Liquidity ratios

This section of the IB Business Management syllabus looks at liquidity ratios (AO2, AO4) and examines the possible strategies to improve these ratios (AO3).

Liquidity ratios are financial ratios that examine an organization’s ability to pay its short-term liabilities and debts. Liquidity refers to the ease with which a business can convert its assets into cash without affecting its market value, i.e. it measures a firm’s ability to repay short-term liabilities without having to use external sources of finance.

The IB Business Management syllabus specifies the following two liquidity ratios:

Current ratio

Acid test ratio (also known as the quick ratio).

These liquidity ratios are used to measure the extent to which an organization can pay off its short-term debts using its current (liquid) assets. It is vital for all organizations to manage their liquidity in order to prevent a liquidity crisis (the situation that arises when the organization is unable to pay its short-term debts). In the worst-case scenario, a liquidity crisis could lead to insolvency, i.e., bankruptcy of the business.

The current ratio is a short-term liquidity ratio used to calculate the ability of an organization to meet its short-term debts (within the next twelve months of the balance sheet date). It calculates the value of an organization’s liquid assets relative to its short-term liabilities.

Recall from the balance sheet (Unit 3.4) that a firm's liquid assets are comprised of:

cash

stock (also known as inventory), and

debtors

Also, recall that a firm's current liabilities (short-term debts) are comprised of:

bank overdrafts

trade creditors, and

short-term loans.

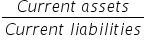

The current ratio is calculated using the formula:

For example, if a firm’s current assets are valued at $25 million and its current liabilities equal $15 million, then the current ratio = $25m million ÷ $15 million = 1.67 (or sometimes expressed as 1.67:1). This figure means that for every $1 of current liabilities that the firm owes to its creditors, it has $1.67 in highly liquid current assets.

In general, the minimum figure for the current ratio for any organization, must be 1.0 (or 1:1). What this means is that the firm has just enough liquid assets to pay off its short-term liabilities.

To improve the current ratio, a business needs to increase its current assets and/or reduce its current liabilities. Hence, it can take any combination of the following actions:

Attract more customers, perhaps by changing the pricing strategy and/or improving its promotional strategies.

Encourage customers to pay by cash, thereby improving the firm’s cash inflows.

Use any available cash to pay off short-term debts, thereby reducing the interest (debt) burden on the business in the long run.

Negotiate with suppliers for an extended trade credit period (e.g. from 30 days to 40 days), thereby improving its own liquidity position.

Case Study - Nine West's liquidity problems

Read this short but excellent BBC article about the closure of shoe retailer Nine West due to liquidity problems.

At the time of filing for bankruptcy under US law, Nine West estimated that its assets were valued between $500 million to $1 billion, but that its liabilities were anywhere between $1 billion to $10 billion!

Click the link here to read the article.

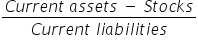

The acid test ratio (also known as the quick ratio) is a short-term liquidity ratio used to measure an organization’s ability to pay its short-term debts (within the next twelve months of the balance sheet date), without the need to sell any stock (inventories). Stocks are ignored from the calculation as some inventories are not highly liquid, such as work-in-progress or very expensive finished goods sold in niche markets. This makes the stock difficult to sell or convert into cash in a short period of time.

Calculating the acid test ratio is similar to the current ratio except that stocks (inventories) are excluded from the calculation of current assets. As mentioned above, this is because stocks are not always highly liquid assets for some businesses. It tends to be the preferred measure of short-term liquidity for businesses with inventories that are not always easily converted into cash and/or for businesses that have a long working capital cycle.

The acid test ratio is calculated using the formula:

For example, if a business has current assets equal to $18 million, current liabilities equal $12 million and stock equals $2 million, then the firm’s acid test ratio = ($18 million – $2 million) ÷ $12 million = $16m / $12m = 1.33 (or sometimes expressed as 1.33:1). This figure means the business has $1.33 worth of liquid assets (without having to sell any of its inventory) for every $1 of current liabilities that the organization incurs.

It is usual to expect as a bare minimum that firms have an acid test ratio of no less than 1:1, otherwise it would mean that the business has a serious liquidity problem. For example, an acid test ratio of 0.8:1 would mean the business only has $0.80 of current assets (ignoring its illiquid stocks or inventories) for each $1 of current liabilities that it owes to creditors. Hence, the business has insufficient liquid funds to pay off its short-term debts.

To improve the acid test ratio, a business can opt to:

Use the same methods that improve the current ratio (essentially, any combination of methods that raise cash inflows for the business and/or reduce its cash outflows).

Improve its stock control management system (see Unit 5.5) in order to reduce the cash outflows associated with poor stock control management. This is because the value of a firm’s acid test ratio improves as its level of stocks (inventories) falls.

Key concept - Change

Discuss how change can impact the profitability and liquidity ratios of a business organization.

ATL Activity - Video review

Watch this 10-minute video to consolidate your understanding of liquidity ratios:

The acid test ratio (also known as the quick ratio) is a short-term liquidity ratio used to measure an organization’s ability to pay its short-term debts (within the next twelve months of the balance sheet date), without the need to sell any stock (inventories).

The current ratio is a short-term liquidity ratio used to calculate the ability of an organization to meet its short-term debts (within the next twelve months of the balance sheet date).

Liquidity refers to the ease with which a business can convert its assets into cash without affecting its market value, i.e., it measures a firm’s ability to repay short-term liabilities without having to use external sources of finance.

Liquidity ratios are a category of financial ratios used to measure the extent to which an organization can pay off its short-term debts using its current (liquid) assets.

Muller Books Limited (MBL) is a small business specializing in publishing and distributing educational books and resources. The privately listed company was founded by Sarah Muller. MBL has a small office in Dresden, Germany. The company employs 4 full-time staff and several part-time staff. Sarah has a good working relationship with her staff and the local bank manager.

MBL has enjoyed several years of expansion in the provision of online education products, such as interactive e-books and online teacher training courses for a wide range of subjects. However, these are becoming somewhat dated and several rival companies have recently established an online presence in the market. The booming economy has also meant that interest rates in Germany are on an upwards trend.

Five years ago, Sarah was able to secure a patent (legal protection) on a piece of software used for MBL’s online teacher training. The company has been dependent on this software for establishing a broad customer base. Sarah has been informed by Lucy Croft-Wang, her accountant, that MBL’s software developmental expenses have risen dramatically. Lucy presented the following financial information for MBL as at 31st December 2021, which raised some working capital and liquidity issues. All figures are expressed in euros (€):

Cost of sales | 90,000 |

Current assets | 60,000 |

Current liabilities | 55,000 |

Expenses | 60,000 |

Non-current assets | 750,000 |

Non-current liabilities | 320,000 |

Retained profit | 85,000 |

Sales revenue | 350,000 |

Shareholders’ funds | 350,000 |

(a) | Define the term non-current assets. | [2 marks] |

(b) | Construct a profit and loss account for MBL using the financial information given above. | [4 marks] |

(c) | Calculate the value of the current ratio. | [2 marks] |

(d) | Using your answer from question (c) above and the information in the case study, explain why MBL is said to have “some working capital and liquidity issues”. | [4 marks] |

(e) | Examine possible financial strategies that Sarah Muller could use to deal with her company’s working capital and liquidity issues. | [6 marks] |

Download a PDF copy of the exam practice question here for use with your students.

Teacher only box

Answers

(a) Define the term non-current assets. [2 marks]

Non-current assets are resources owned by a business that are not intended for resale within the next twelve months, e.g., delivery van, fixtures and fittings, land and trademarks. They are therefore relatively illiquid assets.

Award [1 mark] if there is some understanding of ‘non-current assets’ shown, although the answer might lack clarity.

Award [2 marks] if ‘non-current assets’ is clearly defined, similar to the example above.

(b) Construct a profit and loss account for MBL using the financial information above. [4 marks]

Profit and Loss account for MBL for year ended 31st December 2021 (all figures in euros €):

Sales revenue

Cost of sales

Gross profit

Expenses

Profit

350,000

(90,000)

260,000

(60,000)

200,000

Award [1 – 2 marks] if limited understanding is shown. The profit and loss account might be presented in an incoherent format.

Award [3 – 4 marks] if the construction of the profit and loss account is coherent although there are two or more errors. An appropriate title might be missing from the accounts.

Application of the Own Figure Rule (error carried forward) should apply where appropriate. Award 4 marks for an accurate construction of the profit and loss account, with an appropriate title used.

(c) Calculate the value of the current ratio. [2 marks]

Current ratio = €60,000 ÷ €55,000

Current ratio = 1.09:1

Award [1 mark] for the correct answer but without any/the correct working out shown.

Award [2 marks] for correctly calculating the ratio with the coo working out shown.

(d) Using your answer from question (c) and the information in the case study, explain why MBL is said to have “some working capital and liquidity issues”. [4 marks]

Working capital issues (problems) occur when a firm has insufficient working capital (net current assets) in the short term, i.e. within twelve months of the balance sheet date. Longer term liquidity issues occur when a firm experiences high gearing during times of escalating interest rates because the commitment to non-current (long term) liabilities drain the firm’s financial resources.

Hence, the current ratio of 1.09:1 means that for every €1 of current liabilities, MBL only has €1.09 worth of liquid assets. In fact, non-current assets account for 92.6% of firm's total assets, i.e., [€750,000 / (€750,000 + €60,000)] × 100. This means that MBL lacks adequate liquidity.

HL only candidates might also choose to use the gearing ratio to look at the longer term liquidity issues. In this case, MBL’s gearing ratio is quite high at 42.38% (€320,000 ÷ €755,000). The necessity to repay long term creditors with interest means that MBL’s level of gearing could make the company quite vulnerable since the German economy is experiencing higher interest rates. Candidates might also refer to the €85,000 of accumulated retained profit which could be used to tackle its immediate liquidity issues.

Award [1 – 2 marks] for a limited response with some understanding shown. There are omissions in the explanation and/or the answer lacks coherence and application to MBL.

Award [3 – 4 marks] for applying the liquidity ratio (the current ratio and perhaps the gearing ratio). There is a good explanation of how the current ratio suggests MBL might be facing issues regarding its working capital and liquidity. Appropriate use of terminology is shown.

(e) Examine possible financial strategies that Sarah Muller could use to deal with her company’s working capital and liquidity issues. [6 marks]

Issues that could be considered include the following points:

Obtaining an overdraft to deal with the lack of working capital – this might not be too difficult since Sarah has a good professional relationship with her local bank manager. However, interest rates are on an upwards trend.

Since interest rates are increasing, cash outflow on MBL’s long term liabilities (which represent over 42% of the company’s capital employed) will increase, thereby adding further pressure to company’s liquidity position.

Since the firm relies on e-commerce, extending its products and training courses to overseas clients (schools and teachers) beyond German might help to increase revenue; thereby improving MBL’s liquidity position.

However, MBL could be experiencing problems with overtrading, i.e. expanding too quickly without the necessary financial and human resources to do so. Hence, one strategy would be to limit its rate of expansion in the USA and other countries.

Tighter credit control – MBL can limit trade credit to their customers or reduce the credit period offered so that the company can receive its cash sooner (thereby improving its working capital and liquidity position).

Accept any other valid factor that is examined in the context of MBL.

Award [1 – 2 marks] for a generalized answer that lacks reasoning and/or coherence. The answer might appear in a list-like format.

Award [3 – 4 marks] if there is some understanding of the demands of the question, but the answer lacks detail and/or clarity in some areas. At the top end, there is an attempt at application of the stimulus material.

Award [5 – 6 marks] if the examination is thorough and considers numerous ways that MBL could use to deal with its working capital and liquidity issues. Appropriate business management terminology and examples are used throughout the answer in connection with information related to MBL.

Return to Unit 3.5 - Profitability and liquidity ratio analysis homepage

Return to Unit 3 - Finance and accounts homepage

IB Docs (2) Team

IB Docs (2) Team