Formulae Quiz

Take the Dynamic Quiz below to see how many of the formulae your students know...

What is the formula for calculating the closing balance in a cash flow?

The closing balance is the amount of cash in the business at the end of a reporting trading period (such as the end of the week or end of the month). Hence, the correct formula is Closing balance = Opening balance + Cash inflow - Cash outflow, i.e. Opening balance + Net cash flow.

What is the formula for calculating straight-line annual depreciation? (HL Only)

The straight-line annual depreciation method reduces the value of an asset by a pre-determined fixed amount. Hence the formula is the Purchase Cost ÷ Useful lifespan to get the annual amount of depreciation

What is the formula for calculating sales revenue?

Sales revenue is the money a firm earns from selling its goods and/or services. Hence, the formula is Unit price × Quantity sold (or Price × Quantity)

What is the formula for calculating Average Fixed Cost?

The average fixed cost (AFC) is simply the total fixed costs of the firm spread over the number of units of output, so is calculated by using the formula Total Fixed Costs ÷ Output level

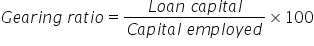

What is the formula for calculating capital employed?

Capital employed refers to the sum of internal and external sources of finance for a business. Hence, this is comprised of loan capital (external sources) plus share capital and retained profits (both internal sources)

What is the formula for determining the cost to make? (HL Only)

The cost to make refers to how much a firm must pay if it produces goods for which it intends to sell to consumers (rather than the costs of buying the goods to resell to customers). The formula is: Cost to make = TFC + (AVC × Q) or TFC + TVC, where:

TFC = Total fixed costs

AVC = Average variable costs

Q = Quantity

TFC = Total fixed costs, and

TVC = Total variable costs

What is the formula for calculating a firm's cost of sales (COS)?

The cost of sales (COS) are the direct costs of trading, so are calculated by using the formula: Opening stock + Purchases – Closing stock.

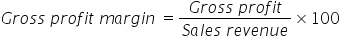

What is the formula for calculating gross profit?

Gross profit is also referred to as trading profit, i.e. the difference between sales revenue and the direct costs of production (cost of goods sold)

What is the formula for calculating the net cash flow?

The net cash flow (NCF) is simply the difference between cash inflow and cash outflow per time period, usually per month.

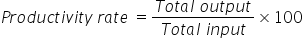

What is the formula for calculating labour productivity?

Labour productivity is the output per worker, so is calculating by the formua total output / number of workers.

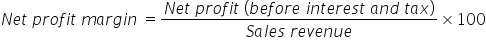

What is the formula for calculating net current assets? (HL Only)

As the name suggests, the term net current assets is the difference between current assets and current liabilities. Hence the correct formula is Current assets – Current liabilities.

What is the formula for determining break-even?

Break-even is determined by the formula Total fixed costs ÷ (P – AVC) x Quantity, i.e. Total fixed costs ÷ Unit contribution

What is the formula for calculating current assets?

Current assets are items of value owned by the business, intended for trading purposes (unlike fixed assets). These comprise of stocks (inventory), cash, and debtors

What is the formula for calculating current liabilities?

Current liabilities are sums of money owed within the (current) tax year, i.e. Overdraft + Tax + Dividends + Creditors

What is the formula for calculating the reducing-balance annual depreciation? (HL Only)

The reducing-balance annual depreciation method reduces the value of an asset by a predetermined percentage each year. Hence, it can be calculated using the formula Purchase cost – Cumulative depreciation (or the Historic cost – Cumulative depreciation).

What is the formula for calculating net current assets?

As the name suggests, the term net current assets is the difference between current assets and current liabilities. Hence the correct formula is Current assets – Current liabilities.

What is the formula for calculating the margin of safety?

The safety margin is the difference between a firm's actual sales volume (how much it sells) and how much it needs to sell in order to break even). Therefore, the correct formula is Margin of safety = Level of demand – Break-even quantity.

What is the formula for calculating profit?

Profit (before interest and tax) is the financial surplus of a firm after all its direct costs (or cost of sales) and indirect costs (expenses) have been paid, i.e., Profit = Gross profit – Expenses.

What is the formula for determining the cost to buy? (HL Only)

The cost to make refers to how much a firm must pay if it purchases products which it intends to resell to the consumer (rather than the costs of producing the product in-house). The formula is: Cost to buy = Price × Quantity.

What is the formula for calculating profit?

Profit is the positive difference between a firm's sales revenue (or Total revenue) and its costs of production (or Total costs)

Return to the Exams homepage

IB Docs (2) Team

IB Docs (2) Team