For-profit social enterprises

Source: TradeKindness

“Social and environmental dimensions are woven into the fabric of the company itself. They are neither first nor last among our objectives, but an ongoing part of everything we do.”

- Dame Anita Roddick (1942 – 2007), Founder of The Body Shop

Social enterprises are an example of social purpose organizations (SPOs). They aim to primarily provide a solution to important social or environmental issues. They exist to to create a better world due to the role they play to improve society overall. As they are not always revenue-generating, SPOs often need financial funding and suitable human resources. Other SPOs include charities, cooperatives, and non-governmental organizations (NGOs).Although there is no universally accepted definition of a social enterprise (and the legal definition differs between countries), it is essentially an organization that focuses on meeting social objectives (such as improving social and environmental well-being) and not only commercial business objectives such as profit maximization or maximizing shareholder returns (see Case Study 2 - M-Pesa below).

Traditional, for-profit organizations strive to maximise profits or financial gains for their owners (shareholders). Jack Welch (former Chairman and CEO of GE - General Electric) said: "Even in these uncertain times, every company should practise good corporate citizenship post op but they also need to face the reality that's you first have to make money before you can give it away." In other words, whilst traditional businesses might donate money to charitable causes or have ethical objectives, they primarily aim to earn a profit.

Unlike traditional commercial for-profit businesses, social enterprises combine social and commercial agendas in order to achieve their social and environmental agenda, i.e., they strive to gain a financial surplus to facilitate social gain. Their activities, by definition, purposely create social benefits.

Some differences between social enterprise, traditional commercial (for-profit business entities), and charitable organizations are outlined below.

| Charities | Social enterprises | Traditional businesses |

| Mission driven (charitable mission) | Purpose driven (social purpose) | Vision driven (commercial vision) |

| Funded by donations | Funded by internal and external sources | Funded by owners, investors, and internal and external sources |

| Surplus reinvested | Profits reinvested | Profits distributed to owners |

| Purely charitable | Focus on social benefits | Corporate social responsibilities* |

| Focus on societal gains | Focus on social impact and financial gains | Focus on financial returns |

* Whist traditional businesses may allocate some funds to CSR, it is not their main or most important focus. Instead, the main drivers for such businesses is profit, growth, and protecting shareholder value. A growing number of traditional businesses are reporting on the triple bottom line to as part of their CSR and sustainability goals.

According to the Harvard Business Review, traditional businesses focus on their mission whereas social enterprises focus on their purpose. The differences between an organization's mission and purpose are outlined in the table below.

| Mission | Purpose |

| What we do | Why we do it |

| Operating a business | Sharing a dream |

| Strategic | Cultural |

| Creates buy-in | Instils ownership |

| Provides focus | Fuels passion |

| Builds a company | Builds a community |

In reality, it is up to each business to determine its preferred approach to its mission or purpose.Nevertheless, social enterprises generate revenue like any business organization, but hold community objectives for the wellbeing of others in society, rather than primarily aiming to earn profit for their owners.

According to Social Enterprise UK, to be classified as a social enterprise, a business must:

have a clear social or environmental mission set out in its governing documents and be controlled in the interest of that mission

be independent of state or government control, and earn more than half of its income through trading

re-invest or donate at least half of its profits or surpluses towards their mission

be transparent in the way they operate and the impact they have.

Types of social enterprise explicitly featured in the IB Business Management syllabus:

For-profit social enterprises (AO3): (i) Private sector companies, (ii) Public sector companies, and (iii) Cooperatives.

Non-profit social enterprises (AO3): (iv) Non-governmental organizations (NGOs)

Note that social enterprises can, and often are, for-profit organizations. However, the difference is their existence (or social purpose) is beyond profitability as its very existence generates social benefits. In other words, profit follows as a consequence of its social and environmental goals, rather than as a result of its commercial activities. Also, it is important to understand that a social enterprise is not a charity.

Watch this short video about The Big Issue, established as a street newspaper in September 1991 and now published in four continents. The social enterprise says that it exists to change lives, by giving people who are experiencing homelessness or who are vulnerably housed a hands up, rather than a hand out.

A for-profit social enterprise uses commercial business practices in order to achieve social goals, such as improving the environment, building better communities and developing social wellbeing. Such organizations do not focus on generating profits for their shareholders but strive to build and improve communities.

There are three main types of for-profit social enterprises covered in the IB Business Management syllabus:

Private sector companies

Public sector companies

Cooperatives.

Note: The IB acknowledges that the legal definition of a social enterprise varies between countries. Therefore, the IB recommends that teachers and students should research and arrive at an appropriate set of definitions that differentiate between the different types of organizations in their respective local or national context, especially with respect to the legal differences between social enterprises and charities.

Top tip!

For-profit social enterprises are not traditional charities. Unlike traditional charities, for-profit social enterprises need to earn a profit (or financial surplus) in order to survive. This is because traditional charities rely on donations as their main source of finance.

Key concept - Sustainability

For-profit social enterprises have three main objectives, commonly referred to as ‘the triple bottom line’. The triple bottom line, a business management model developed by John Elkington (b.1949), comprises of the following:

Economic objective (profit) - to earn a profit to fund its activities and growth in a sustainable way.

Social or cultural objective (people) - to provide social gains for members of local communities, such as providing job opportunities and support for less-privileged members of society.

Environmental objective (planet) - to manage and operate the business in such a way as to protect the ecological (natural) environment, i.e., behaving in an environmentally sustainable and responsible manner.

Top tip!

Remember that social enterprises can be not-for-profit or for-profit. All social enterprises focus on meeting social goals and not only commercial business objectives.

Top tip!

HL students should learn this section of syllabus thoroughly as the focus of the Paper 3 exam (HL only) is on a social enterprise. The examination addresses three key aspects:

The Paper 3 examination also requires students to do three main things:

identify and describe a human need (worth 2 marks)

explain the potential organizational challenges facing the social entrepreneur wanting to meet this need (worth 6 marks), and

write a decision-making document that includes a business recommendation or plan of action (worth 17 marks)

Private sector companies are for-profit business organizations that operate in the private sector. They differ from those that operate in the public sector in terms of ownership, and control, the purpose of their existence, how they raise finance, how they are managed, and how any profits (financial surplus) are distributed or how losses dealt with.

For-profit social enterprises can operate in as private sector companies in the private sector of an economy. Examples of for-profit social enterprises that operate as private sector companies include:

Examples of private sector for-profit social enterprises include:

Change Please - The British coffee chain with outlets in London and Manchester donates all of its profits to tackle the problems of homelessness (see Case Study 1 below).

KASHF Foundation - This organization provides financial and social-support services to female entrepreneurs to empower them to set up their own businesses in food production, cloth making, and other industries in Pakistan.

M-Pesa - A multinational mobile phone-based money transfer, financing, and microfinance service provider that also provides mobile banking services (see Case Study 2 below).

- SECLO Foundation - Financial company that provides sustainable energy solutions, such as solar-powered lightning, to low-income households and small businesses in India.

- Thaely - A vegan footwear brand that manufactures sports shoes (sneakers) from waste plastic bags and bottles (each pair contains 15 plastic bags and plastic 22 bottles)

TOMS Shoes, known for giving away one pair of shoes (to those in need) for every pair the private sector social enterprise sells.

Watch this short community outreach video from TOMS shoes.

A for-profit social enterprise operating as a private sector company is a revenue-generating, profit-seeking organization but the purpose of its existence is mainly concerned with social goals which are at the centre of its operations. This differs from commercial or traditional for-profit companies that aim to maximise earnings for their shareholders (owners). For-profit social enterprises have social objectives and use ethical practices to achieve these goals.

Therefore, for-profit social enterprises in the private sector earn their revenues and profit in socially responsible ways and uses the surplus to directly benefit the society or environment rather than distributing the profit to owners in the form of dividend payments.

Case Study 1 - Change Please

Coffee, Change, and Cause

Change Please is a social enterprise based in London and Manchester, UK, which uses coffee as a way out of homelessness. The company hires and trains homeless people to become baristas. The company is known for its life-changing coffee as 100% of any profits go straight to alleviating homelessness in London, Manchester, and an expanding number of locations.

In this short video clip, Cemal Ezel, the founder of the company, says that the social enterprise provides a London-living wage job, housing, bank account, and therapy support to its beneficiaries.

The profits from Change Please are used to empower people experiencing homelessness, by giving them employment as well as support, financial stability, and self-belief so they can survive and thrive. In 2021, the company won a contract to supply coffee to 10 Downing Street - the official residence and the office of the Prime Minister of Great Britain. Change Please is proof that a private sector company can be successful, have an authentic social purpose, and still grow. As the company puts it, "A really good coffee doesn't just taste good, it does good too."

Task

Read more about Change Please in this article from Secret London, a London-based multimedia company, and answer the questions that follow.

Answers

Change Please is part of a social enterprise project that aims to support what social cause? Tackling the problems of the homelessness crisis in London

In which year did Change Please first open? 2015

How many hours of employment a week does Change Please offer its staff? 40 hours (working week)

The volume of homelessness has doubled since which year? 2010

How does Change Please aim to help homeless people? Helping them to find their own accommodation, improving their mental health, and rediscovering their sense of community

A further example is microfinance providers. Microfinance providers are for-profit social enterprises that operate as private sector companies. They offer a financial service to those without a job or on very low incomes. These members of society would not ordinarily be able to secure bank loans. The concept of microfinance was developed by Nobel Prize winner Muhammad Yunus (www.muhammadyunus.org/) in 2006, in association with the Grameen Bank.

The aim of providing microfinance is to help entrepreneurs, especially women, struggling to finance their business start-ups to gain access to loans of a small amount. Microfinance can give these people the opportunity to become self-sufficient and empower them to run their businesses. As with the majority of loans, interest is charged on the amount borrowed, although these are typically lower than what commercial banks would charge.

Microfinance has helped female entrepreneurs in Vietnam

Click the icon below to read about the advantages and disadvantages of microfinance providers as an example of for-profit social enterprises operated as private sector companies.

Advantages of microfinance providers

The advantages of establishing a business as a microfinance provider as a form of for-profit social enterprise include:

Microfinance can help many people to get out of poverty by making them become financially independent.

Around half of the world’s people live on less than $2 a day, (with the vast majority of these living in low-income countries or highly indebted poor countries) so microfinance can help to provide poverty relief.

They help to empower entrepreneurs of small businesses, especially women and the underprivileged working and living in low-income countries.

Microfinance can create benefits for the wider community, such as improved healthcare, education and employment opportunities.

Microfinance providers act in a socially responsible way by helping the poorest and most vulnerable adults in society.

Microfinance can help to build and foster a culture of entrepreneurialship and economic independence.

Disadvantages of microfinance providers

However, there are potential drawbacks of establishing a business as a microfinance provider. These limitations include the following points:

Some people regard the practice of microfinance providers as being unethical as they earn profits from low-income individuals and households.

Microfinance only provides finance on a small scale, so is unlikely to be sufficient to make a real difference to society as a whole.

Microfinance loans incur interest charges, so can be rather expensive for small business owners who find it difficult to earn enough revenue to keep up with their loan repayments.

Microfinance increases the debts of entrepreneurs who may subsequently struggle in their business venture.

Due to relatively low profitability, microfinance providers may struggle to attract and/or retain employees and managers, given that their remuneration packages are unlikely to be matched by larger for-profit financial companies such as commercial banks and insurance companies.

Case Study 2 - M-Pesa offering financial opportunities in Kenya

M-Pesa (M for mobile, pesa is Swahili for 'money') is a mobile phone-based money transfer, financing and microfinancing service. It was launched in 2007 by Vodafone in collaboration with Safaricom and Vodacom, the largest mobile network operators in Kenya and Tanzania respectively. M-Pesa has since expanded to Afghanistan, South Africa, India, Romania and Albania. M-Pesa allows users to deposit, withdraw and transfer money as well as pay for goods and services easily using a mobile device, such as a smartphone.

As a mobile banking service, M-Pesa does not have any branches. Its customers can deposit and withdraw money from a network of agents that includes resellers and retail outlets acting as banking agents. With lower operating costs, M-Pesa can reach out to a larger number of people. M-Pesa's customers are charged a small fee for sending and withdrawing money using the service.

The service has been praised for giving millions of people access to the formal financial systems and for reducing crime in otherwise largely cash-based societies. Within the first five years of its operations, M-Pesa had registered about 17 million accounts in Kenya, and about 7 million accounts in Tanzania.

Source: Adapted from The New York Times

Case Study 2 - Fifteen

For decades, television celebrity chef Jamie Oliver has campaigned to improve children’s diets in schools. Since 2002, he trained disadvantaged young people, many of whom were expelled from school and/or unemployed, to become chefs at his social enterprise called Fifteen. This was a chain of restaurants that operated in London and Cornwall (UK), Melbourne (Australia), and Amsterdam (Netherlands) and operated until 2019 when it collapsed due to liquidity issues. Fifteen had used all profits for giving young people greater opportunities to have a better future.

ATL Activity 1 (Research and Communication skills)

In groups of 2 or 3, investigate the operations, achievements, and challenges of any one of the following private sector companies that operate as for-profit social enterprises. Be prepared to share your findings with the rest of the class.

Change.org - The world's largest social change platform that enables users to create campaigns to attract supporters regarding social and/or environmental matters and issues they care about.

Pigeonly - A technology social enterprise company that operates to help prisoners (inmates) and their families communicate and send photos more affordably.

Spoiler Alert - Based in Boston in the US, this company provides a way for unwanted food to go to people in need, with nearly 50 million Americans living in “food insecure” households.

TOMS Shoes - The pioneer of the Buy One Give One shoes initiative to support underprivileged people, such as children in low-income countries.

In addition to microfinance providers, cooperatives are another example of private sector companies that operate as social enterprises (explained below).

Mass rail transit operators are often run as public sector companies

The public sector is the part of the economy composed of government-owned and/or government-controlled enterprises. It does not include any private sector enterprises (sole traders, partners, limited liability companies, and private sector social enterprises).

Public sector companies operate in a commercial-like way (selling goods and/or services in order to generate a financial surplus) but are owned and/or controlled by government authorities. They can be owned wholly or partially by the government. They are set up as legal business entities to partake in the commercial business activities, enabling successful public sector companies to earn a financial surplus for the government to be used for the benefit of society as a whole.

An example is Canada Line, which is a mass rapid transit operator in British Columbia, Canada. It was opened in 2009 and is owned by TransLink, the statutory authority responsible for the regional transportation network in British Columbia. As with all transportation operators, Canada Line's main revenue stream is from commuters who use their train services. It is also funded by the Canadian government, government agencies, and private partners.

Box 1 - For-profit public sector companies in India

Oil and Natural Gas Corporation Limited

Coal India Limited

Power Grid Corporation of India

National Thermal Power Corporation

Gas Authority of India Limited

Mahanadi Coalfields

Power Finance Corporation Limited

Northern Coalfields

Rural Electrification Corporation

Nuclear Power Corporation of India Limited

Quite often, the public sector is unable to provide the necessary resources and finances to operate an enterprise, so some of the funding required comes from the private sector. In such a case, a public-private partnerships (PPP) is established. A PPP is a jointly established enterprise by a government and one or more private sector businesses. According to the World Bank, a PPP is defined as a long-term contract between a private company and a government agency for providing a public asset or service, in which the private party bears significant risk and management responsibility (not necessarily the majority stake though). The exact arrangements will differ from case to case and from country to country, but often involve the public sector having a majority share in the joint venture. In any case, the public sector company exists to create employment and to reinvest profits (financial surplus) back into the business and the local community.

Read more about PPPs as a form of for-profit social enterprises by clicking on the icon below.

Note: Whilst "PPP" does not appear explicitly in the new guide, public-private partnerships are a common example of public sector companies, so are relevant to the discussions in this section of the syllabus.

Examples of PPP projects include bridge construction projects in Australia and railroad services in Japan. In China, the Shanghai Disney Resort is owned 47% by the Walt Disney Company with the Chinese government owning the remaining 53% majority stake. In Hong Kong, the same arrangement exists with the HK Disneyland Resort established as a PPP between the Walt Disney Company (with 47% of the shares) and the Hong Kong SAR government (with 53% share). As the majority shareholder, these amusement parks are operated as public sector companies, with the social purpose of generating and sustaining jobs and cultural tourism for Hong Kong and Shanghai.

.jpg)

Shanghai Disneyland is a public-private partnership

Such strategic partnerships are a suitable type of organization when the finance for public projects (such as prisons or public parks) lack sufficient funding. The financial burden of a PPP is often borne by the government while the expertise is provided by the private sector partner (such as the Walt Disney Company).

Watch this short video about how PPPs can help countries to provide the funding needed for public infrastructure:

Did you know?

Did you know that Washington University is a private sector organization whilst the University of Washington is a public sector enterprise?

Washington University (formerly known as Washington University in St. Louis) is a private research university was founded in 1853. By contrast, the University of Washington was founded in established in 1861 and is a public research university located in Seattle, Washington.

It can be confusing to distinguish between private and public sector companies, but make sure you know the differences between the private and private sector as well as private and public traded companies.

Other examples of service providers in the public sector that operate as for-profit social enterprises include:

Broadcasting services, such as national broadcasters of television and radio services.

Educational establishments, such as schools, colleges, and universities.

Housing associations to provide social housing for people.

National health service providers that charge for some of their services although provide free basic healthcare services to the vast majority of the population.

Public transport providers, such as buses and mass rail transit.

Sports and leisure centres, including public swimming pool.

Advantages of public sector companies

The advantages of establishing public sector enterprises as a form of for-profit social enterprise include:

Providing a viable solution for the government to finance projects that it simply does not have enough money for unless it is able to charge for the services provided.

As the product is provided by the government, there are fewer risks involved.

By being able to charge for their services, public sector companies help to reduce the debt burden of the economy and taxpayers in particular.

Public sector companies create secure employment opportunities and have a positive impact on local communities and the country’s overall economic growth and development.

Limitations of public sector companies

However, there are potential drawbacks of establishing public sector enterprises. These limitations include the following points:

By funding a particular public sector enterprise, the government gives up the option of financing other items of government expenditure, such as road maintenance, flood defence systems, and developing communications networks.

In addition, most public sector enterprises are expensive to operate (involving high set-up costs and running costs). This means they can be high-risk businesses with unpredictable rates of return on the investments. For example, Hong Kong Disneyland opened in 2005 but took seven years to declare a profit (the annual profit in 2012 was only US$13.97 million).

Hence, it can be difficult to persuade private sector partners or investors to help fund public sector companies. Investors could be unsure and unwilling to form a PPP, for example, due to the uncertainty of such businesses being able to generate any long-term profit.

Public sector companies are often associated with bureaucratic policies and procedures, which can cause inefficiencies and delays to decision making.

ATL Activity 2 - Public-private partnerships

Investigate the scale and scope of public-private partnerships on the World Bank’s website here.

The World Bank's Open Learning Campus (OLC) also has an insightful video about PPPs here.

Top tip!

Do not confuse publicly held companies, which operate in the private sector and offer their shares on a public Stock Exchange, with public corporations, which are public sector companies owned by the government on behalf of the general public.

Cooperatives exist for their owner-members

Cooperatives are for-profit social enterprises that are owned and managed by their members. Examples are employee cooperatives, producer cooperatives, managerial cooperatives and customer cooperatives. Cooperatives exist throughout the world, but are predominant in the agricultural and retail sectors of the economy in many parts of Europe.

According to the United States Federation of Worker Cooperatives (USFWC), there were 612 worker cooperative in the US in 2021, generating a gross revenue of $283 million. Globally, there are around 3 million organizations set up as a cooperative and around 12% of the world population are members of at least one of these cooperatives.

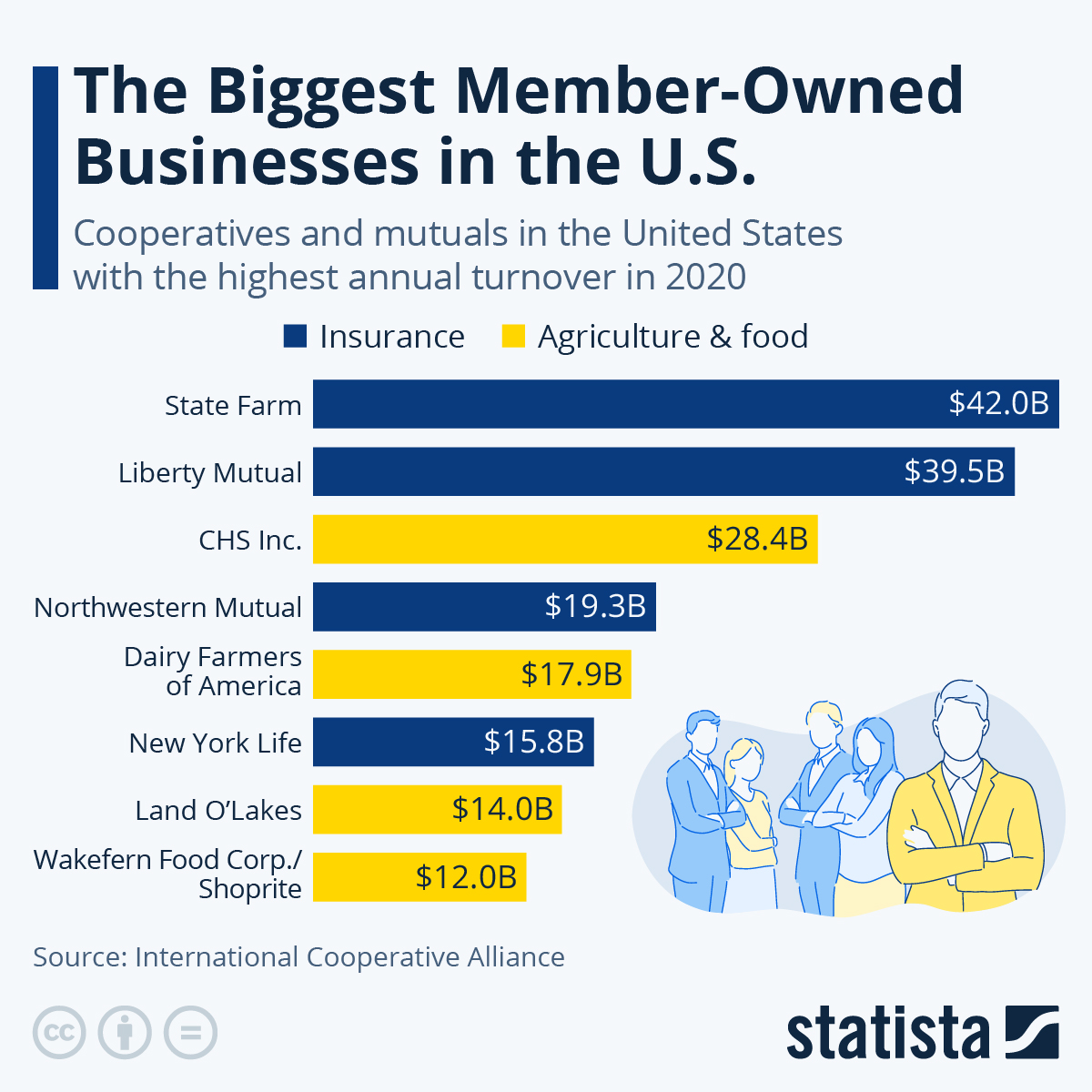

This chart shows the largest cooperatives in the US. State Farm, with its headquarters in Bloomington, Illinois, is America's largest cooperative in terms of sales turnover. The insurance company operates as a member-owned cooperative and generated an income of $42 billion in 2020. The business model used by State Farm means the cooperative pays its policyholders either a dividend or reduces premiums.

Source: Statista (29 June 2023)

Features of cooperatives

As a category of for-profit social enterprises, cooperatives strive to provide a service for the members, providing and creating value, instead of seeking to earn a desired level of profit margin for their member-owners. However, any profits of the cooperative are shared with its members.

Most cooperatives are registered as limited liability organizations. Like limited liability companies, cooperatives have a separate legal entity from their shareholder owners. Hence, shareholders, directors, managers, and employees are not held personally liable for any debts incurred by the cooperative.

All member shareholders are expected to help run the cooperative, although it is overseen by an elected board of directors that makes long-term strategic decisions.

All members of a cooperative have equal voting rights, irrespective of their role in the business or their level of investment in the cooperative.

Members of a cooperative have limited liability, restricted to the amount they invested in the business.

Cooperatives tend to have a democratic culture, with empowerment of its members to make decisions. The organizational structure is rather flat as there is decentralised decision making (see Unit 2.2).

Watch this short video clip the Singapore National Co-operative Federation. The video shows how the idea of cooperatives came about, following the industrial revolution. It also covers the functions of cooperatives. There is no need to watch the final minute of the video unless you are based in Singapore:

Advantages of cooperatives

The advantages of establishing cooperatives as a form of for-profit social enterprise include:

Cooperatives are not difficult or expensive to set up.

Cooperatives are tax exempt because the focus of the business is on serving the collective interests of its member-owners and the community (such as home care associations for the elderly).

As all member shareholders are expected to help run the cooperative, it is more likely to succeed.

Similarly, as the owners have equal voting rights, the cooperative is more democratic so the members feel equally important to the success of the business. This is likely to lead to a harmonious working environment.

There is an absence of pressure from external investors and shareholders, so the member-owners of the cooperative can run the business that best suits their own interests.

As cooperatives strive to benefit their members and society, they often qualify for government financial support.

Unlike partnerships or sole traders, there is continuity in a cooperative should a key owner leave the organization, for whatever reason.

Disadvantages of cooperatives

However, there are potential drawbacks of establishing a business as a cooperative. These include the following points:

As cooperatives are not profit-driven, it can be difficult to attract investors, financiers and member-shareholders.

Similarly, employees and managers of cooperatives may lack the financial motivation to excel, due to the absence of a profit motive.

Most cooperatives have very limited sources of finance as their capital depends on the amount contributed by their members.

Most cooperatives are unable to hire a range of specialist managers to run the business, due to the lack of financial rewards and sources of finance to remunerate their senior staff. This can limit the success of the cooperative.

A democratic culture is not always effective. Despite some members having more to contribute to the organization and greater responsibilities, they only get one vote as do all other members. This can be somewhat inefficient and perceived as unfair for some members.

Common mistake

Students often confuse charities with social enterprises. Whilst there are similarities, there are legal differences regarding the funding and operations of these different business entities.

Unlike traditional or mainstream charities, social enterprises are funded by commercial (trading) activities for the majority of their revenue streams whereas traditional charities rely on donations, government grants, and/or endowments (such as a financial gift of money or other asset or a scholarship given to a person or to an institution).

True or False quiz

To test your understanding of cooperatives, have a go at the following true or false questions.

| Statement | True or False? | |

| 1. | A cooperative is established to serve the common interests of its members. | True |

| 2. | A cooperative operates in the private sector of the economy. | True |

| 3. | Cooperatives are for-profit organizations. | True |

| 4. | A cooperative has a board of directors that makes strategic decisions. | True |

| 5. | Members of a cooperative have unlimited liability. | False |

| 6. | There is a legal separation between the members of a cooperative and the business itself. | True |

| 7. | Any financial surpluses or profit is distributed between members of the cooperative and/or used as retained profit. | True |

| 8. | Cooperatives are not permitted to declare a profit, with any surpluses being entirely reinvested in the business. | False |

| 9. | All owner-members of a cooperative have equal voting rights. | True |

| 10. | There is continuity in a cooperative should a key owner leave the organization. | True |

Business Management Toolkit (BMT)

Discuss the importance of SWOT analysis for a non-profit social enterprise of your choice.

You will find it useful to refer to BMT 1 - SWOT analysis prior to answering the above task.

Not all social enterprises are for-profit organizations. Some social enterprises are not run for profit, such as non-governmental organizations (NGOs) and charities. However, even these non-profit organizations must earn a surplus from their business in order to continue operating. The difference is that the surplus is reinvested back in the social enterprise and/or the community.

Click the link here to read more about types of non-profit social enterprises.

Exam Practice Question 1

(a) | Outline why it is important for social enterprises to earn a profit or financial surplus. | [2 marks] |

| (b) | Describe two features of a social enterprise. | [4 marks] |

| (c) | Explain two differences between for-profit social enterprises and traditional for-profit commercial businesses. | [4 marks] |

Answers

(a) Outline why it is important for social enterprises to earn a profit or financial surplus. [2 marks]

Social enterprises, be they for-profit or not-for-profit, strive to achieve social objectives and earn sales revenue in excess of their operational costs in order to continue operating in a sustainable way. Social enterprises are unable to deliver social benefits if they do not effectively manage the financial health of the business. In other words, without a profit (or financial surplus), the social enterprise ceases to operate for social gain.

Award [1 mark] for an answer that shows limited understanding of the demands of the question.

Award [2 marks] for an answer that shows good understanding of the demands of the question, similar to the example above.

(b) Describe two features of a social enterprise. [4 marks]

Possible features include:

Social enterprises operate in a commercial way (to generate a surplus or profit) but provide an authentic social or environmental purpose to their operations.

They are directly involved in producing goods or providing services.

They have, and are driven by, social aims and ethical values.

They strive to achieve a financial surplus in order to expand the activities of the social enterprise.

They are self-sustaining. i.e., they do not rely on charity or philanthropy for their on-going sustainability, but generate revenue from sales. They are not charities.

Accept any other appropriate feature that is accurately described.

Mark as a 2 + 2

For each feature, award [1 mark] for an appropriate answer and a further [1 mark] for an accurate description.

(c) Explain two differences between for-profit social enterprises and traditional for-profit commercial businesses. [4 marks]

Possible differences include an explanation of:

While traditional for-profit commercial businesses strive to return a profit to their owners, for-profit social enterprises strive to return a financial surplus for social benefit.

Unlike for-profit commercial businesses, any profit earned by a for-profit social enterprise is not redistributed to shareholders in the form of dividends, but reinvested in the social enterprise to for social and/or environmental gain.

Accept any other appropriate feature that is accurately described.

Mark as a 2 + 2

For each feature, award [1 mark] for an appropriate difference and a further [1 mark] for an accurate explanation.

Exam Practice Question 2 - Cooperatives

State Farm Insurance, the highest-turnover US cooperative in 2020, generated $42 billion in annual sales. Other successful member-owned cooperatives in the US include Liberty Mutual, Northwestern Mutual, and New York Life. Agricultural cooperatives, such as Dairy Farmers of America, also ranked amongst the top earners with annual sales turnover of $17.9 billion. Globally, the top 300 cooperatives had a turnover of $2.2 trillion, with most generating up to $5 billion in sales.

The French Groupe Crédit Agricole, an international banking group and the world's largest cooperative financial institution, had the highest total turnover in 2020 at $89 billion. France, the USA, and Germany have the most high-earning cooperatives.

Cooperatives come in various forms, including consumer, producer, and worker cooperatives. For example, in the US, there were 612 worker cooperatives in 2021, generating $283 million in revenue. Globally, approximately 3 million companies operate as cooperatives, with 12 percent of the world population being members.

Source: adapted from Statista

(a) | Define the term cooperatives. | [2 marks] |

| (b) | Explain two benefits of being a member of a cooperative. | [4 marks] |

| (c) | Explain why is can be difficult to measure the market share of cooperatives such as Groupe Crédit Agricole or Dairy Farmers of America. | [4 marks] |

Answers

(a) Define the term cooperatives. [2 marks]

A cooperative is a type of for-profit social enterprise that operates on the principles of mutual cooperation, collective ownership of its members, and having democratic control. The primary goal of a cooperative is to serve the interests of its members rather than maximizing profits for external shareholders.

Award [1 mark] for a definition that shows limited understanding of the term cooperatives.

Award [2 marks] for a definition that shows a clear understanding of the term cooperatives, similar to the example above.

(b) Explain two benefits of being a member of a cooperative. [4 marks]

Possible benefits could include:

Membership offers financial benefits as members gain from the collective success of the organization. Successful cooperatives like State Farm Insurance generate significant sales, resulting in potential financial rewards for its members. These rewards can include dividends, lower prices, or cooperative investments.

By pooling resources and leveraging collective bargaining power, cooperative members benefit access to economic opportunities not available to individuals, such as negotiating lower prices from their suppliers,. This enables members to gain from potential large economies of scale.

Cooperative members have a say (vote) in decision-making. Unlike traditional business models, cooperatives operate on a "one member, one vote" basis, ensuring equal participation. Hence, members can actively influence operations, policies, and strategy. This collective influence allows members to shape the cooperative based on their shared values and member engagement.

Cooperatives promote collaboration and knowledge sharing amongst their members. Cooperative members learn from each other's experiences, expertise, and best practices, leading to improved business practices, productivity, and innovation. This supportive network fosters a sense of community and providing support for individual members to pursue their business endeavours.

Accept any other benefit, explained in the context of the case study.

Mark as a 2 + 2

For each benefit, award [1 mark] for a valid benefit of being a member of a cooperative and a further [1 mark] for a valid explanation.

(c) Explain why is can be difficult to measure the market share of cooperatives such as Groupe Crédit Agricole or Dairy Farmers of America. [4 marks]

Market share is the percentage of a market controlled by a particular organization based on quantifiable measures, most typically sales revenue per annum. It reflects the organization's degree of market power and competitive strength. It is calculated by dividing a firm's sales revenue by the total market sales revenue, expressed as a percentage figure.

It can be difficult to measure the market share of cooperatives such as Groupe Crédit Agricole or Dairy Farmers of America due to any of the following reasons:

- Diverse markets - Cooperatives operate in various sectors and industries, ranging from insurance and finance (Groupe Crédit Agricole) to agriculture (Dairy Farmers of America ). The diversity makes it challenging to measure their market share accurately or meaningfully. Each cooperative may have a significant market share within its respective industry, but comparing their market share across different sectors becomes complex and perhaps needless.

- Membership structure - Cooperatives are member-owned organizations, and their focus is on serving the interests of their members rather than maximizing sales or profits. As a result, their business models often prioritize cooperation and collaboration amongst members rather than engaging in intense competition with other businesses. Their member-centric focus make it challenging to accurately measure and compare their market share against traditional for-profit enterprises.

Award [1 - 2 marks] for a response that shows some understanding of the demands of the question. The response may be generic and lacks clear application of the stimulus material.

Award [3 - 4 marks] for an answer that shows good understanding of the demands of the question. There is effective use of relevant business management terminology throughout the response. The response includes appropriate application of the stimulus material.

Cooperatives are for-profit social enterprises that are owned and managed by their members.

A for-profit social enterprise uses commercial business practices in order to achieve social goals, such as improving the environment, building better communities and developing social wellbeing.

Microfinance providers are for-profit social enterprises that offer a financial service to those without a job or on very low incomes.

Private sector companies are for-profit business organizations that operate in the private sector.

Public-private partnerships (PPP) are an example jointly established by a government and one or more private sector businesses.

Public sector companies operate in a commercial-like way (selling goods and/or services in order to generate a financial surplus) but are owned and/or controlled by government authorities. They can be wholly or partially owned by the government.

Social enterprises are organizations that use commercial business principles and practices to achieve social and/or environmental objectives by competing with other rival businesses.

Return to the Unit 1.2 - Types of organizations homepage

Return to the Unit 1 - Introduction to Business Management homepage

IB Docs (2) Team

IB Docs (2) Team