The purpose of accounts to different stakeholders

The purpose of accounts to different stakeholders (AO2)

"Accountability breeds response-ability".

- Stephen R. Covey (1932 - 2012), Author of "The 7 Habits of Highly Effective People"

Final accounts are the published accounts of an organization, made available to and used by different stakeholders, such as managers, employees, shareholders, sponsors, financiers, and investors. This differs from management accounting (not covered in the IB syllabus), which refers to financial accounts created by and used for internal and confidential purposes. The final accounts of a business consist of two important sets of financial documents:

The profit and loss account (also known as the income statement), and

The balance sheet (also known as the statement of financial position).

Users of final accounts include both internal and external stakeholder.

Internal stakeholders include managers, employees and shareholders. They can use the final accounts to gauge the performance of the business, in order to negotiate pay deals or to judge the level of job security.

External stakeholders include banks, suppliers, customers and the government. External stakeholder groups are interested in an organization’s final accounts in order to enable them to make sensible and coherent decisions. For example, financiers such as commercial banks and other lenders use the final accounts to evaluate the organization’s ability to afford its debts (or borrowing).

Managers

Reasons why managers are interested in the final accounts include being able to:

measure the performance of the business against organizational targets.

benchmark key indicators (such as net profit figures) against those of rival businesses.

review financial performance against planned or targeted performance.

help with decision-making, e.g. to assess whether the business has sufficient funds for new investment projects.

set budgets and targets for the future, e.g. target profit.

monitor and control business expenditure across the various departments in the organization.

assist strategic planning, e.g. growth and evolution of the organization.

Final accounts assist managers with strategic planning

Employees

Reasons why employees are interested in the final accounts include:

Employees can use final accounts to gauge the extent to which their jobs are secure; a profitable business with a healthy balance sheet will create improve job security and promotional opportunities.

Workers can use final accounts as part of the negotiation process with labour unions to discuss pay rises and conditions of employment; again, a profitable and healthy business helps workers to strengthen their case for job security and pay rises.

Top tip!

Improved profitability does not necessarily mean that workers are entitled to a pay rise. Nevertheless, data in the final accounts can improve the negotiation power of labour unions to further support their members.

Shareholders

Reasons why shareholders are interested in the final accounts include being able to:

Measure whether the business is more or less profitable, and how this has changed over time.

Measure the value of the business and judge whether this has increased over time.

Calculate the return on their investment (refer to profitability ratios).

Determine how much dividends (share of the organization’s profits) they receive.

Decide whether the organization has prospects for growth and expansion.

Compare the financial performance of different businesses in order to make rational investment decisions (whether to buy or sell any shares in the company).

Note: Potential/new shareholders and investors are also interested in the final accounts of a business, as they need access to the financial data to decide whether to invest in the company. This can be done by calculating its profitability ratio (see Unit 3.5), measuring its gearing ratio, and determining the company’s liquidity position (see Unit 3.6).

Financiers

Reasons why financiers (such as commercial banks or microfinance providers) are interested in the final accounts of a business include being able to:

Decide whether to lend money to the business, and how much to lend, by judging the degree of risk involved.

Check on the creditworthiness of the organization before overdrafts or loans are given.

Assess the extent to which the business is able to pay back its borrowing (with interest).

Financiers examine final accounts to judge on the creditworthiness of their clients

Suppliers

Reasons why suppliers will be interested in the final accounts of a business include being able to:

Assess whether the business has sufficient liquidity to pay its debts (trade credit).

Determine the creditworthiness of the business in order to gauge the level of risk involved.

Negotiate improved credit terms, such as deciding whether to extend the trade credit period or to demand immediate cash payment.

Customers

Reasons why customers will be interested in the final accounts of a business include:

Gauge whether a business is finically secure, especially if there is a long working capital cycle (a lengthy delay between the customers paying and receiving the products).

Determine whether the business offers security and reliability in its services; otherwise, customers will go elsewhere and purchase by rival suppliers.

Determine whether there will be future supplies of the product they are purchasing – this is particular important for customers that rely on a particular supplier or business.

Top tip!

Remember that businesses can be customers too. For example, McDonald’s restaurants in the Guangzhou region of China purchase their McNuggets from an outsourced company called McKeys. McDonald’s is the customer, whereas McKeys is the supplier in this case.

The government

Reasons why the government (including tax authorities) will be interested in the final accounts of a business include:

To calculate and check (verify) the amount of tax that is due to be paid by the business.

To measure the extent to which the business is able to expand and create jobs in the economy.

To assess the liquidity position of the business, in case there is a threat of business closure, which could cause serious economic problems (depending on the size of the business and the market in which it operates).

To ensure the business operates within the law, by adhering to the country’s accounting rules and laws.

Authorities require businesses to pay their taxes

Competitors

As an external stakeholder group, competitors may be interested in the final accounts of a particular business operating in the same industry or market. These reasons include:

Being able to compare their own financial accounts with the business in question, in order to judge their own financial performances.

Benchmark best practise by examining what the business does well, and determine how they themselves can improve.

ATL Activity - Nine West

Read this short but insightful BBC article about the closure of shoe retailer Nine West due to liquidity problems. Consider the stakeholders that are most affected by the bankruptcy. Click the link here to read the article.

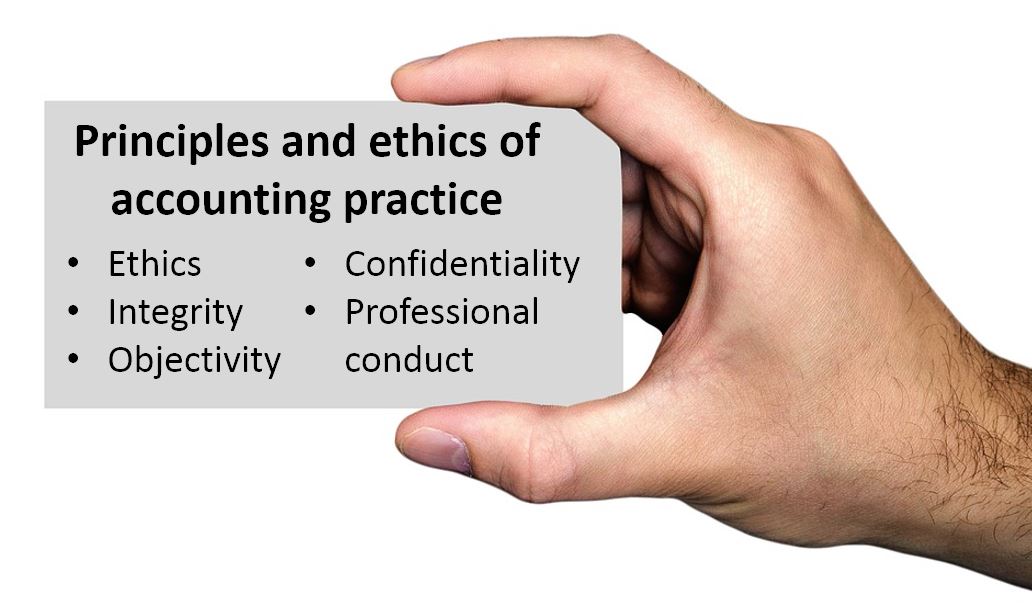

Key concept - Ethics

There are ethical (moral) values that accountants must observe when compiling the final accounts of a business. Ethical behaviour is about doing what is perceived to be the right thing to do, from society’s point of view. Wrongdoings, even if not illegal, are unethical.

The compilation of final accounts is influenced by ethical codes of practice. In many countries, there are professional regulatory bodies set up to monitor ethical standards and practices in the accountancy industry. Examples include the Australian Accounting Standards Board, Accounting Standards Committee of Germany, and America’s Financial Accounting Standards Board.

Accountants need to be open, transparent and honest in the recording and reporting of all financial transactions. This mean the final accounts of an organization should be produced accurately and truthfully, meeting the needs of the relevant tax authorities and all other stakeholders of the business, e.g. the senior management and owners of the firm. Hence, most businesses will have an annual internal and/or external audit of their financial accounts, to ensure that their accounting practices were completed with integrity.

The ethics of accounting practice mean that accountants and financial managers are privy to confidential information. It is therefore essential that those with access to such data and information about a certain company do not misuse this for their personal benefit.

Watch this short video about the unethical (and illegal) nature of insider trading. Insider trading occurs when an individual makes a trade on the stock exchange after learning important and confidential information about a particular company for their own personal gain. This information is not, however, available in the public domain.

The Certified Public Accountant (CPA) and the Association of Chartered Certified Accountants (ACCA) require their members to adhere to strict ethical standards, principles, and practices

Key concept - Creativity

A firm's final accounts must be handled with some caution. Since there is no single accounting standard that is universally accepted, accountants can be creative in the compilation of final accounts. Creative accounting (or window dressing) is the legal manipulation of financial statements based on the accounting principles and rules in the country in order to make the figures look more flattering (in the same way that people clean and tidy their homes before guest are due to arrive). Examples of window dressing include:

Showing an overdraft that is repayable after twelve months as a long term liability to improve the working capital figure of the business. This is perfectly legal since in practice the firm could apply for an extension in repaying the overdraft.

Including a realistically optimistic valuation of intangible assets.In other orders, how firms treat and value intangible assets will affect the values shown in their balance sheets.

Using ‘sale and leaseback’ just before the final accounts are due will show a sudden hike in the liquidity position of a firm, although leasing fixed assets will cost the company more in the long run. Similarly, some fixed assets might be sold just before the reporting date to improve working capital.

Outstanding bills and loans that are about to be paid off can be postponed until after the date of the accounts. This can also allow firms to benefit from tax concessions.

Declaring sales revenues (in the P&L account) for items paid on credit for which payment has yet to be received. This boosts the profit figures, much to the delight of shareholders.

The choice of method to depreciate fixed assets (covered earlier in this Unit) will affect the reported value of fixed assets. In addition, delaying depreciation charges until after the balance sheet date will mean a higher reported value for the firm’s fixed assets.

Creative accounting does not cover the illegal misrepresentation of financial records. Instead, this would be fraudulent and unlawful. It is important to be aware of window dressing since it can hide shortcomings in a firm’s financial performance. For example, manipulating figures in the final accounts to make working capital look more impressive does not solve any underlying liquidity problem.

Key concept - Ethics

Discuss the importance of ethics in the context of accounting practice.

Possible areas for discussion could include:

Integrity - Accountants need to be open and honest in all aspects of their professional conduct, e.g., final accounts should be reported accurately and truthfully with the tax authorities and all other interested stakeholders.

Objectivity - The reporting of final accounts should not contain bias or undue influence of others parties. Accounting practices should be free of any conflict of interest between the business and its various stakeholder groups.

Professional competence and due care - This means accountants have a professional duty to continue their professional knowledge and act diligently. They should stay up to date with developments in the industry, including changes in legislation and accounting practices.

Confidentiality - Accountants must respect the confidentiality of financial data and information acquired as a result of their profession. They must not disclose any of this to third parties unless there is a legal or professional duty to do so. The data must not be used for personal gain of the accountant or third parties. This is both a legal and ethical obligation.

Professional conduct - Accountants must avoid any action that could bring their profession into disrepute, e.g., they must comply with relevant laws and regulations regarding accounting practices.

Business Management Toolkit

How important is it to include the financial accounts of a business in a SWOT analysis?

You might find it useful to refer to SWOT analysis prior to answering the above task.

Return to the Unit 3.4 - Final accounts homepage

Return to the Unit 3 - Finance & accounts homepage

IB Docs (2) Team

IB Docs (2) Team