of the gearing ratio.

Apply the own figure rule (OFR), or error carried forward, where appropriate.

There are numerous ways for a business to improve its gearing ratio. These methods include:

Paying off some of the firm’s long-term liabilities (loan capital), such as making additional mortgage payments.

Enhancing the firm’s working capital (liquidity position) by improving its stock control, giving incentives for customers to pay earlier / on time, and/or reducing the credit period given to customers. An improved working capital position (or working capital cycle) enables the business to use additional funds to pay off debts, thereby reducing its level of gearing.

Trying to use or rely more on internal sources of finance, such as retained profits or share capital, instead of external finance (which incurs interest charges).

Watch this video to consolidate your understanding of financial ratios, focusing on the limitations of using ratios:

The creditor days ratio is an efficiency ratio that measures the average number of days an organization takes to repay its creditors (suppliers who the business has bought products from using trade credit).

The debtor days ratio is an efficiency ratio that measures the average number of days an organization takes to collect debts from its customers (those who have bought goods and services on trade credit).

Efficiency ratios are used to measure how well the resources of a business are used in order to generate income.

The gearing ratio is an efficiency ratio that measures the extent to which an organization is financed by external sources of finance.

The stock turnover ratio is an efficiency ratio that measures the number of days it takes a business to sell its stock (inventory).

Which of the following is not classified as an efficiency ratio?

The acid test ratio (also known as the quick ratio) is a liquidity ratio, rather than an efficiency ratio. Efficiency ratios examine the use of an organization’s resources in terms of its assets and liabilities.

Firm X has cost of goods sold (COGS) valued at

The formula for calculating stock turnover ratio = Cost of goods sold (COGS) divided by Average stock value. The average stock = (Opening stock + Closing stock) / 2. In this case, cost of goods sold =

Which of these firms is most likely to have the highest stock turnover ratio?

The stock turnover ratio varies for different businesses in different industries. Whilst the stock turnover rate is likely to be high for IKEA and Hodder Education, it is Carrefour that will have the highest stock turnover ratio. This is because the stock on supermarket / hypermarket shelves are sold at a much faster rate than furniture items or textbooks.

Which financial ratio calculates the time taken by a business to collect money from customers who buy items on credit?

The debtor days ratio calculates how long it takes a business, on average, to be paid by customers who have purchased items on credit.

What is the correct formula for calculating the creditor days ratio?

The creditor days ratio calculates the average number of days a business takes to pay its creditors. Hence, the creditor days ratio is calculated using the formula: (Creditors ÷ Cost of goods sold) × 365.

What does an increase in the creditor days ratio suggest is happening in the business?

A delay in making payment to suppliers will increase the creditor days ratio. The creditor days ratio calculates the average number of days the business takes to pay its creditors, such as suppliers.

What is the correct formula for calculating the gearing ratio?

The gearing ratio calculate the extent to which a firm’s capital employed is being financed by external loans. Hence, the gearing ratio is calculated using the formula: (Loan capital ÷ Capital employed) × 100.

A business has long-term borrowings of

The gearing ratio is calculated using the formula: (Loan capital ÷ Capital employed) × 100. Long-term borrowings represent loan capital. In this case, loan capital of

What does a fall in the creditor days ratio suggest for the business?

Worsening payment terms with the firm’s suppliers mean that earlier payment is needed. This causes a fall in the creditor days ratio for the business.

What is the correct formula used to calculate the debtor days ratio?

The debtor days ratio calculates the average number of days it takes, on average, for a business to collect its debts from customers, i.e. those who purchased goods and/or services on credit terms. The formula to calculate this is (Debtors ÷ Sales revenue) × 365, i.e. the value of money owed to the business as a proportion of its sales revenues, expressed in number of days.

For more questions on this topic, have a go at these review questions from the InThinking Business Management Question Bank to test your understanding of efficiency ratios - click the link here to access the quiz.

If you are seeking additional resources for quantitative questions for student use, these resources are also recommended:

55 Quantitative Worksheets Pack for IB Business Management, by Kenneth Tang, published by L7E (www.level7education.com)

Business Management for the IB Diploma Quantitative Skills Workbook, published by Hodder Education - please click here for the details.

Return to the Unit 3.6 - Efficiency ratio analysis (HL only) homepage

Return to the Unit 3 - Finance & Accounts homepage

IB Docs (2) Team

IB Docs (2) Team