Contribution analysis

Common mistake

Contribution is not the same as value added, although the two terms are often confused by students:

- Unit contribution = Price minus Average variable cost, i.e. P – AVC

- Value added per unit = Price minus Average total costs, i.e. P – ATC

This means that value added considers both variable and fixed costs of production, whereas unit contribution only considers the cost of goods sold (COGS) or the variable costs.

Exam Practice Question 1 - Heather Manetta's Hotdogs

Heather Manetta is a hotdog vendor. She sells hotdogs for $10 each and has unit variable costs of $6. She pays $2,000 rent per month. On average, she sells 1,500 hotdogs per month.

(a). | Calculate Heather Manetta's contribution per unit. | [2 marks] |

(b). | Calculate Heather Manetta's total contribution per month. | [2 marks] |

(c). | Calculate Heather Manetta's break-even quantity. | [2 marks] |

(d). | Calculate Heather Manetta's average profit per month. | [2 marks] |

Answers

For each question, award 1 mark for the correct answer and 1 mark for showing appropriate working out.

(a). Calculate Heather Manetta's contribution per unit. [2 marks]

$10 – $6 = $4 contribution per unit.

(b). Calculate Heather Manetta's total contribution per month. [2 marks]

$4 × 1,500 hotdogs = total contribution of $6,000 per month

(c). Calculate Heather Manetta's break-even quantity. [2 marks]

BEQ = $2,000 / ($10 – $6) = 500 hotdogs per month

(d). Calculate Heather Manetta's average profit per month. [2 marks]

Profit = Total contribution – Fixed costs = $6,000 – $2,000 = $4,000

Exam Practice Question 2 - Mayer's Doughnuts

Vicky Mayer is the owner of Mayer's Doughnuts. The business has variable costs of $0.25 per doughnut and Vicky sells these for $1.50 each. Her fixed costs are $10,000 per month. She sells an average of 9,500 doughnuts each month.

(a). | Calculate the unit contribution for Mayer’s Doughnuts. | [2 marks] |

(b). | Calculate the number of doughnuts the firm has to sell each month in order to reach break-even. | [2 marks] |

(c). | Calculate the monthly safety margin for Mayer’s Doughnuts. | [2 marks] |

(d). | Use the above answers to plot the break-even chart for Mayer’s Doughnuts. | [5 marks] |

Answers

(a). Calculate the unit contribution for Mayer’s Doughnuts. [2 marks]

The formula for contribution per unit is selling price minus variable cost per unit (P – AVC).

Given that P = $1.50 and AVC = $0.25, the contribution per unit is $1.25

Award 1 mark for the correct working out and 1 mark for the correct answer with the correct unit of measurement ($).

(b). Calculate the number of doughnuts the firm has to sell each month in order to reach break-even. [2 marks]

The formula for break-even is fixed costs divided by unit contribution, i.e. TFC ÷ (P – AVC). Hence, BEQ = $10,000 ÷ $1.25 = 8,000 doughnuts per month.

Award 1 mark for the correct working out and 1 mark for the correct answer with the correct unit of measurement (doughnuts).

(c). Calculate the monthly safety margin for Mayer’s Doughnuts. [2 marks]

The safety margin is calculated by finding the difference between actual sales and the break-even quantity

Hence, the safety margin = 9,500 – 8,000 = 1,500 doughnuts

Award 1 mark for the correct working out and 1 mark for the correct answer with the correct unit of measurement (doughnuts).

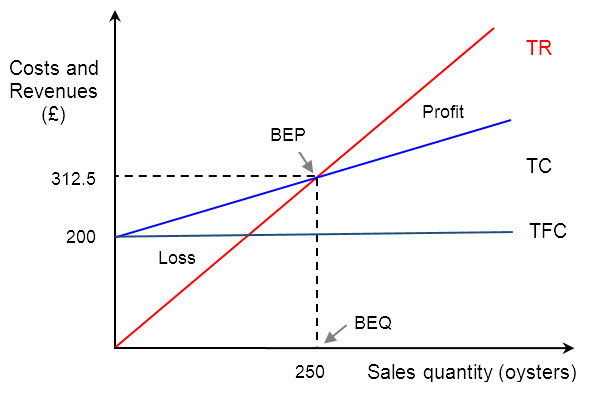

(d). Use the above answers to pot the break-even chart for Harvey’s Doughnuts. [5 marks]

Break-even chart for Harvey’s Doughnuts

.jpg)

Award 1 mark for each of the following, up to the maximum of 5 marks:

- Correctly plotting and labelling the total sales revenue (TR) line

- Correctly plotting and labelling the total cost (TC) line

- Clearly identifying the break-even output at 8,000 doughnuts

- Clearly identifying the margin of safety of 1,500 doughnuts

- Correctly labelling of both axes.

Back to Unit 3.3 Break-even analysis homepage

Back to Unit 3 Fnance & Accounts homepage

IB Docs (2) Team

IB Docs (2) Team